ID: PMRREP34836| 181 Pages | 17 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

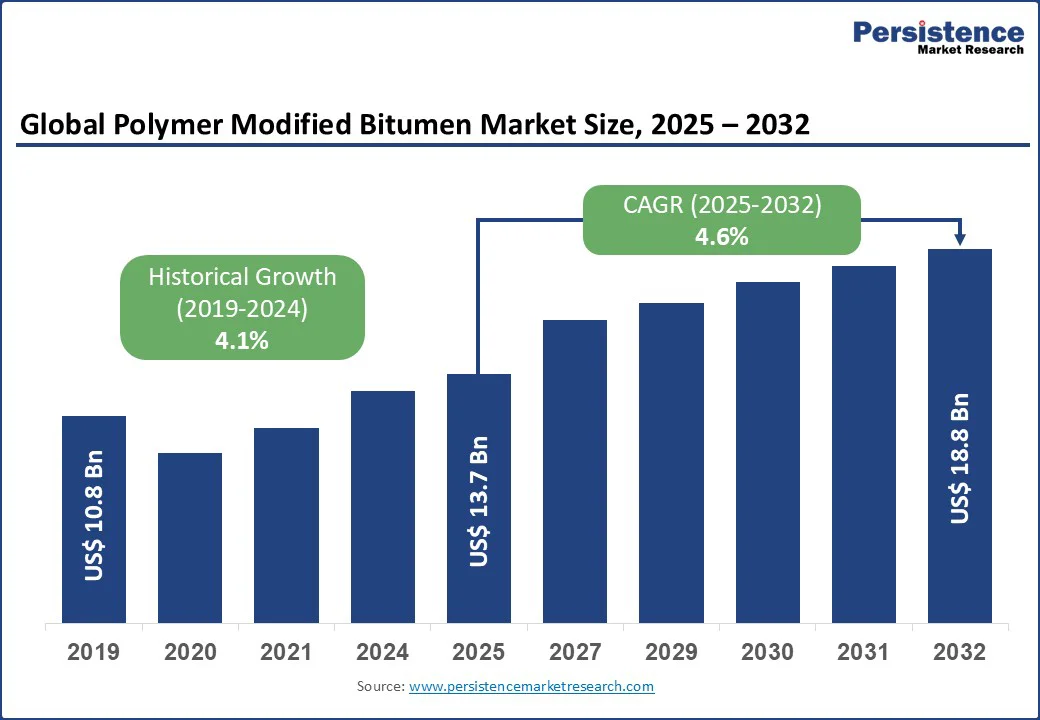

The global polymer-modified bitumen market size is likely to increase from US$13.5 Bn in 2025 to US$18.8 Bn by 2032, reflecting a CAGR of 4.6% in the forecast period 2025 - 2032 due to the rising investments in infrastructure renewal, particularly highways and transport networks, which is driving demand for durable materials.

Key Industry Highlights:

Global demand for polymer modified bitumen is surging due to a rise in infrastructure investment and the urgent need for durable road construction materials. According to the United Nations, 68% of the world’s population is likely to live in urban areas by 2050, creating immense pressure on transportation and housing infrastructure. The World Bank highlights that global infrastructure investment must reach 4.5% of annual GDP by 2030 to meet development and sustainability goals, pushing demand for advanced solutions in the Bitumen Market that extend road life and minimize maintenance.

Additionally, the OECD reports that global road freight activity will double more by 2050, stressing the importance of resilient, high-performance pavements. These structural shifts in urbanization, freight movement, and infrastructure financing are also influencing adjacent sectors such as the industrial flooring industry, where durability and long-term performance are equally critical. Collectively, these dynamics establish PMB as a crucial solution to meet global durability and performance requirements.

Despite its performance benefits, PMB adoption faces significant barriers from high costs and volatile raw materials. The U.S. Department of Energy recorded a 20% rise in polymer production costs between 2021 and 2023, primarily due to Russia-Ukraine and Middle East conflicts disrupting crude oil supply chains, raising manufacturing expenses. Similarly, the International Energy Agency reported that global crude oil prices fluctuated by over 50% in 2022, directly impacting bitumen and polymer feedstock prices, which also influence the overall dynamics of the bitumen adhesives market.

In addition, regulatory frameworks such as the European Union’s REACH legislation and U.S. EPA VOC emission standards impose stringent compliance requirements that increase operational costs for producers. For cost-sensitive regions, these combined challenges make PMB less accessible compared to conventional materials, with similar cost pressures observed in the Asphalt Additives Market, thereby restraining wider adoption despite its proven durability advantages.

The push for sustainable and climate-resilient infrastructure is creating strong opportunities for eco-friendly PMB solutions. The U.S. Environmental Protection Agency promotes recycled polymer use in road construction, reducing landfill waste and cutting emissions. In line with circular economy goals, the European Commission estimates that recycling 1 ton of plastic saves 1.5 tons of CO2 emissions, a benefit directly realized when plastics are blended into PMB.

In practice, India has constructed over 100,000 km of roads using plastic-modified bitumen, showcasing the scalability of this innovation. Beyond recycling, advanced research into self-healing PMB technologies shows potential to increase pavement life by up to 50%, lowering both maintenance costs and environmental impact. With governments and industries committing to greener materials, sustainable PMB adoption is not only driving road development but also influencing adjacent sectors such as the Playground Surface Materials Market, where durability and eco-friendly innovations are gaining importance.

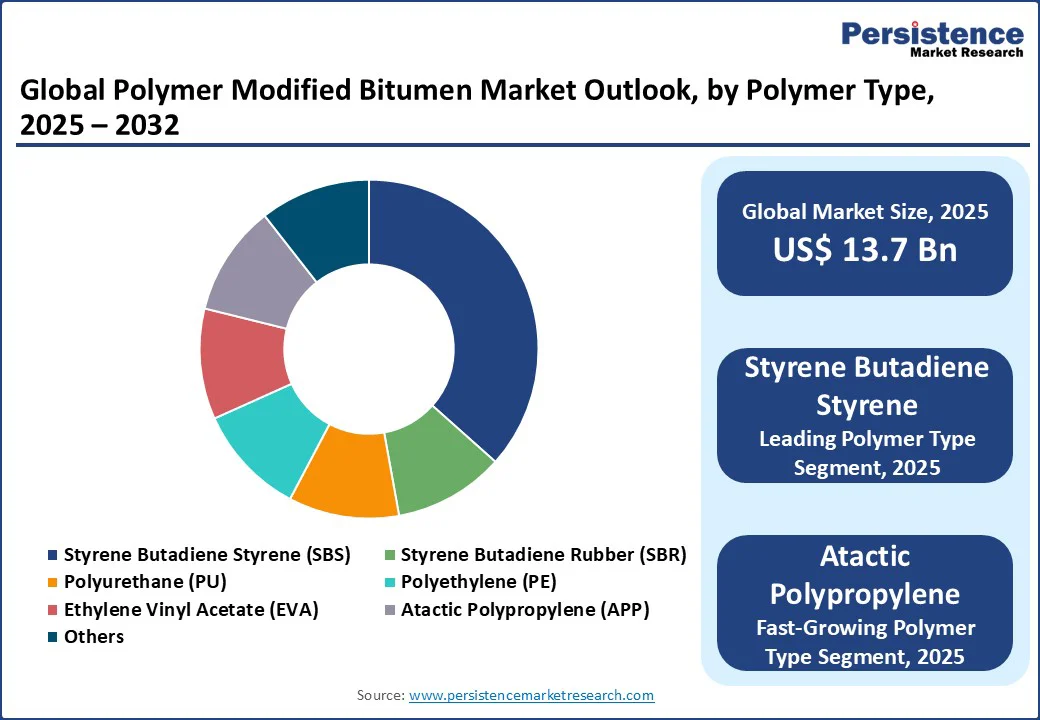

Styrene-Butadiene-Styrene (SBS) holds the largest 35% share in the polymer modified bitumen market due to its superior elasticity, high resistance to rutting, and ability to withstand temperature fluctuations. SBS-modified bitumen is widely used in road construction and roofing applications because it enhances the durability and flexibility of asphalt pavements. According to the IEA, global road networks exceed 64 million kilometers, with Asia-Pacific and North America accounting for more than 60% of annual new road construction.

Additionally, the United Nations estimates that nearly 70% of the world’s population will live in urban areas by 2050, creating growing demand for long-lasting road infrastructure. These statistics indicate that SBS will continue to dominate, as governments and contractors increasingly prefer advanced polymer modified bitumen to extend pavement lifespan, reduce maintenance costs, and improve road safety under heavy traffic conditions.

Road construction is the leading application segment with 68% revenue share for polymer modified bitumen, driven by massive global investments in transportation infrastructure. According to the World Bank, over US$ 2 trillion is spent annually on infrastructure, with roads representing a major portion of this investment. The OECD reports that developing economies allocate more than 40% of their transport budgets to highways and expressways.

Furthermore, the International Transport Forum highlights that global freight demand is expected to triple by 2050, placing additional stress on road networks. Polymer modified bitumen, with its superior performance in high-traffic and extreme weather conditions, is increasingly adopted to address these challenges. Its ability to minimize rutting, cracking, and maintenance costs makes it the preferred material for highways, airports, and expressways. With rapid urbanization and rising vehicle ownership across Asia-Pacific, North America, and Europe, road construction will remain the dominant application for polymer modified bitumen in the coming years.

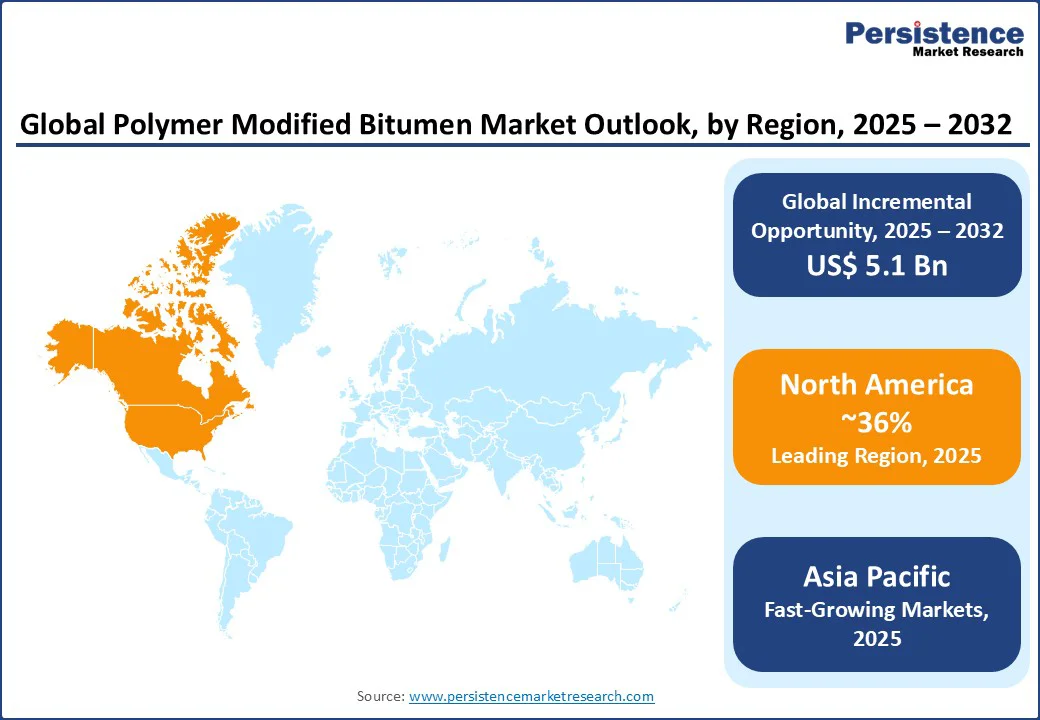

The North America polymer modified bitumen market is expanding due to strong infrastructure spending and road maintenance programs. The region also holds 36% share by value globally. The U.S. Federal Highway Administration highlights that over 43% of the nation’s roads are in poor or mediocre condition, driving demand for high-performance paving solutions like PMB. Canada is also investing heavily in resilient transport infrastructure, with the Canadian Infrastructure Bank allocating billions toward sustainable projects.

Rising construction of highways, urban transit systems, and growth in the U.S. Roofing Material Market are further supporting demand for polymer modified bitumen across the region. The push for durable, weather-resistant road materials to withstand extreme climates in states like Texas and Alaska continues to boost adoption. With increasing investments in smart and sustainable cities, North America is positioning PMB as a preferred material for long-lasting road networks and roofing applications, making the region a leading consumer in the global polymer modified bitumen market.

Europe polymer modified bitumen market is driven by stringent sustainability policies and growing road rehabilitation projects. According to the European Commission, nearly 75% of inland freight transport relies on road networks, necessitating stronger and more durable materials such as PMB to handle heavy traffic. The European Asphalt Pavement Association reports that more than 90% of Europe’s road network uses asphalt, which is increasingly being upgraded with polymer modification for enhanced performance.

Countries such as Germany, France, and the UK are investing significantly in smart infrastructure and sustainable construction practices, further boosting the demand for PMB in paving and roofing applications. Additionally, the European Union’s Green Deal targets sustainable construction materials, encouraging contractors to shift toward polymer modified bitumen for longer-lasting and environmentally efficient infrastructure. With regulatory pressure and the modernization of road networks, Europe continues to remain a highly lucrative region for PMB adoption.

Asia Pacific polymer modified bitumen market is witnessing rapid growth, driven by large-scale infrastructure development and urbanization. The Asian Development Bank estimates that the region requires over US$ 1.7 trillion annually for infrastructure investments to support economic expansion, which is fueling demand for durable road surfacing solutions such as PMB.

India’s Ministry of Road Transport and Highways reported construction of more than 10,000 kilometers of highways in 2023, while China continues to expand its expressway network beyond 177,000 kilometers, according to government statistics. Increasing adoption of polymer modified bitumen in roofing and waterproofing chemicals applications is also supported by the region’s booming real estate and construction sector.

The extreme climate conditions in the Asia Pacific, ranging from monsoons to high heat, make PMB an ideal choice for extending road life and reducing maintenance costs. With rising investments in smart cities and transportation projects, Asia Pacific is emerging as the fastest-growing region with a 5.6% CAGR between 2025 and 2032 in the polymer modified bitumen market.

The global polymer modified bitumen market is highly competitive, with leading companies investing in sustainable technologies and product innovations to gain market share. Nynas AB has a strong presence with its premium product line, such as Nypol PMB, widely used in European highway projects due to its enhanced rutting resistance and long-term durability.

Shell plc continues to dominate with its Cariphalte range, a polymer-modified binder extensively deployed across airports and motorways to ensure high-performance asphalt surfaces. ExxonMobil leverages its polymer technology expertise to supply Styrene-Butadiene-Styrene-based PMB, catering to large-scale infrastructure in North America and Asia Pacific.

Companies such as Sika AG are expanding their portfolio with bio-based PMB additives aimed at reducing carbon emissions, aligning with the EU’s Green Deal sustainability targets. Oil India Limited and Gazprom are strengthening their positions by ensuring supply security in emerging Asian and Eastern European markets. Collectively, these strategies reflect an industry shift toward eco-friendly, durable, and cost-effective polymer modified bitumen solutions to meet rising global infrastructure needs.

The global polymer modified bitumen market is valued at US$ 13.5 Bn in 2025 and is expected to reach US$ 18.8 Bn by 2032, growing at a CAGR of 4.6%.

Road construction remains the largest segment, driven by demand for durable, weather-resistant pavements.

Asia Pacific leads the market expansion, with India and China witnessing massive adoption in road development projects.

Climate resilience, durability, urbanization, and sustainable infrastructure initiatives are fueling strong market growth.

Eco-friendly PMB with recycled plastics and innovations such as self-healing technologies create major growth opportunities.

Leading companies include Shell plc, ExxonMobil, Nynas AB, Sika AG, and Oil India Limited.

|

Report Attribute |

Details |

|

Market Size (2024E) |

US$ 13.5 Bn |

|

Projected Market Value (2031F) |

US$ 18.8 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

4.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.1% |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Billion for Value Tons for Volume |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

By Polymer Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author