ID: PMRREP31787| 188 Pages | 21 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

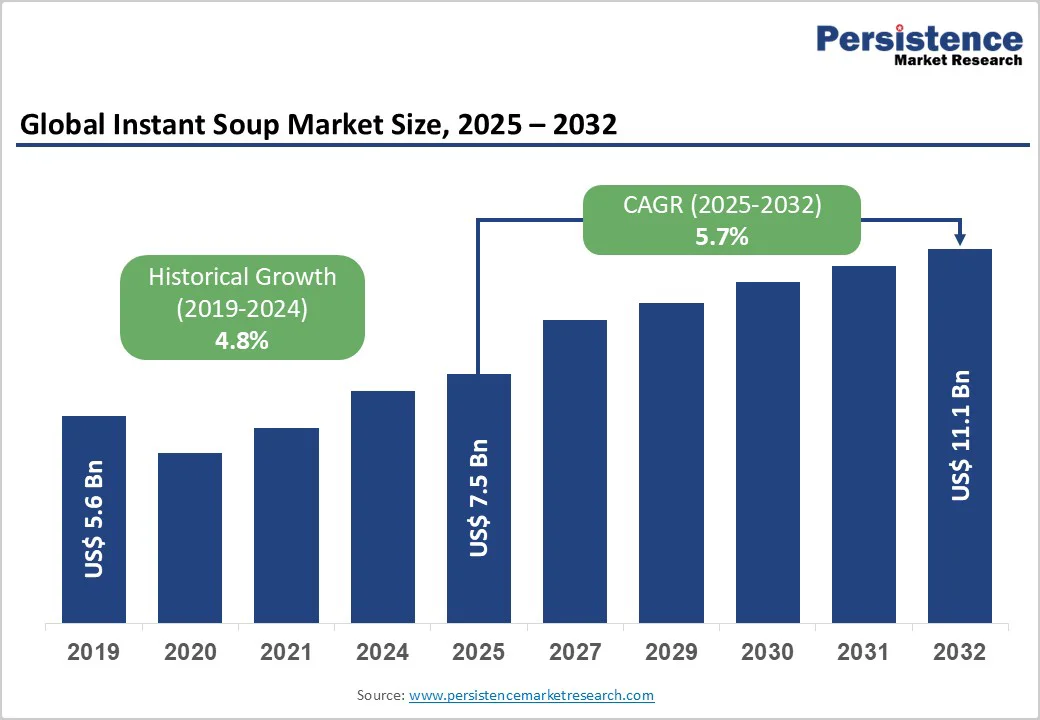

The global instant soup market size is likely to be valued at US$7.5 billion in 2025 and is projected to reach US$11.1 billion at a CAGR of 5.7% during the forecast period from 2025 to 2032.

The global instant soup industry is undergoing a significant transformation, driven by urbanization, premiumization, and the growing demand for healthier convenience foods. Shifting consumer behavior, ingredient innovation, and advanced processing technologies are redefining competition, giving both legacy brands and startups room to innovate.

| Key Insights | Details |

|---|---|

|

Global Instant Soup Market Size (2025E) |

US$7.5 Bn |

|

Market Value Forecast (2032F) |

US$11.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.8% |

Modern urban life leaves little time for elaborate cooking, pushing consumers toward fast, flavorful, and nutritious meal options. This lifestyle transformation has significantly accelerated the demand for instant and ready-to-eat soups. With increasing dual-income households, long working hours, and a growing on-the-go eating culture, consumers seek quick meal replacements that require minimal preparation.

Instant soups perfectly align with these needs by offering convenience without compromising on taste or satiety. The surge in single-person households and urban millennials prioritizing time efficiency further amplifies the market’s growth. Moreover, manufacturers are responding with healthier, premium, and portable soup formats ranging from cup soups to pouch-based solutions designed for instant consumption. This shift illustrates how urbanization continues to redefine eating habits worldwide.

Volatile ingredient prices have become a significant obstacle for instant soup manufacturers, disrupting production planning and profit stability. The costs of vegetables, spices, and meat ingredients are highly sensitive to climatic variations, supply chain interruptions, and global commodity market shifts. These fluctuations directly inflate raw material expenses, forcing producers to adjust retail prices or compromise on formulation quality. Unpredictable agricultural yields and rising transportation costs further strain price consistency, particularly for brands that rely on imported ingredients. This instability challenges long-term contracts with retailers and weakens consumer trust in value-for-money offerings. As ingredient volatility intensifies, manufacturers face mounting pressure to balance cost control, product integrity, and competitive pricing in a margin-sensitive segment.

A growing appetite for culinary authenticity is pushing instant soup brands toward chef-inspired recipes that echo restaurant-quality experiences. Incorporating artisanal ingredients such as slow-roasted vegetables, hand-picked herbs, and ethically sourced meats offers differentiation in a category often criticized for uniform taste and high processing. Consumers seeking premium convenience are increasingly drawn to products emphasizing freshness, texture, and minimal industrial intervention. For established players, this shift presents a route to premiumization and stronger brand loyalty. For startups, it opens a creative niche to experiment with gourmet profiles like miso-ginger broth or truffle-infused mushroom soup. Transparent ingredient sourcing and clean-label claims amplify trust, helping these products capture both health-conscious and flavor-driven segments in the evolving instant soup landscape.

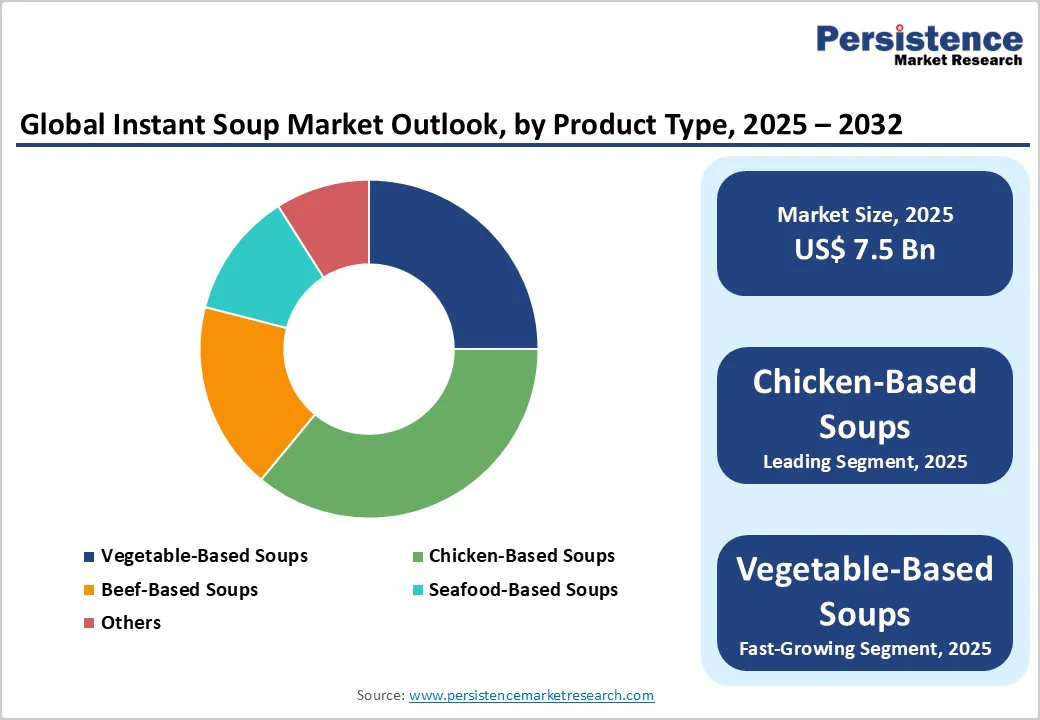

Chicken-based instant soups hold approximately. 35% market share as of 2024, driven by their universal appeal, balanced flavor profile, and high protein content that aligns with comfort and nutrition preferences. Their versatility across regional cuisines, from creamy Western broths to spicy Asian variants, keeps them a staple choice for diverse consumers. Convenient rehydration, mild seasoning, and wide availability in both premium and budget formats further reinforce their dominance. Vegetable-based soups are gaining ground among flexitarian and vegan consumers seeking lighter, plant-forward options. Beef-based soups retain popularity in markets favoring hearty, protein-rich meals, while seafood-based soups cater to niche audiences seeking coastal flavors and functional nutrition. Together, these variants reflect evolving dietary diversity within the global instant soup landscape.

Organic instant soups are projected to grow at a CAGR of 8.6% during the forecast period, reflecting the rapid shift toward clean-label and sustainable food consumption. Consumers are increasingly seeking convenient meal options free from synthetic additives, pesticides, and genetically modified ingredients. This aligns with growing health awareness and the global emphasis on environmentally responsible sourcing. Brands leveraging organic certification and transparent ingredient origin are positioned to capture premium shelf space and consumer trust. Expanding distribution through online health-food platforms and specialty retailers further accelerates visibility. As younger demographics embrace mindful eating, demand for organic instant soups featuring whole grains, dehydrated vegetables, and natural seasonings is set to rise, reshaping competition in the convenience food segment.

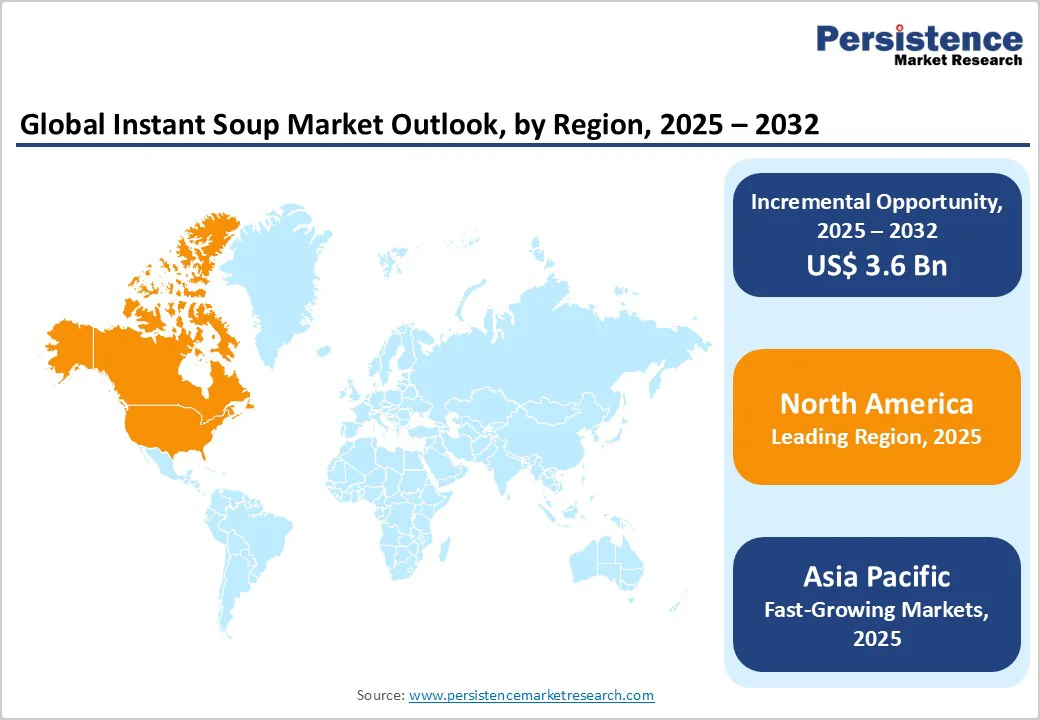

North America holds approximately 36% market share in the global instant soup market, driven by evolving consumer preferences for quick, nutritious, and premium meal solutions. In the U.S., rising demand for high-protein, low-sodium, and organic instant soups reflects a shift toward wellness-oriented convenience foods. Canadian consumers are increasingly interested in plant-based and gluten-free formats, aligning with sustainability and dietary inclusivity trends.

Brands such as Campbell’s, Progresso, Lipton, Knorr, and Annie’s Homegrown are leading innovation through reformulations featuring cleaner labels, reduced preservatives, and locally sourced ingredients. The growing popularity of single-serve pouches and microwavable cups underscores lifestyle-driven consumption patterns. Digital grocery platforms and meal-kit integrations are further reshaping how North American consumers discover and engage with instant soup offerings.

Asia Pacific is expected to grow at a CAGR of 7.8% during the forecast period, driven by urbanization, changing meal patterns, and increasing demand for convenient, flavor-rich food. In China, premiumization is shaping the category, with consumers favoring soups containing traditional herbs and natural seasonings. India’s market is expanding through fusion flavors that blend local spices with global profiles, appealing to younger consumers. Thailand’s preference for spicy, aromatic broths continues to influence regional product innovation, while Indonesia sees rising consumption of affordable, portion-controlled packs suited for daily meals. Domestic and regional players are emphasizing cleaner formulations, reduced sodium, and locally sourced ingredients. E-commerce platforms and modern retail formats are accelerating accessibility, making instant soups a staple across diverse income groups.

The global instant soup market remains moderately consolidated, with established brands dominating shelf space while agile startups inject innovation through niche positioning. Leading players are enhancing portfolios with clean-label formulations, low-sodium variants, and high-protein options to align with evolving health preferences. Investment in advanced drying technologies, such as freeze-drying and vacuum dehydration, is improving ingredient retention and flavor authenticity. Startups are increasingly focusing on organic certifications, transparent sourcing, and small-batch production to attract eco-conscious consumers. Companies are also modernizing processing lines to enable reduced cooking times and customizable seasoning blends. Strategic collaborations with packaging innovators and e-commerce platforms are reshaping competitiveness, emphasizing sustainability, shelf stability, and sensory appeal as key differentiators in this evolving convenience food category.

The global instant soup market is projected to be valued at US$ 7.5 Bn in 2025.

The growth of the global instant soup market is being driven by the increasing urban lifestyle that fuels demand for convenient, ready-to-eat meal solutions.

The global instant soup market is poised to witness a CAGR of 5.7% between 2025 and 2032.

Introducing chef-inspired soups with artisanal ingredients and minimal processing is a key market opportunity.

Major players in the global instant soup market include Nestlé, Unilever, General Mills Inc., Conagra Brands, Inc., The Campbell's Company, Ajinomoto, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Nature

By Packaging Type

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author