ID: PMRREP3030| 189 Pages | 3 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

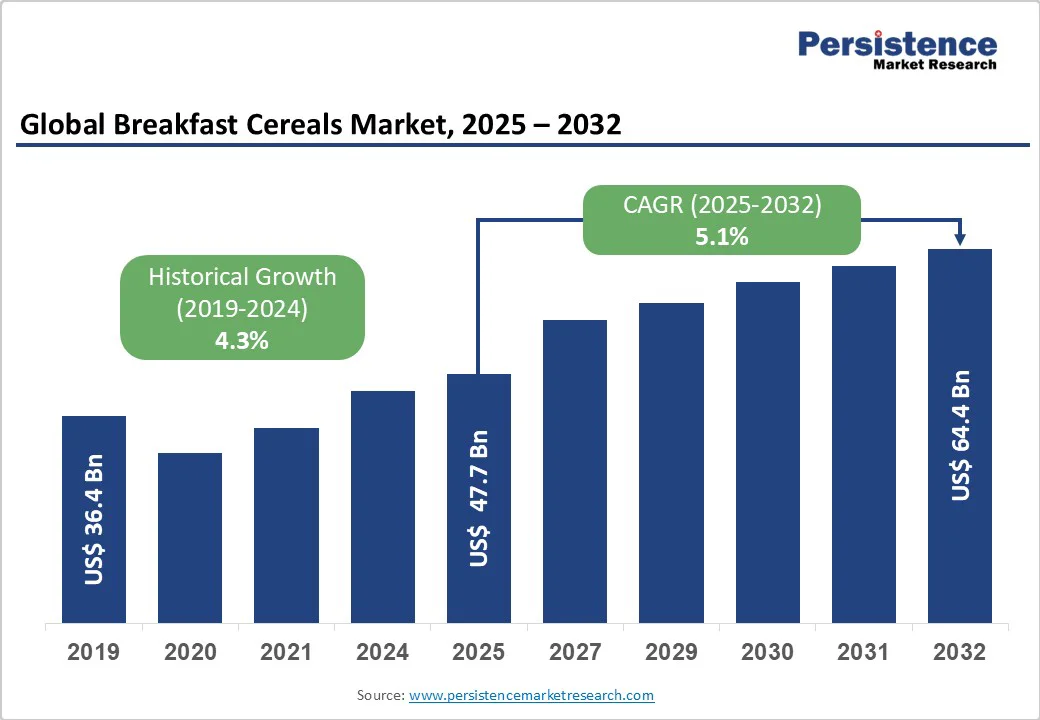

The global breakfast cereals market size is likely to value US$ 47.7 billion in 2025 and projected to reach US$ 64.4 billion by 2032, growing at a CAGR of 5.1% during the forecast period from 2025 to 2032.

Global consumers are increasingly opting for breakfast cereals that are quick to prepare and convenient, fueling growth in pre-packaged and on-the-go options. Rising cases of celiac disease and food intolerances have boosted demand for gluten-free and specialty cereals.

| Key Insights | Details |

|---|---|

| Breakfast Cereals Market Size (2025E) | US$ 47.7 Bn |

| Market Value Forecast (2032F) | US$ 64.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.3% |

The global breakfast cereals market is being driven by consumers’ growing preference for healthier, nutrient-dense food options that support active and balanced lifestyles. Rising awareness about the role of diet in preventing obesity, diabetes, and cardiovascular diseases has encouraged people to shift from traditional sugar-loaded cereals to high-protein, whole-grain, and fiber-rich variants. Increasing adoption of vegan, gluten-free, and organic diets is also pushing manufacturers to diversify their product lines with clean-label and plant-based offerings.

Additionally, fortified cereals enriched with probiotics, vitamins, and minerals are gaining popularity among families and health-conscious millennials. Continuous innovation, strategic launches by leading brands, and the rising penetration of premium health cereals in emerging economies further act as strong growth drivers for this market.

A major restraint in the global breakfast cereals market comes from tightening government regulations on sugar content and health-related claims. With rising concerns over obesity and childhood diabetes, authorities across regions are enforcing strict guidelines to limit added sugar in packaged foods, including cereals.

This has created challenges for manufacturers traditionally reliant on sweetened offerings to attract younger consumers. Restrictions on marketing cereals as “healthy” or “nutritious” without scientific backing have put pressure on brands to reformulate products and ensure compliance.

Reformulation not only increases production costs but also risks altering taste profiles, potentially reducing consumer acceptance. These regulatory hurdles slow down product launches, raise operational complexities, and limit aggressive promotional strategies, thereby acting as a significant barrier to growth in the global breakfast cereals market.

One significant opportunity in the breakfast cereals market lies in the development of personalized nutrition-based products that cater to specific health goals and dietary preferences. As consumers increasingly demand tailored solutions for weight management, gut health, immunity, and energy enhancement, manufacturers can leverage functional ingredients such as plant proteins, omega-3s, probiotics, and adaptogens.

Digital tools, including AI-driven nutrition apps and subscription models, can enable brands to offer customized cereal mixes directly to households, enhancing consumer loyalty and value addition. Furthermore, there is strong growth potential in fortifying cereals with regionally relevant superfoods such as quinoa, chia, or moringa, appealing to both local and global markets.

By aligning product innovation with consumer wellness aspirations and transparency in labeling, companies can establish themselves as leaders in the premium functional space, unlocking new revenue streams and competitive advantage.

The Ready-to-Eat (RTE) segment dominated the breakfast cereals market in 2024, accounting for the largest revenue share of 83.2%. The segment’s strong performance is primarily driven by the growing consumer demand for convenient, quick, and on-the-go breakfast options. Single-serve cereal packs and ready-to-eat granola bars have gained immense popularity, offering consumers a nutritious and hassle-free way to start their day.

Additionally, the widespread availability of RTE cereals across multiple retail channels, including supermarkets, hypermarkets, convenience stores, and e-commerce platforms, has significantly enhanced product accessibility, making it easier for consumers to purchase their preferred cereals anytime, anywhere.

The rising adoption of fortified and functional RTE cereals, such as high-protein, fiber-rich, and gluten-free options, has further contributed to the segment’s growth. Overall, the RTE segment’s convenience, variety, and nutritional benefits continue to lead to its leading position in the global breakfast cereals market.

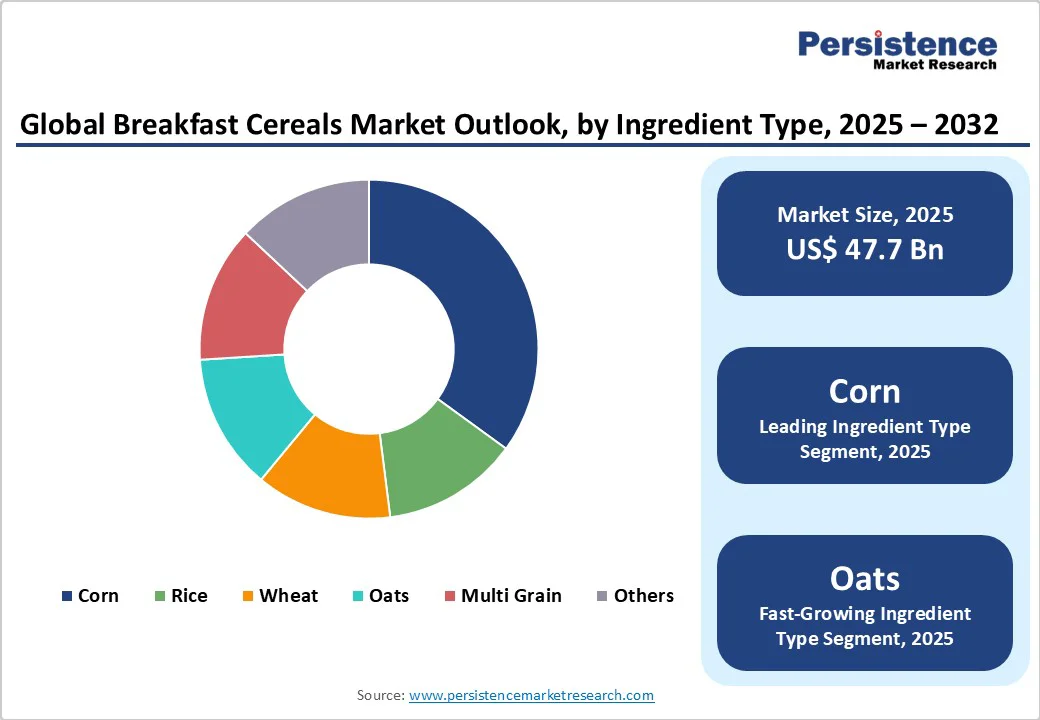

The corn segment dominated the global breakfast cereals market in 2025, accounting for the largest revenue share. Corn-based cereals, such as cornflakes and puffed corn products, are highly popular due to their light texture, mild taste, and versatility combined with milk, yogurt, or fruits.

The segment’s dominance is supported by widespread consumer familiarity, ease of production, and availability of high-quality corn at competitive prices. Corn cereals are also commonly fortified with vitamins and minerals, making them an attractive choice for health-conscious consumers seeking nutritious breakfast options.

Meanwhile, the oats segment is emerging as the fastest-growing ingredient type in the market. Rising awareness of the health benefits of oats, including high dietary fiber content, cholesterol management, and digestive health support, is driving demand. Additionally, the increasing preference for gluten-free, plant-based, and functional breakfast options has contributed to the rapid growth of oat-based cereals, particularly in developed and urban markets.

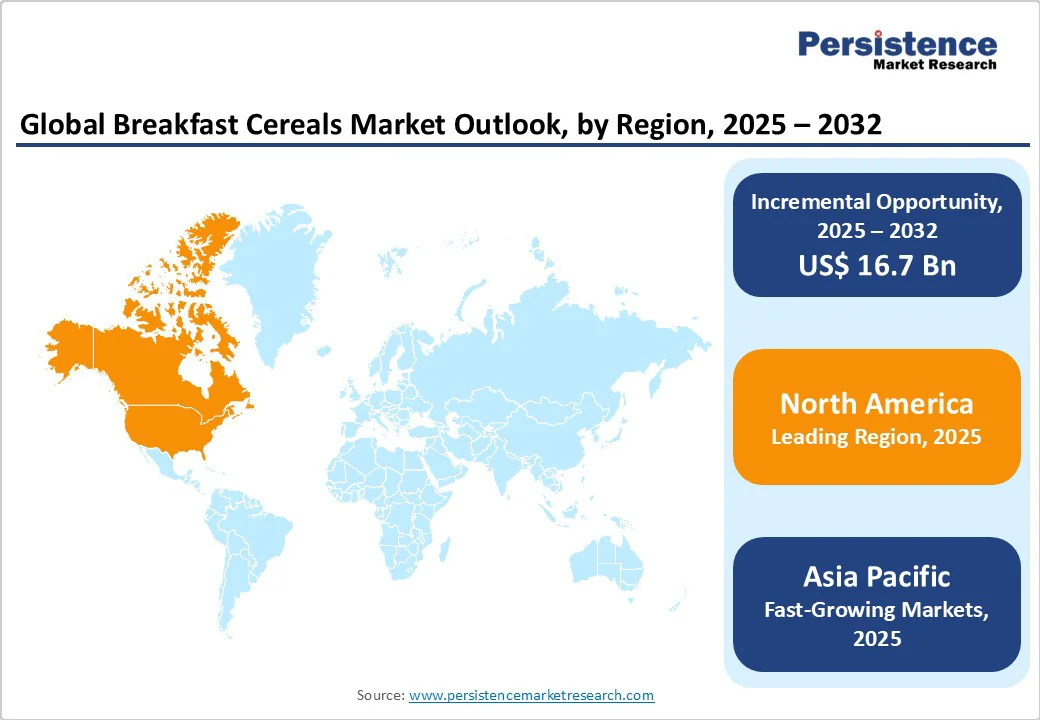

North America breakfast cereals market remains the largest globally, led by the United States, due to high consumer preference for ready-to-eat (RTE) cereals and established brand loyalty. Busy lifestyles and the demand for convenient, quick breakfast options continue to drive growth.

Major players such as Kellogg’s, General Mills, Post Holdings, and Quaker have expanded their portfolios with product innovations like high-protein cereals, gluten-free options, and limited-edition flavors to cater to evolving consumer tastes

For instance, Cheerios Protein and Cinnamon Toast Crunch’s experimental flavors have captured consumer interest, while PepsiCo’s Life brand launched multigrain cereals focusing on functional benefits like immune and bone health.

Additionally, companies are strengthening distribution through supermarkets, convenience stores, and e-commerce channels, enhancing product accessibility. Health and wellness trends, including fortified and low-sugar cereals, are also shaping the market, ensuring steady revenue growth and maintaining North America’s leading position in the global breakfast cereals industry.

Europe breakfast cereals market is expected to grow steadily, driven by increasing health awareness and convenience-focused lifestyles. Consumers are prioritizing nutritional value, seeking cereals high in fiber, vitamins, and minerals, which aligns with the rising demand for balanced diets.

Traditional cereals such as cornflakes and muesli remain popular, but there is a growing preference for organic, whole-grain, plant-based, and gluten-free options that cater to dietary needs and food sensitivities. In Germany, health-conscious consumers are shifting toward fortified and reduced-sugar cereals, while online retail and home delivery services enhance convenience.

The UK market is experiencing similar trends, with demand for granola, muesli, and nutrient-enriched cereals rising steadily. Major players like Kellogg’s, Cereal Partners UK, and Weetabix continue to innovate, offering products that combine taste, health, and convenience, while private-label and emerging brands intensify competition and drive product differentiation across Europe.

The Asia-Pacific breakfast cereals market is projected to grow at the fastest CAGR from 2025 to 2032, driven by changing lifestyles, rising urbanization, and increasing workforce participation. Consumers in the region are seeking convenient and nutritious breakfast options that save time and fit busy schedules. In China, rapid urbanization, rising disposable incomes, and adoption of Western eating habits are boosting per capita cereal consumption, with premium and imported products gaining traction.

Japan presents a blend of traditional rice-based breakfasts and a growing preference for convenient, health-oriented cereals such as granola and muesli, particularly among younger consumers. India is expected to witness the highest growth, fueled by urbanization, nuclear family structures, and increased health awareness. The entry of multinational brands, wider product variety, and strong marketing initiatives have further expanded market reach, making ready-to-eat cereals a preferred choice across households in the region.

The global breakfast cereals market is highly competitive, with major players such as Kellogg’s, Nestlé, General Mills, PepsiCo (Quaker), and Post Holdings dominating through strong brand portfolios and extensive distribution networks.

These companies focus on innovation, product diversification, and marketing strategies to capture evolving consumer preferences, including organic, gluten-free, and functional cereals. Regional and niche players are also gaining traction by targeting health-conscious consumers with natural, clean-label offerings, intensifying competition across developed and emerging markets alike.

The global breakfast cereals market is projected to be valued at US$ 47.7 Bn in 2025.

Health-conscious consumers demand nutritious options, busy lifestyles require convenient meals, and innovative flavors attract diverse demographics seeking quick breakfast solutions.

The global market is poised to witness a CAGR of 5.1% between 2025 and 2032.

Emerging markets expansion, organic product development, protein-enriched formulations, plant-based alternatives, premium positioning, and e-commerce channel growth.

Kellogg's, General Mills, and Nestlé., and others are some of the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Ingredient Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author