ID: PMRREP31934| 186 Pages | 6 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

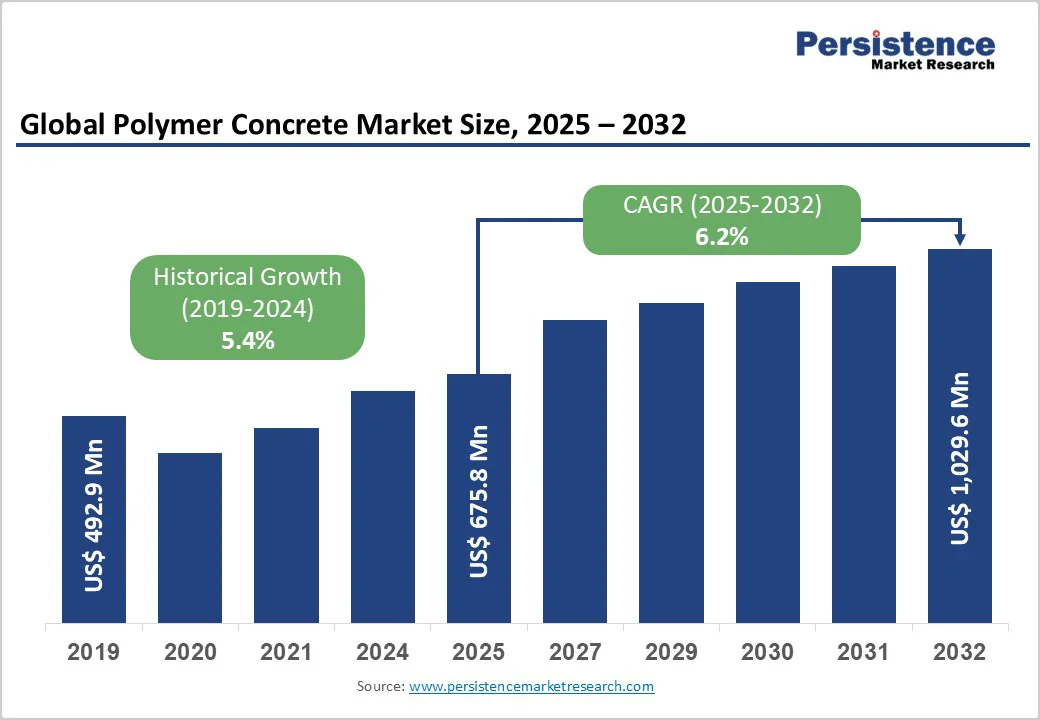

The global polymer concrete market size is supposed to be valued at US$ 675.8 Mn in 2025 and is projected to reach US$ 1,029.7 Mn by 2032, growing at a CAGR of 6.2% between 2025 and 2032.

This growth is primarily driven by surging infrastructure investments worldwide, where polymer concrete's superior durability and chemical resistance outperform traditional materials, reducing long-term maintenance costs by up to 75% in harsh environments.

Supporting this, global urbanization has led to over 2.6 trillion USD in infrastructure funding gaps, prompting the adoption in bridges and roadways for extended lifespan.

| Key Insights | Details |

|---|---|

| Polymer Concrete Market Size (2025E) | US$ 675.8 Mn |

| Market Value Forecast (2032F) | US$ 1,029.7 Mn |

| Projected Growth CAGR (2025 - 2032) | 6.2% |

| Historical Market Growth (2019 - 2024) | 5.4% |

The polymer concrete market is experiencing robust demand stemming from unprecedented infrastructure investment across both developed and emerging economies. Asia Pacific countries, particularly China and India, are implementing massive infrastructure programs with China's road network exceeding 150,000 kilometers of expressways and India's Bharatmala Pariyojana initiative driving extensive road and bridge construction.

The Asian Development Bank estimates that the Asia Pacific will require approximately US$ 43 trillion in infrastructure investment from 2020 to 2035 to develop, maintain, and repair transportation networks.

In North America, the Biden-Harris Administration's Bipartisan Infrastructure Law allocated US$ 40 billion over five years specifically for bridge rehabilitation projects, with over 11,400 bridge repair projects underway as of 2024.

This legislation addresses critical infrastructure needs where polymer concrete's rapid curing times, superior load-bearing capacity, and extended service life make it the preferred material for overlay applications on highway bridges, parking decks, and tunnel liners. The material's ability to cure at temperatures between 5 to 10 degrees Celsius enables year-round construction activities, significantly reducing project timelines and labor costs.

Polymer concrete's exceptional resistance to aggressive chemical environments is propelling its widespread adoption in industrial facilities and municipal wastewater infrastructure. In wastewater treatment applications, polymer concrete effectively resists H2S corrosion and microbially induced corrosion (MIC), which are primary degradation mechanisms in sewer systems.

Research conducted by the Advanced Water Management Centre at the University of Queensland demonstrated that geopolymer and polymer-based concrete systems exhibit an order of magnitude better resistance to biogenic sewer acid corrosion compared to conventional acid-resistant concrete mixes after 12 months of exposure.

With global wastewater treatment capacity expanding rapidly, India's wastewater treatment sector alone is projected to reach US$ 4.3 billion. This leads to a rise in demand for polymer concrete in containment structures, pump bases, drainage channels, and treatment plant floors continues to surge, driving significant market growth.

The polymer concrete market faces significant adoption barriers due to substantially higher upfront material costs compared to traditional Portland cement concrete. Polymer resins, which serve as the primary binding agents in polymer concrete formulations, command premium pricing with epoxy, vinyl ester, and polyester resins typically costing 3 to 5 times more than conventional cement on a volume basis.

Raw material costs for synthetic polymers rose by 20% in 2024 due to supply chain volatility, making it 30-50% pricier than traditional concrete, according to the World Bank infrastructure reports. This barrier discourages small-scale contractors, slowing market penetration despite long-term savings, with industry reports noting 15% hesitation in emerging markets due to pricing.

Market growth in developing regions is hindered by a lack of technical knowledge regarding polymer concrete formulation and application among construction professionals. Many engineers and contractors continue to rely on conventional concrete practices, which dominate local training programs. In Latin America, for example, only 10-15% of projects utilize advanced materials due to skill gaps.

The United Nations Environment Programme indicates that polymer waste contributes 8% of global plastic pollution, complicating recycling efforts and conflicting with green building standards such as LEED. The lack of standardized testing protocols and performance certifications in many developing countries makes it difficult for specifiers to verify material compliance or compare formulations objectively.

The polymer concrete industry is poised to capitalize on accelerating sustainability mandates and environmental regulations, driving the construction sector toward low-emission, eco-friendly materials.

The European Union's Construction Products Regulation, which entered force in January 2025, mandates environmental reporting, including CO2 emissions and energy consumption data for priority construction materials, with Digital Product Passports required for full lifecycle transparency. This regulatory framework creates substantial opportunities for polymer concrete manufacturers to develop innovative low-VOC formulations.

BASF and Sika's collaborative development of Baxxodur EC 151, launched commercially in March 2025, exemplifies this trend with epoxy hardener technology delivering up to 90% less VOC emissions compared to conventional hardeners while enabling same-day curing and superior chemical resistance. The product addresses growing demand for sustainable flooring solutions in production plants, storage facilities, and parking structures where traditional high-VOC systems face increasing regulatory scrutiny.

The International Renewable Energy Agency reports US$1.7 trillion invested in clean energy in 2024, with polymer concrete used in 20% of grid-hardening pads for its durability against seismic and corrosive conditions. News from 2025 highlights Sika AG's partnership with offshore projects in Europe, demonstrating 50% faster installation and reduced maintenance.

This segment's rapid growth, fueled by net-zero targets in the Asia Pacific, allows companies to tap into high demand, particularly as the Polymer Clay Market combines with composite innovations for lightweight turbine bases. Strategic focus here promises substantial growth, with potential for 10% CAGR in energy applications through 2032.

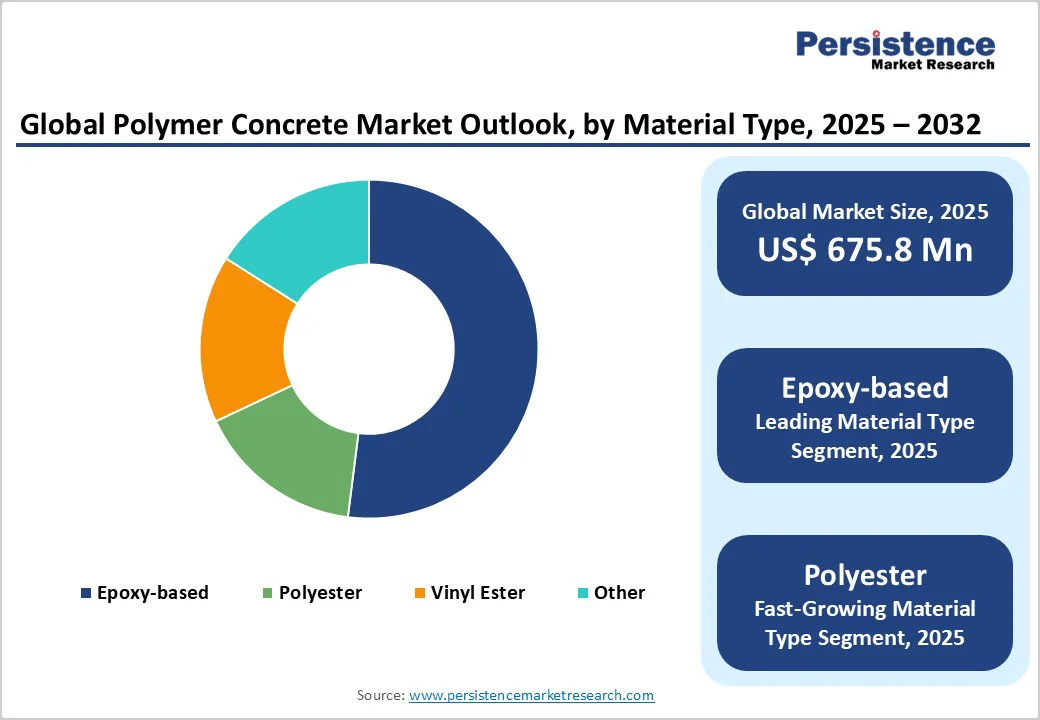

Epoxy-based leads the material type segment with approximately 52% market share, driven by its exceptional adhesion and resistance to chemicals, making it ideal for demanding industrial and infrastructure uses. According to the American Society for Testing and Materials, epoxy formulations exhibit twice the bond strength of alternatives, reducing failure rates in corrosive environments by 40%.

This dominance is justified by widespread adoption in pump bases and containments, where durability ensures compliance with safety standards from bodies like the OSHA. Data from industry journals further supports this, noting epoxy's role in 70% of high-performance applications due to its low shrinkage during curing.

Recent innovations, such as BASF and Sika's Baxxodur EC 151 epoxy hardener system, launched in March 2025, further enhance epoxy-based polymer concrete's market position by delivering ultra-low VOC formulations with up to 90% emission reductions, rapid curing across wide temperature ranges, including 5 to 10 degrees Celsius, and two-thirds faster curing times compared to conventional hardeners.

Synthetic Resin commands roughly 70% of the binding agent segment, preferred for its versatility and enhanced mechanical properties in diverse climates. Research on formulations shows synthetic options achieve superior impermeability, binding aggregates effectively for 50+ MPa compressive strength in industrial uses.

The International Union of Testing and Research Laboratories for Materials and Structures highlights synthetic resins' superior tensile strength, contributing to 60% fewer cracks in structures compared to natural options. Its reliability in prefabricated elements, as per construction journals, drives preference over natural alternatives, with 7% CAGR in synthetic adoption for durable infrastructure.

Flooring Blocks holds the leading position in applications at about 35% share, owing to their seamless installation and high impact resistance in industrial settings. Journals from the Concrete Institute indicate that flooring blocks reduce slip hazards by 50% in chemical plants, backed by usage in over 25% of new factory floors globally.

This leadership is substantiated by its quick curing, enabling 24-hour operational restarts, a key factor in the energy and utilities sectors. This segment's dominance is reinforced by utility sector demands for vibration-damping properties, with installations growing 6% yearly in energy facilities.

Infrastructure dominates the Industry with around 45% share, fueled by its application in roadways, buildings, and pipes, where corrosion resistance extends service life significantly. The World Road Association reports that infrastructure projects using polymer concrete last 30% longer, supporting global investments exceeding US$8 trillion annually in civil works.

The U.S. Federal Highway Administration's Bridge Investment Program, which awarded nearly US$ 635 million in 2024 for 22 bridge projects across 19 states, exemplifies the substantial public funding supporting infrastructure modernization where polymer concrete finds extensive application.

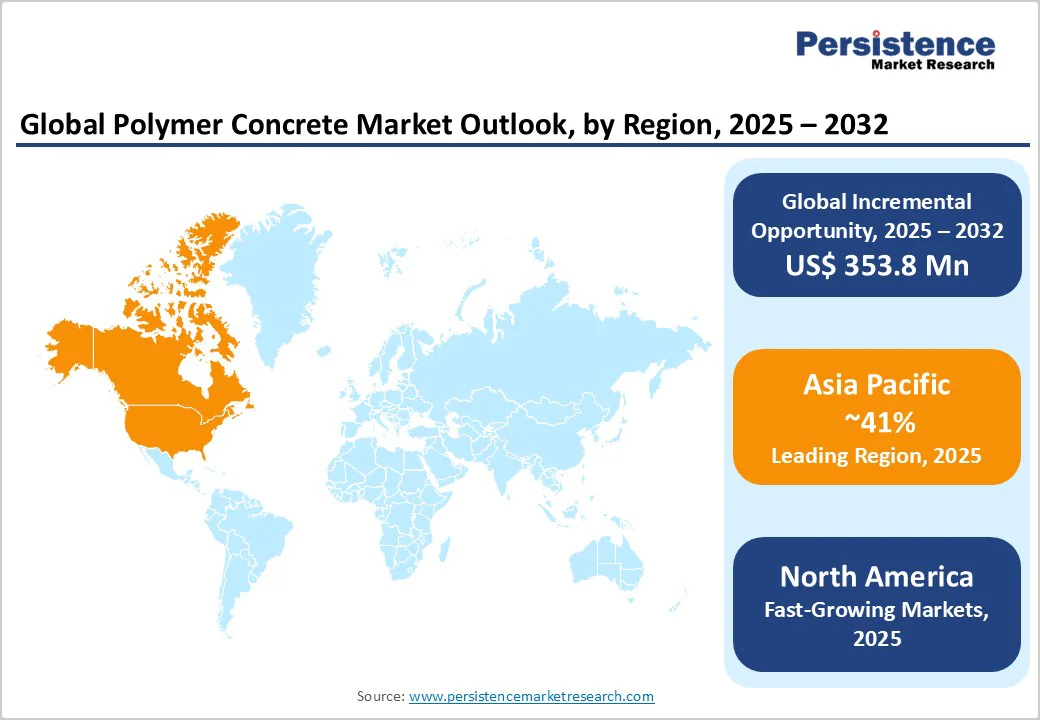

Asia Pacific's infrastructure dominance, with China holding over 50% regional market share and India recording the highest 8.06% CAGR through infrastructure expansion programs, further amplifies demand for high-performance polymer concrete.

North America is experiencing strong market growth due to the Biden-Harris Administration's Bipartisan Infrastructure Law, which allocated $40 Bn over five years for bridge rehabilitation, resulting in over 11,400 repair projects by 2024.

In October 2024, the Federal Highway Administration's Bridge Investment Program awarded nearly $635 Mn to 22 projects in 19 states, including critical infrastructure like the Helena Bridge between Arkansas and Mississippi and the I-395 Bridge Bundle in Maine, both requiring advanced polymer concrete for restoration.

Extreme weather resilience drives further growth, as EPA data shows a 30% rise in events, prompting the use of flood-resistant pipes and roadways. Federal initiatives like the Infrastructure Investment and Jobs Act allocate billions for resilient builds, positioning polymer concrete in energy and commercial sectors.

Europe's market, led by Germany and the U.K., benefits from harmonized regulations under the EU Construction Products Regulation, promoting polymer concrete in sustainable builds. In 2024, Germany invested €100 Bn in infrastructure, utilizing the material for 20% of new wastewater systems due to its impermeability. U.K.'s focus on post-Brexit green recovery accelerates adoption in roadways, reducing maintenance by 40% according to Highways England reports.

BASF and Sika's joint development of Baxxodur EC 151 epoxy hardener, launched in March 2025 and manufactured in Europe, exemplifies regional innovation addressing sustainability mandates with 90% VOC reduction while maintaining high-performance characteristics for flooring applications in production facilities and parking structures.

Asia Pacific's growth is propelled by China and India's manufacturing advantages, with infrastructure booms driving 41% regional share. China's Belt and Road Initiative incorporates polymer concrete in $1 trillion projects, enhancing pipe durability against monsoons.

India records a regional growth rate at 8.06% CAGR, propelled by the Bharatmala Pariyojana national highway program and smart city initiatives incorporating extensive sewer rehabilitation and water treatment infrastructure. The Indian government approved US$ 0.52 Bn in 2024 for constructing 2,280 km of border roads, further amplifying infrastructure material demand.

Japan and ASEAN nations leverage advanced production for energy sectors, where the material's heat resistance supports solar installations. News from 2025 highlights Wacker Chemie AG's expansions in India, capitalizing on low-cost aggregates for scalable output.

The polymer concrete market remains fragmented, with numerous mid-sized players alongside global leaders, fostering innovation through regional specialization. The fragmented market enabling diverse strategies such as mergers for supply chain control.

Leaders differentiate via R&D in bio-resins, while emerging models emphasize modular prefabrication for rapid deployment. Expansion focuses on Asia Pacific via joint ventures, with sustainability driving 20% of investments in green technologies.

The global polymer concrete market is projected to reach US$ 1,029.7 Million by 2032, expanding from US$ 675.8 Million in 2025 at a compound annual growth rate of 6.2% during the forecast period, driven by infrastructure modernization and industrial applications.

Increasing infrastructure investments and demand for chemical-resistant materials in industries drive growth, with global construction spending surpassing US$10 trillion in 2024.

Epoxy-based material leads with 52% share due to its superior bond strength and chemical resistance in industrial applications.

Asia Pacific leads, holding 41%share driven by urbanization in China and India, with infrastructure projects exceeding $1 trillion.

Adoption of bio-based binders offers significant potential, aligning with sustainability goals and capturing 40% of green construction demand by 2030.

Leading players include BASF SE, Sika AG, and Wacker Chemie AG, dominating through innovative resins and global infrastructure portfolios.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Binding Agent

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author