ID: PMRREP33131| 199 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

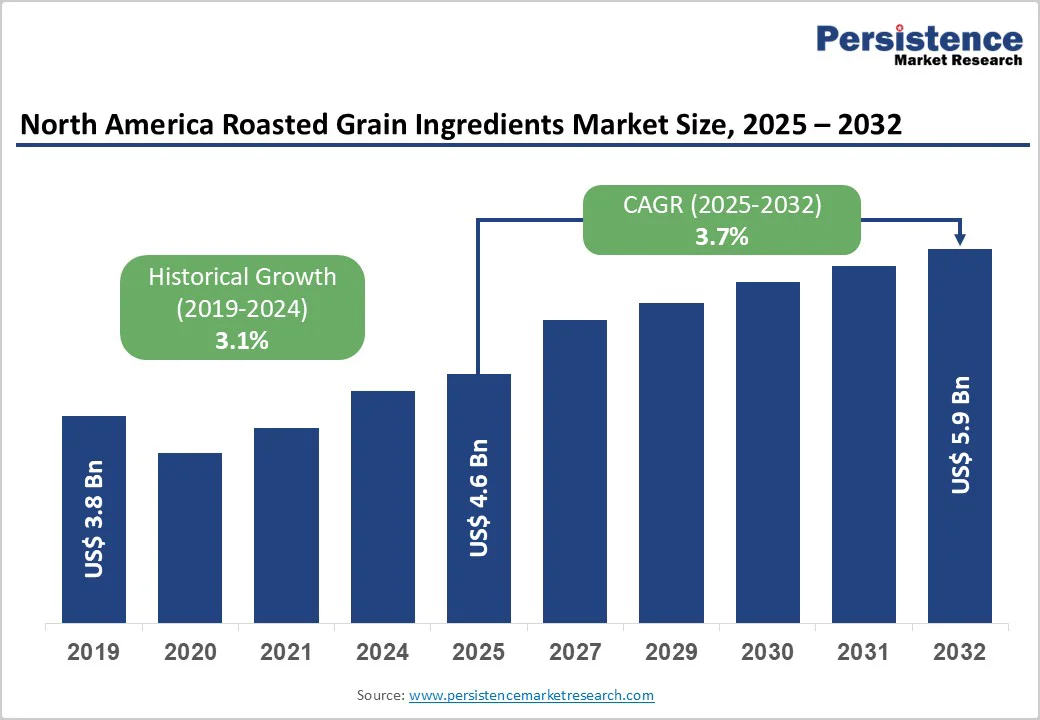

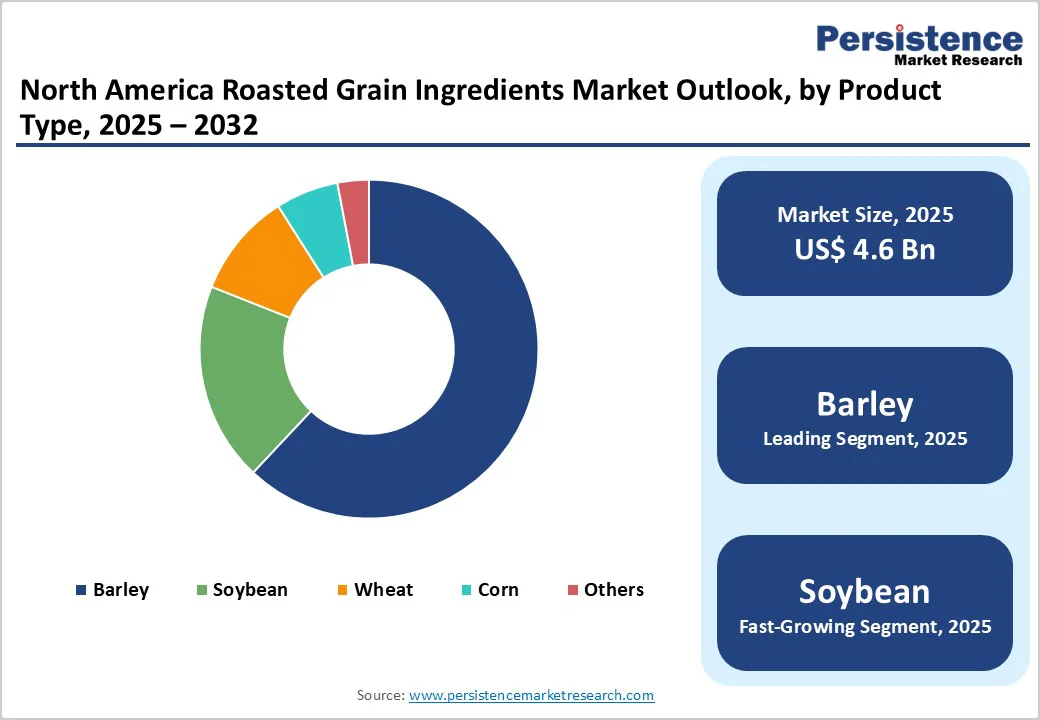

The North America Roasted Grain Ingredients Market size is valued at US$ 4.6 billion in 2025 and is projected to reach US$ 5.9 billion at a CAGR of 3.7% during the forecast period from 2025 to 2032. North America’s roasted grain ingredients market is transforming evolving consumer lifestyles, clean-label demands, and functional beverage trends redefine ingredient innovation. The region’s strong craft brewing heritage and health-oriented product development are shaping a market that blends tradition with modern wellness-driven consumption.

| Key Insights | Details |

|---|---|

|

North America Roasted Grain Ingredients Market Size (2025E) |

US$ 4.6 Bn |

|

Market Value Forecast (2032F) |

US$ 5.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.7% |

Beverages derived from roasted grain ingredients offer several advantages, such as better quality, consistency in taste, and a variety of flavors, thus helping accelerate the alcoholic and non-alcoholic beverage market. Furthermore, improvements in economic conditions across the North American region have led to increased disposable incomes and a higher standard of living, which have contributed to the rising trend of premiumization and consumption of alcoholic drinks and beverages. The North American beverage market has benefited from the increasing number of women consuming alcohol. For example, premium high-strength ready-to-drink cocktails have been on the rise, both in the U.S. and Canada, as consumers seek convenient alternatives to suit their active lifestyles.

Fluctuating production and prices of food grains directly influence roasted grain ingredient manufacturing costs and sales. Rising grain prices elevate production expenses, impacting market stability. The global food production crisis, largely driven by resource scarcity, further intensifies supply challenges. Conventional grain farming relies heavily on fertilizers and pesticides, which pose health risks and are driving consumers toward organic alternatives. Additionally, climate change, water scarcity, and soil degradation continue to disrupt grain yields and quality. Since key staples like wheat and barley are primarily reserved for human consumption, limited quantities remain available for commercial processing into roasted grain ingredients, thereby constraining market expansion and creating volatility across the value chain.

A distinct opportunity is emerging in North America as consumers increasingly pursue caffeine-free and wellness-oriented beverages. Roasted grain extracts made from barley, rye, or chicory offer rich flavor depth and natural functionality, positioning them as ideal bases for coffee alternatives and nutritional drinks. These extracts cater to health-conscious consumers seeking digestive support, low-acid beverages, and improved sleep quality without compromising taste. Startups and established ingredient manufacturers can innovate through tailored roasting profiles, clean-label formulations, and fortification with adaptogens or probiotics. The growing café culture embracing functional, plant-based beverages provides an opening for brands to introduce roasted grain blends that deliver aroma, comfort, and wellness, appealing to both premium and mainstream beverage categories.

Barley holds approx. 63% share as of 2025, emerging as the dominant product type in the North America roasted grain ingredients market due to its versatility, malty flavor, and wide application in beverages, bakery, and functional food formulations. Its balanced nutritional profile, rich in fiber and antioxidants, aligns with the region’s preference for wholesome and clean-label ingredients. Roasted barley’s aroma and deep color make it a key base for caffeine-free coffee substitutes and malt-based beverages. Soybean-based roasted ingredients are gaining attention for their protein content, while roasted wheat is valued for its mild flavor in breakfast cereals. Corn-based roasted grains, on the other hand, are expanding in snack and ready-to-eat formulations targeting flavor diversity and texture enhancement.

Organic roasted grain ingredients are projected to achieve a CAGR of 4.9% during the forecast period. It is driven by rising consumer awareness of chemical-free, sustainably sourced foods. As shoppers increasingly scrutinize ingredient origins, demand for grains grown without synthetic fertilizers or pesticides is accelerating. Organic roasted barley, wheat, and corn are gaining traction in clean-label snacks, plant-based beverages, and specialty bakery products catering to the wellness-focused demographic. The growing preference for traceable supply chains and USDA-certified organic labeling further enhances consumer trust. With food and beverage manufacturers reformulating portfolios to meet eco-conscious standards, organic roasted grain ingredients are evolving from niche health products to mainstream functional components in the region’s evolving food landscape.

The North America roasted grain ingredients market is witnessing dynamic evolution as consumer demand moves toward plant-based, functional, and clean-label applications.

In the U.S., ingredient suppliers are collaborating with craft brewers and non-dairy beverage developers to incorporate roasted barley and wheat extracts for deeper flavor profiles and nutritional appeal. Canada is seeing growth in roasted grain flour used by food processors to enhance aroma and texture in baked goods and snack bars. Leading companies such as Briess Malt & Ingredients Co. and Siemer Milling Company are expanding production capacities while startups focus on specialty roasting techniques and sustainable sourcing. Across both countries, the trend toward premiumization and clean-label credentials is amplifying interest in roasted grain ingredients as key differentiators in the food & beverage space.

The North America Roasted Grain Ingredients market is projected to be valued at US$ 4.6 billion in 2025.

Evolving consumer lifestyles and the growing trend of premiumization are propelling the growth of the North America Roasted Grain Ingredients market.

The North America Roasted Grain Ingredients market is poised to witness a CAGR of 3.7% between 2025 and 2032.

Developing roasted grain extracts for caffeine-free coffee alternatives and wellness drinks is a key market opportunity.

Major players in the North America Roasted Grain Ingredients market include Boortmalt Group, Malteurop Group, Briess Malt & Ingredients Co., Muntons plc, Rahr Corporation, Great Western Malting Co., Siemer Milling Company, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Nature

By Form

By End-use

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author