ID: PMRREP21562| 192 Pages | 27 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

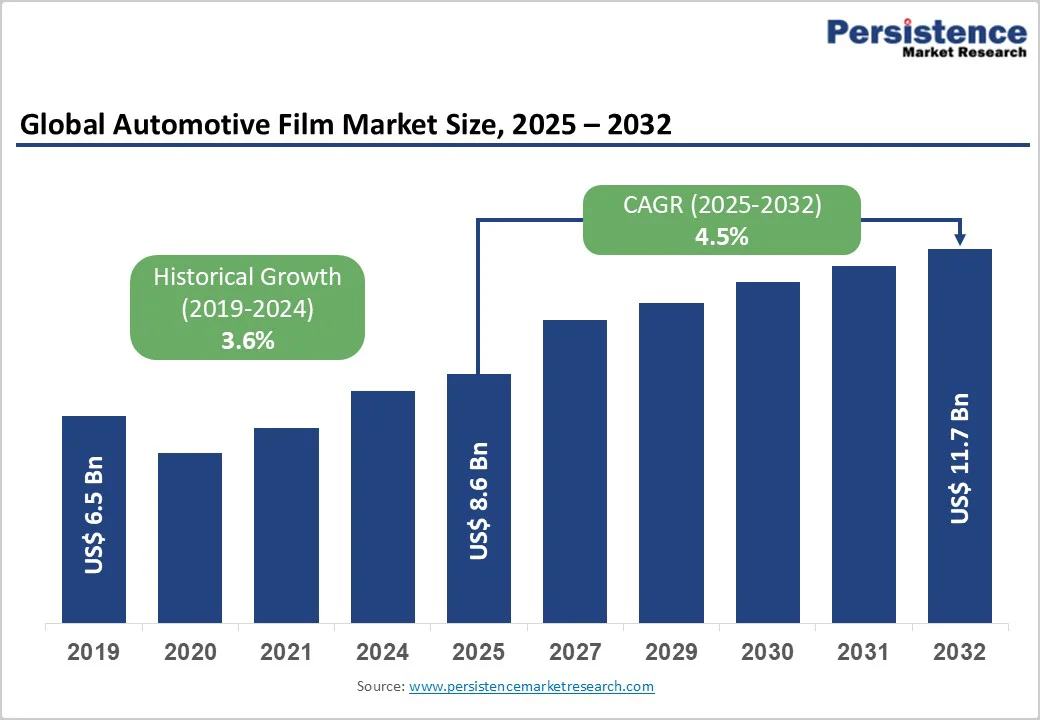

The global automotive film market size is valued at US$ 8.6 billion in 2025 and is projected to reach US$ 11.7 billion, growing at a CAGR of 4.5% between 2025 and 2032.

Key growth drivers include increasing consumer preference for vehicle protection and aesthetic customization solutions, greater understanding of the long-term benefits of UV-resistant films, and expanding use of self-healing paint protection film technologies in both high-end and volume vehicle segments.

| Key Insights | Details |

|---|---|

| Automotive Film Market Size (2025E) | US$ 8.6 Bn |

| Market Value Forecast (2032F) | US$ 11.7 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.6% |

Rising consumer preference for personalized vehicle appearance combined with protective functionality drives automotive film adaptation across demographic segments, particularly among affluent consumers prioritizing paint preservation and privacy features. Over 60% of vehicle owners in developed markets now consider protective films essential rather than luxury items, with paint protection films valued at US$532.3 million in 2025 growing 9.8% annually through 2032.

The vehicle customization market, benefiting from self-healing paint protection films with superior optical clarity and non-yellowing TPU (thermoplastic polyurethane) materials provides demonstrable aesthetic value, maintaining showroom-quality appearance indefinitely.

Automotive wrap films enabling color changes, matte finishes, and custom designs without permanent paint modification appeal to consumers prioritizing vehicle flexibility and resale value preservation. Luxury automotive brands, including Porsche, Tesla, and BMW, increasingly offer factory-integrated PPF packages, recognizing customer demand for comprehensive protection, with XPEL reporting 32.6% year-over-year revenue growth through OEM strategic collaborations.

Government mandates establishing visual light transmission (VLT) standards, eco-friendly film development initiatives, and OEM integration of factory-fitted tinted glass create compliance-driven procurement demand while supporting premium positioning of advanced film technologies.

Indian Supreme Court and Central Motor Vehicle Rules mandate 70% VLT for windshields and 50% VLT for side windows with strict enforcement through penalties and license suspension, eliminating illegal aftermarket tinting while creating demand for compliant OEM solutions. Manufacturers, including Maruti increasingly offer factory-fitted Dark Green UV-cut glass as a legal alternative to aftermarket films, driving market migration toward OEM-installed solutions.

Sustainable film development initiatives targeting biodegradable and recyclable PPF materials, addressing environmental concerns create marketing differentiation and appeal to eco-conscious consumers. Electric vehicle adoption prioritizing lightweight materials and advanced technologies creates demand for protective films integrating with touchscreen displays, connectivity features, and glare reduction capabilities.

Automotive film installation requires specialized technical expertise, precision application equipment, and time-intensive labor, creating elevated costs constrain market penetration, particularly in price-sensitive residential and light commercial vehicle segments.

Professional PPF installation requiring 8-16 hours of labor for full vehicle coverage with certified technician expertise elevates total project costs 50-75% above materials, creating affordability barriers for mainstream consumers. Installation complexity, including precise surface preparation, metering, heating, and edge sealing, prevents DIY applications, limiting market expansion to professional network capacity constraints.

Retrofit installation on existing vehicles generates higher per-unit costs compared to OEM integration at manufacturing, creating a pricing premium deterring aftermarket adoption relative to new vehicle factory-installed options. Geographic availability of qualified installers concentrated in major metropolitan areas creates geographic disparities limiting market penetration in secondary and tertiary markets lacking technical service infrastructure.

International film supply chains dependent on specialty chemical suppliers, polymer manufacturers, and precision coating facilities face disruption risks from geopolitical tensions, shipping delays, and raw material availability constraints creating pricing uncertainty and installation schedule delays. TPU base material sourcing from limited suppliers in Europe, China, and Japan creates supply concentration risk with potential disruptions affecting global film availability and pricing.

Film manufacturer consolidation with larger players including 3M, Eastman Chemical, and XPEL, controlling 40-50% global market share, creates pricing power constraining smaller regional competitors and limiting market expansion opportunities. Extended lead times of 6-12 weeks for custom film specifications and color availability constrain availability, preventing spontaneous consumer purchasing and forcing advance procurement planning.

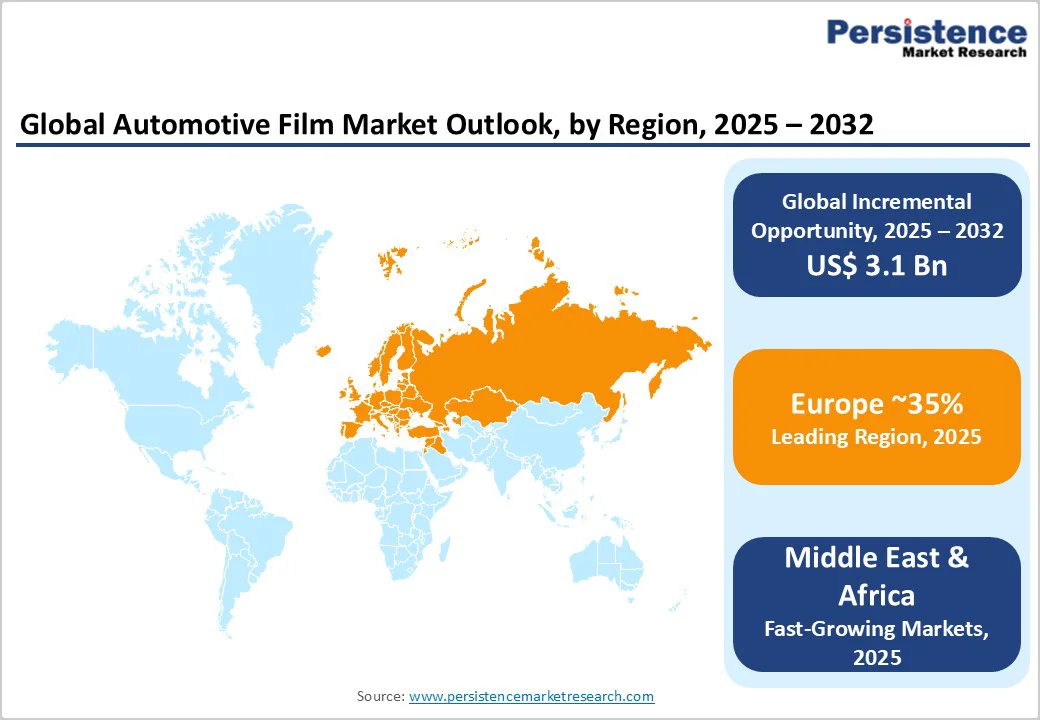

Rapidly expanding vehicle ownership in the Asia Pacific, Latin America, and Middle East regions combined with fleet electrification initiatives create substantial market opportunities for standardized film solutions adapted to regional climate and regulatory requirements. India automotive film market is projected at a 7.21% CAGR in the forecast period driven by rising car ownership, lifestyle changes, vehicle financing expansion, and brand advocacy, creating untapped market potential.

Southeast Asia countries include Indonesia, Thailand, Vietnam, and Philippines experiencing 15% annual vehicle sales growth create proportional demand for protective films with OEM integration increasingly specified in new vehicle orders. Electric vehicle adoption reaching 13.8 million units in 2023 with projected growth to 39 million units by 2030 creates incremental film demand for premium EV models requiring advanced protection and sleek aesthetics preservation.

Emerging convergence of automotive films with smart glass technology, augmented reality displays, and vehicle-to-infrastructure (V2I) communication systems creates premium market opportunities for films enabling technological integration while maintaining optical clarity.

Smart glass films incorporating liquid crystal technology enabling switchable opacity create privacy functionality while maintaining driver visibility, with development costs and production complexity creating premium pricing opportunities.

Integration of protective films with augmented reality heads-up displays and windshield-mounted information systems requiring optical precision and glare reduction drives demand for specialty films combining protection with advanced functionality.

Film technology convergence with infrared-reflective coatings, anti-glare properties, and thermal management capabilities enable vehicles to reduce air conditioning load 15-20% while maintaining interior comfort, aligning with EV efficiency objectives.

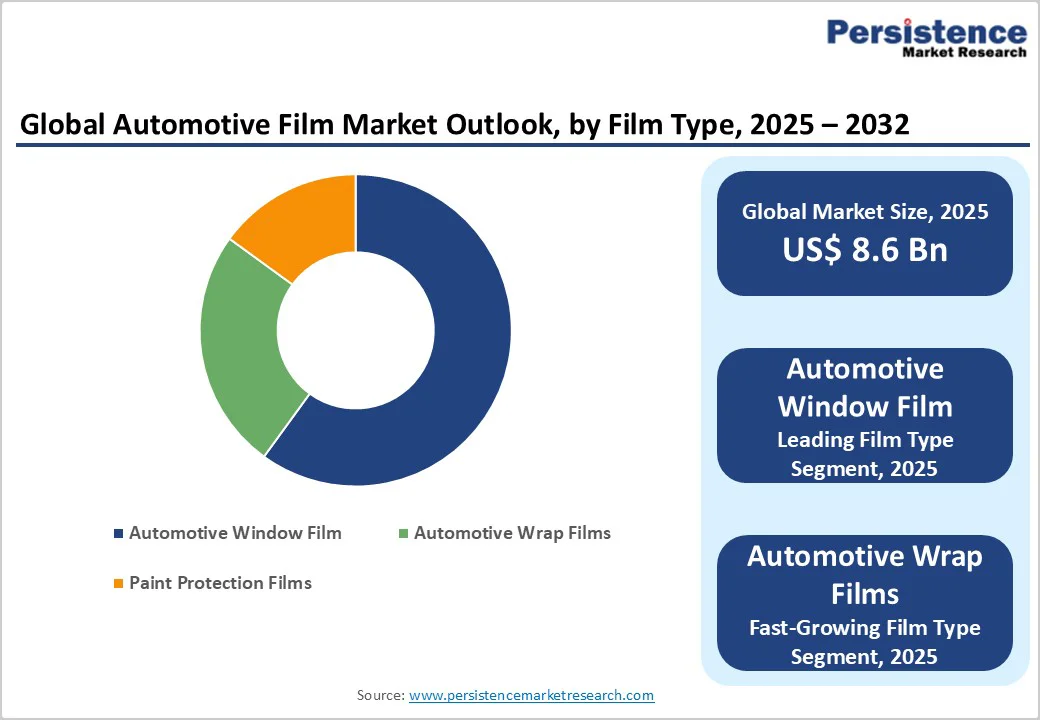

Automotive window films dominate with 67.1% market share, driven by demand for heat reduction, UV protection, and privacy across residential, commercial, and fleet applications. These films reduce solar heat gain by 50%, improving comfort and HVAC efficiency by 15% in hot climates, while ensuring compliance with visible light transmission (VLT) regulations. The tinting film market, valued at US$3.9 billion in 2023 is projected to reach US$6.7 billion by 2033 at a 5.6% CAGR.

Automotive wrap films, growing at 8% CAGR, gain popularity as cost-effective repainting alternatives offering custom colors, matte finishes, and carbon textures. With 40-60% lower costs than repainting and strong adoption in China (16% CAGR), wrap films drive personalization and fleet branding growth globally.

Exterior film applications dominate with a 65.4% market share, driven by demand for aesthetic enhancement, paint preservation, and UV protection that sustain vehicle resale value and showroom appearance.

Paint protection films (PPF) account for 42.4% of market value, safeguarding against chips, scratches, and contaminants, while window films block over 99% UV rays, reduce cabin heat by 15-20°F, and minimize glare to enhance safety and comfort. Exterior wraps for color customization, fleet branding, and motorsport styling generate strong aftermarket revenue and justify premium pricing through comfort, energy savings, and paint longevity.

Interior applications, growing at 8% CAGR, are propelled by smart glass integration, interior surface protection, and technology-enabled films improving cabin comfort, safety, and infotainment compatibility-creating emerging premium opportunities in next-generation vehicle interiors.

Passenger cars dominate the automotive film market with a 62.1% share, supported by high penetration in developed regions, affluent buyers valuing aesthetics, and luxury OEM integration from brands like BMW, Mercedes-Benz, Audi, and Porsche offering films as premium options. With over 70 million cars sold annually, developed markets show 12-18% adoption, while emerging markets at 3-5% present major growth potential. Consumers’ willingness to invest 4-6% of vehicle cost in protection fuels steady aftermarket demand through customization and wrap films.

Light commercial vehicles (LCVs) are the fastest-growing segment (7-9% CAGR), driven by expanding delivery fleets and emphasis on driver comfort, cargo security, and energy efficiency. Protective and privacy films reduce AC load by 15-20%, enhance safety, and support fleet standardization in Asia Pacific and emerging markets.

North America generates approximately US$2.45 billion market in 2025 growing at 6.8% CAGR through 2032, driven by robust aftermarket industry, high consumer disposable income, consumer preference for vehicle aesthetics, and established distribution networks supporting premium film products.

The United States dominates regional market with 75-78% share through high vehicle ownership rates, affluent consumer base investing 4-6% of vehicle purchase price in protective solutions, and extensive professional installation networks servicing major metropolitan areas.

Paint protection film market growing at 9.8% CAGR particularly in luxury and performance vehicle segments reflects consumer recognition of technology superiority and willingness to pay premium pricing for advanced self-healing films with 10-year warranties.

Commercial fleet segment expansion driven by Uber, Amazon, and delivery service fleets recognizing operational efficiency improvements through heat-reducing window films and privacy protection supporting bulk procurement contracts.

Europe represents US$1.62 billion market in 2025 growing at 5.2% CAGR through 2032, characterized by premium product demand, strong emphasis on vehicle aesthetics, and established OEM integration leadership from German luxury manufacturers.

Germany leads European adoption with 28-30% regional share through premium automotive industry dominance with BMW, Mercedes-Benz, and Audi manufacturing excellence, high consumer demand for sophisticated protection solutions, and strict quality standards.

United Kingdom contributes steady growth through heritage vehicle preservation culture, premium automotive enthusiasm, and strong aftermarket services sector supporting professional installation capacity.

France and Spain demonstrate consistent growth through commercial fleet modernization, automotive industry leadership, and consumer preference for vehicle aesthetics and value preservation. Regulatory harmonization through EU vehicle safety directives and environmental standards creates consistent market conditions supporting cross-border supplier competition and technology transfer.

Asia Pacific represents the fastest-growing region at approximately 16% CAGR through 2032, with market value reaching approximately US$6.5-7.0 billion by 2032 comprising 50%+ global market shares through vehicle ownership expansion, climate-driven heat reduction demand, and manufacturing advantages.

China dominates regional market with 45-50% share through extraordinary vehicle sales growth reaching 26+ million units annually, rising luxury vehicle sales, growing consumer awareness of protective film benefits, and domestic manufacturer emergence including Beijing Tianxing and Shenzhen Yonghong.

India emerges as high-growth market at 7.21% CAGR through rapidly expanding vehicle ownership, rising disposable incomes, lifestyle improvements, and OEM integration as standard delivery package creating mainstream penetration acceleration from historic niche positioning.

Japan maintains significant market through advanced automotive industry, consumer emphasis on vehicle maintenance and aesthetics, strong appreciation for premium protective solutions, and technological innovation leadership in PPF development.

The automotive film market exhibits moderate-to-high consolidation with leading players commanding approximately 40% combined market share, while regional specialists and emerging manufacturers capture growing segments through localized expertise and cost-competitive offerings.

XPEL Inc. emerges as market leader with estimated annual revenue of US$450-650 million from paint protection films and related products, controlling 10% global market share through technology differentiation, strategic OEM partnerships with luxury brands, and strong brand positioning.

3M Company maintains competitive positioning with an estimated US$350 million annual revenue from automotive film operations, including Scotchgard PPF line, leveraging global distribution networks and institutional relationships across automotive aftermarket.

The Automotive Film market is estimated to be valued at US$ 8.6 Bn in 2025.

The key demand driver for the Automotive Film market is the rising consumer and OEM focus on vehicle aesthetics, protection, and energy efficiency.

In 2025, the North America region will dominate the market with an exceeding 35% revenue share in the global Automotive Film market.

Among the Film type, Automotive Window Film holds the highest preference, capturing beyond 67.1% of the market revenue share in 2025, surpassing other parts.

The key players in Automotive Film are 3M Company, Eastman Chemical Company, Avery Dennison Corporation and Lintec Corporation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Film type

By Application

By Vehicle type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author