ID: PMRREP22567| 189 Pages | 13 Jun 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

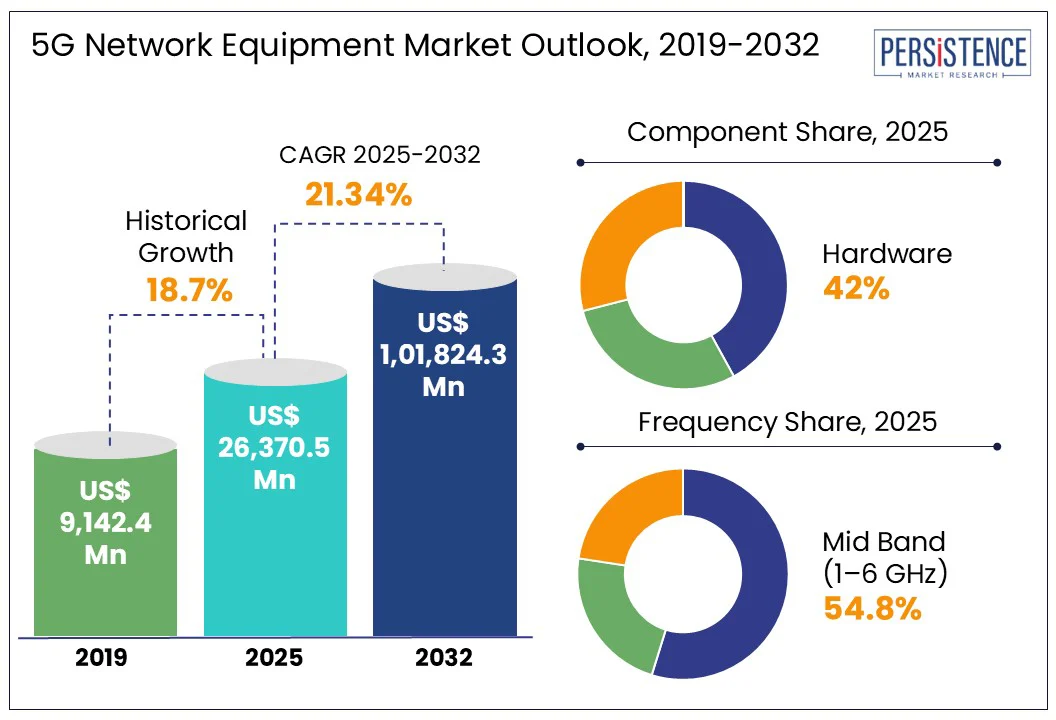

The global 5G network equipment market size is projected to rise from US$ 26,370.5 Mn in 2025 to US$ 101,824.3 Mn by 2032. It is anticipated to witness a CAGR of 21.3% during the forecast period from 2025 to 2032.

Industries and consumers increasingly demand faster, more reliable wireless communication, and the need for robust 5G infrastructure has become critical. The transition from 4G to 5G represents a significant leap, not just in speed, but also in network efficiency, latency reduction, and device connectivity. Cloud-native 5G cores and edge computing are gaining traction, enabling more flexible and scalable deployments. This shift is not only reducing costs but also increasing the agility of network operators in addressing emerging service demands.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

5G Network Equipment Size (2025E) |

US$ 26,370.5 Mn |

|

Market Value Forecast (2032F) |

US$ 101,824.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

21.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

18.7% |

The global surge in mobile data consumption is reshaping the telecommunications landscape, significantly amplifying the demand for 5G network equipment. As of February 2025, approximately 5.6 billion individuals worldwide are internet users, representing 67%-68% of the global population. This vast user base, combined with the growing popularity of data-intensive applications, has led to unprecedented levels of mobile data traffic. On average, each smartphone consumes 19 gigabytes of data per month, driven by high-definition video streaming, online gaming, and other bandwidth-heavy services.

According to the November 2024 Ericsson Mobility Report, global mobile data traffic excluding fixed wireless access (FWA) is projected to grow 2.5 times its current levels, reaching approximately 303 exabytes per month by 2030. Additionally, 5G’s share of total mobile data traffic is expected to increase from 25% in 2023 to 34% by the end of 2024, underscoring its rapid expansion as telecom operators scale their networks to meet growing user demands.

Deploying strong 5G networks is challenging due to limited available spectrum, especially in the mid-band range, which balances coverage and capacity. Much of this spectrum is already assigned to services like military communications and satellites. Reallocating or sharing it involves complex coordination and lengthy policy reforms, often causing delays.

For instance, in the United States, the Federal Communications Commission (FCC) has actively facilitated the auction of high-band spectrum, making nearly 5Ghz available for 5G applications. However, mid-band spectrum continues to be in high demand due to its advantageous propagation properties. The FCC’s efforts to release additional mid-band frequencies, including the 3.7-4.2 GHz range, require intricate negotiations to address the needs of existing users while accommodating the expansion of 5G services.

High-band frequencies provide ultra-fast data rates but have limited range, requiring dense infrastructure. Low-band frequencies offer wider coverage but at lower speeds. Balancing these trade-offs demands strategic planning and significant investment to ensure optimal 5G network performance across different environments.

Open RAN introduces a modular and interoperable approach to network architecture, allowing operators to mix and match components from various vendors. This flexibility not only promotes innovation but also drives down costs, creating fertile ground for new opportunities within the 5G ecosystem. For instance, in December 2024, Ericsson secured a multi-year, multi-billion-dollar extension deal with Bharti Airtel for 4G and 5G RAN products and solutions. Under this agreement, Ericsson will deploy centralized RAN and open RAN-ready solutions to enhance network coverage and capacity.

Major equipment vendors are expanding their portfolios to support open RAN. For instance, Ericsson is planning to offer 130 radio products supporting open and programmable networks by 2025. This strategic move underscores the company’s commitment to providing flexible, scalable, and future-proof network solutions, in line with the industry’s shift toward open RAN architecture.

The integration of 5G and edge computing is rapidly transforming digital infrastructure across industries, enabling applications such as autonomous cars, smart cities, and industrial automation. These use cases demand ultra-low latency, real-time data processing, and localized intelligence, which are effectively supported by this convergence. In India, major telecom operators like Airtel and Jio are actively deploying edge computing to enhance their 5G networks, with Airtel establishing over 120 edge data centers and partnering with IBM, while Jio integrates edge computing into its cloud-native 5G network across more than 50 facilities to enable industry-specific applications.

In the United States, a coalition including General Dynamics Information Technology, Amazon Web Services, Cisco, Dell Technologies, Splunk, and T-Mobile is accelerating 5G and edge computing adoption in government operations. This collaboration focuses on developing 5G-powered tools for public sector applications such as military logistics, healthcare, education, and smart infrastructure. These developments reflect a significant market shift where edge computing integration not only improves existing capabilities but also drives innovative services across multiple sectors.

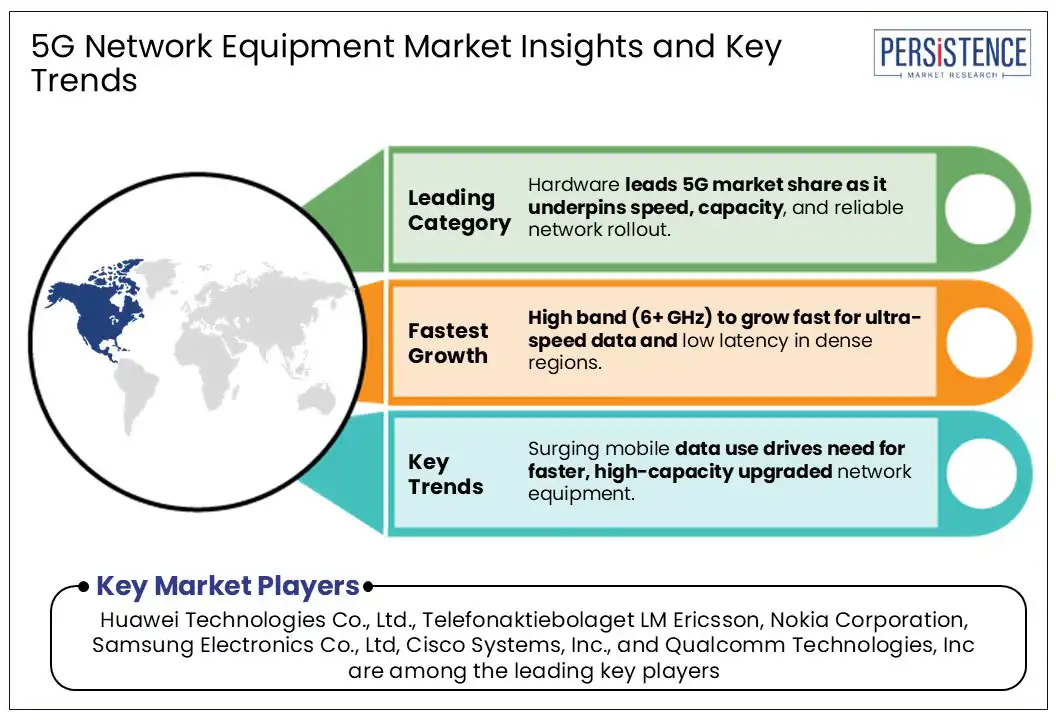

Based on component, the market is segmented into hardware, software, and services. Among these, hardware is projected to account for over 42% of the market share in 2025, driven by rising demand for high-capacity base stations, small cells, and massive MIMO antennas. They are essential for enabling ultra-low latency and high-speed connectivity, especially in urban and industrial areas. Increasing investments in smart cities, IoT, and autonomous technologies are accelerating hardware deployments.

The software segment is expected to grow significantly due to the increasing adoption of cloud-native and virtualized network functions. As operators shift from hardware-centric to software-defined networks, demand for network slicing, orchestration, and real-time analytics rises.

Based on frequency, the mid-band (1–6 GHz) frequency segment holds the largest market share due to its balanced performance in terms of coverage and capacity. It offers faster data speeds than low-band and better range than high-band, making it ideal for widespread deployment in urban and suburban areas. It supports dense user environments efficiently, which is crucial for mobile broadband and IoT applications.

The high band frequency segment is expected to grow at a significant rate due to its ability to deliver ultra-fast data speeds and low latency, making it ideal for applications such as augmented reality, autonomous vehicles, and advanced industrial automation. Growing investments in mmWave infrastructure and spectrum auctions by governments are accelerating adoption.

Asia Pacific is the fastest-growing market for 5G network equipment market. China has surpassed 4.4 million 5G base stations with 5G user penetration reaching 75.9% as of March 2025. The Government’s 14th Five-Year Plan prioritizes 5G infrastructure development, encouraging domestic equipment manufacturers such as Huawei and ZTE to innovate and expand.

India’s Digital India and Make in India programs aim to attract investment in 5G manufacturing and promote the adoption of indigenous telecom equipment. These strategic initiatives are creating a favorable ecosystem for network equipment providers. Countries such as South Korea and Japan are at the forefront of deploying 5G in smart factories and logistics, driving demand for specialized 5G network components, including mmWave radios, massive MIMO antennas, and edge computing devices.

North America is projected to account for approximately 32% of the market share by 2025. Security concerns have significantly influenced the U.S. 5G network equipment market. In February 2025, the FCC approved a $3.1 billion spectrum auction to help telecom companies remove Huawei and ZTE equipment from their networks, reinforcing efforts to protect national telecommunications infrastructure.

AT&T signed a multi-year expansion deal with Nokia to enhance its voice core network, incorporating Voice over New Radio (VoNR) into a fully cloud-native IMS Voice Core architecture. This upgrade will enable faster service deployment, improved automation, and cost efficiencies, supporting AT&T’s goal of delivering secure, customer-focused networks.

According to a study in Canada, the implementation of 5G is expected to contribute to a reduction of 48 to 54 million tonnes of carbon dioxide emissions by 2025, equivalent to removing 10.5 million vehicles from the road for a year. This potential for significant emission reductions is encouraging further investment in 5G infrastructure and equipment.

The EU's 5G Action Plan aims to make 5G widely accessible, enhancing Europe’s global competitiveness with expected revenues of US$256 billion by 2025. It promotes coordinated deployment, early rollout, spectrum allocation, and innovation through public-private partnerships. This initiative positions Europe as a leader in 5G research and global standardization.

As per the study, the rollout of 5G standalone (SA) networks, which operate independently of 4G infrastructure and are crucial for industrial applications, remained limited. By the end of 2024, only 40% of Europe's population had access to 5G SA, compared to 91% in North America and 45% in Asia-Pacific. This disparity underscores the need for substantial investment in 5G network equipment to meet the growing demand for high-speed, low-latency connectivity.

The 5G network equipment market is moderately consolidated. Companies continuously invest billions to push the boundaries of radio access network (RAN) technology, edge computing, and network slicing. This sustained innovation not only keeps their equipment competitive but also builds intellectual property portfolios that serve as market barriers against competitors. They are increasingly shifting towards service-oriented business models. Models such as network-as-a-service (NaaS), subscription services, and managed services are gaining popularity.

The global market is projected to be valued at US$ 26,370.5 Mn in 2025.

Increasing demand for high-speed connectivity, growing adoption of IoT devices, and the need for enhanced network capacity and low latency are key market drivers.

The market is poised to witness a CAGR of 21.3% from 2025 to 2032.

The integration of 5G with edge computing for real-time data processing opens new avenues for network equipment providers.

Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Samsung Electronics Co., Ltd, and Qualcomm Technologies, Inc. are among the leading key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Component

By Frequency

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author