- Executive Summary

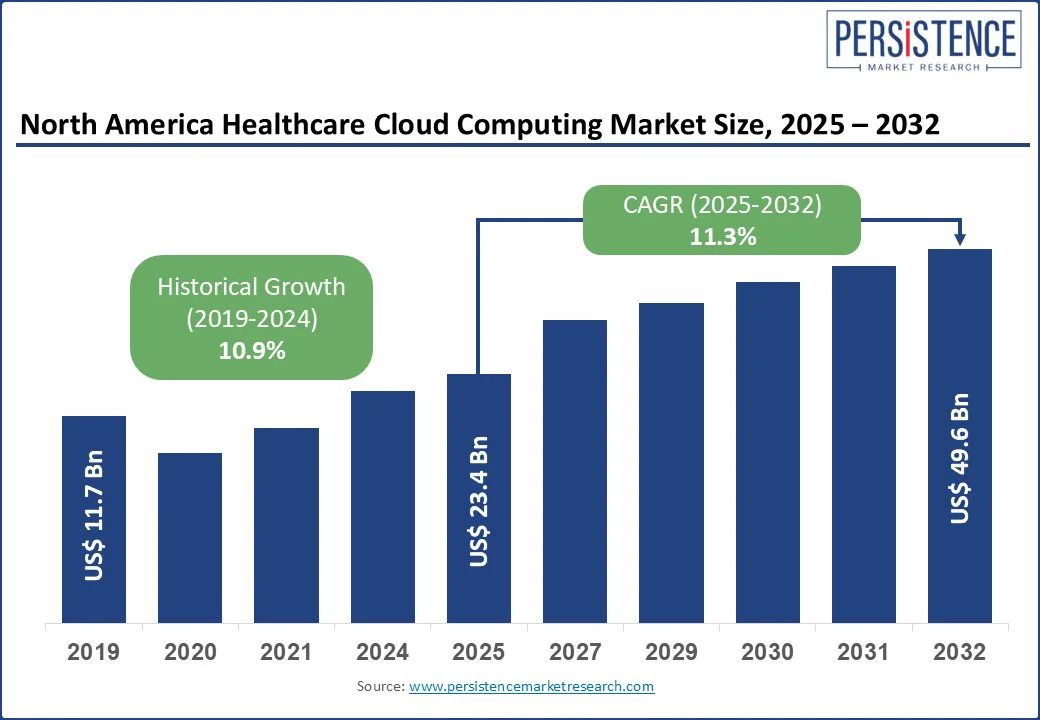

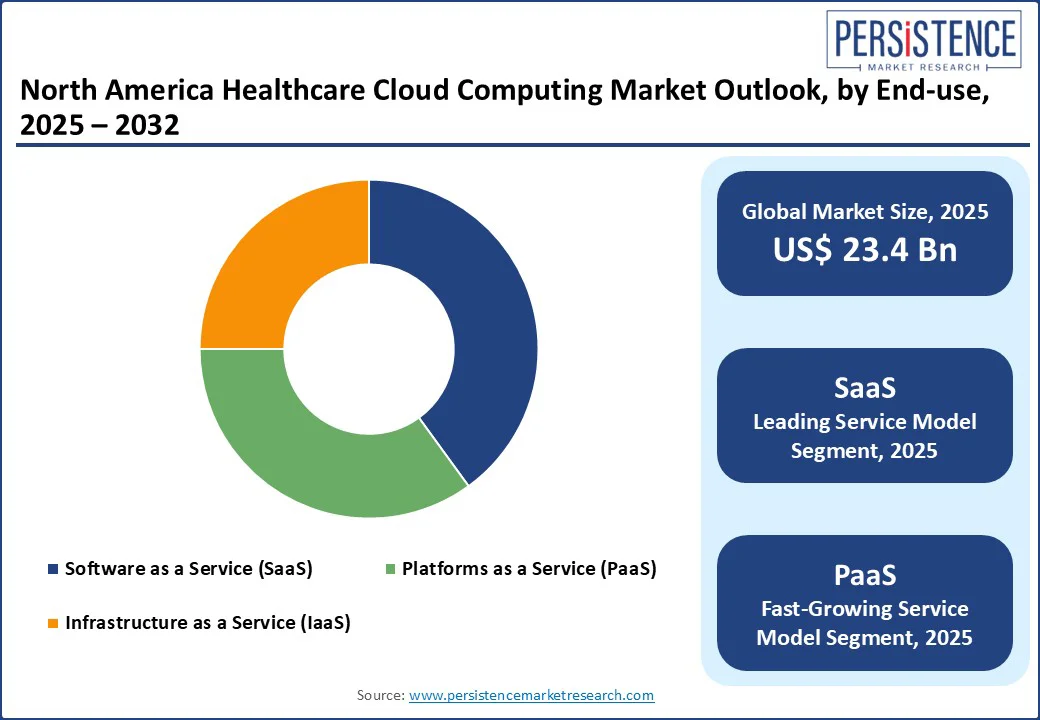

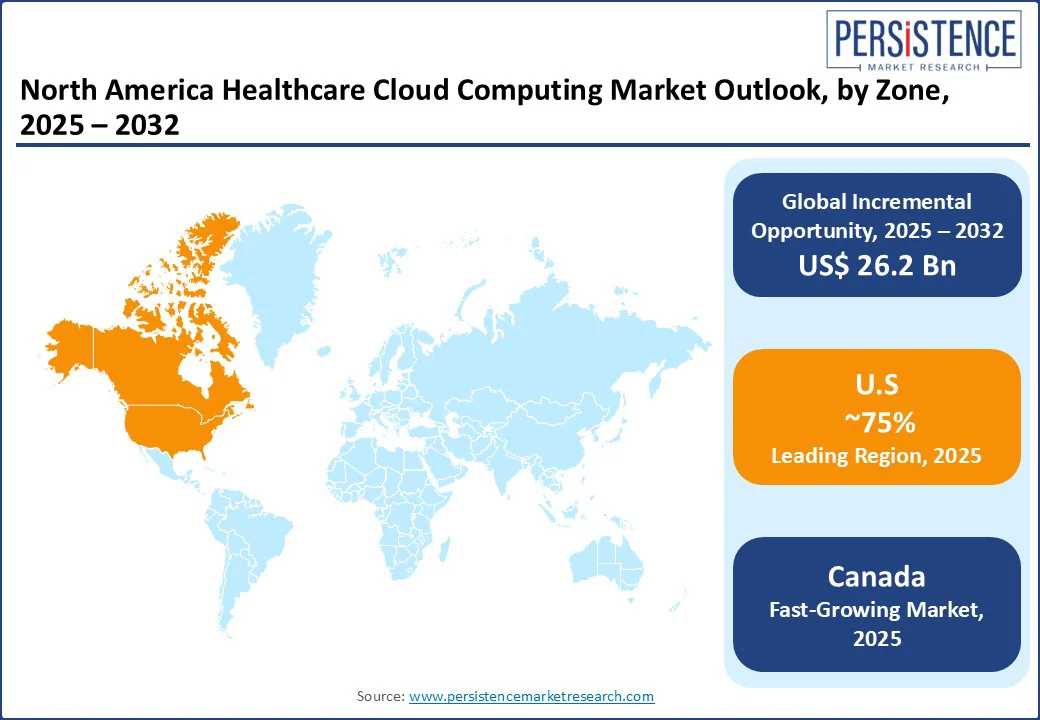

- North America Healthcare Cloud Computing Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Value Chain Analysis

- Key Market Players

- Regulatory Landscape

- PESTLE Analysis

- Porter’s Five Forces Analysis

- Consumer Behavior Analysis

- Price Trend Analysis, 2019 - 2032

- Key Factors Impacting Product Prices

- Pricing Analysis, By Application

- Regional Prices and Product Preferences

- North America Healthcare Cloud Computing Market Outlook

- Market Size (US$ Bn) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, 2025-2032

- North America Healthcare Cloud Computing Market Outlook: Application

- Historical Market Size (US$ Bn) Analysis, By Application, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Clinical Information Systems

- Non-Clinical Information Systems

- Market Attractiveness Analysis: Application

- North America Healthcare Cloud Computing Market Outlook: Deployment Model

- Historical Market Size (US$ Bn) Analysis, By Deployment Model, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Deployment Model, 2025-2032

- Public Cloud

- Private Cloud

- Market Attractiveness Analysis: Deployment Model

- North America Healthcare Cloud Computing Market Outlook: Service Model

- Historical Market Size (US$ Bn) Analysis, By Service Model, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Service Model, 2025-2032

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

- Market Attractiveness Analysis: Service Model

- North America Healthcare Cloud Computing Market Outlook: End-use

- Historical Market Size (US$ Bn) Analysis, By End-use, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By End-use, 2025-2032

- Healthcare Providers

- Healthcare Payers

- Market Attractiveness Analysis: End-use

- Market Size (US$ Bn) Analysis and Forecast

- North America Healthcare Cloud Computing Market Outlook: Region

- Historical Market Size (US$ Bn) Analysis, By Region, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Region, 2025-2032

- North America

- U.S.

- Canada

- Market Attractiveness Analysis: Region

- U.S. Healthcare Cloud Computing Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By Deployment Model

- By Service Model

- By End-use

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Clinical Information Systems

- Non-Clinical Information Systems

- Market Size (US$ Bn) Analysis and Forecast, By Deployment Model, 2025-2032

- Public Cloud

- Private Cloud

- Market Size (US$ Bn) Analysis and Forecast, By Service Model, 2025-2032

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

- Market Size (US$ Bn) Analysis and Forecast, By End-use, 2025-2032

- Healthcare Providers

- Healthcare Payers

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Canada Healthcare Cloud Computing Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By Deployment Model

- By Service Model

- By End-use

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Clinical Information Systems

- Non-Clinical Information Systems

- Market Size (US$ Bn) Analysis and Forecast, By Deployment Model, 2025-2032

- Public Cloud

- Private Cloud

- Market Size (US$ Bn) Analysis and Forecast, By Service Model, 2025-2032

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

- Market Size (US$ Bn) Analysis and Forecast, By End-use, 2025-2032

- Healthcare Providers

- Healthcare Payers

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Competitive Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- CareCloud Corporation

- Overview

- Segments and Application

- Key Financials

- Market Developments

- Market Strategy

- Carestream Health Inc

- ClearData Networks Inc

- Cisco Systems

- EMC Corporation

- Dell Inc.

- Hewlett-Packard Company

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Others

- CareCloud Corporation

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment