ID: PMRREP33534| 175 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

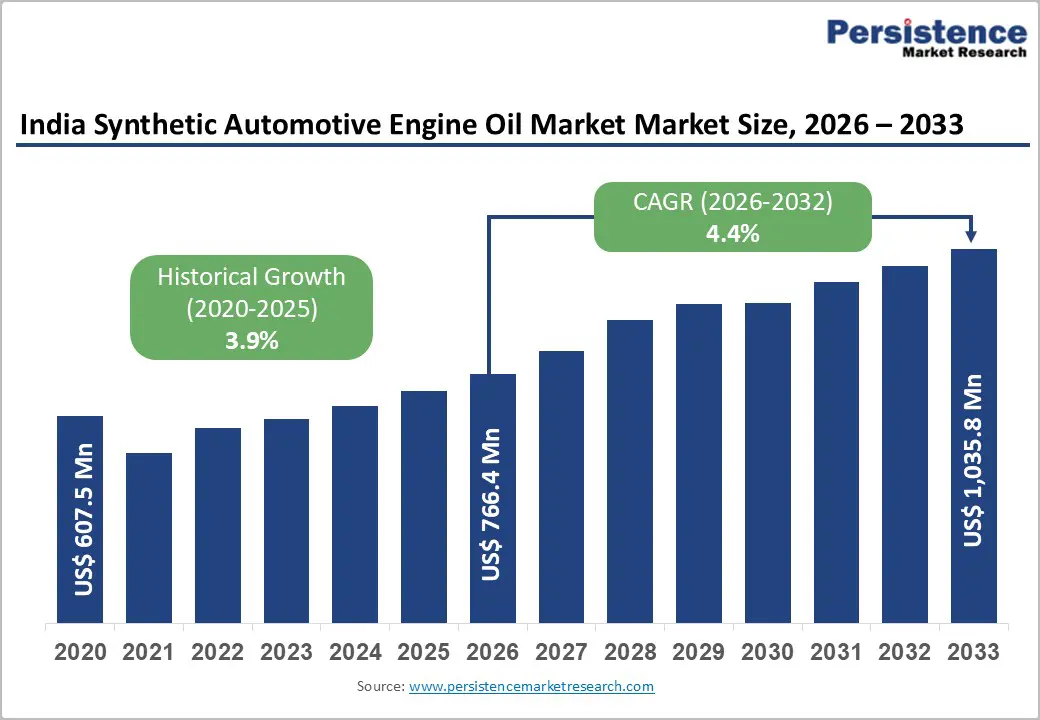

India synthetic automotive engine oil market size is likely to be valued at US$ 766.4 million in 2026 and is projected to reach US$ 1,035.8 million by 2033, growing at a CAGR of 4.4% between 2026 and 2033.

Key factors driving the India synthetic automotive engine oil market include the rapid growth in vehicle ownership and expansion of the vehicle parc, rising demand for high-performance lubricants in modern Bharat Stage VI (BS VI)-compliant engines, increasing consumer preference for extended engine life and fuel efficiency, and the stringent emission norms requiring specialized synthetic formulations.

| Key Insights | Details |

|---|---|

|

India Synthetic Automotive Engine Oil Market Size (2026E) |

US 766.4 Mn |

|

Market Value Forecast (2033F) |

US$ 1,035.8 Mn |

|

Projected Growth CAGR(2026-2033) |

4.4% |

|

Historical Market Growth (2020-2025) |

3.9% |

India’s automotive landscape is witnessing a significant expansion, driven by rising incomes, greater urbanization, and stronger economic activity. Total vehicle production reached 31.0 crore units in FY 2024–25, up from 28.4 crore units in the previous fiscal year, underscoring sustained manufacturing momentum. Passenger vehicles recorded all-time high sales of 43.02 lakh units, supported largely by surging demand for utility vehicles, which now contribute 65% of segment sales. With commercial vehicles also registering steady demand at 9.57 lakh units, the overall vehicle parc is growing rapidly across metropolitan as well as Tier-II and Tier-III regions.

This expanding on-road fleet directly boosts consumption of synthetic engine oils, as modern engines increasingly require lubricants that offer enhanced wear protection, superior viscosity performance, and prolonged drain intervals. Rising consumer awareness regarding preventive maintenance, coupled with OEM recommendations for synthetic-grade oils in turbocharged, high-compression, and technologically advanced engines, is strengthening the shift from conventional mineral oils to premium synthetic formulations.

The nationwide rollout of Bharat Stage VI (BS VI) emission norms in April 2020 has driven a fundamental shift in India’s lubrication ecosystem. By mandating an 88% reduction in NOx and 50% reduction in particulate matter compared to BS IV, the regulation has compelled OEMs to integrate sophisticated emission-control technologies such as Selective Catalytic Reduction (SCR), Diesel Particulate Filters (DPF), Gasoline Particulate Filters (GPF), and advanced Exhaust Gas Recirculation (EGR) systems. These systems are highly sensitive to oil quality, ash content, and sulfur levels, thereby increasing reliance on synthetic and semi-synthetic oils engineered specifically for low-SAPS (Sulfur, Ash, Phosphorus) compatibility.

Synthetic engine oils provide enhanced thermal stability, oxidation resistance, low volatility, and improved lubricity, performance attributes essential for protecting BS VI engines operating under higher pressures and elevated temperatures. Moreover, the simultaneous transition to 10 ppm ultra-low sulfur diesel (ULSD) has necessitated lubricants with tighter chemical formulations to prevent corrosion and ensure proper functioning of aftertreatment devices. As compliance becomes non-negotiable across all vehicle categories, from two-wheelers to heavy-duty trucks—the market is experiencing accelerated adoption of premium synthetic lubricants tailored to BS VI performance requirements.

The adoption of synthetic automotive engine oils in India faces persistent challenges due to high price sensitivity and entrenched competition from mineral-based alternatives. Although synthetic oils offer superior thermal stability, engine protection, and longer drain intervals, their considerably higher price points often discourage buyers in cost-conscious segments. This challenge is amplified by the dominance of the unorganized sector, which accounts for 40% to 45% of the Indian automotive engine oil market, supplying low-cost, substandard, and sometimes counterfeit products that appeal to rural and budget-focused consumers. As a result, many buyers prioritize immediate affordability over the long-term performance benefits of premium lubricants.

The situation is especially evident in the two-wheeler segment, where mineral oils accounted for 70.1% of total volumes in 2024, reflecting deeply ingrained user preference for low-cost formulations. The intense competition from established mineral oil brands and emerging regional players, many of whom possess strong distributor relationships and aggressive pricing, continues to limit the pricing flexibility and market expansion prospects for synthetic oil manufacturers.

The rapid expansion of modern passenger vehicles and utility vehicles (UVs) in India is creating a strong and sustained opportunity for synthetic automotive engine oil manufacturers. With BS-VI emission norms now fully integrated into new vehicle production, automakers are increasingly using advanced, high-compression, turbocharged petrol engines that require superior lubrication, thermal stability, and low-viscosity oils such as 0W-20, 5W-30, and 0W-16. Synthetic oils align perfectly with these engineering requirements, offering optimized fuel economy, faster cold starts, extended drain intervals, and better protection for after-treatment systems such as DPFs and catalytic converters. Passenger vehicle sales have touched record levels, and UVs alone contribute more than 60% of this volume, many of which come with OEM recommendations, or even mandates, for full-synthetic or semi-synthetic lubricants within warranty programs.

This structural shift in vehicle mix is accelerating synthetic oil penetration far beyond premium segments, as mid-range SUVs and turbo-petrol hatchbacks increasingly rely on advanced lubricants for performance and durability. As consumers prioritize smoother driving experience and better engine longevity, the aftermarket sees growing acceptance of synthetics, supported by dealership networks and organized service centers that actively promote OEM-approved products. Together, these factors position the modern PV and UV segment as one of the strongest long-term drivers of synthetic oil demand in India.

The premium two-wheeler and performance motorcycle segment is emerging as a high-value and fast-growing opportunity for the Indian synthetic automotive engine oil market. South and West India, in particular, are witnessing strong adoption of 150cc+, 200cc, and 300cc+ motorcycles, along with increasing demand for superbikes, adventure bikes, and high-performance street bikes. These vehicles operate at higher RPMs, generate greater heat, and require superior lubrication to prevent engine wear and maintain consistent power delivery, conditions under which mineral oils fall short.

Synthetic oils, especially PAO-based and ester-based formulations, offer exceptional thermal stability, oxidation resistance, film strength, and protection during aggressive riding and long-distance touring. With younger consumers prioritizing performance, fuel efficiency, and engine longevity, synthetic oils are becoming the preferred choice during both OEM servicing and aftermarket oil changes. The growth of organized service centers, premium bike dealerships, and branded workshops in metropolitan areas is further accelerating synthetic oil adoption by promoting manufacturer-recommended lubricants. Additionally, the rise of biking communities, adventure touring culture, and premium commuting has increased awareness about the advantages of synthetic oils, making this segment a profitable opportunity with high conversion rates from mineral and semi-synthetic products.

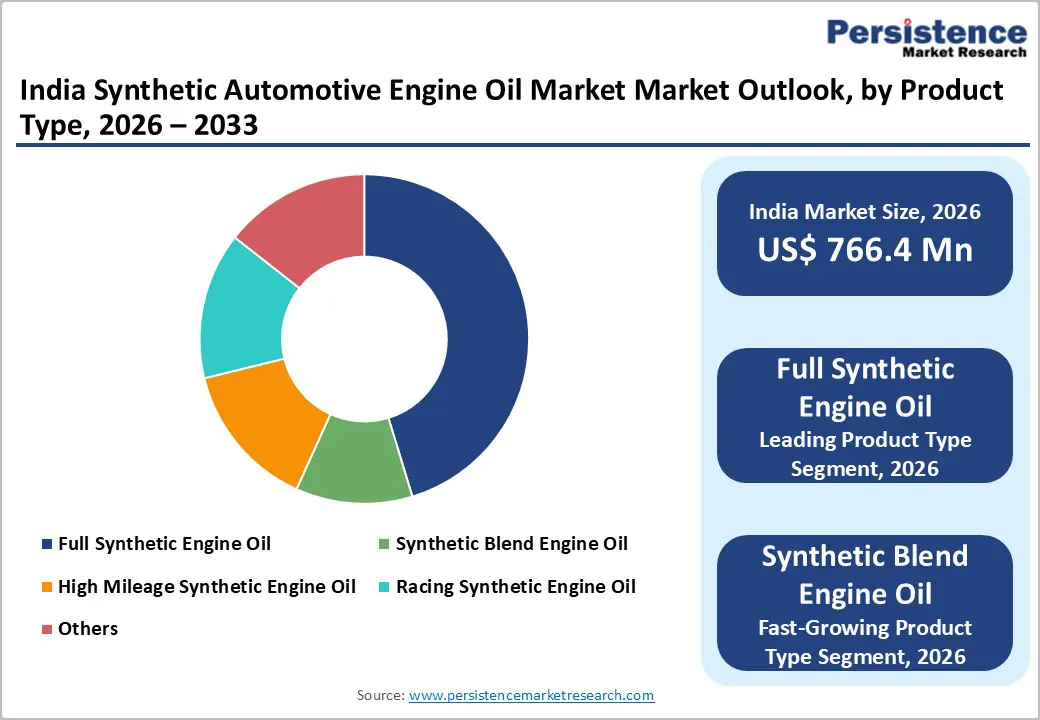

Full Synthetic Engine Oil emerges as the dominant segment within the Synthetic Automotive Engine Oil market, commanding an estimated 40% market share based on volume and value metrics. Full synthetic formulations, manufactured through chemical synthesis rather than petroleum refining, deliver superior performance characteristics including exceptional thermal stability across extreme temperature ranges, superior oxidation resistance enabling extended drain intervals, and enhanced wear protection for critical engine components.

Modern consumer preferences increasingly favor full synthetic oils due to their demonstrable benefits including improved fuel economy of 5-10%, extended maintenance intervals reducing operational costs, and enhanced engine cleanliness through advanced detergent packages. The segment's dominance is reinforced by stringent BS VI compliance requirements that favor fully synthetic formulations with reduced SAPS (Sulfated Ash, Phosphorus, and Sulfur) content.

Group IV Polyalphaolefin (PAO) base oils command approximately 55% market share within the synthetic engine oil segment, emerging as the most widely utilized synthetic base oil technology in India. PAO-based formulations deliver exceptional viscosity-temperature characteristics, maintaining stable viscosity across diverse operating temperatures from -30°C to +120°C, critical for Indian climatic conditions ranging from northern winters to southern summers.

PAO oils offer hydrolytic stability, preventing degradation in presence of moisture, combined with superior solvency and oxidation resistance properties. Their relative affordability compared to alternative synthetic base oils, coupled with proven performance in luxury vehicles and high-performance applications, has established PAO as the industry standard.

5W-30 viscosity grade represents the dominant segment with approximately 45% market share, establishing itself as the optimal viscosity specification for Indian automotive conditions. The "5W" rating indicates excellent cold-flow properties at temperatures as low as -30°C, while the "30" specification ensures adequate viscosity stability at high operating temperatures, positioning 5W-30 as suitable for diverse climatic zones from Himalayan regions to coastal areas.

This grade has achieved widespread adoption across passenger vehicles, light commercial vehicles, and mid-range motorcycles due to its balanced performance characteristics and OEM recommendations for modern turbocharged and naturally aspirated engines. 0W-20 and 0W-40 viscosity grades are increasingly gaining market traction for newer fuel-efficient vehicles, particularly among premium brands emphasizing enhanced fuel economy.

Passenger cars constitute the largest vehicle type segment for synthetic engine oils, representing approximately 55% of market demand. India's passenger vehicle segment achieved record sales of 43.02 lakh units in FY 2024-25, with utility vehicles now comprising 65% of total sales, driving substantial demand for advanced synthetic formulations required by modern turbocharged SUV engines. Premium vehicle segments including Mercedes-Benz, BMW, and luxury SUVs mandate synthetic oils meeting stringent MB 229, BMW LL-01, and equivalent specifications, establishing baseline performance expectations across the passenger vehicle category.

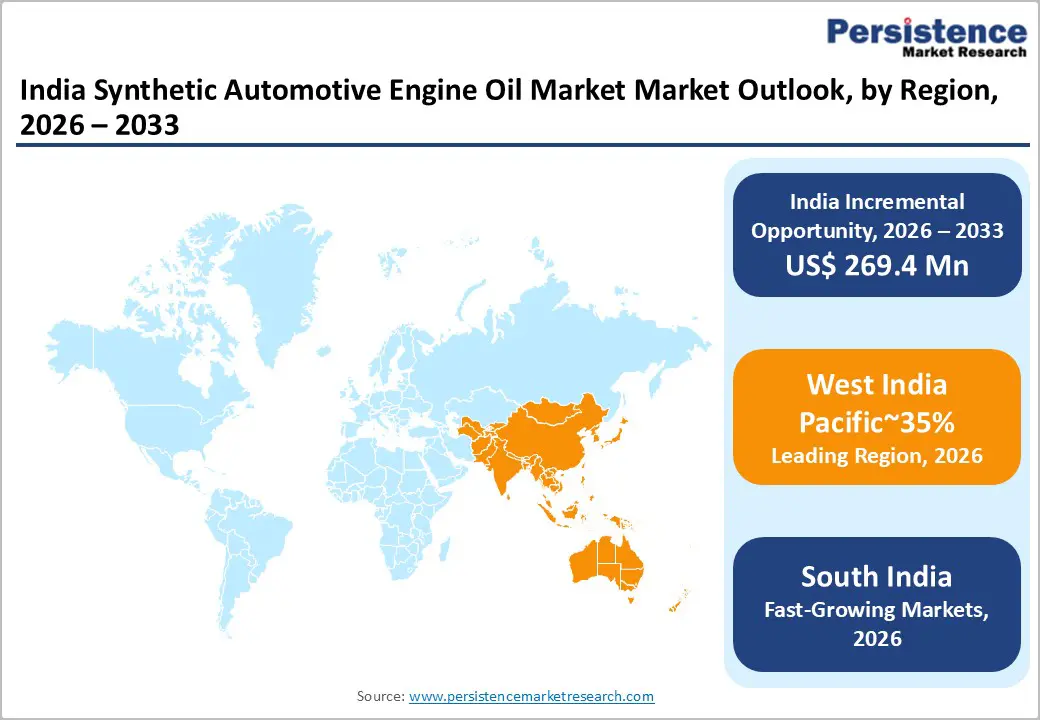

North India, comprising major states including Delhi, Punjab, Haryana, Uttar Pradesh, and Rajasthan, represents a significant market hub driven by substantial industrial and commercial activities concentrated in the Delhi-NCR corridor and Punjab. The region contributes significantly to national automotive consumption through high urban density, diverse consumer preferences, and established logistics infrastructure. North India witnessed accelerated demand for 5W-30 viscosity grades during winter months due to harsh climatic conditions, driving premiumization trends and synthetic oil adoption among quality-conscious consumers.

The region's hybrid market composition, characterized by brand-conscious premium buyers in metropolitan areas and cost-sensitive consumers in secondary cities, creates competitive dynamics favoring diversified product portfolios addressing multiple market segments. Recent regulatory initiatives and improved highway infrastructure have stimulated commercial vehicle demand, driving logistics sector expansion and corresponding synthetic engine oil consumption.

West India, encompassing Maharashtra, Gujarat, and Goa, emerged as the dominant region with approximately 38.5% market share in 2026, anchored by established automotive manufacturing clusters and well-developed industrial infrastructure. Higher household incomes and faster adoption of modern passenger cars and utility vehicles in these markets have accelerated the shift toward low-viscosity, BS-VI-compliant synthetic oils, giving the region a higher penetration rate than the national average.

The booming logistics and e-commerce ecosystem around western ports and distribution corridors is further boosting demand, as fleet operators increasingly prefer long-drain synthetic formulations to reduce downtime and improve total cost of ownership. Organized workshops and OEM service centres in major cities actively promote premium lubricants, strengthening the synthetic product mix. However, price sensitivity in peri-urban and rural pockets, along with a large network of independent garages that continue to rely on mineral oils, still slows full-scale transition across vehicle categories.

South India represents one of the strongest growth regions for the synthetic automotive engine oil market, driven by its high concentration of technology-driven urban centers, strong automotive manufacturing ecosystems, and rapidly expanding premium vehicle ownership. States such as Tamil Nadu, Karnataka, and Telangana host major OEM plants, R&D hubs, and dense dealership networks, enabling faster penetration of BS-VI–compliant, low-viscosity synthetic lubricants.

Cities like Chennai, Bengaluru, and Hyderabad have a large base of modern passenger cars, utility vehicles, and performance two-wheelers, all of which increasingly require synthetic or semi-synthetic oils for optimal engine protection and fuel efficiency. The region’s thriving IT workforce, higher disposable incomes, and preference for premium mobility solutions, including SUVs, high-end two-wheelers, and EV-compatible lubricants, further accelerate the shift toward advanced lubricants.

India synthetic automotive engine oil market demonstrates moderate consolidation with the top five companies collectively controlling approximately 55 - 60% market share. Public Sector Undertakings (PSUs) including Indian Oil Corporation Limited, Bharat Petroleum Corporation Limited, and Hindustan Petroleum Corporation Limited together maintain dominant positions through extensive distribution networks, government backing, and established brand recognition.

International players including BP plc (Castrol), Royal Dutch Shell, Exxon Mobil Corporation, Chevron Corporation, and Fuchs Petrolub SE compete aggressively through premium product portfolios and advanced research initiatives. Market leaders pursue expansion strategies through manufacturing facility investments, OEM partnerships, and acquisition activities strengthening competitive positioning.

India Synthetic Automotive Engine Oil market was valued at US$ 766.4 Mn in 2026 and is projected to reach US$ 1,035.8 Mn by 2033, growing at a CAGR of 6.6% during the forecast period.

The primary growth drivers include BS VI emission standards compliance mandating advanced formulations, rising consumer awareness regarding fuel efficiency benefits, and increasing premium vehicle adoption particularly in utility vehicle segments.

Full Synthetic Engine Oil dominates the market with approximately 40% market share, driven by superior performance characteristics, excellent thermal stability, reduced SAPS content complying with BS VI specifications.

Eest India leads the market with approximately 35.5% market share, anchored by established manufacturing clusters in Maharashtra and Gujarat and well-developed distribution networks supporting automotive aftermarket and OEM segments.

Rising Premium Two-Wheeler and Performance Bike Segment, Rapid Growth of Modern Passenger Vehicles and UVs, and Growing Shift Toward Organized Service Centers presents significant growth opportunities.

Indian Oil Corporation Limited, Bharat Petroleum Corporation Limited, and Hindustan Petroleum Corporation Limited etc., represent the leading market competitors, collectively commanding approximately 55 - 60% India market share.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Base Oil Type

By Viscosity Grade

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author