ID: PMRREP30447| 200 Pages | 9 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

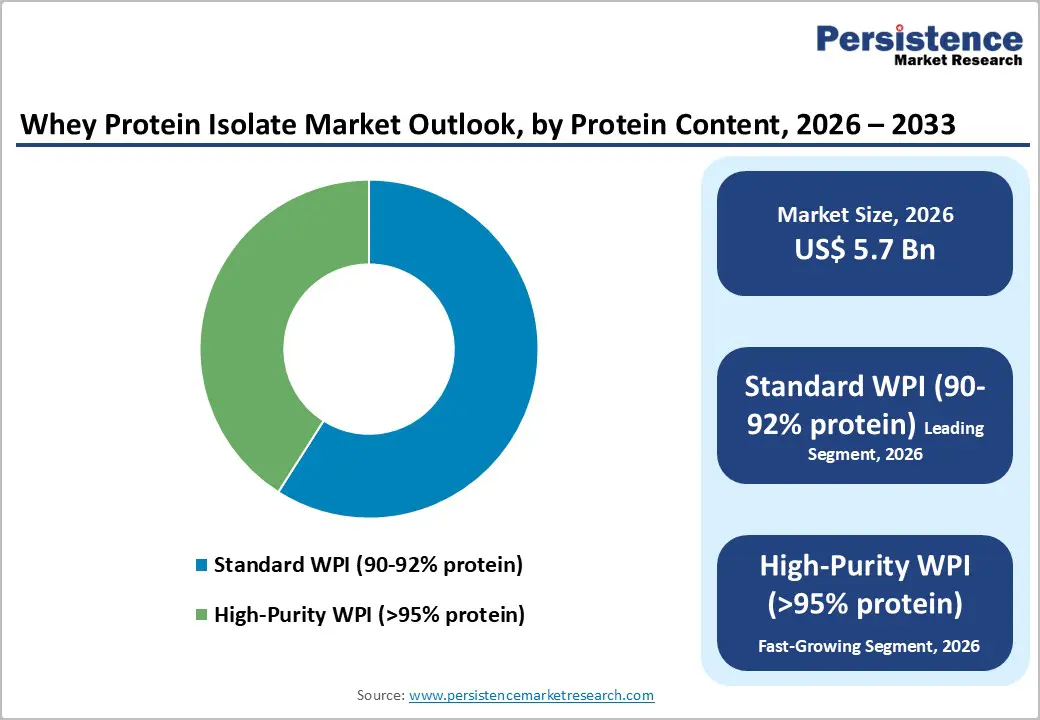

The global whey protein isolate market size is estimated to grow from US$ 5.7 billion in 2026 to US$ 8.8 billion by 2033 growing at a CAGR of 6.4% during the forecast period from 2026 to 2033.

The global market is evolving rapidly, fueled by fitness-driven lifestyles, demand for convenient protein solutions, and rising interest in clean-label, high-purity, and organic formulations. Consumers increasingly seek products that combine performance, taste, and sustainability, creating dynamic opportunities for both established players and innovative startups.

| Key Insights | Details |

|---|---|

| Whey Protein Isolate Market Size (2026E) | US$ 5.7 Bn |

| Market Value Forecast (2033F) | US$ 8.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.5% |

The surge in fitness and gym culture worldwide is reshaping protein consumption patterns, driving a strong demand for whey protein isolates. Fitness enthusiasts, athletes, and lifestyle-focused consumers are increasingly integrating high-purity protein supplements into pre- and post-workout routines to support muscle recovery, strength gains, and overall performance. Boutique gyms, CrossFit studios, and specialized training centers are promoting personalized nutrition plans, creating an ecosystem that encourages regular protein supplementation.

This cultural shift is amplifying demand across ready-to-drink beverages, protein powders, and fortified snacks. Social media influencers and professional trainers are actively endorsing whey protein products, making them aspirational as well as functional. Urban consumers, in particular, are seeking convenient, clean-label protein solutions to complement rigorous fitness routines and health-focused lifestyles.

The rising popularity of plant-based protein alternatives is reshaping the competitive landscape for whey protein isolates, creating a notable market restraint. Consumers concerned with lactose intolerance, environmental impact, and ethical sourcing are increasingly turning to pea, soy, rice, and hemp proteins, challenging traditional animal-derived options. This shift is particularly pronounced among younger people and among those following flexitarian diets, who prioritize sustainability and plant-forward nutrition.

Brands that focus solely on whey protein face pricing pressure and potential market share erosion, as plant-based alternatives offer comparable protein content and added appeal from clean-label positioning and allergen-free claims. To remain competitive, whey protein manufacturers must emphasize superior bioavailability, taste innovation, and hybrid formulations that combine animal and plant protein benefits.

Convenience-driven nutrition is transforming how younger consumers engage with protein supplementation, creating a strong opportunity for ready-to-drink whey protein beverages and meal replacements. Millennials and Gen Z increasingly prioritize on-the-go solutions that combine taste, functionality, and clean-label ingredients, seeking products that fit into busy lifestyles, fitness routines, and work-from-anywhere habits. Attractive flavors, innovative packaging, and portion-controlled formats enhance appeal, making these products central to daily protein intake.

Startups can leverage direct-to-consumer channels, subscription models, and social media marketing to build brand awareness quickly, while established players can expand portfolio diversity through co-branded launches or collaborations with lifestyle and fitness brands. Functional enhancements, such as added vitamins, electrolytes, or adaptogens, further differentiate offerings in competitive urban markets.

Standard WPI (90-92% protein) holds approximately 62% market share as of 2025, reflecting its widespread adoption among fitness enthusiasts, athletes, and general wellness consumers. Its balanced protein concentration delivers optimal muscle recovery and growth benefits while maintaining good solubility, mixability, and taste, making it highly versatile across powders, RTD beverages, and meal replacements. Manufacturers favor this segment for its cost-effectiveness, reliable nutritional profile, and ease of integration into diverse formulations, from protein bars to fortified snacks.

High-Purity WPI (>95% protein) is gaining traction in specialized sports nutrition and clinical applications, where maximum protein density and minimal lactose content are critical. Premium consumers and professional athletes increasingly seek these ultra-concentrated isolates, driving innovation in processing technologies, flavor masking, and clean-label formulations to cater to niche, high-value market segments.

Organic WPI is projected to grow at a CAGR of 8.9% in the global Whey Protein Isolate market during the forecast period, driven by rising consumer preference for clean-label, sustainably sourced, and minimally processed nutrition. Health-conscious buyers increasingly seek products free from synthetic hormones, antibiotics, and pesticides, elevating organic WPI as a premium choice in sports nutrition, functional foods, and wellness formulations.

This growth is further supported by the expanding popularity of plant-forward lifestyles and holistic nutrition approaches, where transparency and traceability influence purchasing decisions. Startups and established players are responding with certified organic formulations, eco-friendly packaging, and ethically sourced whey, enabling differentiation, stronger brand trust, and access to niche, high-value consumer segments across global markets.

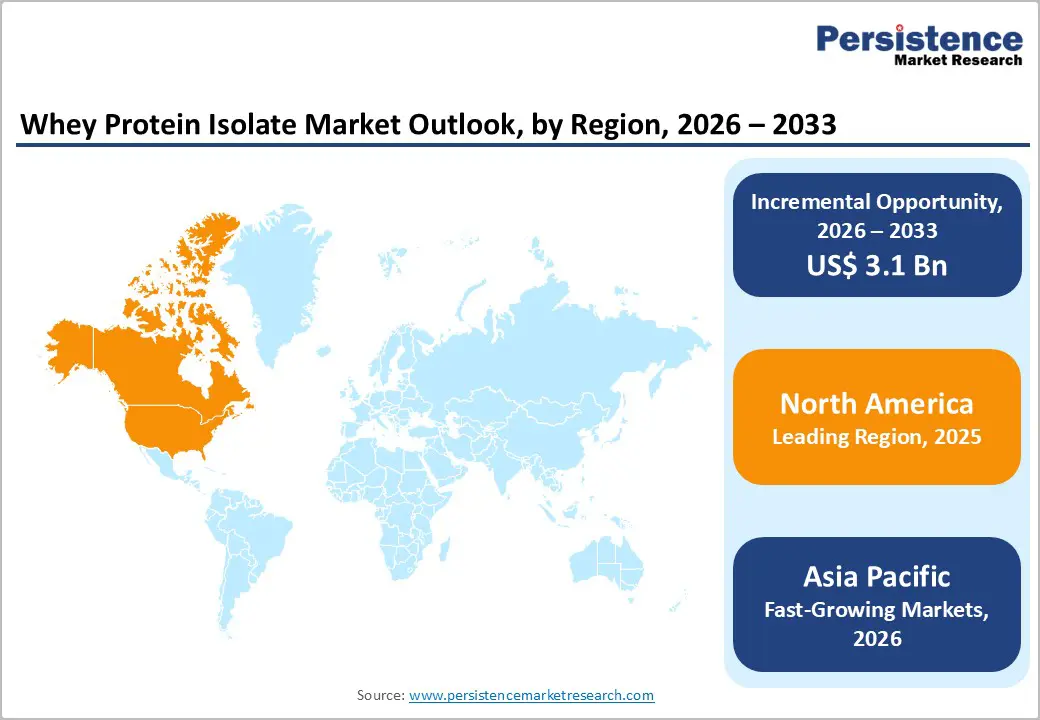

North America holds approximately 38% market share in the global whey protein isolate market, reflecting strong consumer focus on fitness, protein-enriched diets, and functional nutrition. In the U.S., demand is rising for ready-to-drink protein beverages, protein-fortified snacks, and high-protein meal replacements tailored for millennials and Gen Z. Clean-label, organic, and sustainably sourced WPI variants are gaining traction among health-conscious consumers who value transparency and premium quality.

Canada is witnessing growth in protein supplements for sports nutrition and clinical applications, supported by expanding e-commerce channels and subscription-based delivery models. Retailers and specialty stores are emphasizing traceable, high-purity WPI, while product innovation in flavors, textures, and convenient formats continues to drive adoption across both urban and suburban markets.

Asia Pacific whey protein isolate market is expected to grow at a CAGR of 7.6%, fueled by rising fitness awareness, expanding gym culture, and growing demand for functional nutrition across emerging and developed economies. In India, urban consumers are increasingly adopting WPI-based shakes, meal replacements, and protein-enriched snacks to support active lifestyles, while e-commerce platforms are simplifying access to premium and imported products.

China’s market is witnessing strong uptake of high-purity and organic WPI among young professionals and sports enthusiasts, supported by protein-focused nutrition programs and online fitness communities. Japan and South Korea are seeing growth in ready-to-drink protein beverages and fortified wellness products, with emphasis on clean-label, traceable ingredients. Across the region, innovation in flavors, formats, and convenient consumption continues to shape the expanding WPI landscape.

The global whey protein isolate market exhibits a moderately fragmented landscape, where legacy dairy players and agile startups compete through innovation, scale, and speed to market. Leading companies are expanding portfolios with high-purity, organic, and fortified WPI products, while emphasizing clean-label formulations and traceable sourcing to meet evolving consumer expectations. Startups are introducing ready-to-drink shakes, functional snacks, and personalized nutrition solutions, often leveraging digital platforms for direct-to-consumer engagement.

Sustainability initiatives include energy-efficient processing, ethical sourcing, and eco-friendly packaging. Strategic collaborations, vertical integration, and acquisitions are strengthening supply chains and global distribution. Production expansions target high-demand regions, with adherence to government regulations on food safety, protein content labeling, and dairy compliance shaping competitive positioning and long-term market resilience.

The global whey protein isolate market is projected to be valued at US$ 5.7 Bn in 2026.

Rising fitness and gym culture is boosting demand for protein supplements is driving the global whey protein market.

The global Whey Protein Isolate market is poised to witness a CAGR of 6.4% between 2026 and 2033.

Developing ready-to-drink protein beverages and meal replacements targeting millennials and Gen Z is the key opportunity for key players in the market.

Major players in the global Whey Protein Isolate market include Glanbia plc, Saputo Inc., Fonterra Co-operative Group, Arla Foods Ingredients, Lactalis Ingredients, FrieslandCampina, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Protein Content

By Nature

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author