ID: PMRREP32529| 192 Pages | 8 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

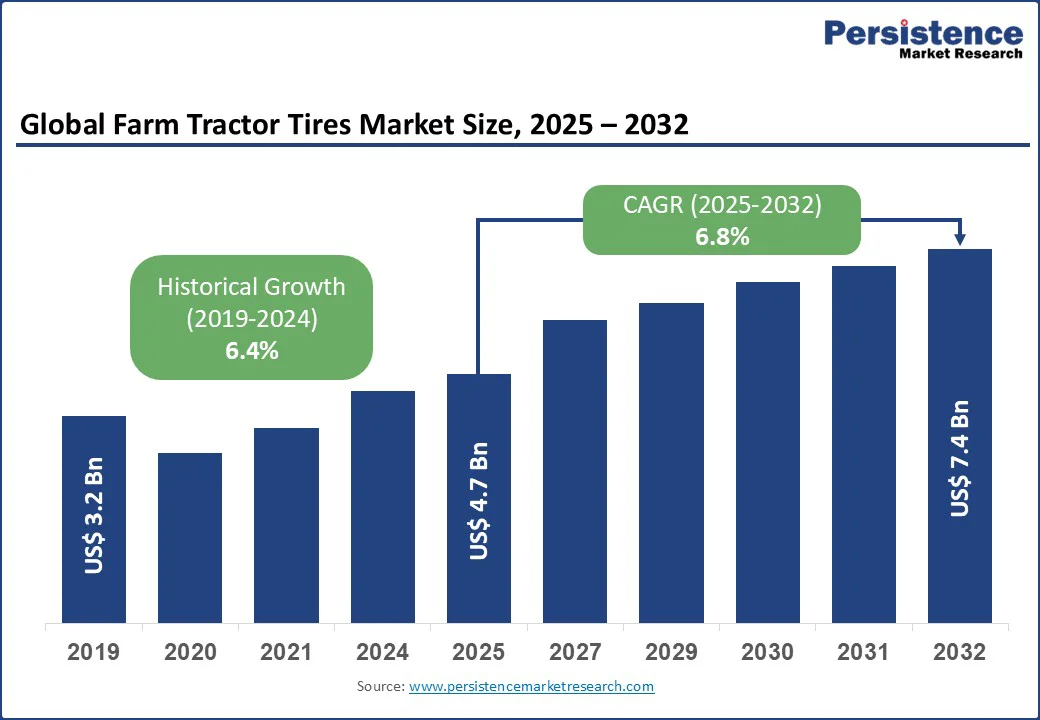

The global farm tractor tires market size is likely to be valued at US$4.7 Bn in 2025 and is expected to reach US$7.4 Bn by 2032, growing at a CAGR of 6.8% from 2025 to 2032.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Farm Tractor Tires Market Size (2025E) |

US$4.7 Bn |

|

Market Value Forecast (2032F) |

US$7.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.4% |

The farm tractor tire industry is primarily driven by the increasing mechanization of agriculture to meet rising global food demand. Growing tractor adoption, expansion of large-scale farming, and supportive government policies in regions such as the Asia Pacific and North America are key contributors.

Rising food demand, driven by global population growth and evolving dietary preferences, is accelerating the pace of agricultural mechanization. Farmers are increasingly shifting to tractors and modern machinery to boost crop yields, enhance efficiency, and meet the rising need for cereals, pulses, fruits, and vegetables. For instance, under India’s Sub-Mission on Agricultural Mechanization (SMAM), more than 460,000 machines have been distributed, and over 7,500 Custom Hiring Centers have been established to expand access to mechanized solutions. Such initiatives reflect how government support directly drives tractor adoption, thereby fueling the demand for farm tractor tires, which are essential for reliable traction, stability, and field performance.

In addition, governments in other key agricultural economies continue to subsidize farm equipment to ensure a sustainable food supply. As tractors remain central to farming operations, this sector is witnessing strong growth, supported by rising food consumption and expanding mechanization policies.

High raw material costs pose a major restraint for the farm tractor tires market. The production of tractor tires relies heavily on natural rubber, synthetic rubber, carbon black, steel, and petroleum-based derivatives. These commodities are subject to frequent price volatility due to global supply-demand imbalances, crude oil fluctuations, and inflationary pressures. Rising input costs directly impact manufacturing expenses, reducing margins for tire producers and increasing the overall market price.

As a result, higher tractor tire prices create affordability challenges, particularly for small and medium-scale farmers in emerging economies. This price sensitivity can limit replacement purchases and slow the adoption of premium, high-performance tires. Consequently, escalating raw material costs continue to act as a key barrier.

Technological advancements present a strong growth opportunity. Manufacturers are increasingly investing in advanced tire technologies, such as radial tires, low-pressure tires, and smart tire solutions with integrated sensors. These innovations enhance traction, reduce soil compaction, improve fuel efficiency, and extend tire life, thereby addressing the evolving needs of modern, mechanized farming. Growing demand for precision agriculture further accelerates the adoption of technologically advanced tractor tires.

At the same time, emerging markets in Asia, Africa, and Latin America offer untapped potential. Rising agricultural mechanization, coupled with supportive government policies and expanding food demand, is driving tractor adoption in these regions. As farmers shift towards modern equipment, the tractor tire industry is poised to capture significant growth opportunities across developing economies.

The high load capacity segment (above 3000 lbs) dominates with 45% market share in 2025. These tires play a critical role in heavy-duty farming and construction activities, where tractors frequently operate with heavy implements on rugged terrains. Their ability to deliver greater stability, durability, and efficiency makes them the preferred choice for large-scale farmers. In 2024, nearly 60% of commercial farms relied on high-load-capacity tires to enhance operational performance and reduce downtime in intensive fieldwork.

Meanwhile, the medium load capacity segment (1000–3000 lbs) is emerging as the fastest-growing category. Its versatility in supporting mid-sized tractors, landscaping machinery, and equipment used in commercial farming has fueled strong adoption. Growing demand from landscaping businesses and small-to-medium farms is expanding this segment’s presence across diverse agricultural applications.

The large size tires segment (above 22 inches) holds the leading position in the farm tractor tires market, accounting for about 50% share in 2025. These tires are widely used in large-scale farming and construction due to their ability to provide superior traction, stability, and load-bearing capacity. In 2024, nearly 65% of high-horsepower tractors above 130 HP were equipped with large tires, helping farmers achieve higher productivity and efficiency during heavy-duty operations.

On the other hand, the medium size tires segment (16–22 inches) is witnessing the fastest growth. Their increasing adoption in small to medium farms and landscaping applications is supported by compatibility with compact tractors and turf-friendly designs. A notable 25% rise in usage during 2024 reflects their growing importance in versatile and less intensive agricultural practices

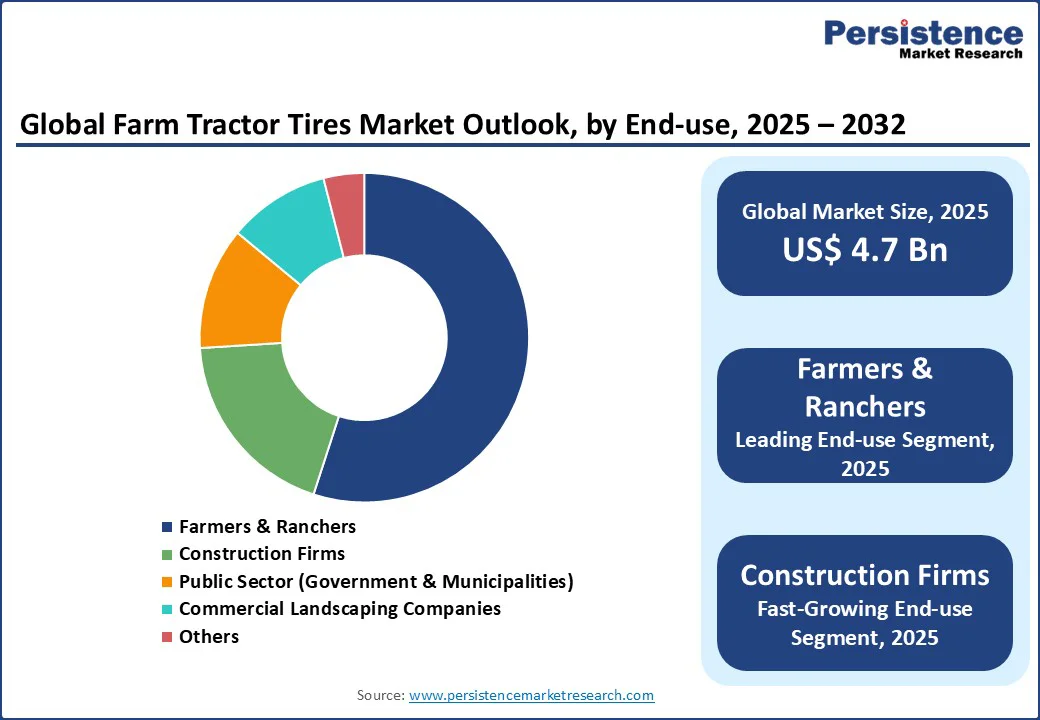

Farmers and ranchers represent the dominant end-user segment in the farm tractor tires market, accounting for about 55% share in 2025. The steady rise in mechanized agriculture across both developed and emerging economies has significantly boosted demand in this category. In 2024, nearly 70% of farmers in developed markets adopted radial tires for their tractors, citing benefits such as improved fuel efficiency, reduced soil compaction, and better overall productivity. This shift has been a key driver of tire demand in large-scale farming operations.

Construction firms are emerging as the fastest-growing segment. A surge in infrastructure development projects, particularly across the Asia Pacific, has increased the use of tractors in land preparation, road building, and leveling activities. This has fueled greater demand for durable, high-load-capacity tractor tires designed to withstand rugged working conditions and heavy operational loads.

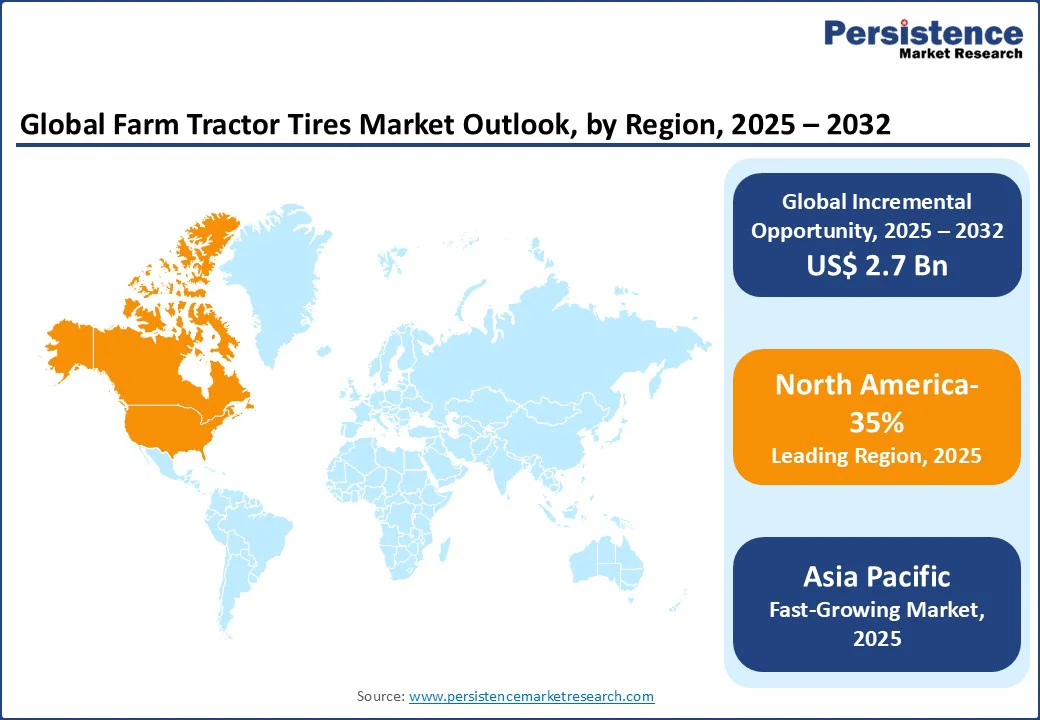

North America leads the farm tractor tires market, holding around 35% share in 2025, driven by high mechanization levels and advanced agricultural infrastructure. Farmers and commercial operators increasingly rely on high-performance radial and high-load-capacity tires to improve fuel efficiency, reduce soil compaction, and enhance productivity in large-scale farming. Strong government support through subsidies and policies promoting mechanized farming further boosts tire adoption. Additionally, the presence of established tire manufacturers and growing investments in precision agriculture technologies reinforce North America’s dominance, making the region a key contributor and setting benchmarks for efficiency and innovation in tractor tire applications.

Europe holds a significant share in the farm tractor tires market, driven by well-established agricultural practices, high tractor penetration, and advanced farming technologies. Farmers increasingly adopt radial and medium- to high-load-capacity tires to improve efficiency, reduce soil compaction, and enhance productivity in diverse crops. Government initiatives promoting sustainable agriculture, mechanization, and precision farming further support tire demand. Additionally, Europe’s strong network of tire manufacturers and emphasis on innovation in durable, eco-friendly tire solutions strengthen the region’s market position.

Asia Pacific is the fastest-growing region in the farm tractor tires market, fueled by increasing agricultural mechanization, rising food demand, and expanding farming activities in countries such as India, China, and Southeast Asia. Small- and medium-sized farms are adopting modern tractors equipped with medium- and high-load-capacity tires to improve efficiency and productivity. Government initiatives supporting mechanized farming, subsidies for tractor purchases, and investment in rural infrastructure further drive market growth. Additionally, growing awareness of high-performance and durable tractor tires among farmers strengthens adoption.

The global farm tractor tires market is highly dynamic, characterized by continuous innovation, strategic partnerships, and capacity expansions. Manufacturers focus on developing advanced radial and high-load-capacity tires to meet growing demand for efficiency, durability, and soil-friendly performance.

Intense competition drives improvements in product quality, cost optimization, and regional distribution networks. Additionally, companies are investing in research and development for smart and eco-friendly tire solutions, ensuring differentiation in a rapidly evolving market and enhancing their presence across global and emerging agricultural regions.

The farm tractor tires market is projected to reach US$ 4.7 bn in 2025, driven by agricultural mechanization and infrastructure growth.

Increasing food demand, precision farming, and infrastructure development fuel market growth.

The farm tractor tires market will grow from US$4.7 bn in 2025 to US$7.4 bn by 2032, with a CAGR of 6.8%.

Technological advancements in smart tires and emerging market growth drive opportunities.

Leading players include BKT, Michelin, Bridgestone, Continental, Titan International, and Trelleborg.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Load Capacity

By Tire Size

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author