ID: PMRREP33617| 190 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

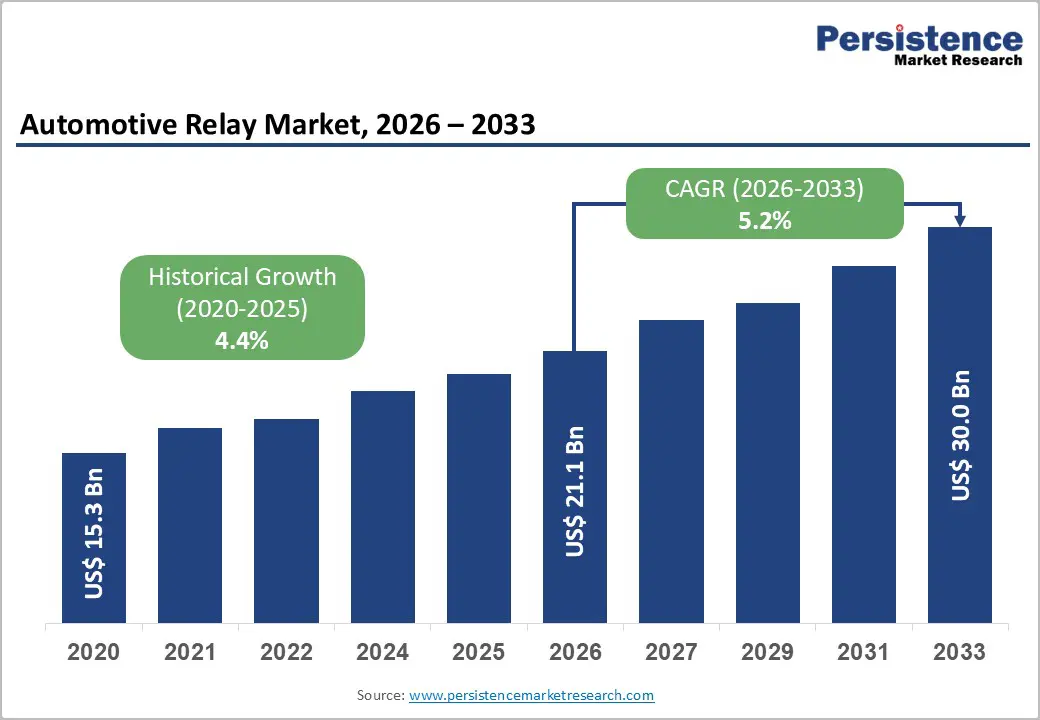

The global automotive relay market size is valued at US$ 21.1 billion in 2026 and is projected to reach US$ 30.0 billion by 2033, growing at a CAGR of 5.2% between 2026 and 2033.

The growth is driven by rapid electric vehicle adoption, which requires high-voltage switching solutions; increasing electronic system complexity and safety features; and architectural evolution toward 48V, 400V, and 800V platforms.

| Key Insights | Details |

|---|---|

| Automotive Relay Market Size (2026E) | US$ 21.1Bn |

| Market Value Forecast (2033F) | US$ 30.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.2% |

| Historical Market Growth (CAGR 2020 to 2024) | 4.4% |

Modern vehicles now incorporate 30-50+ electronic control units (ECUs) managing functions spanning powertrain, safety, infotainment, climate control, and autonomous driving features. Each ECU requires dedicated relay support for switching, isolation, and fault protection. Advanced Driver Assistance Systems (ADAS), in-vehicle connectivity, comfort systems, and luxury features all demand incremental relay quantities per vehicle. Industry analyses indicate that average relay count per vehicle is rising 3-5% annually, with luxury and EV platforms requiring 60-80 relays compared to 35-40 relays in conventional passenger vehicles. Regulatory emphasis on functional safety (ISO 26262, ISO 13849) mandates redundant switching, fail-safe isolation, and arc suppression capabilities, directly favoring advanced relay architectures over mechanical alternatives. This technology-driven complexity supports premium pricing for advanced PCB and high-voltage relays, enabling margin expansion despite competitive pressures.

Global regulatory frameworks including EU's Fit for 55, Euro 7, and EPA Standards, drive manufacturer investments in efficient power distribution, thermal management, and advanced electrical architectures to meet emission and fuel efficiency targets. These regulations incentivize transition from conventional 12V electrical systems toward 48V mild-hybrid and full hybrid/electric platforms, each requiring fundamentally different relay specifications and topologies. PCB relay miniaturization and advanced designs enable 20% weight reduction in electrical harnesses and control systems, directly contributing to fuel economy improvements required by regulatory compliance. Manufacturers across Europe, North America, and Asia Pacific are expanding EV and hybrid production capacity to meet regulatory fleet average emissions targets, creating a multi-billion-dollar market opportunity for relay suppliers supporting compliance-driven vehicle development.

An ongoing obstacle that significantly hampers the progress of the automotive relay market is the integration and miniaturization of components. As the complexity of automotive systems and the limited space available within vehicles continue to escalate, there is an expanding demand for components that are more compact and seamlessly integrated. Nevertheless, the task of miniaturizing relays while maintaining their seamless efficacy can be quite formidable. Relays may experience a reduction in their reliability and lifespan due to power-handling capabilities that are constrained by their size and weight.

Automobile relay manufacturers encounter the complex task of reconciling compact design with optimal functionality, all the while endeavoring to satisfy the sector's need for lighter and more compact components without compromising the dependable performance necessary for the wide array of automotive relay applications. The aforementioned limitation presents a significant challenge in the pursuit of striking a balance between space restrictions and the preservation of efficiency in automotive relay systems.

A significant obstacle that the automotive relay market must overcome is the smooth incorporation of relays into the ever-changing architectures of automobiles. The integration of autonomous driving technologies, ADAS, and EVs has caused a fundamental transformation in the design and operation of vehicles. The task at hand is to modify automotive relays so that they can function efficiently in these dynamic and complex architectures.

The successful integration of relays with various electronic components, communication systems, and sensor arrays necessitates careful engineering to guarantee compatibility, dependability, and maximum efficiency. In the light of the continuous evolution of automotive architectures, manufacturers encounter the persistent obstacle of creating relay solutions that are both flexible and adaptable. Such solutions must be capable of keeping up with the dynamic landscape of contemporary vehicle designs and technologies, which presents a substantial challenge within the automotive relay market.

The emerging dedicated EV charging infrastructure (home, workplace, public DC fast-charging networks) creates a parallel US$ 8-15 billion market opportunity for specialized relays designed for Mode 3/4 AC and DC charging circuits. Omron's new G9KC relay for Mode 3 AC charging exemplifies this innovation, offering the lowest contact resistance on the market and significantly reduced terminal heat rise compared to equivalent devices. As the global EV fleet expands toward 1 billion vehicles by 2040 and charging networks scale from ~2.5 million chargers (2024) toward 15+ million chargers (2033), relay demand for charging infrastructure is estimated at US$ 4 billion annually and growing at 15% CAGR. Suppliers offering integrated charging relay solutions, thermal management features, and long-cycle durability can capture disproportionate share within this high-growth niche adjacent to core automotive markets.

The 48V mild-hybrid architecture is rapidly penetrating global automotive markets as a cost-effective alternative to full hybrid/electric solutions, with penetration projected at 60% by 2033 across developed and emerging markets. 48V systems require specialized relays for energy management, regenerative braking, and auxiliary power circuits, creating incremental demand for moderate-voltage (48V) switching components. Additionally, rising thermal management complexity in EVs (battery cooling, cabin climate control, thermal pre-conditioning) drives demand for automotive relay-based thermal switching and energy management systems. This opportunity is estimated at US$ 2.4 billion annually, growing at 8% CAGR, with manufacturers offering integrated thermal management relay suites capturing premium positioning.

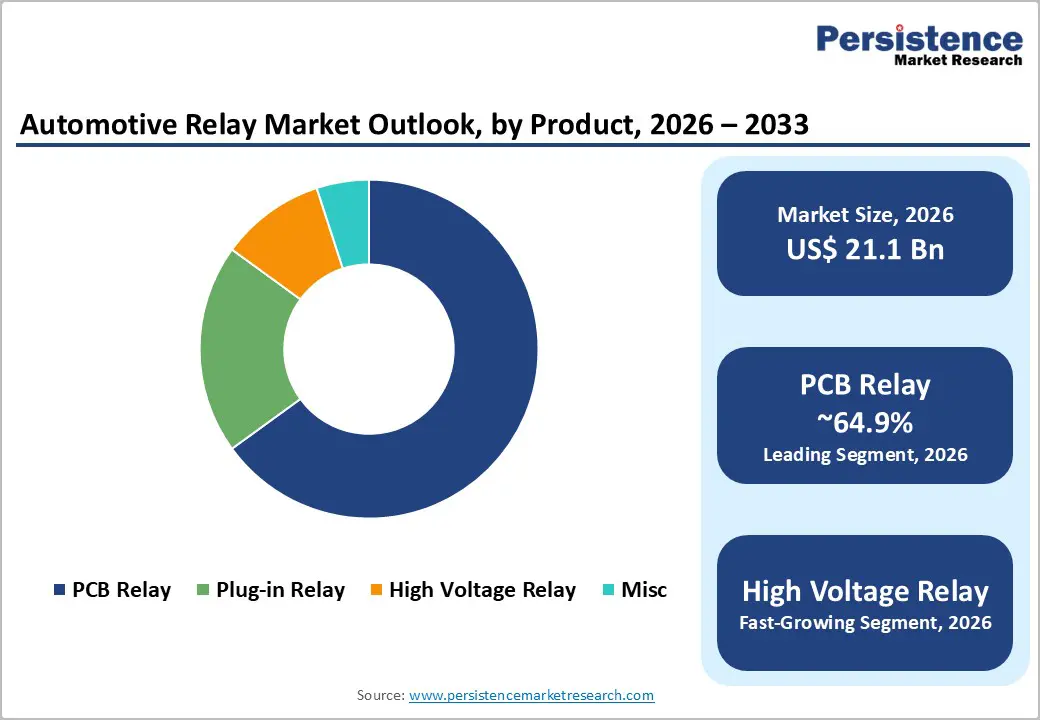

The product type segment is segmented into the PCB relay, plug-in relay, high voltage relay, and miscellaneous. Within the automotive relay market, the plug-in relay segment occupies the most significant position in terms of product category. The expansion of plug-in relays is driven by their multifunctionality, uncomplicated setup process, and extensive integration into diverse automotive systems. Their substantial market dominance can be attributed to their considerable compatibility with a wide range of vehicle architectures and their ability to adapt to various voltage requirements.

On the contrary, the high-voltage relay sector experiences the most rapid expansion due to the expanding prevalence of electric vehicles, and the corresponding need for relays that can manage elevated voltage levels. The imperative function of high voltage relays in electric vehicle (EV) power distribution and battery management systems is driving their market expansion as the automotive industry transitions to electrification.

The voltage segment is sub-segmented into 12V, 24V, and above 24V. The greatest segment of the automotive relay market is 12V. The reason for this hegemony is the widespread installation of 12V electrical systems in many automobiles. As most conventional internal combustion engine vehicles are powered by a 12V electrical system, 12V relays are widely employed in a variety of applications, including illumination and powertrain components.

As electric and hybrid vehicles with higher voltage electrical systems become more prevalent, the above-24V market segment expands at the quickest rate. The adoption of electric and hybrid technologies in vehicles increases the need for relays that can manage higher voltages. This demand drives the expansion of the automotive relay market's above-24V segment.

The vehicle type segment is categorized into passenger cars, LCVs, and HCVs. The passenger car segment dominates the market for automotive relays. The proliferation of passenger cars and the growing incorporation of electronic components in contemporary automobiles are factors that contribute to the widespread application of relays in this sector. As passenger cars further integrate sophisticated safety, comfort, and entertainment functionalities, the expansion of the passenger car segment is propelled by the need for dependable relay systems in specific applications.

On the other hand, the LCV sector is experiencing the most rapid expansion, primarily driven by the growth of the logistics and transportation industry. As LCVs incorporate more sophisticated electronic systems for safety and efficiency, the demand for relays in this segment increases, propelling the automotive relay market to expand.

The North American Automotive Relay market maintains substantial global market share at approximately 30% of worldwide demand, valued at roughly $3.8 billion annually. Market leadership reflects a mature industrial base including world-class oil & gas infrastructure, diversified power generation sector, and advanced manufacturing. The United States represents the region's primary market driver, leveraging established refinery capacity (representing 13-15% of global refining), LNG export terminals (contributing 15-20% of global LNG exports), and an extensive petrochemical production base.

Aging infrastructure replacement creating systematic retrofit opportunities across refineries, power plants, and industrial facilities with 20-30-year-old insulation systems; Stringent DOE and EPA energy efficiency standards driving insulation upgrades for compliance with appliance efficiency mandates and building envelope requirements.

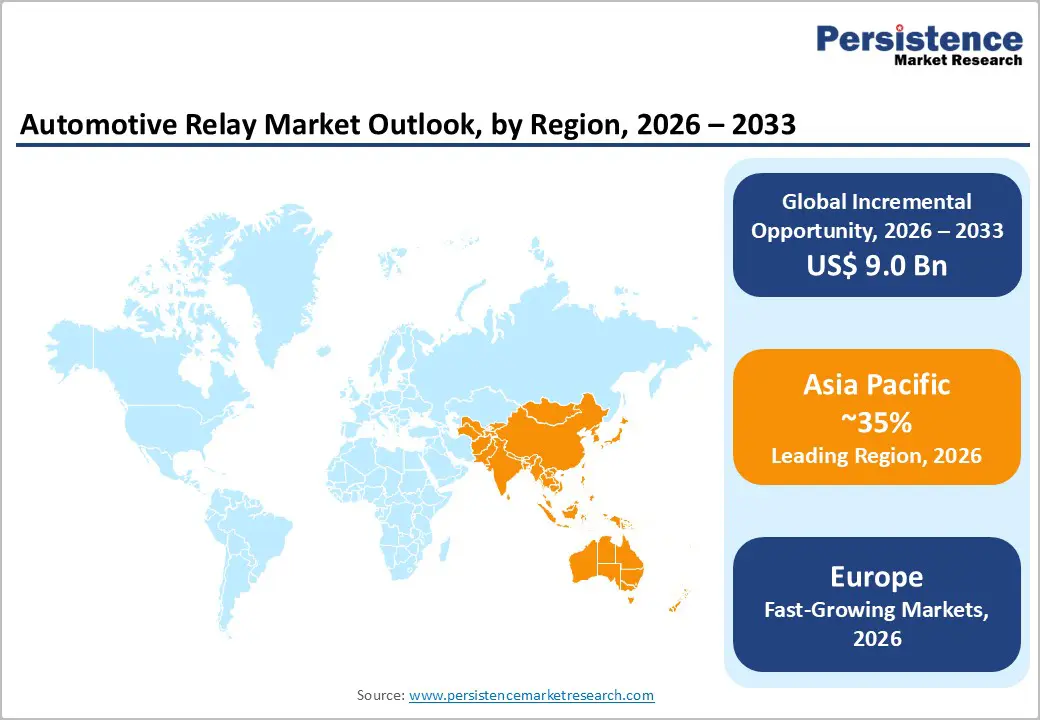

Europe represents approximately 22% of the global automotive relay market value, though regional market dynamics emphasize sustainability and regulatory compliance over volume growth. Market size approximates $2.1 billion annually, with Germany, the UK, France, and Spain accounting for approximately 65% of total regional demand. The European market demonstrates structural maturity with limited new industrial facility construction, but substantial retrofit and modernization activity driven by aggressive environmental and energy efficiency mandates.

European regulatory framework represents the world's most stringent and comprehensive insulation standards. EN 17956 establishes binding technical specifications for industrial equipment insulation, superseding national standards with a unified technical floor. EU's Ecodesign Directive and Energy Performance of Buildings Directive create cascading compliance requirements affecting manufacturing, refining, and utility sectors. Fire safety regulations (particularly EN 13823) mandate non-combustible or limited flame-spread materials for industrial applications, supporting mineral wool and specialty ceramic adoption.

Asia Pacific has emerged as a dominant regional market, commanding 35% of the global automotive relay market share as of 2026, valued at approximately US$2.9 billion annually. The region's market dominance reflects a rapid industrialization trajectory, massive infrastructure investment, and manufacturing expansion, creating substantial insulation demand. China and India represent approximately 70-75% of the regional market value, with emerging ASEAN economies (Vietnam, Thailand, Indonesia) contributing to accelerating growth.

Regulatory frameworks remain less stringent than those in developed markets but are progressively tightening. India's ECBC requirements (effective 2017, updated 2020) establish minimum thermal performance standards for commercial buildings, creating compliance-driven insulation demand among institutional and corporate real estate developers. China implements energy efficiency standards through mandatory equipment labeling and factory energy consumption regulations, though enforcement mechanisms vary by region.

The global automotive relay market is marked by fierce competition among major participants who are competing for technological dominance and market share. Prominent corporations undertake strategic endeavors to fortify their market position, including collaborations, product innovations, and mergers and acquisitions. Established entities frequently sustain a competitive advantage by capitalizing on their vast distribution networks and enduring partnerships with automotive original equipment manufacturers.

Additionally, new entrants emerge to the market, particularly those who specialize in niche segments or novel relay solutions. This competition cultivates an ever-changing atmosphere in which businesses consistently strive to distinguish themselves by providing distinctive products and services that add value. With the advent of electric vehicles, autonomous driving, and connectivity, the automotive industry is undergoing significant changes.

The Automotive Relay market is estimated to be valued at US$ 21.1 Bn in 2026.

The key demand driver for the Automotive Relay market is the increasing electrification and electronic content in vehicles especially the rapid adoption of electric and hybrid vehicles which significantly boosts the need for relays to manage power distribution, battery systems, and various electrical functions within modern automotive architectures.

In 2026, the Asia Pacific region will dominate the market with an exceeding 35% revenue share in the global Automotive Relay market.

Among the Product Type, PCB Relay holds the highest preference, capturing beyond 64.9% of the market revenue share in 2026, surpassing other Product Type.

The key players in Automotive Relay are Denso Corporation, Panasonic Corporation, Omron Corporation and TE Connectivity Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Voltage

By Vehicle Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author