ID: PMRREP34611| 189 Pages | 29 Sep 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

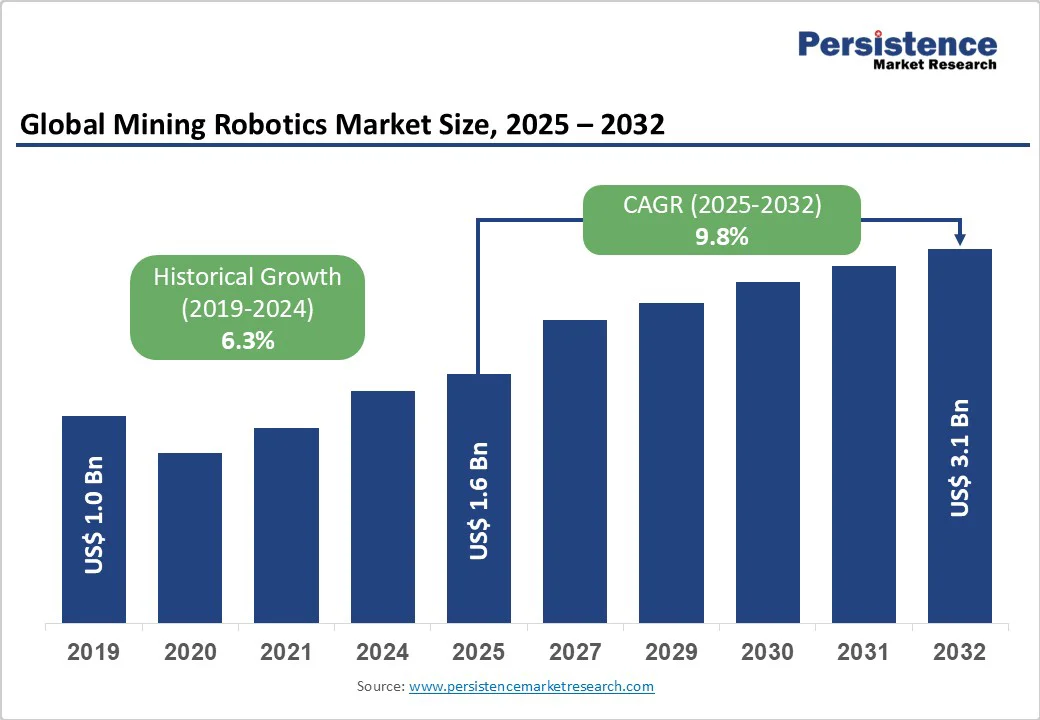

The global mining robotics market size is projected to increase from US$1.6 billion in 2025 to US$3.1 billion by 2032. It is anticipated to witness a CAGR of 9.8% during the forecast period from 2025 to 2032.

Rising concerns over workplace accidents and fatalities are driving the adoption of autonomous and remotely operated mining robots. Advanced technologies, including AI, machine learning, and high-precision navigation systems, enable precise ore extraction, predictive maintenance, and reduced downtime.

| Key Insights | Details |

|---|---|

| Mining Robotics Market Size (2025E) | US$1.6 Bn |

| Market Value Forecast (2032F) | US$3.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 9.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.3% |

Mining operations are inherently hazardous, with frequent accidents causing injuries and fatalities. For instance, on January 29, 2025, at Lexington Coal’s Progress Surface Mine in Raleigh County, WV, a drill operator was fatally injured when a large rock from a 62-foot highwall struck the drill cab.

Robotics addresses these challenges by automating high-risk tasks, such as hauling, drilling, blasting, and inspections, thereby significantly reducing human exposure to hazardous zones. For example, drones and robotic vehicles are being increasingly deployed for site inspections and maintenance of dangerous areas, thereby enhancing operational safety. This shift also mitigates workforce constraints, as the sector faces growing demand for skilled labor in hazardous environments.

Innovation in AI and remote sensing is revolutionizing the capabilities of mining robotics. Intelligent robotic systems now enable autonomous haul trucks, precision drilling robots, and predictive maintenance solutions. By optimizing ore detection and operational efficiency, these systems reduce downtime and operational costs.

Robotics enhances productivity in underground and open-pit mines by automating repetitive, hazardous, or labor-intensive tasks, resulting in average productivity improvements of 20-30% in mines that adopt them. Investments in robotics grew by over 230% between 2019 and 2024, with the market poised to exceed USD 100 billion by 2030.

The substantial cost of advanced autonomous machinery, robotic drilling systems, and AI-powered monitoring solutions limits adoption, especially among smaller mining companies. Implementing robotics often requires upgrading infrastructure and training personnel, adding to expenses.

Long payback periods and fluctuating commodity prices discourage investment, while maintenance and software updates further increase financial burdens. These high capital requirements, particularly in emerging markets with limited access to funding, hinder growth.

Extreme conditions, such as high temperatures, dust, humidity, and corrosive chemicals, increase wear on robotic systems, thereby reducing their reliability. Uneven terrain, narrow tunnels, and limited space in underground and open-pit mines complicate mobility and efficiency.

Payload limitations restrict material handling, affecting productivity and cost-effectiveness, while integration into existing workflows adds complexity. For example, the deployment of large-scale systems, such as Power Supported Longwall (PSLW), which handles 2.4 to 11.33 Mt, underscores the need for robust robots capable of operating in such challenging environments.

Remote-controlled underwater vehicles (ROVs) are expanding opportunities in mining robotics by enabling access to previously unreachable underwater mineral deposits. They allow for precise and efficient extraction, minimizing waste and maximizing resource recovery. Operating underwater reduces environmental impact by avoiding disruption of terrestrial ecosystems, while enhancing safety by removing humans from hazardous conditions.

Increasing adoption of ROVs is driving advancements in underwater robotics, sensing technologies, and automation systems. For instance, DRDO is developing AI/ML algorithms for autonomous underwater mine detection and classification, improving operational efficiency and safety.

High-precision GPS, sensor networks, and advanced vision systems enhance efficiency, safety, and sustainability in mining operations. GPS enables autonomous vehicles to navigate with centimeter-level accuracy, thereby reducing operational delays and minimizing human exposure to hazards. For instance, Sandvik’s AutoMine and OptiMine platforms utilize high-precision GPS for precise positioning and collision avoidance.

Sensor networks, such as Alrosa’s AWMS, enable real-time monitoring of temperature, water levels, and equipment status, thereby automating risk detection and improving productivity. Vision systems support GPS-independent navigation, ore sorting, and structural monitoring, while enabling teleoperation in low-light or confined underground environments. These technologies are creating opportunities to increase extraction efficiency, reduce downtime, and lower energy consumption.

Based on mining techniques, the market is divided into open-pit mining and underground mining. Among these, open-pit mining is expected to account for more than 63.1% share in 2025 due to its widespread use in extracting bulk commodities such as coal, iron ore, and copper.

The technique provides easier access to large deposits, making it more cost-efficient. Large-scale nature of open-pit mines that benefit significantly from robotic automation in hauling, drilling, and blasting, where heavy-duty autonomous trucks and loaders increase operational efficiency and safety.

Underground mining is expected to grow at a significant rate due to rising concerns around worker safety, stricter government regulations, and the need to access deeper ore deposits that cannot be reached through open-pit mining. Advances in compact robotic systems and AI-driven navigation have made subterranean applications more feasible.

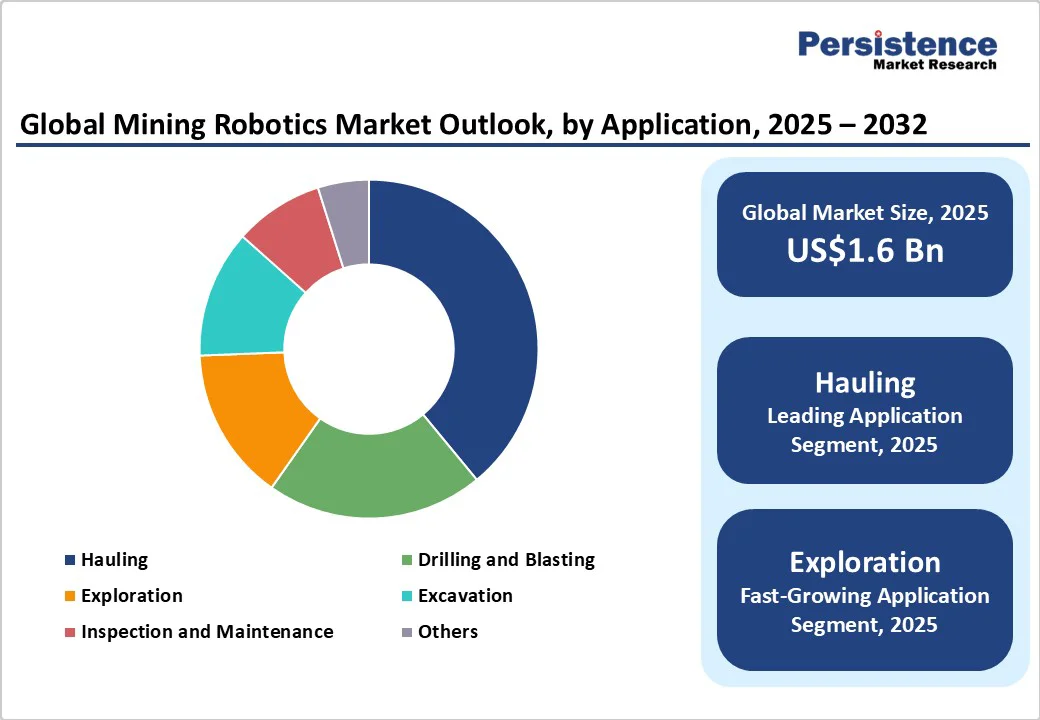

In terms of application, the market is segregated into drilling and blasting, hauling, exploration, excavation, inspection and maintenance, and others. Out of these, hauling is expected to account for more than 32.5% share in 2025 due to the growing need for automation in bulk material transportation.

The growing need to reduce operational costs, improve fuel efficiency, and optimize load cycles is driving demand for autonomous haulage systems. The need for round-the-clock operations without human fatigue makes robotics highly suitable for this application. The ability of robotic hauling systems to integrate with digital fleet management platforms further supports productivity and sustainability goals, thereby strengthening their market dominance.

Exploration is expected to grow at a significant rate due to the rising demand for advanced technologies that identify mineral-rich deposits with greater accuracy and speed. Companies are increasingly turning to autonomous drones, AI-powered mapping, and robotic surveying tools to reduce exploration time and costs. The growing demand for critical minerals, such as lithium, cobalt, and rare earths, for clean energy technologies is accelerating their adoption.

The North American mining robotics market is driven by escalating safety concerns in hazardous underground and surface operations, persistent labor shortages amid declining employment levels, and the need to boost productivity through technological integration. The U.S. mining robotics market benefits from a robust regulatory framework that promotes mine safety and technology innovation through organizations such as MSHA and the Department of Energy.

According to MSHA's fiscal year data for January 2025, there were 31 mining fatalities in fiscal year 2024, reflecting a slight uptick from prior years and maintaining a fatal injury rate of 0.0110 per 200,000 hours worked. These figures are prompting U.S. mines to adopt robotics in order to comply with stricter safety mandates under the Federal Mine Safety and Health Act.

Canada is witnessing a shift toward remote-controlled and autonomous vehicles in its mineral-rich regions, particularly in Ontario and Quebec, to address labor shortages and improve operational efficiency. Rising labor costs and an aging workforce in both the U.S. and Canada are further accelerating the adoption of robotics.

Environmental compliance pressures are also pushing companies to deploy precise, automated machinery that minimizes waste and energy use. In Canada, the adoption of robotics technologies has been relatively modest; according to the Survey of Advanced Technology, only 2.0% of Canadian enterprises had adopted robotics technologies as of 2022.

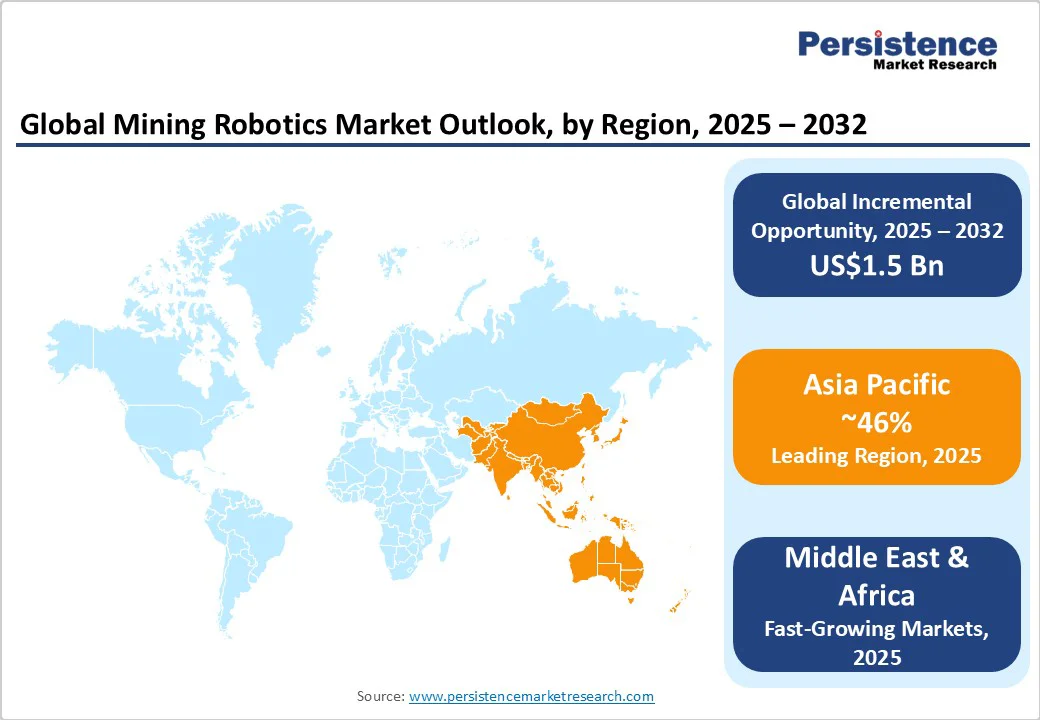

Asia Pacific is expected to account for a share of more than 46% in 2025, driven by increasing automation and safety demands. China is actively transitioning many open-pit operations to underground methods to reduce environmental impact and improve efficiency.

For instance, in China, a smart coal mining project in northwest China set a global record for autonomous driving in 2024, with the world's largest mixed fleet of 56 driverless and over 800 manned trucks operating safely since June.

A Japanese startup developed a mine-clearing support robot using compressed-air excavation technology, which has been successfully trialed in Cambodia and is set to be introduced in Ukraine. India’s mining sector is witnessing labor shortages and heightened safety concerns, driving the adoption of robotics. Mechanization in coal, iron ore, and bauxite mines, along with the need for operational efficiency and reduced human exposure to hazards, is accelerating demand.

Middle East and Africa are expected to grow at a significant rate in mining robotics adoption due to the need to enhance operational safety. Harsh climatic conditions, deep shafts, and unstable geological formations prevalent in the region expose workers to significant risks, including rockfalls and exposure to toxic gases.

Sluggish global demand, falling commodity prices, aging mine infrastructure, and electricity shortages have contributed to production declines. For instance, South Africa’s mining production declined by 7.7% year-over-year, primarily due to reductions in platinum group metal and gold production, although growth in iron ore production partially offset the decline.

Governments in countries such as Saudi Arabia are promoting the adoption of technology through industrial modernization programs. The push for sustainable mining practices and the reduction of environmental impact favor the use of automated equipment.

In countries with large-scale mineral extraction, such as South Africa (gold and platinum) and Morocco (phosphates), robotics is increasingly integrated to improve precision and cost-effectiveness. Robotics solutions help reduce downtime and maintenance costs by providing real-time monitoring and predictive maintenance capabilities.

The mining robotics market is consolidated, with leading players holding over 42% market share in 2024. Companies are adopting innovation-driven strategies focused on AI-enabled autonomy, electrification, and advanced sensor integration to enhance efficiency and safety. They are pursuing cost leadership through modular robotics platforms that lower deployment and maintenance expenses.

The global mining robotics market is projected to be valued at US$1.6 Bn in 2025.

The need for enhanced safety, operational efficiency, and productivity in hazardous mining environments is a key driver of the market.

The mining robotics market is poised to witness a CAGR of 9.8% from 2025 to 2032.

Advancements in autonomous robotics and AI-driven systems are creating strong growth opportunities.

Sandvik AB, ABB, Komatsu Ltd., Caterpillar, Epiroc, Hitachi Construction Machinery Co., Ltd., Rockwell Automation, HollySys are among the leading key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Mining Technique

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author