ID: PMRREP3107| 199 Pages | 20 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

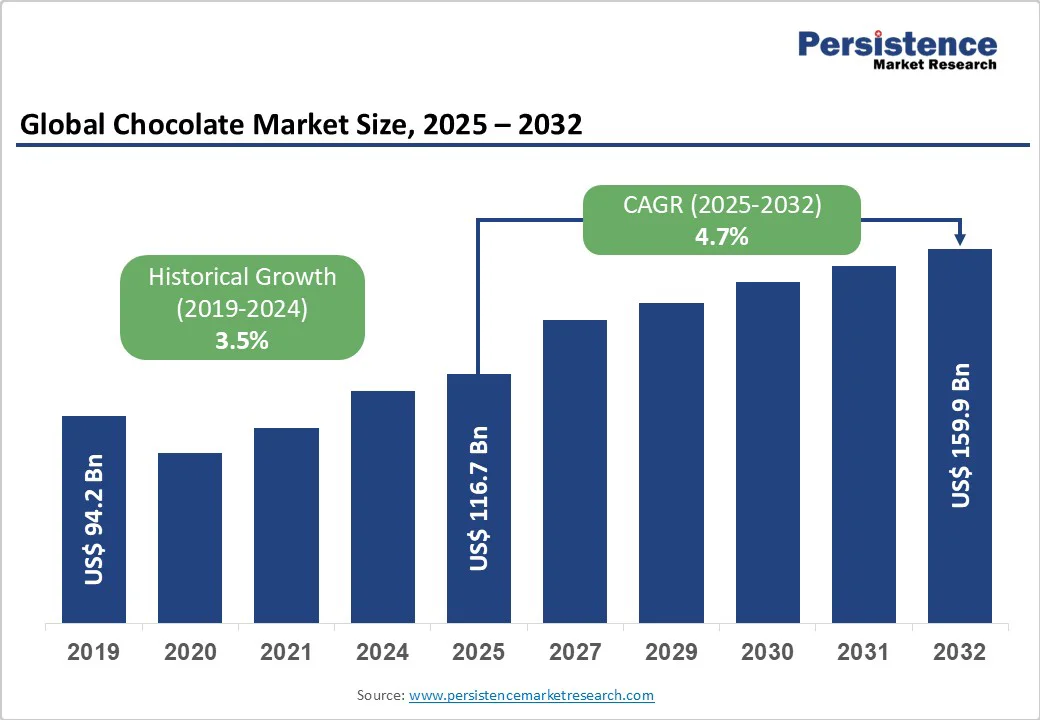

The global chocolate market size is likely to be valued at US$ 116.7 billion in 2025, and is projected to reach US$ 159.9 billion by 2032, growing at a CAGR of 4.7% during the forecast period 2025 - 2032.

This growth is fueled by rising consumer demand for premium and ethically sourced chocolates that emphasize quality, sustainability, and health benefits such as antioxidant properties of dark chocolate.

Increasing disposable incomes, especially in emerging markets, are also enabling greater consumption of luxury and specialty chocolate products. Trends such as the expansion of online retail channels, innovative flavor combinations, organic and vegan chocolate varieties, and environmentally conscious packaging are further driving market expansion.

| Key Insights | Details |

|---|---|

| Global Chocolate Market Size (2025E) | US$ 116.7 Bn |

| Market Value Forecast (2032F) | US$ 159.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.5% |

Chocolate has transformed from simply a treat into a vital way to express personal feelings, with seasonal and customized gifting becoming a major factor in the global chocolate industry. Festivals, holidays, and special events such as Valentine’s Day, Diwali, Christmas, and Easter witness a surging demand for high-end, themed, and personalized chocolates.

Options for customization, such as engraved messages, custom packaging, and curated collections, boost emotional connection, making chocolates a thoughtful and memorable gift. Luxury chocolatiers and new startups are taking advantage of this trend by creating limited-edition collections, handcrafted designs, and experiential packaging that appeal to gift-givers looking for unique ways to show affection. Online stores and subscription services also make personalized gifting easier by offering convenience, creative options, and prompt delivery.

Cocoa cultivation is increasingly vulnerable to climate stress, posing a critical challenge to consistent bean quality and price stability in the chocolate market. Extreme weather events, rising temperatures, and shifting rainfall patterns disrupt flowering, pod development, and harvest cycles, directly affecting yield and flavor profile.

Key cocoa-producing countries such as Cote d’Ivoire, Ghana, Ecuador, and Cameroon face heightened risks, impacting millions of smallholder farmers dependent on stable incomes. Variability in bean quality can lead to fluctuating prices for manufacturers, complicating sourcing strategies and product formulation.

Climate-induced supply inconsistencies further exacerbate pressures on sustainability and traceability efforts, particularly as major importers such as the European Union (EU) demand ethical, high-quality cocoa.

Cocoa cultivation is increasingly vulnerable to climate stress, posing a critical challenge to consistent bean quality and price stability in the global chocolate market. Extreme weather events, rising temperatures, and shifting rainfall patterns disrupt flowering, pod development, and harvest cycles, directly affecting yield and flavor profile.

Key cocoa-producing countries such as Cote d’Ivoire, Ghana, Ecuador, and Cameroon face heightened risks, impacting millions of smallholder farmers dependent on stable incomes. Variability in bean quality can lead to fluctuating prices for manufacturers, complicating sourcing strategies and product formulation.

Additionally, climate-induced supply inconsistencies exacerbate pressures on sustainability and traceability efforts, particularly as major importers like the European Union demand ethical, high-quality cocoa. These challenges collectively restrain market growth and elevate operational risks for chocolate producers worldwide.

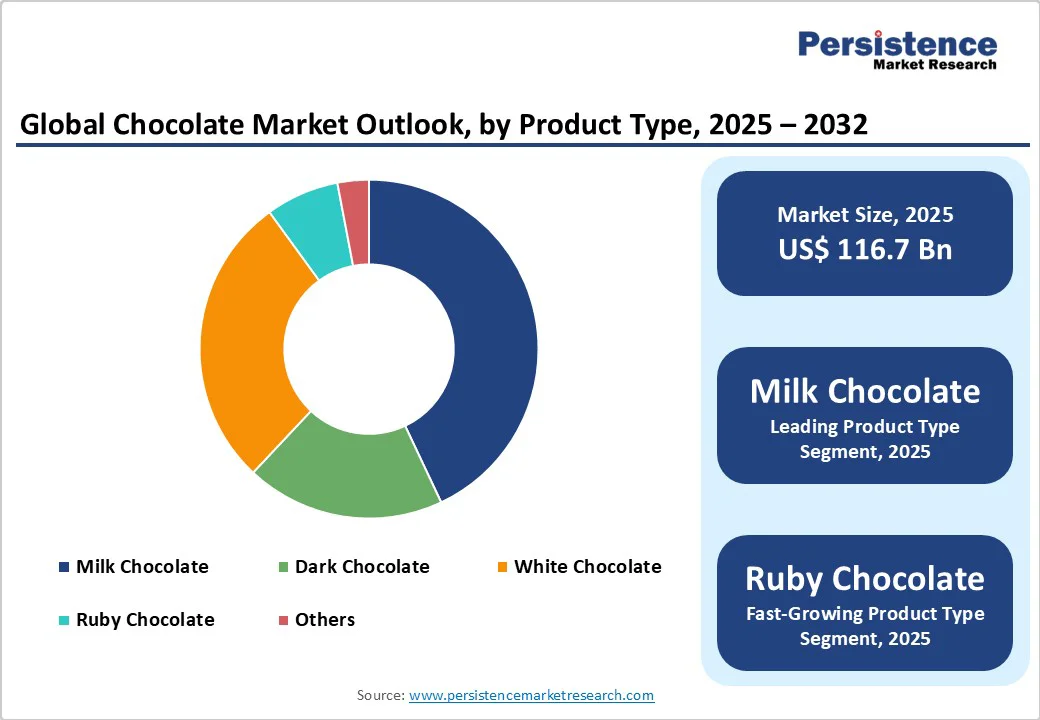

Milk chocolate will continue to dominate the chocolate market revenue share in 2025 due to its widespread consumer appeal, smooth texture, and balanced sweetness that suits a broad range of tastes. Its versatility in confectionery, baking, and snack applications makes it a preferred choice for both household consumption and industrial use.

Dark chocolate, valued for its high cocoa content and perceived health benefits, is gaining traction among health-conscious consumers seeking antioxidants and lower sugar alternatives. White chocolate offers creamy, sweet indulgence and is often used in premium confectionery and decorative applications.

Ruby chocolate, the newest entrant, attracts attention with its naturally pink hue and unique berry-like flavor, providing innovative options for gifting and limited-edition products.

Chocolate bars are anticipated to hold the leading market share in 2025, owing to their widespread consumer appeal, convenience, and strong presence in both retail and impulse-buy channels. Their diverse flavor profiles, portion-controlled packaging, and strong branding resonate well across various demographics, making bars a staple choice globally.

However, the fastest-growing segment over the forecast period is expected to be chocolate chips and chunks, driven by rising consumer interest in baking, confectionery, and home cooking activities. Increased demand from premium bakery products, artisanal desserts, and the expanding breakfast foods category fuels growth in this segment.

Innovation in chip and chunk shapes, sizes, and flavor infusions also supports consumer engagement, while the surge in e-commerce and at-home consumption trends further amplifies market penetration. Consequently, the bars segment maintains dominance through volume and familiarity, while chips and chunks capitalize on evolving consumption occasions and culinary trends to register accelerated growth.

Online retail is projected to grow at a CAGR of 8.9% during the forecast period from 2025 to 2032, driven by increasing consumer preference for convenience, doorstep delivery, and personalized shopping experiences in the global chocolate market. E-commerce platforms allow brands to offer curated assortments, limited editions, and subscription-based chocolate boxes, enhancing customer engagement and loyalty.

Supermarkets and hypermarkets continue to play a critical role by providing wide availability, competitive pricing, and promotional displays that attract bulk purchases and impulse buying. Specialty stores cater to niche segments, emphasizing premium, artisanal, and ethically sourced chocolates, often accompanied by storytelling and tasting experiences that deepen consumer connection.

Together, these channels create a multi-tiered distribution ecosystem that drives both accessibility and premiumization in chocolate sales.

North America is expected to continue to be a vibrant hub for chocolate consumption, powered by evolving consumer preferences and innovative product offerings. As per a Persistence Market Research survey, 38% of U.S. consumers eat chocolate at least once a week, highlighting its enduring popularity. Brands increasingly emphasize premium claims to attract consumers seeking elevated indulgence, while flavor remains the top driver of purchases.

Clean-label ingredients, vegan chocolate, and sustainably sourced cocoa are gaining prominence, reflecting rising health and ethical consciousness. Packaging innovations, particularly for gifting occasions, further boost market appeal. In Canada, similar trends are observed, with consumers valuing artisanal and ethically produced chocolates.

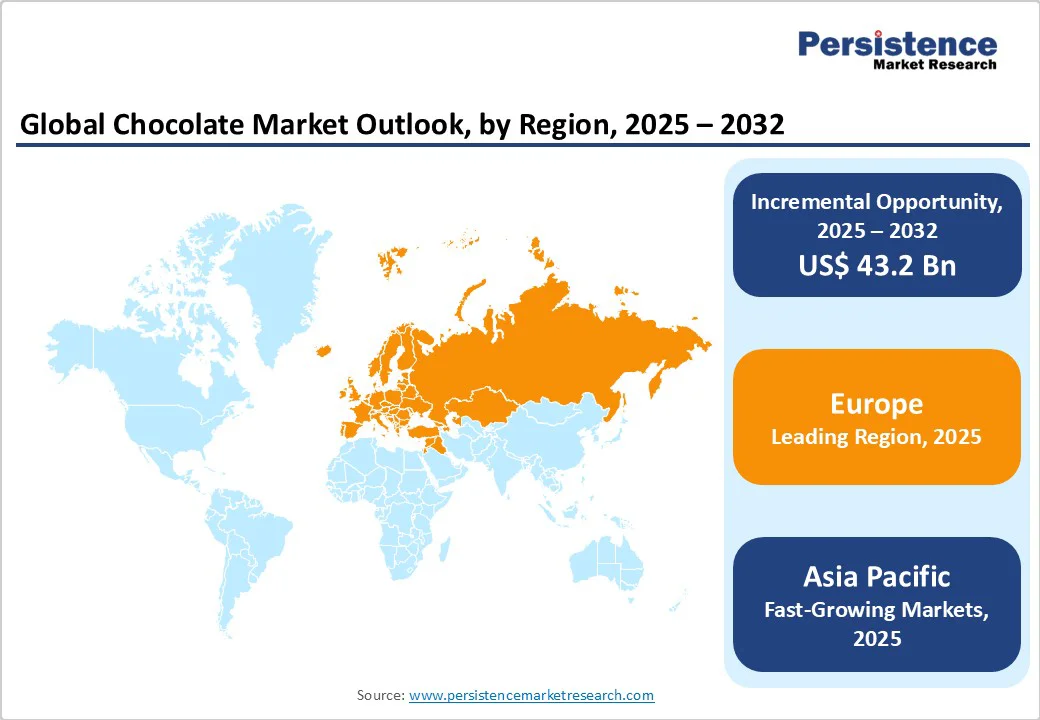

Europe is expected to hold approximately 39% of the chocolate market share in 2025, owing to its rich chocolate heritage, high consumption rates, and advanced manufacturing capabilities. The EU is the world’s largest importer of cocoa beans, accounting for 58% of global imports, ensuring a stable supply for both industrial and artisanal chocolate production.

Germany leads as the largest producer of chocolate as a consumer product, followed by Italy, France, the Netherlands, and Belgium, reflecting strong domestic demand and export potential.

Several global cocoa and chocolate companies are headquartered in Europe, with Barry Callebaut standing out as the largest manufacturer, operating 66 factories worldwide in 2023 and achieving a product sales volume of 2.3 million tons. Premium, sustainably sourced, and flavor-driven chocolates continue to shape the European market landscape.

The Asia Pacific chocolate market is poised for robust growth from 2025 to 2032, driven by rapid urbanization and rising disposable incomes in the emerging economies of China, India, and Southeast Asia. These factors are expanding the consumer base for chocolate products, including premium and specialty offerings.

Increasing westernization of diets and the proliferation of international chocolate brands are fostering greater consumer acceptance and experimentation with diverse flavors and formats. E-commerce platforms and modern retail formats are significantly enhancing product accessibility and variety, fueling impulse purchases and enabling niche product penetration.

Besides the above, health-conscious trends are shaping product development, with growing demand for dark chocolate, sugar-reduced variants, and ethically sourced, organic options catering to sophisticated consumer preferences. The expanding interest of the middle class in indulgence and gifting occasions also contributes to seasonal and premium segment growth.

Furthermore, innovations in packaging, flavor profiling, and product personalization resonate well with younger consumers, reinforcing market momentum.

The global chocolate market landscape is highly dynamic and competitive, characterized by a mix of established multinational brands and agile startups striving to differentiate through innovation and sustainability.

On the supply side, companies are optimizing cocoa bean sourcing from West Africa, Latin America, and Asia, ensuring traceability, ethical farming, and consistent quality. Demand-side trends emphasize premiumization, clean-label ingredients, organic certifications, vegan formulations, and unique flavor combinations. Brands leverage creative packaging, limited-edition launches, and experiential marketing gimmicks to engage consumers.

Innovations in functional chocolates, personalized gifting, and digitally enabled traceability strengthen brand credibility. Asia Pacific presents significant growth potential due to rising disposable incomes, increasing chocolate consumption, and expanding urban retail networks. Strategic investments in sustainable sourcing, product diversification, and region-specific marketing are shaping the competitive landscape and driving long-term market expansion.

The global chocolate market is projected to reach US$ 116.7 billion in 2025.The global chocolate market is projected to reach US$ 116.7 billion in 2025.

High popularity of seasonal and personalized chocolate gifting culture drives the demand for chocolates worldwide.

The market is poised to witness a CAGR of 4.6% between 2025 and 2032.

Formulating innovative flavor infusions and ethnic-inspired chocolates is one of the key market opportunities.

Some of the major market players include The Hershey Company, Mars Inc., Nestlé S.A., and Lindt & Sprüngli AG.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author