ID: PMRREP10343| 200 Pages | 10 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

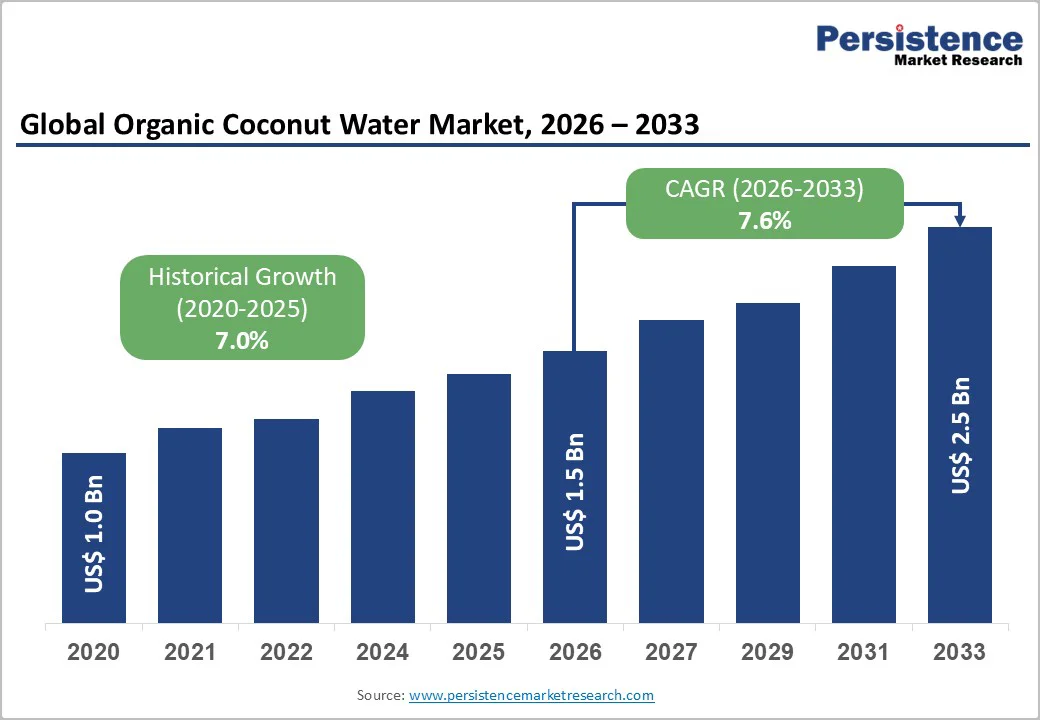

The global organic coconut water market size is likely to be valued at US$ 1.5 billion in 2026, and is estimated to reach US$ 2.5 billion by 2033, growing at a CAGR of 7.6% during the forecast period 2026−2033. The market is expanding steadily due to rising consumer preference for natural hydration beverages, increasing penetration of organic-certified products, and stronger retail availability across developed and emerging regions. Growth further reflects regulatory support for organic farming and improved supply chain traceability. The market’s long-term momentum is reinforced by demand from health-conscious consumers and the food and beverage industry.

| Key Insights | Details |

|---|---|

| Organic Coconut Water Market Size (2026E) | US$ 1.5 Bn |

| Market Value Forecast (2033F) | US$ 2.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.0% |

Rising health consciousness elevates the preference for clean-label hydration as consumers shift toward beverages with transparent sourcing and minimal processing. Growing awareness of calorie intake and artificial additives encourages a move toward naturally sourced options with functional benefits. This shift is reinforced by wellness-focused lifestyles where individuals seek products aligned with fitness routines and daily nutritional goals. Natural electrolytes support this demand, positioning the category as a credible alternative to high-sugar sports beverages.

Demand accelerates as more individuals recognize the role of natural electrolytes in fluid balance, recovery and sustained energy. Fitness participation, outdoor activities and urban working patterns amplify the requirement for portable hydration that delivers measurable functional value. The preference for plant-origin beverages strengthens product relevance in clean-label portfolios adopted by retailers and foodservice operators. This behavioral shift enhances category traction, promoting consistent consumer pull and enabling brands to position the product as a premium wellness beverage within both mainstream and specialized retail environments.

Short shelf life remains a central restraint as the liquid is highly sensitive to enzymatic activity and microbial growth that begins soon after extraction. Its natural composition, rich in sugars, amino acids, and minerals, creates an ideal environment for rapid spoilage, limiting the time available for safe distribution. This volatility increases the burden on cold-chain logistics, elevates wastage risk, and compresses retail handling timelines, making consistent supply more complex for producers and retailers.

Preservation challenges intensify as the category prioritizes clean-label positioning, limiting the use of stabilizers or synthetic preservatives that could extend life. Thermal processing methods support safety yet alter sensory attributes, pushing producers toward advanced technologies such as aseptic systems that demand significant capital commitments. These constraints influence pricing, supply reliability, and inventory management across retail formats. The need for freshness, controlled environments, and rapid turnover shapes industry strategy, reinforcing short shelf life as a structural barrier to scale.

Technological progress in packaging and processing creates a strategic window for brands seeking stronger differentiation and higher value creation. Advancements in aseptic filling, lightweight barrier materials, and high-integrity sealing help preserve natural taste, aroma, and electrolytes with greater precision. Suppliers gain the ability to extend shelf life without altering product purity, supporting wider distribution and reduced wastage. Enhanced process control also strengthens compliance with clean-label expectations, elevating trust and supporting premium positioning across global and regional channels. These improvements equip companies to deliver consistent quality while optimizing production efficiency and energy use.

Innovation in sustainable formats amplifies commercial potential. Compostable cartons, plant-based resins, and recyclable multilayer structures align with rising preference for environmentally aligned hydration choices. Modern processing systems enable gentle treatment methods that protect nutrients while maintaining freshness for longer transport cycles, enabling expansion into new geographies. Brands that invest early secure stronger retailer acceptance, better transport economics, and smoother entry into health-focused consumer segments. This shift creates a competitive edge, turning packaging and processing upgrades into a core lever for growth, market reach, and long-term brand resilience.

The pure segment is projected to maintain the largest share in 2026 at an estimated 60% of global consumption, driven by strong demand for natural hydration and clean-label beverages. Its unprocessed profile, stable nutrient retention, and credibility through organic certification strengthen trust. Broader retail penetration and health-oriented purchasing reinforce its expected leadership across major markets.

On the other hand, mixed organic coconut water is expected to be the fastest-growing segment from 2026 to 2033, supported by flavor-led demand among younger consumers. Blends with tropical fruits enhance taste appeal while keeping calorie levels controlled, enabling wider acceptance. Projected innovation in flavor extensions and differentiated formulations boosts adoption, supporting strong growth across both emerging and mature consumption regions.

Tetra pack is projected to lead the packaging segment in 2026, holding an estimated 65% of the organic coconut water market revenue share on account of its advanced aseptic technology, strong product protection, and extended shelf stability. Its lightweight structure lowers transport costs, while environmentally aligned materials strengthen compliance with sustainability standards. These advantages reinforce its position as the preferred choice for large-scale producers and premium organic beverage brands.

Bottles, especially variants free from Bisphenol A (BPA) and designed for lightweight portability, are projected to be the fastest-growing segment between 2026 and 2033. Greater suitability for on-the-go consumption, higher visibility in gyms and cafes, and rising consumer interest in portable hydration are propelling the uptake of bottled coconut water. Improved recyclability and innovative designs elevate convenience-led appeal, supporting accelerated growth in urban and fitness-oriented markets.

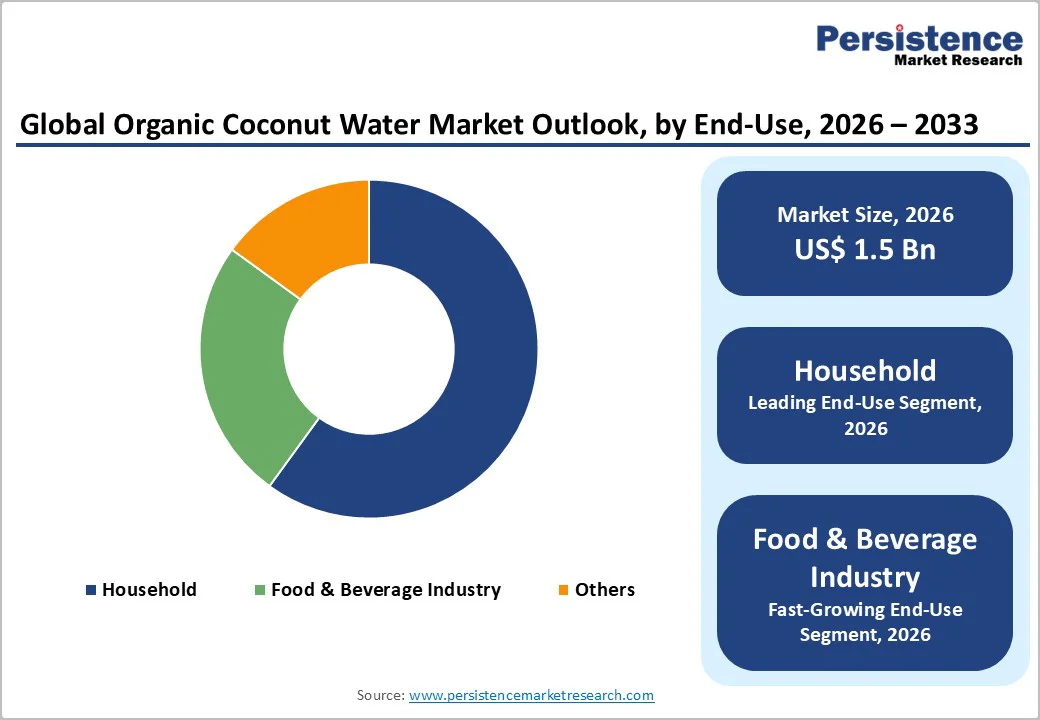

Household consumption is forecasted to lead in 2026 with a 60% market share, aided by the broadening use of organic coconut water as an everyday hydration choice. Strong adoption among health-focused individuals and families reinforces steady demand. Trust in natural ingredients, preference for clean-label beverages, and broad retail availability strengthen the segment’s leadership across diverse consumer groups.

The food and beverage industry is predicted to be the fastest-growing segment during the 2026-2033 forecast period, driven by the expanding use of organic coconut water as an ingredient in smoothies, functional drinks, plant-based formulations, and café products. Exciting innovations in menus, growth in wellness-focused offerings, and rising demand from restaurants and specialty manufacturers support rapid expansion across both mainstream and premium categories.

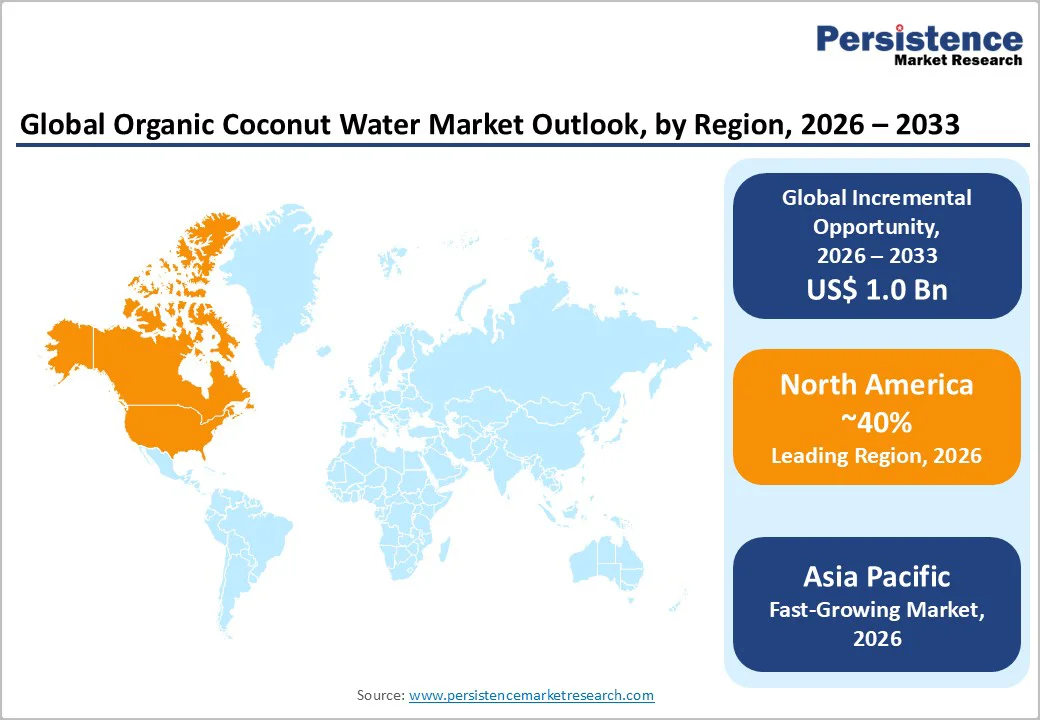

North America is estimated to hold around 40% of the organic coconut water market share in 2026, supported by a distinctive combination of high-value consumer behavior and strong commercialization capabilities. The region benefits from a mature health-and-wellness culture in which natural hydration products gain rapid acceptance. Premium positioning is easier to sustain due to higher disposable income, enabling brands to succeed with cold-pressed, single-origin, and sustainably sourced variants. Retail ecosystems in the United States and Canada offer extensive shelf space for functional beverages, allowing organic coconut water to scale quickly across supermarkets, specialty nutrition stores, and fitness-linked outlets. This environment encourages faster market penetration for both established brands and new entrants targeting clean-label buyers.

Growth is further reinforced by North America’s advanced distribution infrastructure and strong integration with digital retail. The region has one of the highest adoption rates of subscription-based beverage delivery, enabling recurring demand and predictable volume flow. Innovation cycles are fast, supported by active collaborations between coconut water processors, wellness startups, and beverage formulators. These partnerships drive new applications such as electrolyte-enhanced blends and low-sugar formulations tailored to athletic consumers. Transparent sourcing standards and rigorous quality expectations also give North American brands competitive leverage, strengthening their regional dominance.

Europe is emerging as a strongly expanding regional market for organic coconut water, as consumer preferences shift toward natural hydration and clean-label beverages. Regional demand is driven by rising adoption of plant-based drinks within health-conscious demographics, particularly in Germany, France, the United Kingdom, and the Nordic countries. European consumers place a high value on organic certifications, traceability, and ethical sourcing, giving imported organic coconut water a clear advantage when supported by transparent supply-chain practices. The growing presence of organic retailers, premium grocery chains, and functional beverage cafés further strengthens consistent product visibility and encourages trial among new buyers.

Market growth is also supported by Europe’s strict quality regulations, which push suppliers to meet higher purity and sustainability standards. These requirements have encouraged manufacturers to introduce low-sugar, additive-free, and sustainably packaged variants tailored to regional preferences. Rising interest in fitness, wellness tourism, and natural sports hydration expands usage beyond household consumption into gyms, juice bars, and specialty beverage brands. Strong e-commerce adoption and subscription-based delivery models enable broader access across urban and suburban markets. This mix of regulatory rigor, evolving lifestyle patterns, and premium consumption behavior drives Europe’s steady upward trajectory in the organic coconut water category.

Asia Pacific is poised to be the fastest-growing market for organic coconut water through 2033 due to its strong alignment between raw material availability and rapid shifts in consumer preferences. The region contains the world’s largest concentration of organic-certified coconut plantations, enabling a stable supply and cost-efficient processing. Rising urban incomes in nations such as India, Indonesia, Vietnam, and the Philippines are pushing consumers toward natural hydration options, especially products positioned as chemical-free and minimally processed. Local brands leverage cultural familiarity with coconut-based drinks, allowing them to scale quickly through modern retail, quick-commerce platforms, and health-focused outlets.

Growth is further accelerated by government initiatives supporting organic farming, export-focused manufacturing, and value-added coconut products. Regional processors are investing in advanced aseptic systems and sustainable packaging formats to compete globally, increasing production capacity and improving product consistency. The expansion of fitness culture, café chains, and premium beverage boutiques has strengthened demand for organic coconut water as both a standalone drink and a functional ingredient. This combination of supply leadership, rapid lifestyle evolution, and strong export momentum positions Asia Pacific as the fastest-growing region in the category.

The global organic coconut water market structure is moderately fragmented, comprising both global brands and regional producers. Leading companies collectively account for an estimated 40% of market share, with competition focused on product purity, credible organic certifications, and wide distribution networks. Brand reputation and consumer trust play a critical role, particularly in regions with high health-conscious demand. Companies that consistently deliver verified quality and transparent sourcing gain a competitive edge, while smaller players leverage local knowledge and niche positioning to retain market relevance.

Differentiation is increasingly achieved through sustainable practices, innovative packaging, and functional product formulations. Regional producers strengthen their position through established export channels and cost-effective operations, while global brands maximize market reach via strong marketing strategies and extensive retail presence. This combination of local expertise and international scale maintains dynamic competition and fosters ongoing innovation in the category.

The global organic coconut water market is projected to reach US$ 1.5 billion in 2026.

Rising health consciousness, demand for clean-label hydration, and preference for natural, nutrient-rich beverages drive the market.

The market is poised to witness a CAGR of 7.6% from 2026 to 2033.

Key market opportunities include technological advancements in packaging and processing, sustainable sourcing, product innovation with functional blends, and expansion into emerging urban and e-commerce channels.

Vita Coco Company, Inc., PepsiCo Inc., Harmless Harvest Inc., are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Packaging Type

By End-Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author