ID: PMRREP15307| 214 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

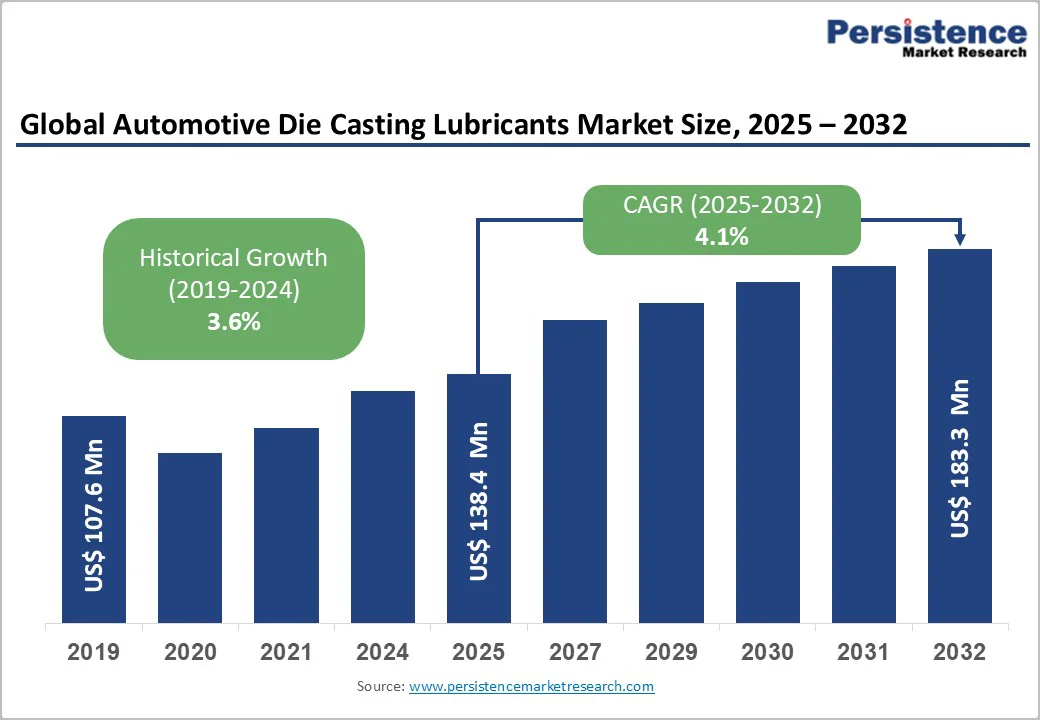

The global automotive die casting lubricants market size was valued at US$138.4 Million in 2025 and is projected to reach US$183.3 Million by 2032, growing at a CAGR of 4.1% during the forecast period from 2025 to 2032, driven by the increasing use of lightweight aluminum and magnesium die-cast components to meet fuel-efficiency standards, the rapid expansion of electric vehicle (EV) production, from 13.8 million units in 2023 to a projected 39 million by 2030, and ongoing advancements in high-pressure die-casting technologies that require more advanced, high-performance lubricant formulations.

| Key Insights | Details |

|---|---|

|

Automotive Die Casting Lubricants Market Size (2025E) |

US$138.4 Mn |

|

Market Value Forecast (2032F) |

US$183.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.6% |

Global automotive industry's strategic shift toward lightweight materials to achieve stringent Corporate Average Fuel Economy (CAFE) standards and carbon emission reduction targets drives exponential demand for aluminum and magnesium die-cast components requiring specialized lubricants, ensuring casting quality and dimensional accuracy. The aluminum die-cast automotive components market is expanding at a high CAGR through 2032, creating proportional demand for advanced lubricants optimized for aluminum's thermal properties and high-volume production requirements.

Automakers achieving 10-15% vehicle weight reduction through aluminum substitution for steel components directly translates to 6-8% fuel economy improvements, with regulatory mandates including the EU's 95g CO2/km by 2030 and U.S. CAFE standards requiring 49 mpg by 2026, compelling manufacturers to adopt lightweight die-cast components across powertrains, chassis, and body structures. The die-casting lubricant segment is growing at a CAGR as it plays an essential role in improving casting quality, reducing defects in high-volume production, and enabling complex component geometries that are impossible through traditional manufacturing.

EV manufacturing expansion is creating incremental demand for die-cast structural components, battery housings, and motor enclosures requiring lubricants with enhanced thermal management properties, minimal contamination potential, and compatibility with sensitive electronic assemblies. Global EV sales reached 13.8 million units in 2023, with projected annual sales of 39 million by 2030, representing a 193% growth trajectory, creating substantial die-casting lubricant opportunities as EV manufacturers prioritize lightweight construction, maximizing battery range, and improving vehicle efficiency.

Tesla's pioneering Giga Press technology, producing mega-castings for the Model Y rear underbody and front subframe, eliminates 70+ individual parts while reducing weight by 10% and assembly complexity by 30%, requiring specialized high-lubricity die-casting lubricants that withstand extreme pressures of 6,000+ tons and temperatures of 700°C+. Major automakers, including General Motors, Ford, Volkswagen, and Toyota, are investing in next-generation die-casting processes with 8,000-9,000 ton presses that require cutting-edge lubricant formulations ensuring smooth mold releases, extended die lifetimes exceeding 100,000 shots, and zero-defect casting quality supporting premium EV aesthetics.

Advanced die-casting applications demanding extreme thermal stability, superior lubricity under pressures exceeding 5,000 tons, and compatibility with multiple alloy compositions create formulation complexity and elevated costs, constraining adoption among smaller die-casting operations with limited budgets. Specialized lubricant development for mega-casting applications requiring operation at 700°C+ temperatures, minimal smoke generation, and extended die life exceeding 100,000 shots necessitates proprietary additive packages, extensive testing protocols, and premium raw materials, elevating product costs 30-50% versus standard formulations.

Water-based lubricants, which require careful formulation balancing of wetting properties, evaporation rates, and lubricity, face technical challenges, including poor surface wetting on hot dies, potential nozzle clogging, and inconsistent film formation that requires multiple spray passes, elevating production cycle times. Performance variability across different casting alloys (aluminum, magnesium, zinc) necessitates customized formulations and application parameters, increasing inventory complexity and preventing economies of scale for die-casters serving diverse automotive component portfolios.

Die-casting lubricant supply chains dependent on specialty chemical additives, emulsifiers, and base oils face disruption risks from commodity price volatility, geopolitical tensions affecting petrochemical supplies, and limited supplier alternatives, creating cost uncertainty and procurement challenges. Specialty additives, including extreme-pressure agents, antioxidants, and thermal stabilizers sourced from concentrated chemical suppliers, create supply vulnerabilities with potential disruptions that could affect production continuity and lubricant pricing.

Base oil prices exhibit 20-35% annual volatility, which is correlated with crude oil markets and directly affects lubricant manufacturing costs, while manufacturers' limited ability to pass increases to price-sensitive automotive OEMs operating under multi-year supply contracts with fixed pricing. The COVID-19 pandemic is highlighting supply chain fragility with extended lead times, shipping delays, and raw material shortages, creating production interruptions and forcing die-casters to maintain higher inventory levels, elevating working capital requirements.

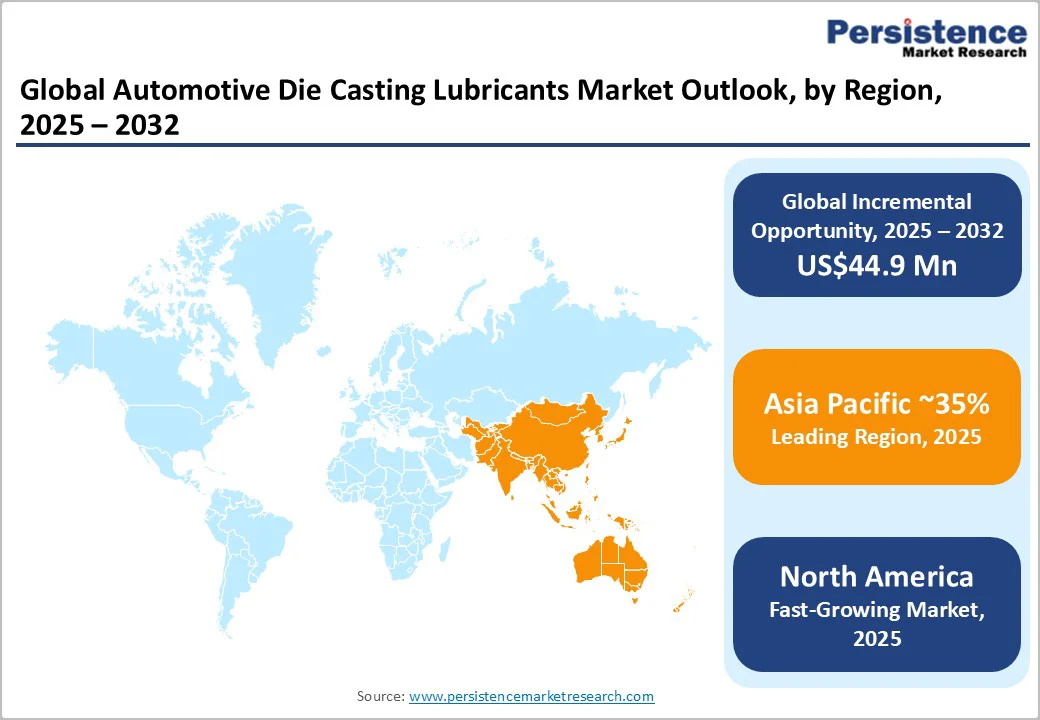

Rapidly expanding automotive production in the Asia Pacific, particularly in China, India, and ASEAN nations, combined with government incentives supporting domestic manufacturing, creates substantial market opportunities for localized lubricant supply to support regional die-casting capacity expansion. The Asia Pacific automotive die-casting lubricant market is growing at the highest CAGR, driven by vehicle production expansion in China (26+ million annual units), India (4.5+ million units with 10%+ yearly growth), and Southeast Asia's emerging automotive hubs, including Thailand, Indonesia, and Vietnam.

China's manufacturing dominance and government initiatives supporting EV supply chain localization create opportunities for lubricant suppliers to establish regional manufacturing, technical support, and just-in-time delivery capabilities serving domestic OEMs and tier suppliers. India's automotive component manufacturing sector, valued at US$50+ Billion and aiming to reach US$200 Billion by 2030 under the government's "Make in India" initiative, creates demand for locally produced lubricants that meet international quality standards while offering cost advantages over imported alternatives.

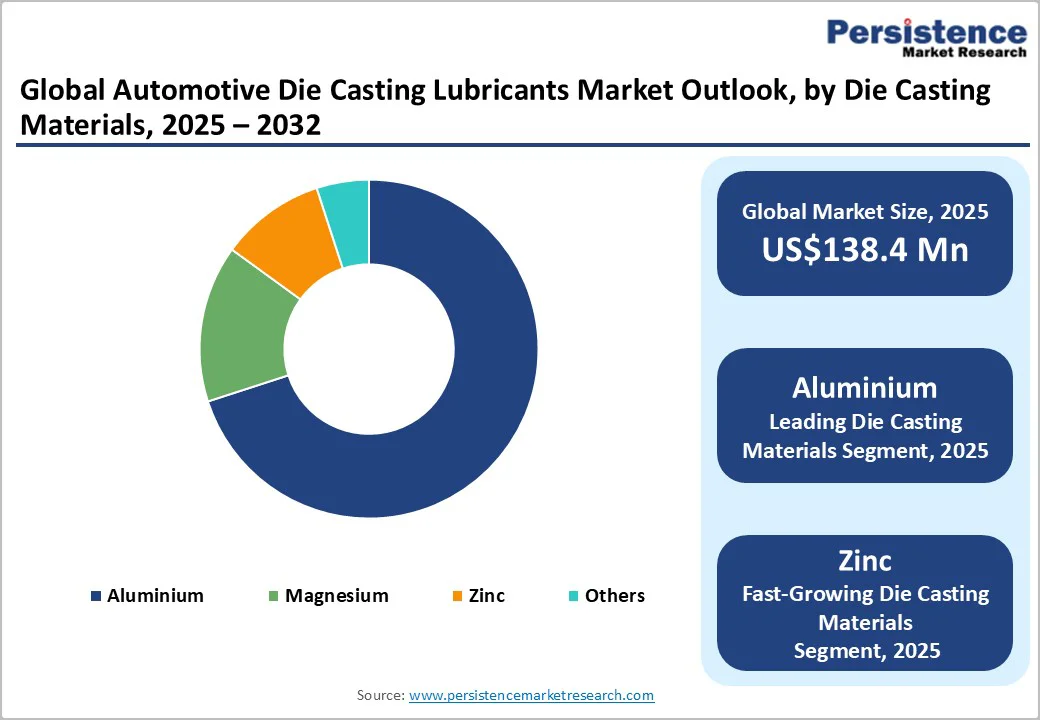

Emerging die-casting applications, including magnesium structural components, zinc precision housings, and hybrid metal-composite castings, require specialized lubricant formulations, creating defensible market positions for suppliers developing application-specific expertise and technical support capabilities. The magnesium die-casting market is expanding 8-10% annually through lightweighting initiatives (35% lighter than aluminum), requiring specialized lubricants to prevent oxidation, manage rapid solidification, and address magnesium's reactive nature, creating technical barriers that protect specialist suppliers.

Zinc die-casting applications for precision components, decorative automotive trim, and electronic housings that traditionally use solvent-based lubricants are transitioning toward water-based alternatives, creating opportunities for suppliers developing high-performance aqueous formulations that match solvent-based release characteristics. Market opportunity for specialty die-casting lubricants is estimated at US$15-25 Million by 2032 as material diversification continues.

Die-casting lubricants dominate with around 85% market share due to their essential role in ensuring part release, die protection, and surface quality across high-volume automotive casting operations. Water-based die lubricants lead aluminum casting applications with excellent dilution ratios, superior cooling, and eco-friendly performance compatible with automated spray systems. Advanced formulations with polysiloxanes and synthetic polymers enhance performance across diverse alloys and temperatures.

Plunger lubricants represent the fastest-growing segment, driven by the adoption of high-pressure and mega-casting technologies by major automakers. These lubricants minimize wear, prevent metal leakage, and improve casting quality under extreme pressures and temperatures, with water-based variants gaining traction for their safety, cleanliness, and superior casting precision in modern die-casting systems.

Water-based lubricants dominate with 76.4% market share, due to strong environmental compliance, superior safety, and cost efficiency from high dilution ratios (1:80–1:150). These formulations reduce raw material use, ensure cleaner work environments, and meet EPA and OSHA standards while delivering consistent performance in aluminum die-casting, the industry benchmark for decades. Their compatibility with automated systems and proven effectiveness reinforce widespread adoption.

Solvent-based lubricants represent the fastest-growing segment, driven by zinc and specialty die-casting applications requiring superior wetting, rapid evaporation, and high lubricity under extreme pressures. They remain preferred for precision components, decorative trims, and magnesium castings, offering excellent surface finishes, oxidation prevention, and thermal stability, while water-based alternatives face performance limits.

Aluminum die-casting dominates with 72.6% market share, driven by its superior strength-to-weight ratio, cost efficiency, and extensive use in lightweight automotive components from engine blocks to chassis structures. Aluminum adoption is propelled by fuel-efficiency and emissions mandates that target 10% vehicle weight reduction and 6% fuel-economy gains. Annual production exceeding 5 million metric tons, 70% for automotive, creates sustained lubricant demand, with water-based formulations serving as industry standards for performance and environmental compliance.

Zinc die-casting is the fastest-growing segment, supported by rising demand for precision components, decorative trims, and EV electronic housings. Zinc’s superior fluidity, corrosion resistance, and dimensional stability enable complex designs and expanding lubricant applications.

North America is driven by advanced manufacturing technology adoption, including mega-casting processes, strong OEM presence demanding premium lubricants, and environmental regulations favoring water-based formulations. The U.S. dominates the regional market with a 75-80% share through automotive manufacturing leadership, including Detroit Big Three (GM, Ford, Stellantis), Tesla's innovative Giga Press technology deployment, and an extensive die-casting supplier network supporting domestic production.

The U.S. automotive die-casting lubricant market benefits from OEM investments exceeding US$100 billion in EV production capacity through 2030, with Ford's US$50 billion electrification commitment and GM's US$35 billion investment creating sustained demand for advanced lubricants supporting next-generation casting processes. Regulatory environment through EPA workplace air quality standards, OSHA exposure limits, and state-level environmental regulations, including California's stringent VOC restrictions, drives water-based lubricant adoption, achieving 80-85% market penetration versus 60-70% global average.

Europe represents approximately US$28-32 million market in 2025, characterized by stringent environmental regulations, premium automotive manufacturing emphasis, and technological leadership in sustainable lubricant formulations. Germany leads European adoption with a 35-40% regional share through automotive industry dominance (Volkswagen, BMW, Daimler, and Audi), an extensive die-casting supplier base, and engineering excellence in process optimization that requires high-performance lubricants.

The European Union's Green Deal mandating carbon neutrality by 2050, REACH chemical regulations, and RoHS directives create a comprehensive regulatory framework compelling transition to low-VOC, biodegradable lubricant solutions meeting stringent environmental standards. The U.K.'s automotive die-casting lubricant market is growing at a high CAGR amid continued automotive manufacturing, despite Brexit challenges, with Jaguar Land Rover and Nissan U.K. operations maintaining substantial die-casting capacity that requires specialized lubricants.

Asia Pacific is projected to be the fastest-growing region through 2032, supported by its strong automotive manufacturing base, rapid expansion in EV production, and the rise of competitive regional suppliers. China dominates the regional market with a 50-55% share through automotive production leadership (26+ million annual units), extensive die-casting infrastructure, and government support for EV supply chain localization, creating opportunities for domestic lubricant suppliers, including Saish Metaflow and regional multinationals.

India is emerging as a high-growth market through expansion of automotive component manufacturing under the "Make in India" initiative, rising vehicle production by domestic OEMs (Tata Motors, Mahindra), and growth in component exports serving global automotive supply chains. Japan maintains a significant market presence through technological leadership (Toyota, Honda, and Nissan), advanced die-casting processes, including semi-solid casting, and premium lubricant demand supporting precision manufacturing and quality requirements.

The global automotive die casting lubricants market exhibits moderate fragmentation with leading players maintaining significant positions through comprehensive product portfolios, established distribution networks, and technological capabilities. Key players are employing strategic mergers and acquisitions to increase their revenue and geographical footprint. Further, players are following an expansion strategy as a key tactic to increase sales in the automotive die casting lubricants market. By investing in the production of innovative products, key players unlock future growth opportunities for the automotive die casting lubricant industry.

The automotive die casting lubricants market is estimated to be valued at US$138.4 Million in 2025.

The key demand driver for the automotive die casting lubricants market is the rising production of lightweight vehicles, and the growing adoption of aluminum and magnesium die casting to meet fuel efficiency and emission reduction targets.

In 2025, the Asia Pacific region will dominate the market with an exceeding 35% revenue share in the automotive die casting lubricants market.

Among the product types, water-based holds the highest preference, capturing beyond 76.4% of the market revenue share in 2025.

The key players in automotive die casting lubricants are Henkel AG & Co. KGaA, Chem-Trend LP, Quaker Houghton Inc., and Moresco Corp.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Lubricant Type

By Die Casting Materials

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author