ID: PMRREP33614| 198 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

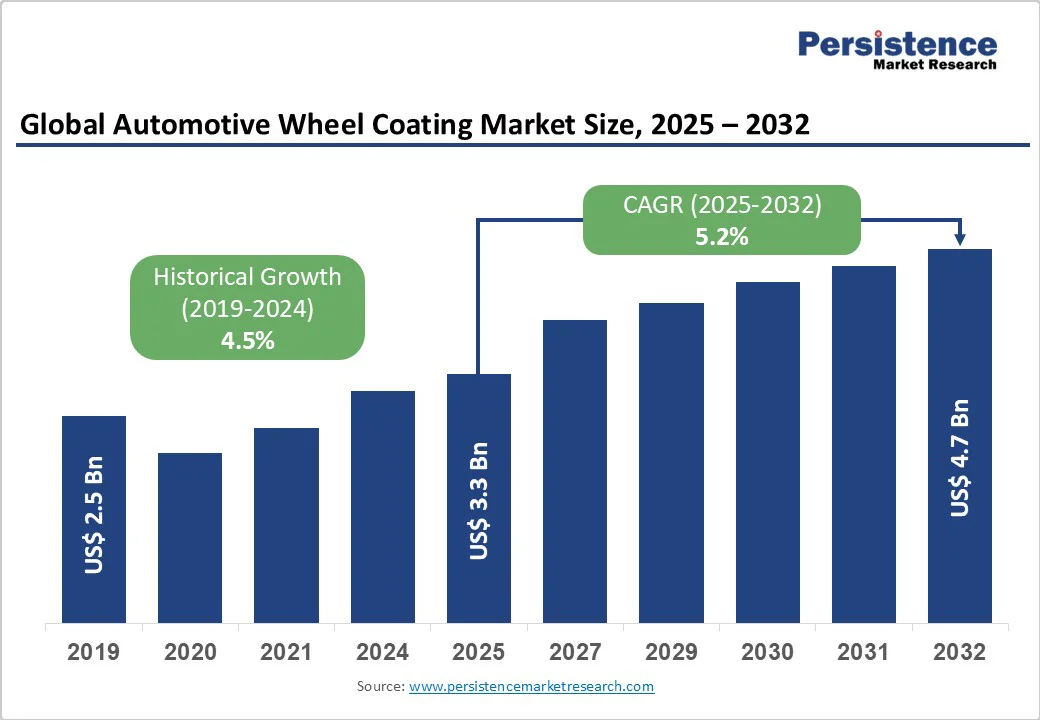

The global automotive wheel coating market size is likely to be valued at US$3.3 billion in 2025 and is projected to reach US$4.7 billion by 2032, growing at a CAGR of 5.2% between 2025 and 2032.

Regulatory requirements for environmentally sustainable materials shape market demand, drive technological advancements in coating formulations, and influence consumer preferences for enhanced wheel aesthetics and performance durability.

| Key Insights | Details |

|---|---|

| Automotive Wheel Coating Market Size (2025E) | US$ 3.3 Bn |

| Market Value Forecast (2032F) | US$ 4.7 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.5% |

Innovations in coating formulations are reshaping the automotive wheel coating landscape. Significant progress in water-based solutions, nano-coatings, and UV-curable products has addressed earlier concerns of volatile organic compound (VOC) emissions and reduced curing times.

Reports from the European Chemicals Agency (ECHA) confirm tightening restrictions on solvent-based coatings, leading many coating manufacturers to pivot toward technologies aligned with Green Deal commitments.

With more than 60% of automotive OEMs investing in R&D to integrate energy-efficient and environmentally compliant coatings, adoption has accelerated. The impact of these innovations extends beyond compliance, improving corrosion resistance, reducing manufacturing cycle times, and enhancing the durability of wheels under extreme conditions.

International regulatory frameworks are significantly influencing the automotive coatings sector. The EU’s REACH regulation and updated Euro 7 emission standards mandate lower VOC emissions, forcing coatings producers to prioritise sustainable alternatives.

The U.S. Environmental Protection Agency (EPA) has enhanced oversight of automotive refinishing processes, particularly in coatings applied at OEM facilities. According to UNEP, the coatings industry is among the top five contributors to industrial VOC release, accounting for approximately 10% of total emissions globally.

The impact compels companies to reformulate, adopt environmentally responsible raw materials, and implement compliance-driven innovations. This compliance environment ensures long-term sustainability integration while creating a competitive edge for early technology adopters.

Global automotive production reached 75.5 million units in 2024 (OICA), with China, North America, and Europe accounting for more than 70% of output. This directly influences demand for wheel coatings due to their integral application in OEM finishing lines.

In regions such as India, passenger vehicle demand surged alongside EV adoption India sold 100,000 electric vehicles in 2024, creating significant scope for specialised lightweight and heat-resistant wheel coatings.

In the U.S., a 2.3% increase in car sales in 2025, ahead of federal subsidy expirations, highlighted the cyclical correlation between policy frameworks and wheel coating demand growth. These macroeconomic tailwinds bolster industry prospects, particularly in emerging economies.

Wheel coatings rely on inputs such as titanium dioxide, solvents, polyester resins, and additives, whose prices are subject to volatility. Titanium dioxide experienced 11% price fluctuations in 2023 due to supply chain disruptions tied to global shipping uncertainties. These cost variations pressure participants to maintain profitability in a highly competitive environment. Failure to stabilise input costs can significantly deteriorate margins for mid-tier players unable to hedge raw material exposure.

The automotive value chain remains vulnerable to transportation delays, geopolitical tensions, and logistics bottlenecks. The COVID-19 pandemic underlined the fragility of sourcing critical raw materials, and subsequent geopolitical conflicts have further strained global distribution.

Industry reports show that global container shipping costs peaked at levels 4.7 times higher than pre-2020 averages, intensifying risks in the coatings sector. While leading multinationals invested in regionalised manufacturing bases, smaller firms face difficulties in building resilience, affecting lead times and customer reliability.

Intelligent coatings represent a transformative opportunity in the sector. These coatings incorporate responsive materials, embedded sensors, or adaptive visual properties to go beyond traditional decorative and protective roles.

For example, coatings capable of changing colour based on environmental stimuli or embedded with nanosensors for early detection of wheel stress showcase convergence between automotive engineering and materials science. This opens pathways for new service models, where coatings become active components in performance monitoring systems, enabling partnerships between OEMs, tier suppliers, and digital service providers.

Consumer demand for customizable aesthetics, coupled with connected car ecosystems, emphasises functional coatings’ value in branding and personalisation. Such technologies carry potential adoption first in premium and sports models, before diffusion into mainstream passenger vehicles as costs are optimised.

Governmental priorities highlight sustainability as a defining opportunity. The EU Green Deal and India’s Automotive PLI scheme emphasize emission reduction and circular economy integration. The shift toward low-VOC and waterborne coating adoption, already dominant in European OEM lines, is expected to replicate globally.

Companies investing in UV-curable and powder-based systems offer customers both compliance assurance and performance benefits. Similarly, EV adoption amplifies lightweighting demand, positioning coatings tailored for composite and carbon-fibre substrates for strong market traction. The opportunity lies in orienting R&D pipelines toward sustainability while leveraging funding and tax incentives tied to environmental innovation.

Rapid motorisation in India, ASEAN, Brazil, and Africa creates opportunities for entry-level and aftermarket-focused coating applications. India produced over 31 million vehicles in FY25 and exported 5.3 million units, creating dual prospects: OEM finishing-line supplies and aftermarket demand in domestic retail networks.

Brazil’s auto sector, with 14% year-over-year sales growth in 2024, also highlights demand for competitively priced coating solutions, driven by local consumer preference for flexible-fuel and hybrid vehicles. These markets provide cost-sensitive but high-volume opportunities for firms equipped with efficient distribution channels and tailored product lines.

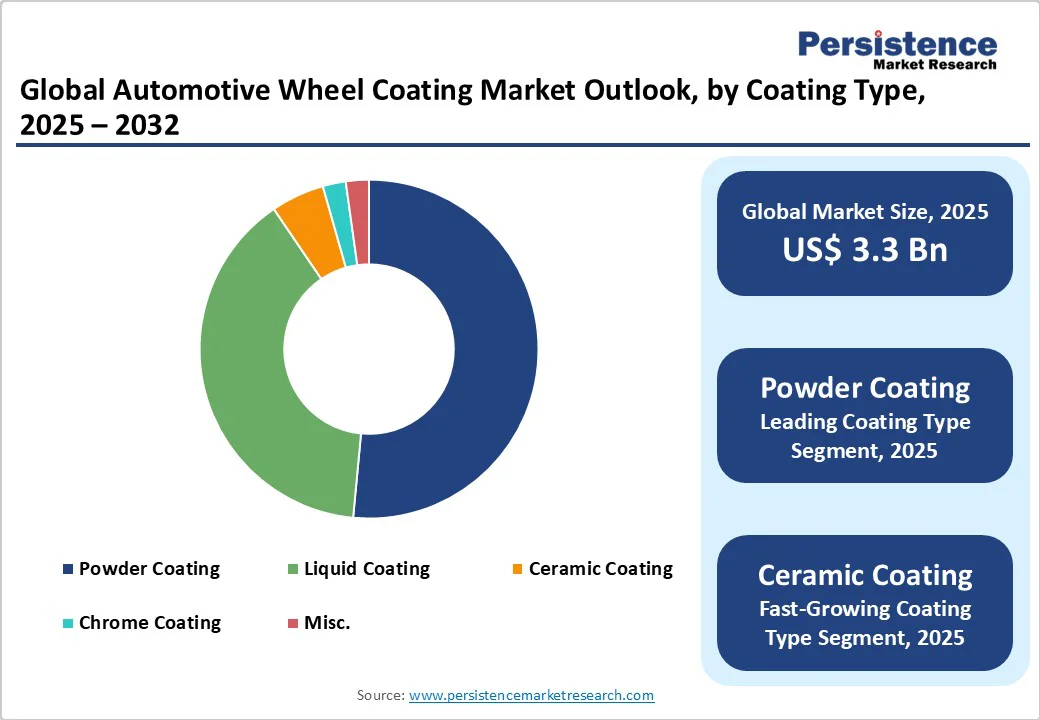

Powder coatings dominate with a 52% share in 2025 due to their durability, eco-friendliness, and absence of VOC emissions. Advanced formulations provide superior corrosion resistance, ensuring broad adoption across OEMs. Strong alignment with tightening environmental regulations consolidates its leadership position.

Ceramic coatings accounted for a 5% share in 2025, ceramic coatings are expanding due to superior resistance to scratches, chemicals, and high temperatures. Particularly significant for high-performance, premium, and sports cars, ceramic coatings target a consumer base prioritizing longevity and advanced aesthetics.

Alloy wheels represent the largest demand share at 62% in 2025, owing to widespread OEM adoption in passenger vehicles. Preferred for their lightweight design and performance-enhancing heat management, they reinforce the integration of coatings that combine functionality and visual appeal.

Composite materials capture 6% in 2025, supported by increasing use of carbon-reinforced plastics in premium and EV categories. Their alignment with electrification and lightweighting trends creates scope for specialised coatings that balance structural compatibility and finish quality.

OEM applications comprise 70% in 2025, driven by direct integration into assembly lines where performance consistency, compliance, and lifecycle reliability are prioritized. Coordination with OEM production cycles ensures stable volumes.

Representing 30% in 2025, the aftermarket segment is stimulated by the trend of vehicle refurbishment, customization, and wheel replacement. The aftermarket enables strong opportunities for premium coatings, ceramic finishes, and consumer-personalized alternatives.

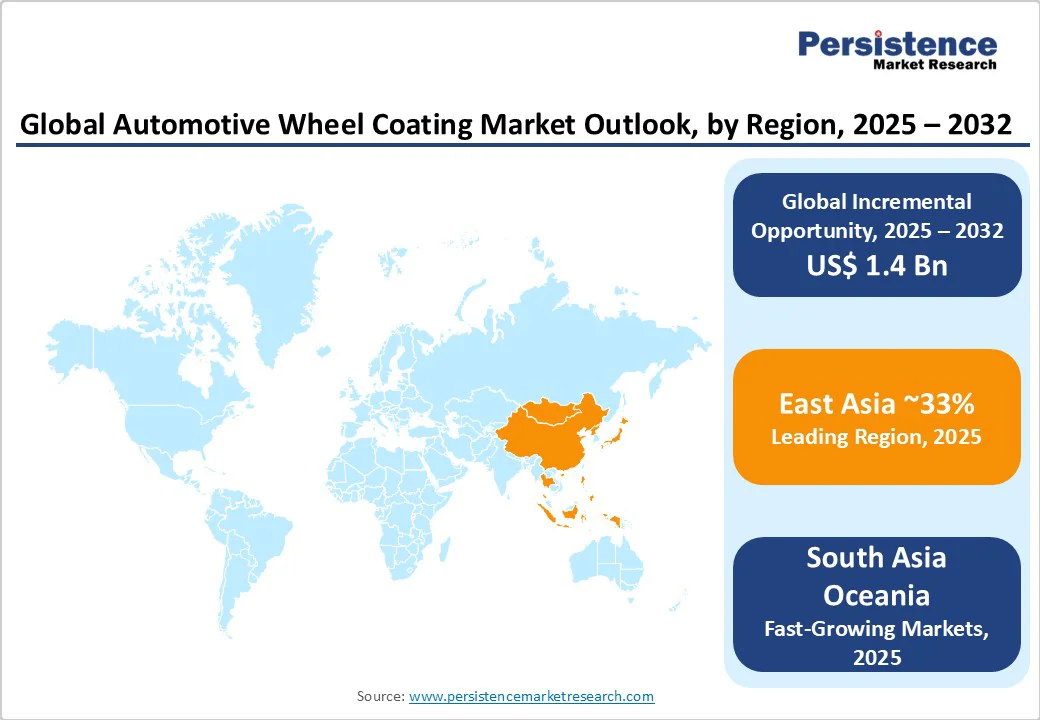

North America accounts for 17.2% share, supported by strong U.S. market demand. In 2025, U.S. sales reached 1.46 million units in August alone, reflecting EV-driven demand ahead of subsidy expirations. Regulatory enforcement by the EPA compels the adoption of eco-friendly coatings. Key factors include product innovations, strong aftermarket penetration for pickups/SUVs, and premium sports model launches.

Strategic partnerships between coating producers and OEMs strengthen competitiveness, while investment opportunities centre on EV wheel substrates and ceramic finishes for performance models.

Europe holds a 19.8% share, with Germany as the continent’s largest production base, producing 4.1 million cars in 2024. Stringent VOC caps under REACH regulations ensure waterborne and powder coatings dominate. Export performance underscores premium market power, with 60% of global premium cars linked to Germany.

The U.K. and France invest heavily in EV-linked R&D, shaping demand for composite-compatible coatings. Investment is driven by export-oriented production, sustainability-led innovation pipelines, and harmonised regulatory frameworks across the EU.

East Asia leads with a 33% share, while South Asia & Oceania hold a 14%. China remains the single largest contributor, with 23 million car sales in 2024. Japan and South Korea remain innovation hubs, but with volume contractions.

India demonstrates robust demand, producing 31 million vehicles in FY25, supported by government-led EV policies and export surges of 5.3 million units. The region’s competitive strengths include cost-efficient manufacturing, expanding consumer bases, and accelerating premium car adoption in urban markets. ASEAN’s market conditions add aftermarket and mid-tier OEM opportunities.

Latin America accounts for 9% share, underpinned by Brazil's dominance. Brazil’s auto sales surged by 14.1% in 2024, supported by interest in hybrids and EVs (EV sales rose by 219%). The aftermarket is recovering strongly, reinforced by consumer interest in personalised and decorative coatings. Investments from FCA, GM, and VW in production facilities further expand growth platforms.

MEA contributes with focus on South Africa. The market attracts interest for entry-level passenger cars and LCV aftermarket coatings. Challenges include economic volatility, but competitive opportunities emerge as Chinese brands extend production footprints and expand supply networks.

The global automotive wheel coating market is moderately consolidated, with a few leading multinational corporations holding significant market shares while numerous smaller regional players contribute to market diversity. The market exhibits characteristics of an oligopolistic structure, where major companies leverage technological innovation, sustainability, and regional expansion to maintain a competitive advantage.

Leading players such as AkzoNobel N.V., PPG Industries Inc., Axalta Coating Systems, BASF SE, Nippon Paint Holdings, and Kansai Paint Co. focus on developing eco-friendly coating formulations, expanding powder and ceramic coating technologies, and strengthening their presence in emerging markets. Manufacturers are prioritizing investments in advanced coatings that reduce VOC emissions and enhance durability, alongside strategic partnerships to expand their OEM and aftermarket reach.

The global automotive wheel coating market is projected to be valued at US$ 3.3 Bn in 2025.

The powder coating segment is expected to hold a 52% market share in 2025 due to its superior corrosion resistance, environmental compliance with low VOC emissions, and strong adoption by OEMs seeking durable and eco-friendly wheel finishing solutions.

The automotive wheel coating market is poised to witness a CAGR of 5.2% from 2025 to 2032.

The automotive wheel coating market growth is driven by technological advancements in eco-friendly coating formulations, stringent environmental regulations, and expanding automotive production globally.

Key market opportunities include the rise of intelligent coatings with functional features, sustainability-driven innovations in low-VOC and waterborne coatings and expanding demand in emerging automotive markets.

Key market players in the automotive wheel coating market include PPG Industries Inc., Akzo Nobel N.V., BASF SE, Axalta Coating Systems, Kansai Paint Co., Ltd., Nippon Automotive Paints, Berger Paints, Sherwin-Williams Company, Esoteric Car Care, and Nano Pro Ceramic.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Coating Type

By Substrate

By Vehicle Type

By End-use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author