ID: PMRREP3318| 189 Pages | 16 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

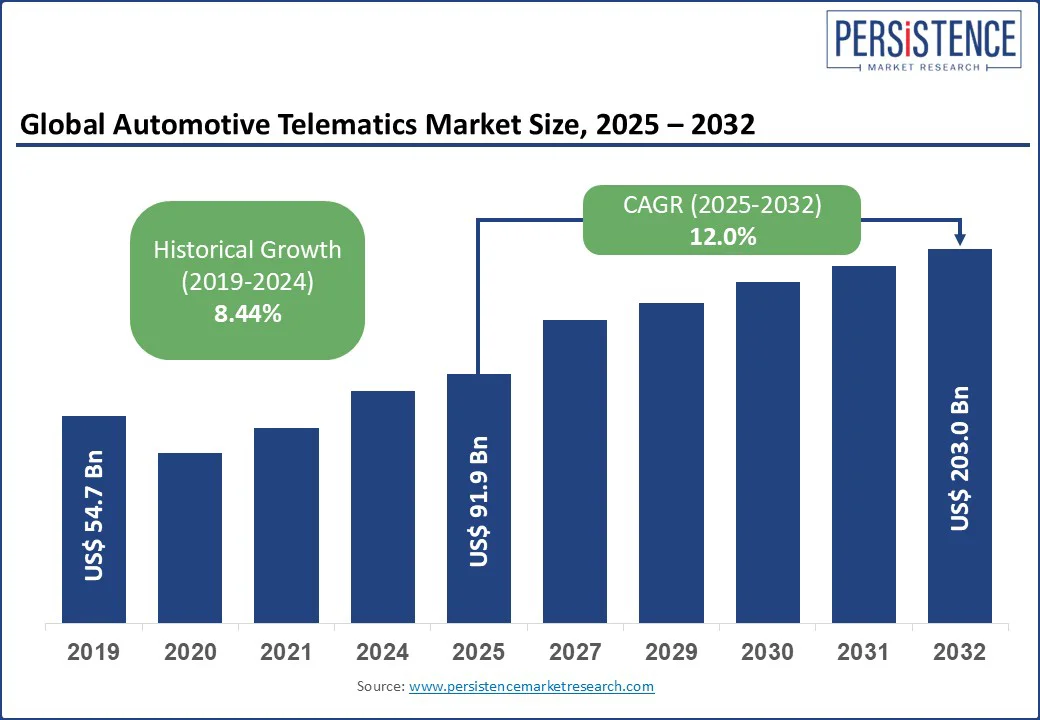

The global automotive telematics market size is likely to be valued at US$ 91.9 Bn in 2025, and projected to reach US$ 203.0 Bn by 2032, growing at a CAGR of 12.0% during the forecast period 2025 - 2032 owing to the introduction of AI-powered predictive maintenance solutions, integration of 5G-enabled vehicle-to-everything (V2X) communication, and enhanced driver-assistance systems.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Automotive Telematics Market Size (2025E) | US$ 91.9 Bn |

| Market Value Forecast (2032F) | US$ 203.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 12.0% |

| Historical Market Growth (CAGR 2019 to 2024) | 8.44% |

The accelerating adoption of electric vehicles, which require sophisticated telematics systems for real-time monitoring, battery management, and integration with smart charging infrastructure, is proving to be a crucial growth driver.

In 2024, global electric car sales surpassed 17 million, jumping by 25% from the previous year, with more than 20% of new cars sold being EVs, as per the International Energy Agency (IEA). As consumers increasingly shift to EVs, telematics performs the critical function of enabling EV performance and sustainability.

For example, China’s regulatory push through its New Energy Vehicle National Monitoring Platform mandates real-time vehicle data transmission encompassing battery status, location, and energy consumption, cementing the vital role of telematics in governance and compliance.

Moreover, AI-powered predictive analytics within telematics optimize battery longevity and charging cycles, reducing operating costs and environmental impact, a compelling value proposition for fleet operators and individual drivers alike. This electrification drive closely synergizes with advancements in 5G-enabled V2X communication, enabling low-latency data exchange essential for connected and autonomous mobility.

Despite the plethora of advantages, the adoption of automotive telematics faces a crippling challenge in the form of escalating data privacy and cybersecurity risks. Since telematics systems collect vast volumes of granular vehicle and driver data, consumers as well as fleet operators are likely to grow wary of potential misuse and unauthorized access.

Such apprehensions hamper trust in the technology, particularly among privacy-conscious consumers in Europe and North America, where stringent regulations such as GDPR and CCPA are enforced. Recent incidents of hacking connected vehicles have spotlighted vulnerabilities inherent in telematics platforms, exposing risks of remote vehicle control or data breaches.

For instance, in November 2024, security researchers found a vulnerability in Subaru’s STARLINK connected vehicle service that can give hackers unrestricted targeted access to all vehicles and customer accounts across the U.S., Canada, and Japan. Furthermore, high implementation costs to build robust, multi-layered cybersecurity frameworks pose economic barriers, especially for small-to-medium fleet operators and aftermarket solution providers.

While several lucrative opportunities await in the automotive telematics market, the popularity of usage-based insurance (UBI) models, leverage granular driver behavior data collected via telematics to tailor premiums dynamically and incentivize safer driving.

Insurance companies worldwide are under constant pressure to optimize risk assessment amidst soaring accident rates and claims costs. In this scenario, UBI presents a disruptive solution blending real-time vehicle tracking, driver scoring algorithms, and AI analytics.

For example, in the U.S., the insurance company Allstate runs a program called Drivewise that leverages mobile technology to help drivers potentially reduce their insurance costs through safer driving. Such regulatory nudges have also been initiated in Europe, where privacy-compliant telematics frameworks are taking shape.

This surge opens profit-making avenues for telematics vendors to collaborate with insurers, enhancing data accuracy, anonymization, and integration with IoT platforms.

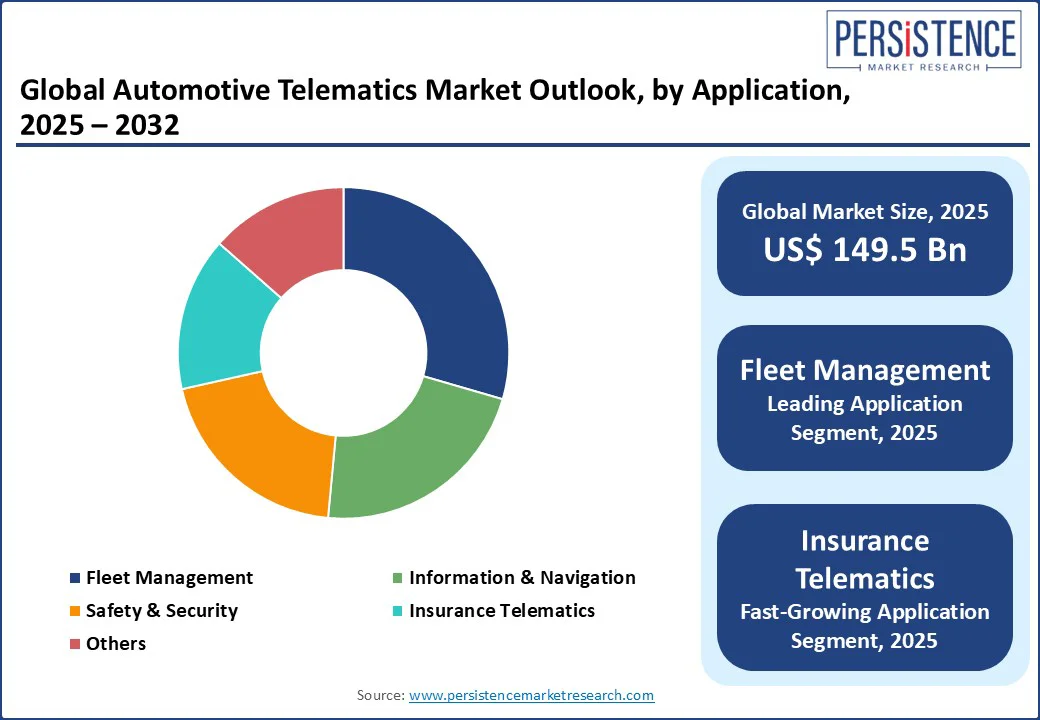

The fleet management segment is expected to hold the largest share nearly 30% in 2025, with its dominance arising from its instrumental role in the logistics & transportation sector, where telematics solutions optimize route planning, fuel consumption, and driver safety metrics, significantly reducing operating costs.

Recent advancements in the form of AI-powered predictive maintenance and real-time driver performance coaching have reduced fleet downtime by a sizeable margin for leading logistics companies across North America and Europe. Regulatory mandates, such as India’s AIS-140 vehicle tracking and Europe’s eCall system, are likely to further augment the need for continuous vehicle monitoring and emergency response functionalities.

Moreover, integration with 5G and IoT platforms enhances capability of telematics to manage fleets dynamically across geographies. The growing emphasis on sustainability and emissions reduction is pushing operators to adopt smart fleet telematics, aligning operational efficiencies with environmental compliance.

Insurance telematics is projected to register the highest CAGR of about through 2032, fueled by the widespread adoption of UBI schemes. This segment leverages extensive driver data analytics, captured through telematics devices, to customize insurance premiums, incentivize safe driving, and reduce accident-related claims.

For example, insurers in the U.S. have reported reductions in claim frequencies by over 15% in UBI-adopted portfolios. Besides this, the fusion of AI and machine learning with telematics enables finer fraud detection and enhances predictive risk modeling, providing insurers with unprecedented precision and operational efficiency.

The embedded telematics segment is anticipated to capture a massive 52% of the automotive telematics market share in the technology category in 2025. The apex position of this segment is powered by the increasing incorporation of factory-installed telematics systems by original equipment manufacturers (OEMs) as a standard feature in connected vehicles.

Embedded telematics provide seamless integration of vehicle diagnostics, safety systems, real-time navigation, and OTA software updates, enabling continuous communication between vehicles and cloud platforms. Regulatory mandates such as India’s AIS-140 for vehicle security have stoked widespread implementation of embedded telematics. The rise of electric vehicles has further amplifies their adoption, as battery health monitoring and smart charging management rely heavily on embedded telematics.

Embedded telematics not only dominates in market share but is also set to boast the highest CAGR from 2025 to 2032. This explosive growth is propelled by the increasing complexity of vehicle systems and the rising consumer preference for integrated, reliable connectivity that tethered and integrated options struggle to match.

Embedded systems support advanced applications such as AI-powered predictive maintenance, in-vehicle infotainment customization, and 5G-enabled V2X communication, critical for autonomous driving and enabling integration with smart city infrastructure. Moreover, embedded telematics facilitates essential services such as usage-based insurance and real-time fleet management, driving recurring revenue models through software-as-a-service (SaaS) platforms.

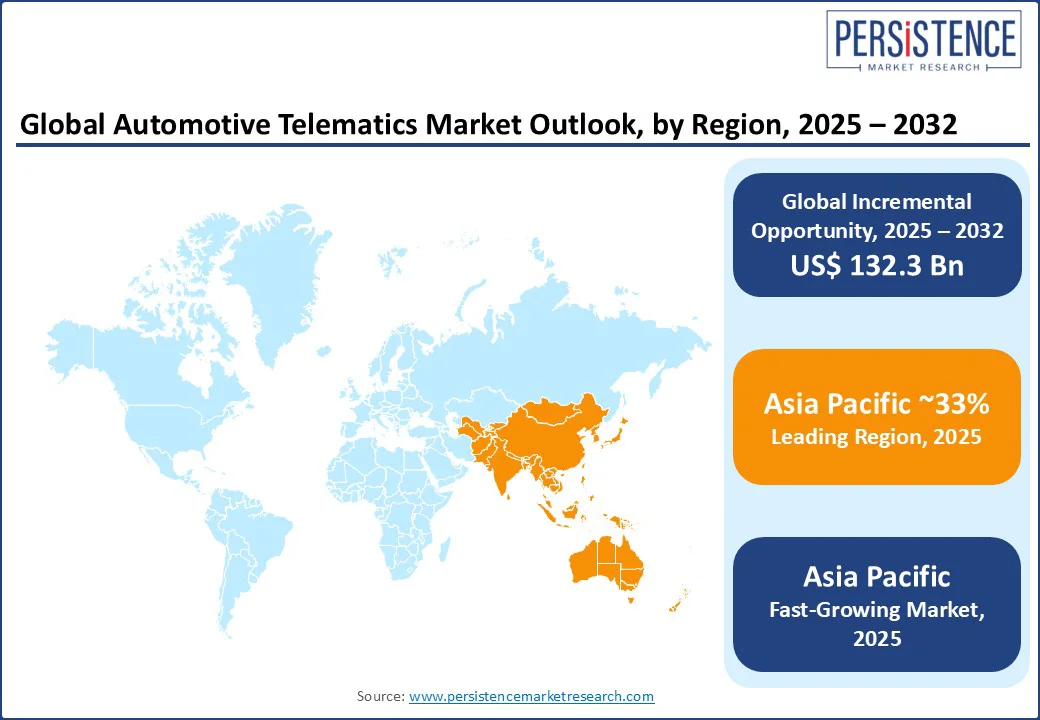

Asia Pacific is poised to claim a higher share of nearly 33% in 2025 and is also set to be the fastest growing regional market through 2032. Increase in vehicle ownership by an expanding middle-income group, exponential growth of urban areas, and promotion of EVs through government initiatives in China, India, Japan, and South Korea are driving the adoption of telematics.

For example, India’s policy push for EVs via the FAME scheme will heighten the requirement for telematics data transmission for electric and hybrid vehicles, fostering regional market growth. Simultaneously, the region's massive investment in and deployment of 5G and smart city projects has laid a solid foundation for innovation in fleet tracking, connected mobility, and remote diagnostics.

OEMs such as Tata Motors, Hyundai, Suzuki, and Toyota are launching telematics-enabled vehicles tailored for local markets, accelerating penetration. In January 2024, for example, Tata Motors announced that it will be connecting 5 lakh commercial vehicles via Fleet Edge, its dedicated connected mobility platform.

Rising demand for smart logistics, ride-sharing, and last-mile delivery across Asia Pacific’s major economic hubs is likely to further boost the adoption of telematics solutions in the coming years.

North America is set to hold a strong 28% of the automotive telematics market share in 2025, driven by its advanced digital infrastructure, high consumer demand for connected car technologies, and a dense concentration of automotive OEMs, tech giants, and telecommunications providers.

Long-running regulatory organizations and frameworks, such as the mandates enforced by the U.S. National Highway Traffic Safety Administration (NHTSA) on vehicle safety and emissions, will push the integration of telematics for compliance and enhanced vehicle performance.

Furthermore, North America is a pioneer in usage-based insurance adoption, which leverages telematics for real-time data-driven risk assessment, boosting market growth. The expansion of 5G networks will also facilitate low-latency vehicle-to-everything communication, expanding autonomous driving capabilities and smart fleet management.

Key players such as Ford, GM, and HARMAN are innovating in embedded telematics, over-the-air updates, and AI-powered analytics platforms. For example, Ford launched Ford Pro and E-Telematics to accelerate the electrification of trucks and vans, with these solutions boasting features such as battery range monitoring and providing energy consumption insights.

In Europe, the market is mainly fueled by the strict regulatory climate put in place by the EU and a wide consumer base that highly values vehicle safety, sustainability, and connectivity. Regulations such as the EU’s eCall emergency service and mandates on environmental emissions have necessitated the incorporation of telematics in vehicles for compliance and enhanced safety.

Europe is also a hotbed for V2X communication pilots and intelligent transportation systems (ITS), positioning telematics at the heart of evolving smart mobility infrastructure. In fact, the European Commission (EC) views ITS as a key enabler in building the single European Transport Area, with the EC co-funding next-gen vehicle connectivity projects such as the Cooperative ITS (C-ITS).

The region is home to a mature automotive industry, spearheaded by giants such as Volkswagen, BMW, and Daimler, which is focused on embedding telematics for advanced driver assistance systems (ADAS), electric vehicle management, and predictive maintenance.

The global automotive telematics market is undergoing a rapid innovation in advanced connectivity technologies and strategic collaborations among automakers and vehicle technology leaders, along with an increasing emphasis on electric and autonomous vehicles by fleet operators.

The integration of AI and machine learning within telematics systems for predictive maintenance, driver behavior analytics, and personalized infotainment is transforming traditional telematics offerings into intelligent, software-driven ecosystems.

For instance, a surge in OTA updates is enabling automakers such as Ford and Toyota to remotely enhance vehicle functionalities and security post-sale, reducing recall costs and improving customer experience. Regulatory mandates such as India’s AIS-140 vehicle tracking standards are compelling OEMs and aftermarket players to adopt telematics solutions compliant with safety and environmental norms, thus driving market participation and innovation.

Additionally, the rise in connected vehicle data monetization, for example, through usage-based insurance and fleet optimization, and real-time diagnostics, has prompted key players to focus on ramping up their data analytics capabilities.

The global automotive telematics market is projected to reach US$ 91.9 billion in 2025.

The accelerating adoption of electric vehicles, which require sophisticated telematics systems for real-time monitoring and battery management, worldwide is driving the market.

The automotive telematics market is poised to witness a CAGR of 12.0% from 2025 to 2032.

The growing adoption of usage-based insurance (UBI) models, which leverage granular driver behavior data collected via telematics to tailor premiums dynamically and incentivize safer driving is a key market opportunity.

LG Electronics Inc., HARMAN International, and Denso Corporation are some leading players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Application

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author