ID: PMRREP35278| 180 Pages | 6 May 2025 | Format: PDF, Excel, PPT* | Industrial Automation

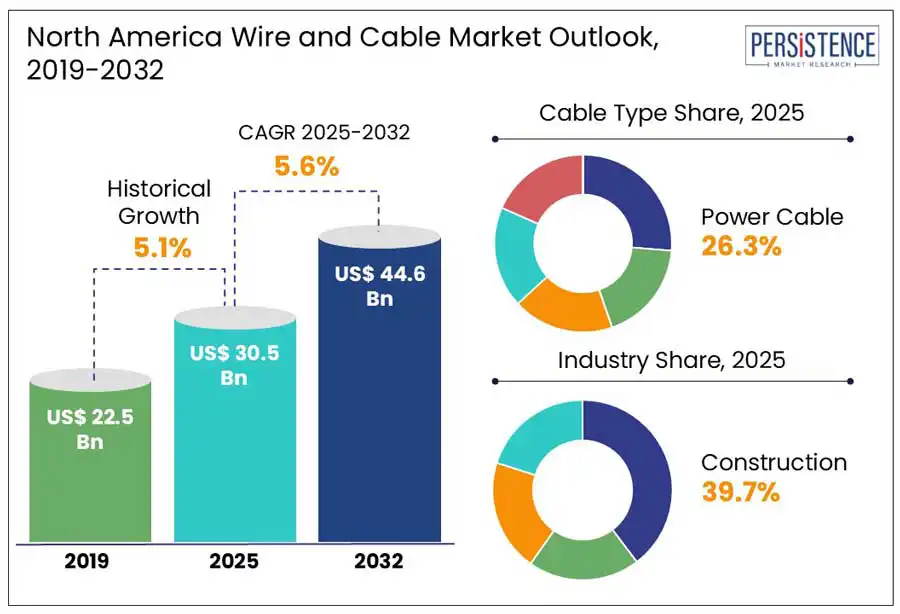

The North America wire and cable market size is predicted to reach US$ 44.6 Bn in 2032 from US$ 30.5 Bn in 2025. It will likely witness a CAGR of around 5.6% in the forecast period between 2025 and 2032.

Increasing demand for uninterrupted internet and electricity connectivity among households is poised to spur the market in North America. Rising investment in clean energy infrastructure is also expected to boost demand for innovative wires and cables. In recent years, cloud and content providers in the region have strived to provide bandwidth-intensive services, accelerating the popularity of submarine infrastructure to attract a new consumer base. Such innovations are likely to support the demand for wires and cables.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

North America Wire and Cable Market Size (2025E) |

US$ 30.5 Bn |

|

Market Value Forecast (2032F) |

US$ 44.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

Various large-scale infrastructure renewal initiatives are expected to propel the North America wire and cable market growth through 2032. In Canada, for instance, the Investing in Canada Plan has allocated nearly CAD 180 Mn over 12 years to push upgrades in communication networks, energy grids, and transportation. These projects often require extensive deployment of fiber optics, control cables, and power cables, thereby augmenting demand.

The rapid energy transition toward renewables is further estimated to boost the market. North America is currently experiencing multiple wind farm and solar project developments, where innovative cables such as submarine and high-voltage cables are important. The U.S., for example, added more than 32 GW (gigawatt) of renewable energy capacity in 2023, found the Solar Energy Industries Association. Significant projects, including the Champlain Hudson Power Express, a 339-mile underwater and underground transmission line carrying hydropower from Canada to New York, are also estimated to require next-generation cables.

Copper price volatility is anticipated to be a key growth hindering factor in the North America wire and cable market. While copper remains a key raw material in most cables, its price fluctuations have resulted in cost uncertainty for manufacturers. These fluctuations are mainly spurred by supply chain disruptions, speculative trading, and geopolitical tensions.

It has hence caused delays in project approvals and cautious ordering behavior by contractors and utilities. London Metal Exchange (LME) copper prices, for example, peaked near US$ 9,400 per metric ton in early 2024. It led to budget revisions for various large-scale infrastructure projects in Midwest U.S. and parts of Alberta.

The offshore wind energy sector is predicted to create lucrative opportunities for wires and cables providers in North America. The U.S. Department of Energy, for instance, has set a target of installing 30 GW of offshore wind by 2030. It is a significant goal that is expected to require extensive use of high-voltage subsea cables.

Projects, including Vineyard Wind 1, located off the coast of Massachusetts, are anticipated to generate 800 MW of electricity. Such projects are speculated to create a high demand for specialized export and inter-array cables. Companies such as Nexans have already extended their operations across the U.S. to mainly fulfill the unmet requirements of this emerging segment.

In terms of cable type, the market is segregated into low voltage energy, power cable, fiber optic cable, and signal and control cable. Among these, power cables are likely to account for a share of around 26.3% in 2025. These are gaining momentum across North America owing to the constant development of its energy infrastructure. It is particularly evident in the ongoing transition toward renewable energy sources from fossil fuels. Demand for medium- and high-voltage power cables that can transmit electricity to urban grids from remote renewable sites is predicted to rise. It is attributed to the development of solar, wind, and hydroelectric power generation across Canada and the U.S.

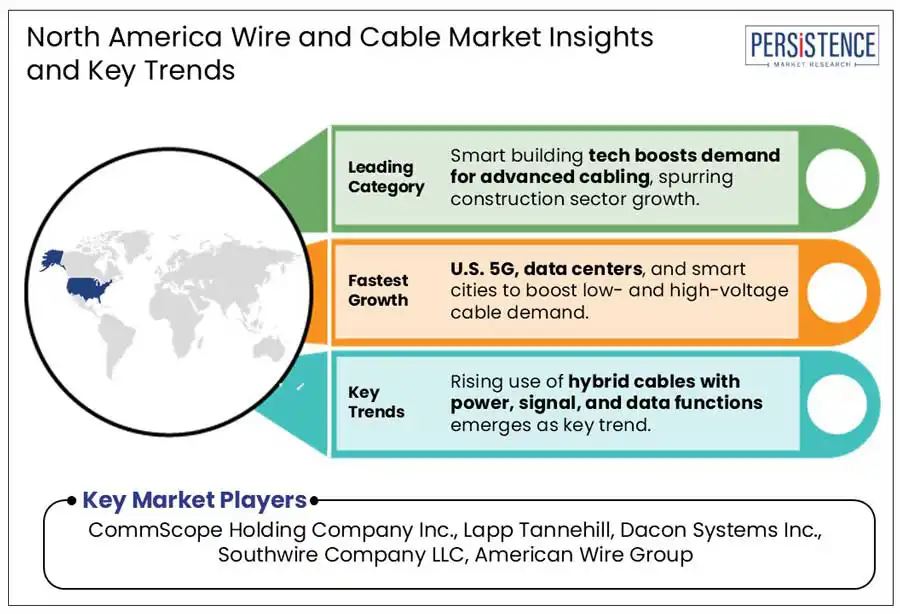

Signal and control cables are assessed to witness a decent CAGR from 2025 to 2032. Rapid expansion of industrial automation in sectors, including oil and gas, automotive, logistics, and manufacturing is expected to boost the segment. The demand for interference-free, reliable signal transmission has become high as factories embrace machine vision systems, Programmable Logic Controllers (PLCs), and robotics. These technologies require cables that can easily withstand electromagnetic interference, temperature fluctuations, and mechanical stress, which is augmenting demand.

Based on Industry, the market is trifurcated into construction, telecommunications, and power infrastructure. Out of these, the construction segment is expected to dominate with a share of nearly 39.7% in 2025, finds Persistence Market Research. Wires and cables are considered the most significant components for manufacturing plants as well as residential and commercial buildings. This is because wires and cables are used to deliver security, voice communications, control, and power to the entire infrastructure. Increasing development of residential buildings in North America due to low mortgage rates and surging demand for cozy living spaces is also expected to propel the segment.

Telecommunications segment, on the other hand, is predicted to see steady growth in the foreseeable future. The ongoing development of 5G infrastructure is poised to be responsible for propelling this segment. Telecom giants, including T-Mobile, AT&T, and Verizon are currently in a rat race to provide the U.S. and Canada with low-latency, high-speed networks. These networks often require dense fiber optic cabling for supporting the superior bandwidth and low latency demands of 5G, further bolstering demand.

The U.S. is speculated to generate approximately 46.3% of the North America wire and cable market share in 2025. The country is currently undergoing a significant transition due to the expansion of renewable energy projects, electrification initiatives, and rising infrastructure investments. Demand for eco-friendly and fire-resistant cables is surging as new building codes and environmental norms become stringent in the country. The National Fire Protection Association (NFPA), for example, recently updated the NFPA 70 (National Electrical Code), raising the focus on sustainability and safety.

Such norms are compelling commercial projects and industries to replace aging wiring systems with halogen-free, low-smoke cables. Companies, including Prysmian Group and Southwire have already extended their production capacities for green-certified cables to cater to the increasing demand from several industries. The U.S. is further aiming for 100% carbon-free electricity by 2035. Hence, the installation of wind and solar energy projects is skyrocketing, thereby driving demand for specialized high-voltage cables for efficient energy transmission.

Increasing focus of various industries on renewable energy projects is anticipated to spur demand for specialized wiring solutions in Canada. The proposed NATO-L subsea cable, for example, aims to connect the country’s renewable energy sources to the U.K. It plans to transmit six GW of electricity over 2,200 miles. This project highlights Canada’s potential in exporting clean energy and the associated demand for high-capacity cables.

Rapid digital transformation is further expected to create new opportunities for wire and cable manufacturers in Canada. The country’s dark fiber network is estimated to be broadened in the foreseeable future due to the rising reliance on cloud services and increasing number of data centers. With surging desire for high-speed data transmission, demand for fiber optic cables is poised to increase. A few local wire and cable manufacturers have also started using recycled copper in their products to raise the recycled content from 14% to 20%.

The North America wire and cable market is highly competitive with the presence of several large- and small-scale companies. Renowned companies are focusing on providing superior performance across various applications, including automotive, industrial equipment, power grids, and data centers. Emerging companies are aiming to extend their geographical presence by joining hands with well-established players. A few companies are also investing in the development of subsea cables to strengthen the existing networks.

The North America wire and cable market is projected to reach US$ 30.5 Bn in 2025.

Increasing infrastructure upgradation projects and rising demand for uninterrupted internet connectivity are the key market drivers.

The North America wire and cable market is poised to witness a CAGR of 5.6% from 2025 to 2032.

Rising investment in 5G infrastructure development and surging installation of solar and wind projects are the key market opportunities.

CommScope Holding Company Inc., Lapp Tannehill, and Dacon Systems Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Cable Type

By Industry

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author