ID: PMRREP4269| 166 Pages | 14 Aug 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

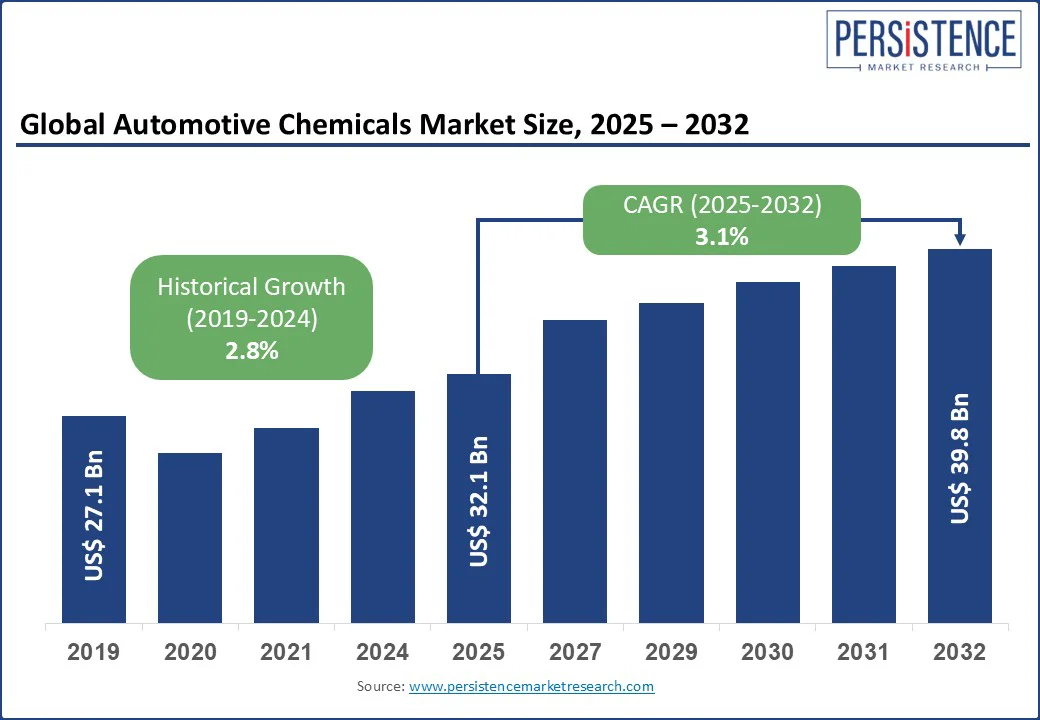

The global automotive chemicals market size is likely to be valued at US$ 32.1 Bn in 2025 and is estimated to reach US$ 39.8 Bn by 2032, growing at a CAGR of 3.1% during the forecast period 2025 - 2032.

The automotive chemicals market driven by vehicle lubricants and auto care products. The growth in eco-friendly automotive chemicals and fluids, market demand for fuel additives in passenger cars, and automotive chemicals for electric vehicle maintenance are reshaping the industry.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Automotive Chemicals Market Size (2025E) |

US$ 32.1 Bn |

|

Market Value Forecast (2032F) |

US$ 39.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.8% |

The automotive chemicals market is driven by several key factors, with a significant focus on the growth in eco-friendly automotive chemicals and fluids and the rise of electric vehicles (EVs). The global EV market expanded by 40% in 2024, according to BloombergNEF, increasing demand for EV-compatible automotive fluids such as specialized coolants and lubricants for battery thermal management and engine components. A 2024 industry report noted that 70% of new EV models require automotive chemicals for electric vehicle maintenance, including dielectric fluids and thermal management solutions, to enhance battery efficiency and longevity.

Sustainable automotive fluids, such as bio-based lubricants and low-VOC coatings, align with global sustainability goals, with 20% growth in eco-friendly product sales in 2024, according to online sources. Regulatory frameworks, such as the EU’s REACH and EPA’s VOC standards, mandate OEM-approved chemical products, boosting adoption of engine oils and coolants and brake fluids by 15% in compliance-driven markets. The sectors demand for fuel additives in passenger cars, with 10% sales growth in 2024, further supports the need for automotive additives to improve fuel efficiency and reduce emissions, particularly in passenger cars and hybrid vehicles. Automotive OEMs such as Toyota and Tesla are integrating sustainable automotive fluids, driving market growth.

Stringent environmental regulations pose a significant restraint to the automotive chemicals market, impacting the production and use of vehicle lubricants, auto fluids, and automotive additives. Regulations such as the EU’s REACH and the U.S. EPA’s Clean Air Act impose strict limits on volatile organic compounds (VOCs) and hazardous chemicals, increasing compliance costs for specialty chemicals and coatings by 20-25%, per a 2024 industry report. For instance, traditional engine oils and transmission fluids face restrictions due to high VOC content, pushing manufacturers toward costly sustainable automotive fluids. In 2024, 60% of countries implemented stricter chemical disposal regulations, per UNEP, affecting recycling processes for automotive aftermarket chemicals. This regulatory pressure limits scalability in price-sensitive markets such as Africa and parts of Asia Pacific, where 40% of consumers opt for non-compliant, cheaper alternatives, per a 2024 survey. Additionally, the transition to EV-compatible automotive fluids requires reformulation, increasing R&D costs by 15%, per industry data, challenging smaller players in the automotive detailing industry.

The development of EV-compatible automotive fluids presents a significant opportunity for the Automotive Chemicals Market, driven by the rapid growth of electric vehicles. The EV market is projected to grow at a CAGR of 25% through 2032, creating demand for specialized auto fluids such as dielectric coolants and thermal management fluids for engine components and battery systems.

A 2024 study noted that EV-compatible fluids improve battery efficiency by 10%, enhancing vehicle range and performance. Companies such as ExxonMobil and BASF SE are investing US$ 500 million in R&D for automotive chemicals for electric vehicle maintenance, per a 2024 report, targeting OEM and aftermarket segments. The automotive detailing industry also benefits, with ceramic coatings for cars seeing 12% growth in 2024 for EV exterior protection. Emerging markets, with 1.2 billion new vehicles projected by 2030, per OICA, offer opportunities for sustainable automotive fluids and fuel additives, particularly in Asia Pacific, where EV adoption is accelerating. This trend aligns with consumer demand for eco-friendly solutions, positioning EV-compatible automotive fluids as a key growth driver.

Engine Oils hold approximately 40% of the industry share in 2025 due to their critical role in vehicle lubricants for engine components. Synthetic engine oils and coolants dominate, with 60% adoption in passenger cars in 2024, per industry data, driven by performance and durability. Additives are fueled by market demand for fuel additives in passenger cars and automotive additives for emissions reduction, with 15% sales growth in 2024.

Engine Components command a 35% market share in 2025, driven by engine oils and coolants and brake fluids for vehicle maintenance. Their use in passenger cars and commercial vehicles supports 50% of application revenue, per a 2024 report. Fuel Additives are driven by market demand for fuel additives in passenger cars to enhance fuel efficiency, with 12% growth in 2024, per industry data.

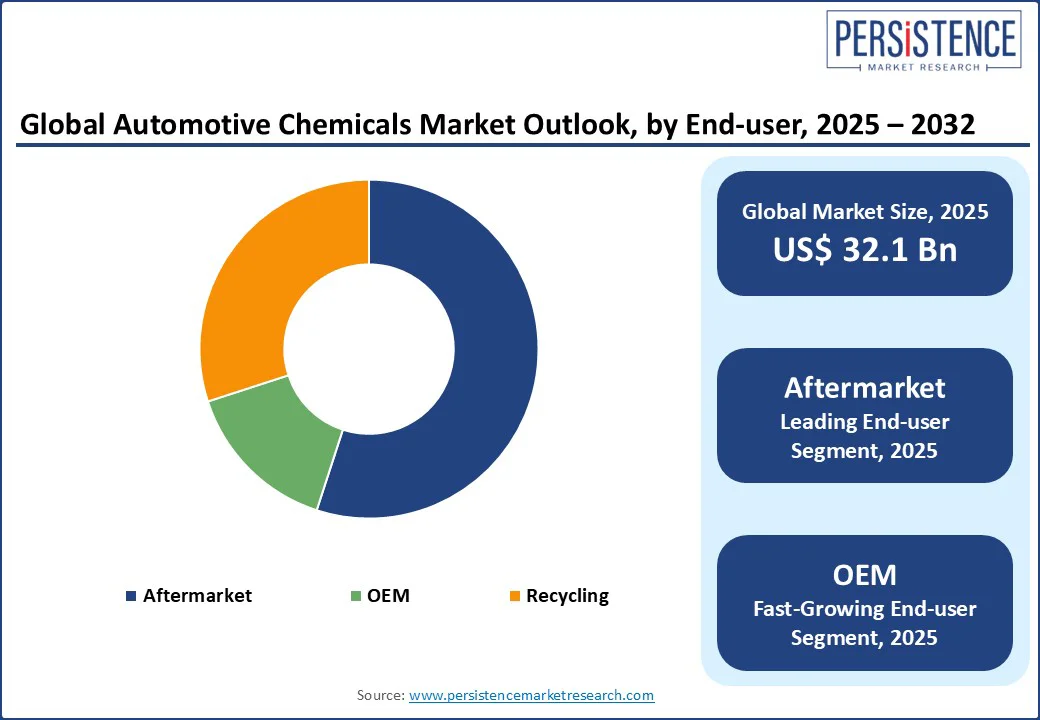

Aftermarket holds a 55% market share in 2025, driven by automotive aftermarket chemicals such as vehicle servicing chemicals and cleaners for interior/exterior cleaning, with 70% of aftermarket sales from retail channels in 2024. OEM is fueled by OEM-approved chemical products for EV-compatible automotive fluids and coatings, with 15% growth in EV applications in 2024.

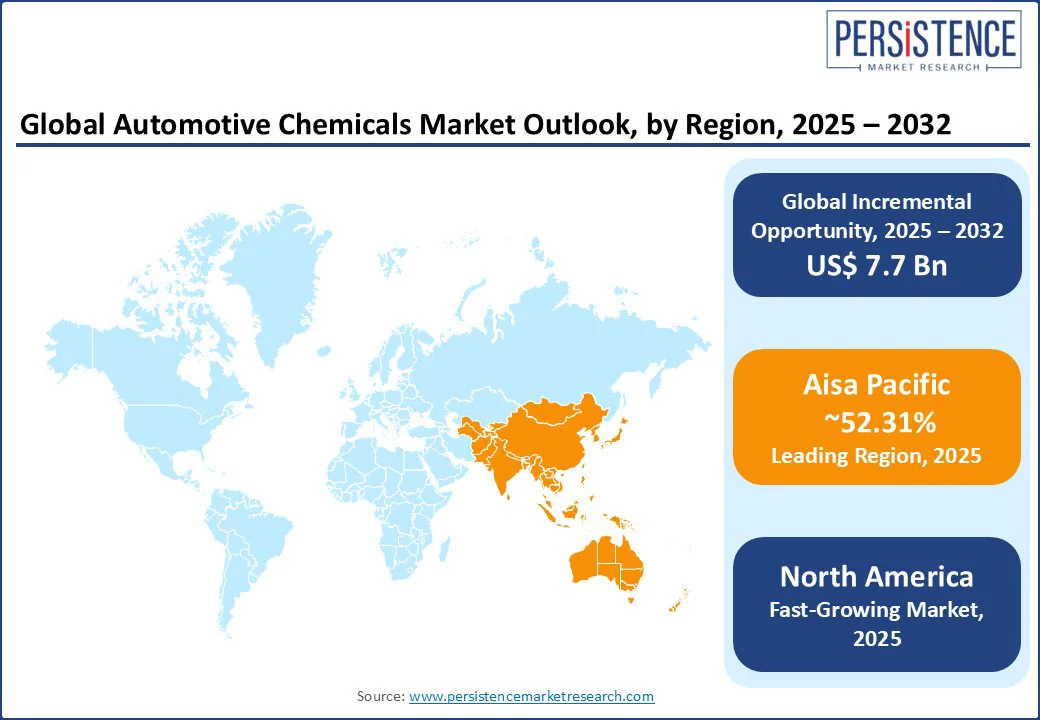

In North America, the automotive chemicals market holds a distinct position, commanding a 25% market share in 2025. The U.S. dominates due to its advanced automotive industry and high demand for auto care products. The U.S. market is driven by EV-compatible automotive fluids and ceramic coatings for cars, with 40% of EVs using specialized fluids in 2024, per industry data. Engine oils and coolants lead, with 50% adoption in passenger cars, per NHTSA. The automotive detailing industry grows by 12% annually, supported by interior/exterior cleaning products. OEM-approved chemical products ensure compliance, with 90% of U.S. products meeting EPA standards in 2024. Automotive OEMs such as Ford and General Motors drive 25% of regional revenue, per a 2024 report, supported by robust distribution networks.

In Europe, the automotive chemicals market accounts for a 15% market share, led by Germany, the UK, and France. Germany’s market is driven by sustainable automotive fluids and coatings from BASF SE and Fuchs Petrolub SE, with 60% of luxury vehicles using ceramic coatings for cars in 2024. The EU’s REACH regulations boost eco-friendly automotive chemicals, with 20% growth in sustainable fluids in 2024. The UK’s focus on vehicle servicing chemicals is supported with BP and Shell plc leading fuel additives. France’s demand for transmission fluids drives 15% market growth in 2024, per industry data. OEM-approved chemical products and recycling initiatives, with €200 million in EU funding for green chemicals in 2024, enhance market growth.

Asia Pacific is the most prominently growing region, holding 52.31% market share, led by China, Japan, and India. China holds a 38% regional market share, driven by a 30% increase in vehicle production in 2024, per OICA, boosting vehicle lubricants and auto fluids. Japan’s market is fueled by EV-compatible automotive fluids and fuel additives, with Toyota and Honda integrating sustainable fluids. India’s market, driven by aftermarket demand for vehicle servicing chemicals and cleaners, with 90% of new vehicles using engine oils in 2024, per government data. The growth in eco-friendly automotive chemicals and fluids and the automotive detailing industry drives innovation, supported by US$ 40 billion in automotive investments by 2030.

The global automotive chemicals Market is marked by fierce competition, with chemical manufacturers competing on innovation, sustainability, and cost-efficiency. DuPont and ExxonMobil dominate in developed markets through OEM-approved chemical products and sustainable automotive fluids, while Fuchs Petrolub SE and Liqui Moly GmbH lead in emerging markets with cost-effective auto care products. EV-compatible automotive fluids, ceramic coatings for cars, and fuel additives add a competitive layer. Strategic partnerships and R&D investments are key differentiators in the automotive aftermarket chemicals segment.

The automotive chemicals market is projected to reach US$ 32.1 Bn in 2025.

The growth in eco-friendly automotive chemicals and fluids, EV adoption, and regulatory compliance are key drivers.

The automotive chemicals market grows at a CAGR of 3.1% from 2025 to 2032, reaching US$ 39.8 Bn by 2032.

Opportunities include EV-compatible automotive fluids, sustainable automotive fluids, and emerging market expansion.

Key players include DuPont, Cabot, ExxonMobil, Dow Inc., BASF SE, Shell plc, Valvoline Inc., Fuchs Petrolub SE, Lubrizol Corporation, 3M, and Liqui Moly GmbH.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author