ID: PMRREP4343| 195 Pages | 15 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

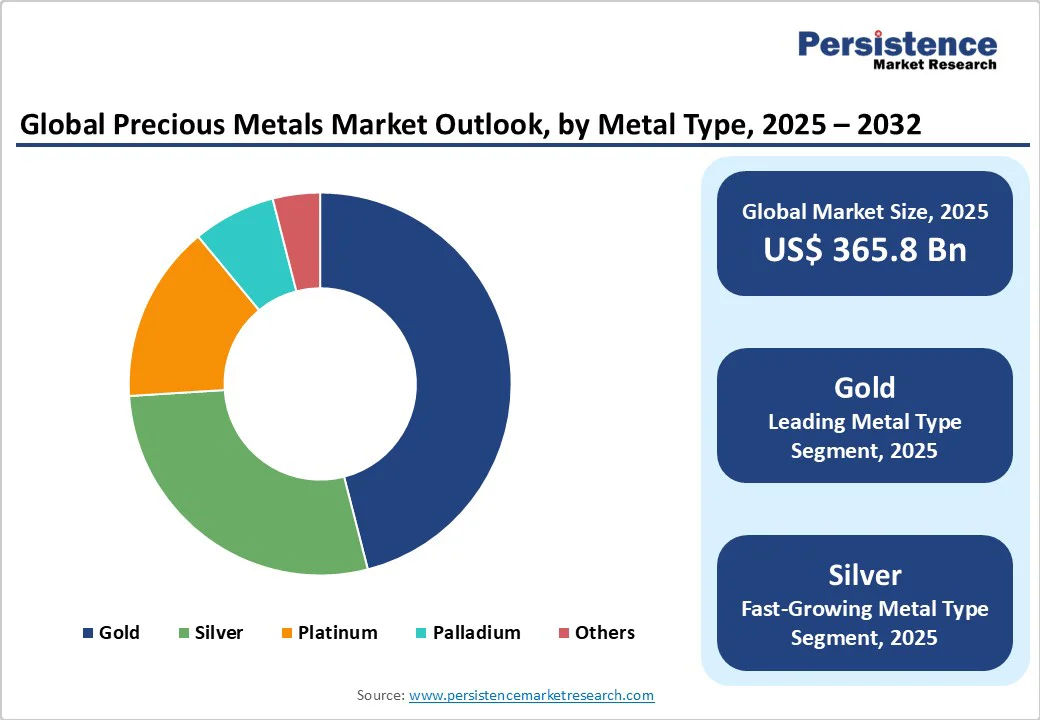

The global precious metals market size is likely to be valued at US$365.8 Billion in 2025, and is estimated to reach US$491.2 Billion by 2032, growing at a CAGR of 4.3% during the forecast period 2025 - 2032, driven primarily by increasing industrial demand for silver and platinum group metals, growing investment appetite for gold-backed instruments, and sustained demand in jewelry sectors across emerging economies.

Technological advancements, combined with regulatory incentives in clean energy and emissions control, are catalyzing expansion, while demographic shifts supporting luxury consumption underpin the broader market resilience.

| Key Insights | Details |

|---|---|

| Precious Metals Market Size (2025E) | US$365.8 Bn |

| Market Value Forecast (2032F) | US$491.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.2% |

The ongoing global transition toward electric and fuel cell vehicles is emerging as a powerful driver reshaping precious metals demand, particularly for platinum and palladium. According to the International Energy Agency (IEA), global electric car sales went past 17 million in 2024, constituting more than 20% of total cars worldwide.

Fuel cell electric vehicles (FCEVs), which rely heavily on platinum catalysts, are also experiencing growing uptake, underpinned by stringent emission regulations, notably the Green Deal targets set by the European Union (EU) and China’s zero-emission vehicle mandates, which are incentivizing original equipment manufacturers (OEMs) to invest in fuel cell technology.

An average fuel cell stack consumes roughly 0.5 grams of platinum, projecting an annual incremental platinum demand increase of approximately 850 tons by 2032, equivalent to roughly 12% of current global platinum production. Beyond automotive applications, fuel cells are penetrating stationary power generation and heavy transport, further intensifying metal demand.

The precious metals market growth faces structural supply risks stemming from the geographic concentration of key metal production and refining. Approximately 70% of global platinum and palladium production originates in South Africa and Russia, while over half of primary silver refining capacity is heavily clustered in North America and Mexico. This concentration exposes the market to geopolitical tensions, labor unrest, and regulatory disruptions.

Historical labor strikes in South African platinum mines during 2021 resulted in output reductions exceeding 15% over six months, triggering sharp price escalations and supply shortages. Simultaneously, international sanctions on Russian palladium exports create potential for supply constraints, which could curtail palladium availability by up to 10% in certain years.

The limited geographic spread of upstream supply compels market participants to manage elevated inventory levels, diversify supplier bases, and explore recycling and secondary sourcing opportunities. Failure to address these risks may result in volatility that could undermine downstream industrial demand and investor confidence.

The rapid acceleration of photovoltaic (PV) solar capacity expansion is unlocking a lucrative niche demand opportunity for silver, driven by its critical role in solar cell metallization. Each solar panel cell incorporates approximately 70 milligrams of silver, making the metal a key raw input in global clean energy transitions.

International Renewable Energy Agency (IRENA) forecasts indicate global PV capacity will reach 2,000 GW by 2032, more than doubling the 900 GW installed in 2024. This growth trajectory translates into incremental annual silver demand exceeding 140 million ounces by 2032, corresponding to about 6% of the current silver supply.

The push toward solar power aligned with policy initiatives in Asia Pacific, Europe, and North America is driving manufacturers to innovate with advanced silver pastes and conductive inks. Emerging silver recycling technologies from solar panel end-of-life processing are anticipated to supplement supply chains effectively. Companies positioned to optimize silver sourcing, advance metallization efficiency, and form strategic partnerships with key solar EPC providers are poised to capture substantial value.

Gold is anticipated to maintain dominance in the precious metals market with an estimated 46% share in 2025, boosted mainly by its enduring appeal in jewelry manufacturing and robust investment demand through bullion and exchange-traded fund (ETF) products. Central bank gold purchases reached a combined 250 tons in 2024, underscoring the metal's role as a financial hedge amid global economic uncertainties.

Silver is the fastest-growing metal segment, anticipated to record a considerable CAGR through 2032. This growth is propelled by expanding industrial applications, including electronics manufacturing and renewable energy technologies such as photovoltaics, where the superior conductivity of silver is vital. Market participants focusing on silver stand to benefit from its diverse end-use technological integrations, positioning it as a critical growth metal beyond traditional investment and ornamentation roles.

Jewelry is set to remain the leading end-user segment with an estimated 54% market share in 2025, sustained by rising disposable incomes and cultural affinity to ornaments in traditional economic systems, particularly in countries such as India and China. The luxury consumer base expansion is upholding a persistently high demand for gold and platinum jewelry while also encouraging design innovation and premiumization.

The industrial segment is the fastest-growing end-use area. The growth trajectory of this segment is underpinned by the intensifying use of platinum group metals, such as rhodium and iridium, in automotive catalytic converters, growing electronic device miniaturization requiring silver, and emerging clean energy technologies. The forces governing the massive demand for metals for industrial applications have necessitated innovations in metal efficiency and recycling to ensure sustainable supply chains.

Bars and coins are likely to constitute approximately 38% of the market in 2025, reflecting steady retail and institutional interest in precious metals as store-of-value and portfolio diversification instruments. The accessibility of bullion products and the proliferation of gold and silver ETFs are expanding investor participation globally.

The powder and solution form segment is gaining momentum with a modest CAGR during the forecast period 2025 - 2032, driven by technological applications in additive manufacturing, printed electronics, and specialty chemicals. These advanced forms facilitate high-precision industrial processes and represent a frontier of innovation that integrates precious metals beyond conventional applications, offering a pathway for product differentiation and market expansion.

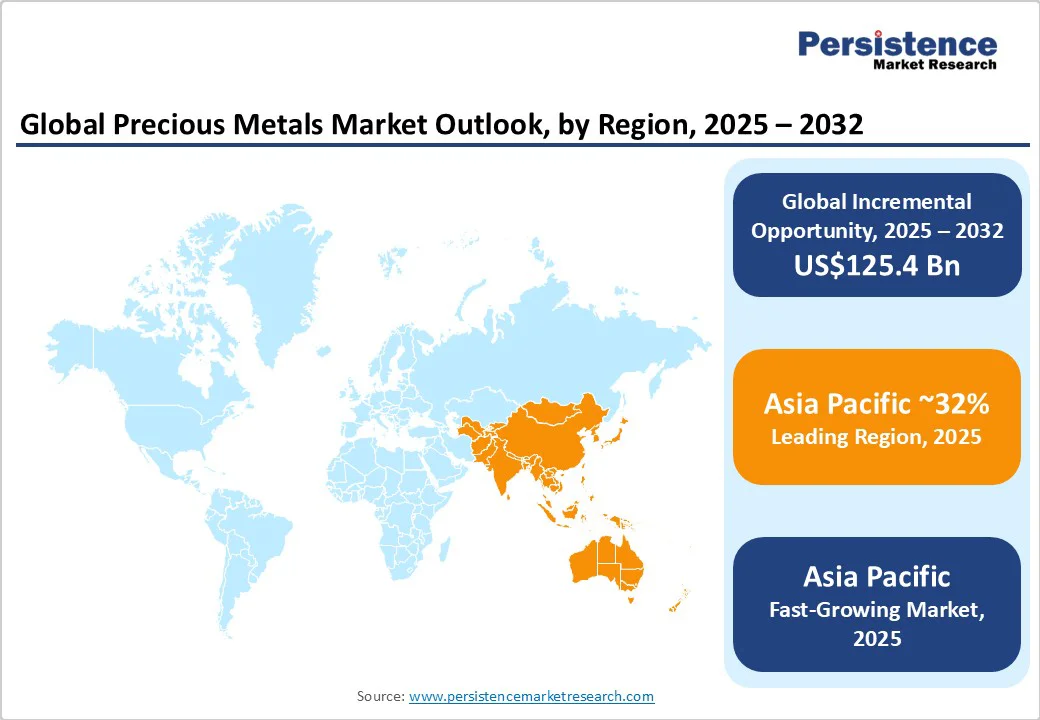

Asia Pacific is anticipated to be the largest regional market, holding an estimated 32% of the precious metals market share in 2025, driven by China’s massive manufacturing scale, India’s jewelry consumption, and the ASEAN region’s evolving industrial base. It is anticipated to be the fastest-growing region, powered by accelerated solar PV deployment, affordable manufacturing costs, and expanding domestic investment channels in the region.

Chinese government policies through the Five-Year Plans actively prioritize green technologies and advanced materials, further stimulating the demand for platinum, palladium, and silver. India’s rising middle class and cultural emphasis on gold jewelry contribute robustly to consumption growth. The competitive environment is characterized by rapid capacity expansions, technology adaptation, and increasing foreign direct investment, presenting an expansive and multifaceted opportunity landscape.

North America is poised to command around a 24% share of the market sales in 2025, underlined by the U.S leadership in fueling investment demand, recycling infrastructure, and advanced manufacturing. The regulatory environment, shaped by the Clean Air Act and EPA emissions standards, has fostered growth in the use of platinum and palladium as autocatalysts.

The robust innovation ecosystem of the U.S. and Canada, particularly in clean energy technologies, microelectronics, and digital trading platforms, enhances regional competitiveness. Leading players are expanding recycling capacity and engaging with federal policy initiatives to support sustainable sourcing, strengthening investment attractiveness. The region’s complex regulatory landscape necessitates proactive compliance strategies to capitalize on growth and mitigate risks associated with environmental and trade policies.

Europe is expected to hold an estimated 21% of the precious metals market share in 2025, with Germany, the U.K., France, and Spain dominating consumption through strong automotive manufacturing and well-established luxury jewelry markets.

The unified regulatory approach in the region is guided by European Union (EU) directives, such as the Emission Trading System and REACH chemical regulations. These policies have incentivized the adoption of platinum group metals in catalysts and encouraged research into sustainable metal use.

The competitive landscape features both established multinational refiners and agile small & medium enterprises (SMEs) innovating in recycling and product development. Investment flows are targeting technology upgrades and circular economy initiatives, enhancing the sustainability credentials of the regional market and positioning Europe as a strategic hub for precious metals value chain integration.

The global precious metals market exhibits a moderately consolidated structure with the top five players, Anglo American Platinum, Barrick Gold Corporation, Newmont Corporation, Sibanye-Stillwater Limited, and Johnson Matthey plc, accounting for approximately 45% of total market revenue. These companies have been engaging in mining operations in different geographies, leveraging integrated refining capabilities and vertical integration strategies.

Beyond the leading firms, the market remains fragmented with numerous mid-tier and smaller refiners contributing specialized services and recycling solutions. This dynamic fosters a competitive pricing environment that drives innovation in production efficiency and recycling technologies. Market leaders maintain dominance through scale advantages and technology investments, while emerging players focus on strategic niches and geographic expansion to capture incremental growth.

The precious metals market is projected to reach US$365.8 Billion in 2025.

Increasing industrial demand for silver and platinum group metals, growing investment appetite for gold-backed instruments, and sustained demand in the jewelry sector are driving the market.

The precious metals market is poised to witness a CAGR of 4.3% from 2025 to 2032.

Regulatory incentives in clean energy and emissions control, intensifying exploration of new precious metal mining sites, and demographic shifts supporting luxury consumption are key market opportunities.

Anglo American Platinum, Barrick Gold Corporation, and Newmont Corporation are some of the key players in the precious metals market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Metal Type

By End-Use

By Form

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author