ID: PMRREP32482| 173 Pages | 28 Jul 2025 | Format: PDF, Excel, PPT* | Food and Beverages

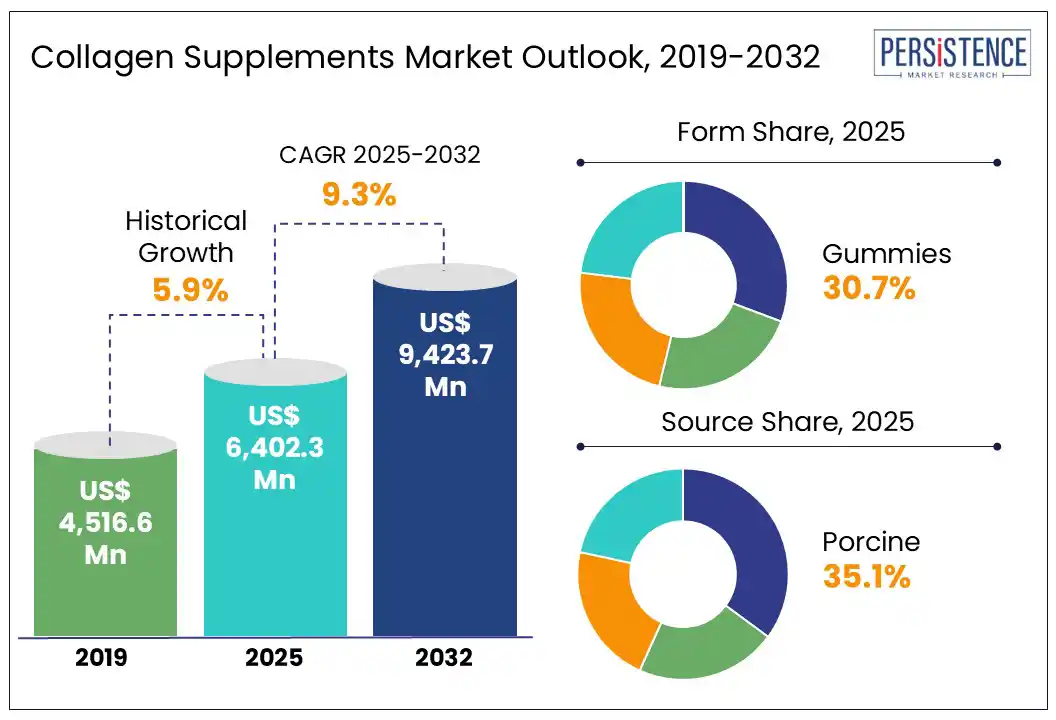

The global collagen supplements market size is anticipated to reach a value of US$ 6,402.3 Mn in 2025 and is set to witness a CAGR of 9.3% from 2025 to 2032. The market will likely attain a value of US$ 9,423.7 Mn in 2032. Collagen, the most abundant protein in the human body, provides support for skin elasticity, joint health, and structural strength. Unfortunately, natural collagen production declines during the mid-20s, with about 1.5% declining every year. The ongoing linear decline leads to visible signs of aging, joint pains, and weaker connective tissues. It has been found through research that consuming collagen regularly can increase skin hydration by 28% and can reduce joint pain in athletes by 43%. With scientific studies continuously revealing more possible benefits, the importance of collagen supplementation in health and wellness keeps increasing.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

| Collagen Supplements Market Size (2025E) | US$ 6,402.3 Mn |

| Market Value Forecast (2032F) | US$ 9,423.7 Mn |

| Projected Growth (CAGR 2025 to 2032) | 9.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.9% |

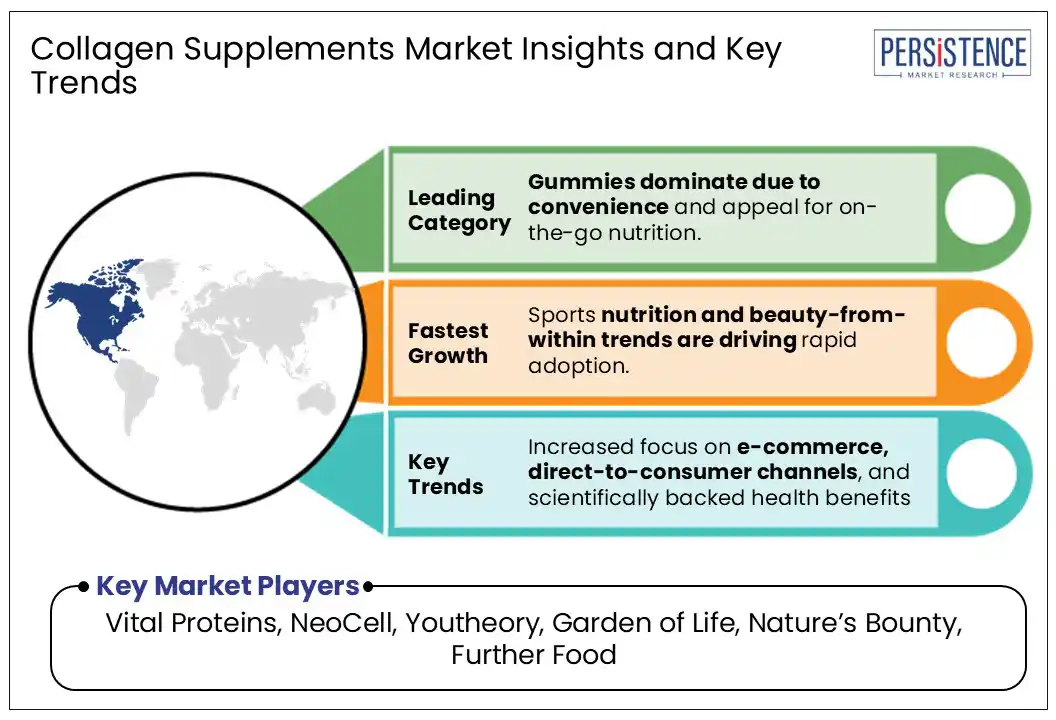

Collagen supplements are projected to be the next big thing in the field of sports nutrition through 2032. This is because, unlike standard whey protein, which only helps with muscle building, collagen provides a wide range of health benefits. The ingredient aids in accelerating recovery times at a fast pace. Leading sports nutrition companies are set to incorporate collagen into their product lines as a result of scientific discoveries showing the advantages of collagen peptides in increasing muscle growth and lowering joint pain brought on by exercise. Product breakthroughs and collaborations are estimated to result from this change. U.S.-based Reebok, for example, recently joined hands with a wellness company called Generation Joy, focusing on enhancing sports nutrition by providing research-backed, effective, and superior products.

The absence of standardization and regulatory monitoring in collagen products is one of the main restraints in the market. In various countries, the U.S. Food and Drug Administration (FDA) or similar agencies do not tightly monitor dietary supplements, including collagen, like they do in the field of pharmaceuticals. As a result, there are now notable differences in quality between manufacturers, with a few products having heavy metal contamination or less collagen than promised. For example, nearly 64% of tested collagen supplements have detectable levels of lead, according to a 2023 study by the non-profit group Clean Label Project, raising questions regarding the product safety. Due to the increased scrutiny of ingredient sourcing and third-party testing, consumer trust is becoming a key concern.

Bovine, marine, and poultry collagens are the main animal-derived sources that have historically been used by the collagen supplements industry. However, the popularity of plant-based and bioengineered collagen is being stimulated by a rising consumer trend toward vegan, cruelty-free, and environmentally friendly alternatives.

Conventional plant-based substitutes for natural collagen emphasized components such as vitamin C, amino acids, and botanical extracts to support the body's collagen production, as natural collagen is an animal protein that is absent from plants. Recent developments in fermentation technology and synthetic biology, however, have made it possible to produce lab-grown, bioidentical collagen. It helps in providing a key substitute that does not require animal extraction. Bioengineered collagen is produced in a lab with precision fermentation, in which genetically modified microorganisms, usually yeast or bacteria, are programmed to make collagen peptides that are identical to those of humans. This contrasts with conventional plant-based collagen boosters.

Using bacteria such as Pichia pastoris to ferment and produce type I, II, and III collagen-the same forms of collagen found in human skin, bones, and cartilage-companies such as Geltor and Jellatech are at the forefront of this technology. The first entirely bioidentical, animal-free collagen, Geltor's PrimaColl, was introduced in 2021 and is said to be 20 times more effective in promoting collagen development than bovine or marine collagen. This invention eliminates worries about contamination, allergies, and ethical or religious constraints, making it a more inclusive option for a wide range of clients.

In the global collagen supplements market, the gummies segment is projected to hold a share of 30.7% in 2025. Because of their high absorption rates and ease of use, collagen gummies are gaining popularity globally. Increasing shift of consumers toward on-the-go nutrition solutions is another key driver. Gummies are mainly gaining momentum among those who prefer quick ways to integrate supplements into their daily diets.

Capsules and tablets, on the other hand, are anticipated to witness a significant CAGR through 2032. A more concentrated dose with fewer fillers is provided through capsules and tablets, unlike gummies, which often contain artificial flavors, added sweeteners, and lower collagen concentrations.

By source, the porcine segment will likely generate a collagen supplements market share of 35.1% in 2025. Considering its excellent bioavailability, cost-effectiveness, and structural resemblance to human collagen, collagen sourced from porcine is largely favored in the market. Porcine collagen is more effective at supporting skin elasticity, wound healing, and joint health than collagen from bovine or marine sources, as it closely mimics Type I and Type III human collagen. Porcine collagen peptides are absorbed up to 1.5 times faster than bovine collagen, according to studies.

Marine and poultry-derived collagen is anticipated to showcase decent growth in the foreseeable future. As it is suitable for pescatarians and halal consumers, marine collagen, which is primarily produced from fish skin and scales, has become increasingly popular. Another significant factor raising its preference is its low molecular weight, which helps improve efficacy and digestibility.

North America is predicted to hold around 25.7% of the market share in 2025. The U.S. collagen supplements market is set to remain at the forefront through 2032 due to the surge of holistic wellness practices and beauty-from-within trends.

More than 60% of American consumers chose collagen supplements for skin health, followed by joint support (40%), and muscle recovery (25%), according to a 2023 Nutrition Business Journal survey. With brands like Vital Proteins, Ancient Nutrition, and NeoCell dominating in sales, the impact of celebrities and wellness influencers has also been important in the country’s growth.

Canada, on the other hand, houses a highly regulated health supplement market, which is resulting in the increasing preference for clinically tested and scientifically validated formulations. Brands such as Organika, Bend Beauty, and CanPrev are capitalizing on this trend by offering high-purity marine and bovine collagen supplements with added functional ingredients like hyaluronic acid and vitamin C.

In the Middle East and Africa, halal-certified bovine collagen is projected to be highly preferred across Saudi Arabia due to dietary restrictions on porcine collagen. However, premium beauty formulations are set to witness a high demand for marine collagen. Through pharmacies, e-commerce platforms such as Noon and Amazon.sa, and upscale beauty stores such as Faces and Sephora Middle East, international products from companies like Vital Proteins, Neocell, and Nature's Bounty have gained momentum in Saudi Arabia.

In Egypt, demand is anticipated to be propelled by increasing access to cost-effective health supplements. With dermatologists and beauty influencers often promoting collagen-infused drinks and powders, social media has been instrumental in raising awareness of collagen in the country.

In Asia Pacific, Japan will likely showcase considerable growth in terms of collagen consumption. Due to the country’s long history of using functional foods and nutraceuticals, collagen is now a staple in skincare and anti-aging products. More than 70% of Japanese women between the age group of 25 and 55 use collagen-infused drinks, powders, and gummies, as per studies. Prominent companies such as Fancl, Meiji, and Shiseido have continuously developed new products by using tripeptides, hydrolyzed fish collagen, and combination formulas with ceramides and hyaluronic acid.

Owing to its highly developed nutricosmetics business, South Korea has established itself as a leader in collagen innovation. Collagen beverages and chewables made up over 60% of total sales, according to the Korea Health Supplements Association. This was primarily due to K-pop and K-drama celebrities promoting collagen-infused products.

India’s market is still at the nascent stage. However, it is anticipated that the country will show average growth with demand from working professionals and fitness enthusiasts. Brands such as HealthKart, OZiva, and Wellbeing Nutrition are focusing on introducing collagen blends with Ayurveda-infused formulations and plant-based proteins to meet the rising holistic wellness requirements.

Leading companies in the collagen supplements industry are focusing on launching new products with unique ingredients and formulations to attract new customers. They are also striving to extend their geographical presence in untapped markets to broaden their client base. A few companies are likely to engage in mergers and acquisitions, as well as collaborations to co-develop innovative products in the market.

The market is set to reach US$ 6,402.3 Mn in 2025.

The industry will likely be valued at US$ 9,423.7 Mn in 2032.

The industry is set to surge at a CAGR of 9.3% through 2032.

Further, Inc., Glanbia PLC, Hunter & Gather Foods Ltd, and Tci Co., Ltd. are the key brands.

Athletes, beauty enthusiasts, and aging consumers are the target audience.

| Report Attribute | Details |

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Form

By Source

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author