ID: PMRREP35379| 145 Pages | 30 May 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

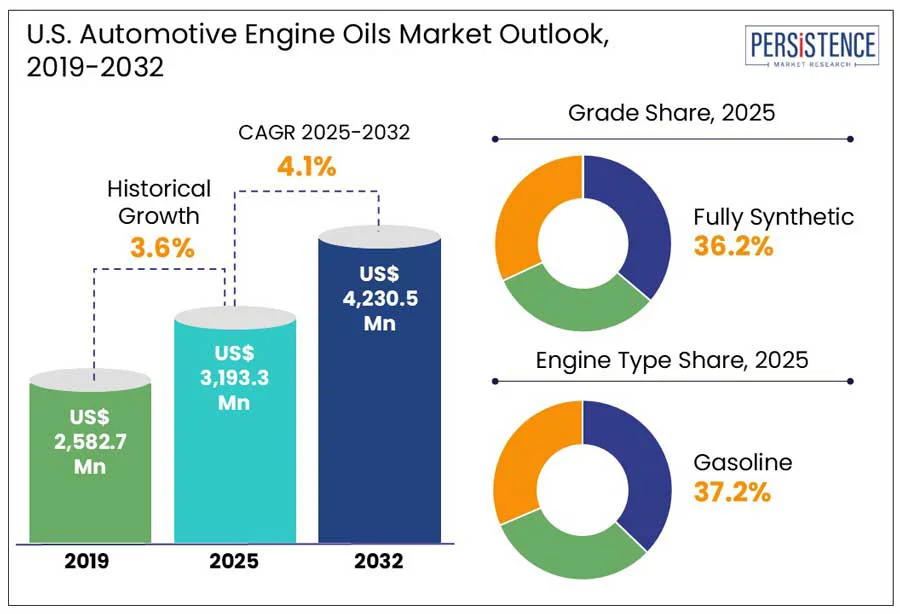

The U.S. automotive engine oils market size is predicted to reach US$ 4,230.5 Mn in 2032 from US$ 3,193.3 Mn in 2025. It will likely witness a CAGR of around 4.1% in the forecast period between 2025 and 2032. As U.S. drivers shift toward turbocharged engines, hybrids, and even electric powertrains, the role of engine oil is undergoing a significant transformation. At present, the market is no longer just about the Society of Automotive Engineers (SAE) grades. It is shaped by the increasing requirement for the prevention of low-speed pre-ignition in direct injection engines. Oil brands are striving to remain stable in stop-start hybrid systems, while increasing EV adoption is gradually chipping away demand.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

U.S. Automotive Engine Oils Market Size (2025E) |

US$ 3,193.3 Mn |

|

Market Value Forecast (2032F) |

US$ 4,230.5 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.6% |

Engine performance and fuel efficiency demands are likely to spur the U.S. automotive engine oils market growth through 2032, finds Persistence Market Research. Modern engines are developed with tight tolerances and operate at high temperatures to meet Corporate Average Fuel Economy (CAFE) standards. These are making them more reliant on oils that reduces internal friction. This trend has bolstered demand for oils such as SAE 0W-16 and 0W-20, which were once niche but are now recommended for various new models.

Rising consumer interest in low-maintenance vehicles and long-drain intervals is further influencing oil preferences. High-performance synthetic oils or automotive engine lubrication systems are gaining momentum as they last upto 15,000 miles between two changes. It is evident in the high-efficiency vehicles and fleets that demand a reduced downtime. This is associated with the surging use of telematics in commercial operations, which evaluates the oil condition and engine loads to maximize efficiency and enhance oil change intervals.

Increasing adoption of Electric Vehicles (EVs) is expected to gradually decline demand for conventional engine oils, mainly in states with stringent Zero-Emission Vehicle (ZEV) mandates. As fully electric powertrains eliminate the internal combustion engine, these do not require motor oil. Leading automakers are implementing electrification strategies, which further highlight this trend.

Stellantis’ Dare Forward 2030 plan, Ford’s Model e division, and General Motors’ Ultium platform, for example, revolve around scaling EV production while lowering internal combustion engine development for passenger cars. As modern customers choose EV models, the cumulative reduction in engine oil use becomes more pronounced. In the aftermarket field, the Take 5 Oil Change, U.S.-based is diversifying their portfolios to include EV brake inspections and coolant top-offs to remain competitive.

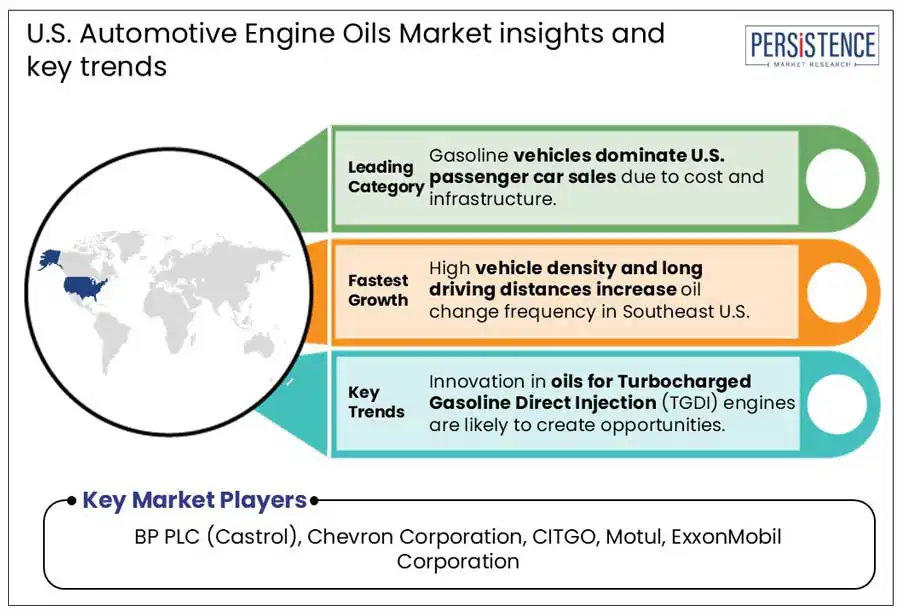

Innovations in engine technology, specifically in the areas of hybridization, direct injection, and turbocharging, are likely to create new avenues for engine oil brands in the U.S. Increasing use of Turbocharged Gasoline Direct Injection (TGDI) engines, for example, has raised the risk of Low-Speed Pre-Ignition (LSPI). In response, oil brands are developing LSPI-resistant formulations such as those conforming to the API SP and ILSAC GF-6 standards. Castrol GTX Magnatec and Mobil 1’s Extended Performance High Mileage are now marketed primarily for TGDI engine protection, enabling brands to create niche performance claims in terms of new engine vulnerabilities.

Hybrid vehicle technologies are further creating new product development opportunities. These engines frequently start and stop, which leads to high moisture accumulation and low oil temperatures, thereby boosting oil degradation. To address this, Liqui Moly and Amsoil have launched hybrid-specific small engine lubricants. Amsoil's Synthetic Hybrid Motor Oil, for instance, provides enhanced thermal stability and corrosion inhibitors at low operating temperatures.

In terms of grade, the market is trifurcated into fully synthetic, mineral, and semi-synthetic. Among these, fully synthetic automotive engine oil is predicted to account for a leading share in 2025 due to its superior performance in extreme temperature conditions. This type of oil is finding increasing use in downsized turbocharged engines as they operate under high pressure. In addition, fully synthetic oils provide superior oxidation resistance and thermal stability, which help prevent sludge formation and breakdown even under demanding conditions.

Semi-synthetic oil, on the other hand, will likely witness a considerable CAGR from 2025 to 2032, owing to its ability to bridge the performance gap between traditional and fully synthetic oils at an accessible price point. It is especially valuable for high-mileage old vehicles and mid-range models. These models do not require the full capabilities of synthetic oil but still benefit from improved protection and viscosity stability.

Based on engine type, the market is segregated into gasoline, diesel, and alternative fuel. Out of these, gasoline is poised to account for a large share in 2025 amid the rising use of gasoline-powered passenger vehicles in the U.S. As per the U.S. Department of Energy, these comprise around 91% of all light-duty vehicles on U.S. roads as of 2024. This well-established base ensures that engine oil formulations, distribution strategies, and marketing remain geared primarily toward the requirements of gasoline engines.

Diesel, on the other hand, is envisioned to showcase a steady growth rate through 2032 due to its important role in commercial, industrial, and agricultural vehicle segments. Despite declining usage in light-duty passenger vehicles, diesel is; leading in sectors, including farming, construction, and long-haul trucking, where engines operate under high loads. This has resulted in a constant demand for high-performance diesel engine oils, specifically those meeting the American Petroleum Institute (API) CK-4 and FA-4 standards.

The West is mainly influenced by regulatory pressure and high environmental consciousness. It is especially evident in states such as California, where tight emissions laws have resulted in the rapid adoption of low-viscosity and synthetic oils. The state’s push for clean combustion engines and innovative regulatory standards, such as those enforced by the California Air Resources Board (CARB), have made it a key hub for premium synthetic blends. Hence, 5W-30 and SAE 0W-16 synthetic oils are more commonly used in new vehicles across the West than in other parts of the U.S.

Retail dynamics in the West also differ, with robust penetration of e-commerce in auto fluids and parts. Platforms such as NAPA Auto Parts and Amazon have strengthened their online channels, mainly in Seattle, San Francisco, and Los Angeles. Consumers in these metro cities often prefer doorstep delivery over visiting physical auto stores. This trend has greatly benefited digitally native brands, including Amsoil, that provides home-delivery subscriptions.

In 2025, Southeast U.S. is expected to account for a leading share of the U.S. automotive engine oils market share due to increasing vehicle ownership and humid climates, putting unique stress on engines and influencing oil preferences. In the Carolinas, Georgia, and Florida, multi-grade oils such as 10W-30 remain popular. This is attributed to their superior performance in extended stop-and-go traffic conditions and high operating temperatures.

The Southeast has also been witnessing a surge in the number of pickup trucks and aging vehicles, specifically in suburban and rural areas. This is anticipated to propel demand for high-mileage and conventional engine oils. Valvoline Daily Protection and Castrol GTX, for example, have been maintaining a strong market presence. This is owing to their availability in retail chains, including Advance Auto Parts and O’Reilly Auto Parts, which have well-established store networks across the Southeast.

The Midwest is heavily influenced by seasonal extremes, mainly harsh winters, that push demand for low-temperature viscosity performance. This has further accelerated the use of full synthetic oils, which offer superior cold-start protection. Brands, including Pennzoil Platinum and Mobil 1 have become highly popular in cold areas such as Wisconsin, Michigan, and Minnesota. This is because of their high compatibility with modern engines and strong performance in sub-zero temperatures.

A key trend in Midwest U.S. is the surge in used car ownership and extended maintenance schedules. It is partially augmented by vehicle supply chain disruptions and economic constraints which started in 2021. This has raised dependence on high-mileage oil products, with Castrol GTX High Mileage and Valvoline MaxLife among the bestsellers at quick-lube outlets. Outlets such as Take 5 Oil Change have also extended their presence in Missouri and Illinois to cater to this ever-increasing demand.

The U.S. automotive engine oils market consists of niche domestic players and global giants focusing on high-mileage and synthetic formulations. Key players are dominating with strong distribution networks and long-standing OEM partnerships that span dealerships, including retail chains such as Walmart and AutoZone as well as quick-lube service centers. Renowned companies are striving to reformulate and innovate due to strict fuel economy norms in the U.S. Various private label brands are focusing on attracting cost-conscious consumers by leveraging acceptable performance benchmarks and competitive pricing.

The U.S. automotive engine oils market is projected to reach US$ 3,193.3 Mn in 2025.

Increasing demand for low-maintenance vehicles and innovations in engine technology are the key market drivers.

The market is poised to witness a CAGR of 4.1% from 2025 to 2032.

Rapid expansion of quick-lube service centers and emergence of doorstep delivery services are the key market opportunities.

BP PLC (Castrol), Chevron Corporation, and CITGO are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Vehicle Type

By Grade

By Engine Type

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author