ID: PMRREP33548| 191 Pages | 5 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

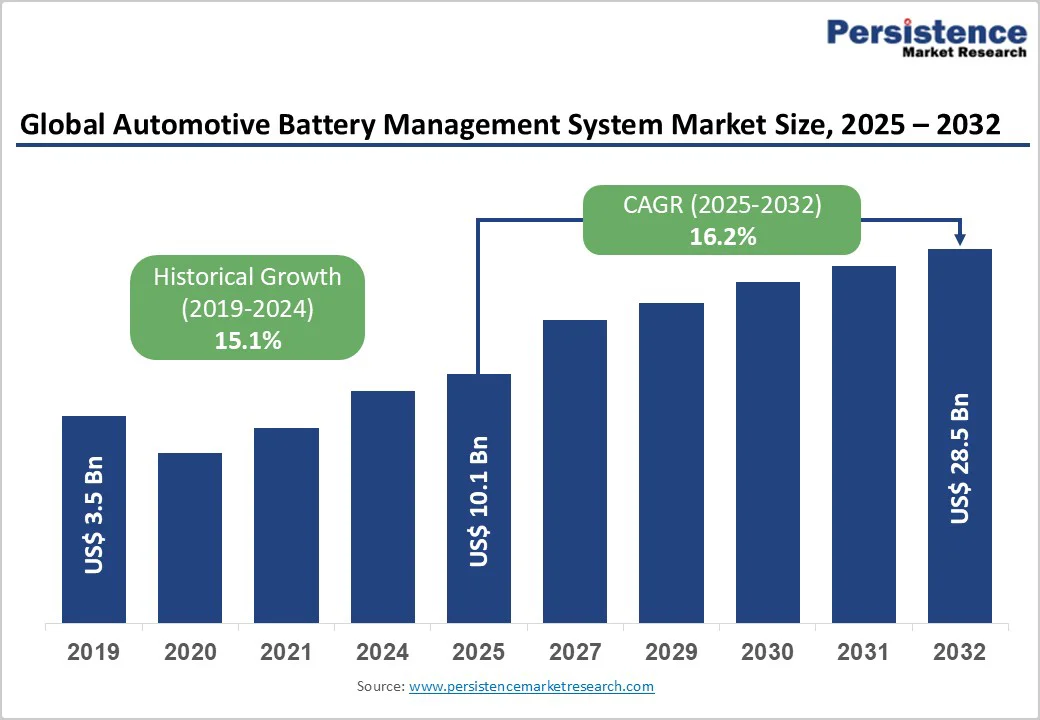

The global automotive battery management system market size was valued at US$10.1 billion in 2025 and is projected to reach US$28.5 billion by 2032, growing at a CAGR of 16.2% between 2025 and 2032.

This exceptional expansion reflects accelerating electric vehicle adoption, reaching 39 million projected annual units by 2030; critical safety requirements that prevent thermal runaway events, achieving 99.9% reliability through state-of-charge (SOC) and state-of-health (SOH) monitoring; and regulatory mandates for battery performance documentation that support circular economy objectives.

| Key Insights | Details |

|---|---|

| Automotive (BMS) Market Size (2025E) | US$10.1 Bn |

| Market Value Forecast (2032F) | US$28.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 16.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 15.1% |

Global electric vehicle sales exceeding 13.8 million units in 2023, with 55% year-over-year growth, create unprecedented BMS demand, as automotive battery management systems represent critical safety infrastructure preventing catastrophic thermal runaway events, overcharging damage, and premature capacity degradation.

Battery management systems monitoring voltage (cell-level precision ±5mV), current (±0.5% accuracy), and temperature (±0.5°C resolution) across 96-200 individual cells within EV battery packs ensure safe operation within defined parameters, with over-voltage, under-current, and over-temperature protection preventing 99.9% of potential failure modes.

Thermal management functionality controlling heating and cooling systems maintains lithium-ion batteries within an optimal 30-35°C operating range, preventing fast-charging damage below 5°C and thermal degradation above 45°C, thereby extending battery lifespan 20-30% versus unmanaged systems.

Emerging regulatory frameworks, including the EU Battery Regulation 2023/1542 mandating battery passport documentation, Chinese battery traceability requirements, and circular economy directives requiring end-of-life battery management, create structural BMS demand for immutable performance data recording.

Battery passport requirements documenting manufacturing provenance, carbon footprint, recycling content, and performance history necessitate BMS cloud connectivity to transmit lifetime operational data, supporting compliance verification, with European implementation targeting 2027 full deployment.

Vehicle-to-grid (V2G) integration, enabling EVs to supply power back to electrical grids, requires sophisticated BMS coordination managing bidirectional power flows, grid synchronization, and battery degradation control, with the V2G market projected to reach $5-8 billion by 2032, creating incremental BMS opportunity.

Fast-charging infrastructure deployment supporting 150-350 kW DC charging requires advanced BMS thermal management, preventing battery degradation, with charging protocols optimized through BMS communication, enabling 10-80% charge completion within 18-25 minutes while maintaining battery health.

Advanced BMS incorporating microcontrollers, analog front-end ICs, isolated gate drivers, high-precision sensors, and communication interfaces commands $800-1,500 per vehicle, representing 8-12% of total battery pack cost, constraining adoption in price-sensitive market segments.

Semiconductor content representing 40% of BMS hardware cost creates supply chain vulnerability, with automotive chip shortages during 2021-2023 demonstrating industry exposure to fab capacity constraints, geopolitical tensions affecting Taiwan/South Korea semiconductor production, and limited supplier diversity for specialized automotive-grade components.

Tariff impacts affecting semiconductor imports from China and South Korea increase BMS costs 12-18%, with U.S. automotive manufacturers facing profitability pressure as component costs rise without proportional vehicle pricing power in the competitive EV market.

System complexity requiring extensive software validation, functional safety certification, achieving ASIL-D ratings, and electromagnetic compatibility testing extends development timelines 24-36 months from initial specification to production deployment, creating barriers for new market entrants.

Automotive BMS software complexity exceeding 500,000-1 million lines of safety-critical code requires comprehensive validation, achieving failure rates below 10^-9 per operating hour mandated by ISO 26262 functional safety standards, with certification costs ranging $2-5 million per platform.

State estimation algorithms calculating SOC and SOH involve complex electrochemical modeling, Kalman filtering, neural networks, and adaptive algorithms requiring extensive calibration across temperature ranges (-40°C to +60°C), aging conditions (0-100% SOH), and diverse drive cycles, with estimation accuracy targets of ±3% SOC and ±5% SOH challenging current technology capabilities.

Thermal runaway prevention requiring multi-level safety architecture with independent monitoring, redundant temperature sensors, contactor control, and pyro-fuse activation creates system complexity where single-point failures must be eliminated through defensive design strategies.

Rapidly expanding EV production across India, Southeast Asia, and Latin America, transitioning from internal combustion engines directly to electric powertrains, creates substantial BMS opportunities as regional manufacturers establish domestic supply chains.

India's EV market is projected to reach 2+ million annual units by 2030, with government support, including $3.5 billion Production Linked Incentive scheme for advanced automotive technology, which creates a localized BMS manufacturing opportunity estimated at $800 million to $1.2 billion, supporting domestic battery assembly and EV production.

China's EV market dominance, producing 9+ million units in 2023, with domestic battery manufacturers CATL, BYD, and CALB commanding 70% global market share, creates regional BMS demand, with Chinese suppliers including HPEV and EVE Energy capturing growing market share through cost-competitive solutions.

Southeast Asian automotive hubs including Thailand, Indonesia, and Vietnam experiencing EV manufacturing expansion through Toyota, Honda, and Hyundai investments create incremental BMS opportunity supporting regional production serving ASEAN markets.

Automotive batteries retaining 70-80% of their original capacity after vehicle retirement create a substantial second-life market for stationary energy storage, with BMS providing critical health documentation to enable safe redeployment and ongoing performance monitoring.

The second-life battery market, projected to reach $12-18 billion by 2032, requires comprehensive BMS data history documenting operational cycles, degradation patterns, and remaining capacity to support residual value assessment and secondary market pricing.

Stationary energy storage applications, including renewable energy integration, grid stabilization, and commercial/industrial peak shaving, benefit from repurposed automotive batteries, offering a 40% cost reduction compared to new battery systems, with BMS enabling safe grid integration and performance optimization.

Circular economy regulations increasingly mandating battery recycling and reuse create regulatory drivers for comprehensive BMS lifecycle documentation, with battery passport requirements necessitating cloud-connected BMS recording complete operational history. Market opportunity for second-life battery BMS is estimated at $1.5 billion by 2032 as circular economy infrastructure matures.

Centralized BMS topology commands 36.4% share in 2025 through cost-effective implementation, concentrating all monitoring and control functions within single central unit, simplifying system architecture and reducing component count.

Single central processor collecting data from individual cell monitoring circuits through wiring harnesses reduces bill-of-materials cost 20-30% versus distributed architectures, supporting mainstream passenger vehicle applications, prioritizing cost optimization.

Simplified communication architecture utilizing CAN bus or LIN interfaces connecting central processor to cell monitoring circuits reduces software complexity and validation requirements versus distributed peer-to-peer communication protocols.

Distributed BMS represents fastest-growing topology at approximately 14% CAGR, expanding through improved scalability for large battery packs, enhanced reliability through failure mode isolation, and simplified wiring, reducing electromagnetic interference.

Decentralized intelligence distributing monitoring and control functions across multiple nodes enables each node to manage 12-24 cells independently, with nodes communicating via CAN or wireless protocols coordinating pack-level functions, supporting battery packs exceeding 100 kWh capacity requiring 200+ cell monitoring.

Enhanced reliability through failure mode isolation ensures that individual node failures affect only the local cell group rather than the complete system, improving overall system availability.

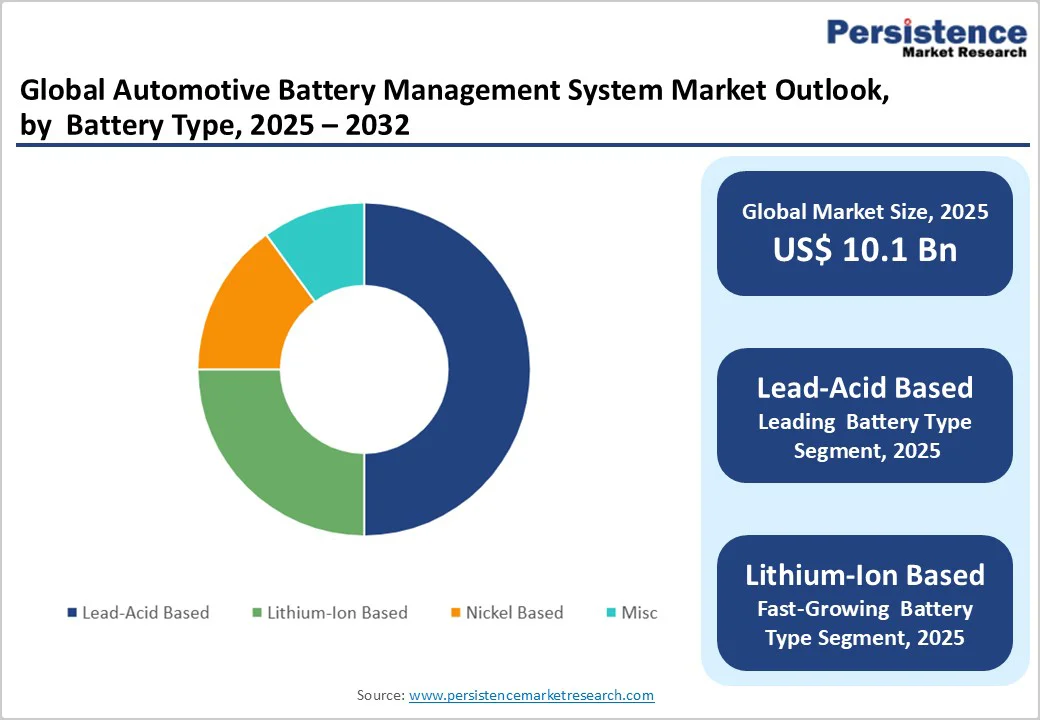

Lead-acid-based BMS commands a 49% share through an extensive installed base in conventional 12V vehicle starting systems, industrial applications, and legacy hybrid vehicle architectures. Start-stop systems deployed in 60%+ of traditional ICE vehicles use lead-acid batteries with simple BMS monitoring of voltage and temperature, supporting engine restart functionality, creating baseline demand independent of the full electrification transition.

Lithium-ion-based BMS represents the fastest-growing segment at approximately 18-22% CAGR, driven by EV adoption, energy storage applications, and replacement of legacy chemistries across automotive applications.

EV battery packs using lithium-ion chemistries (NMC, NCA, LFP) require a sophisticated BMS that manages 96-200 individual cells, with precise voltage monitoring (±5 mV), current measurement (±0.5%), and thermal control to maintain optimal operating temperature.

High-voltage architecture supporting 400-800V systems necessitates isolated measurement circuits, safety interlocks, and redundant monitoring, achieving ASIL-D functional safety ratings commanding $1,000-1,500 per vehicle BMS cost.

Passenger cars command 64.3% market share throughthe largest production volumes and universal BMS deployment across battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), and hybrid electric vehicles (HEV). BEV applications requiring 60-100 kWh battery packs with 300-500 km range utilize a comprehensive BMS managing thermal systems, fast-charging protocols, and SOC/SOH estimation supporting consumer expectations.

The LCV segment represents the fastest-growing vehicle type at approximately 12% CAGR, driven by urban delivery electrification, last-mile logistics transformation, and total cost of ownership advantages favoring commercial EV adoption. Electric delivery vans and urban commercial vehicles requiring 40-80 kWh battery packs, optimized for 150-250 km daily range, utilize a BMS that supports fleet management integration, predictive maintenance, and usage optimization.

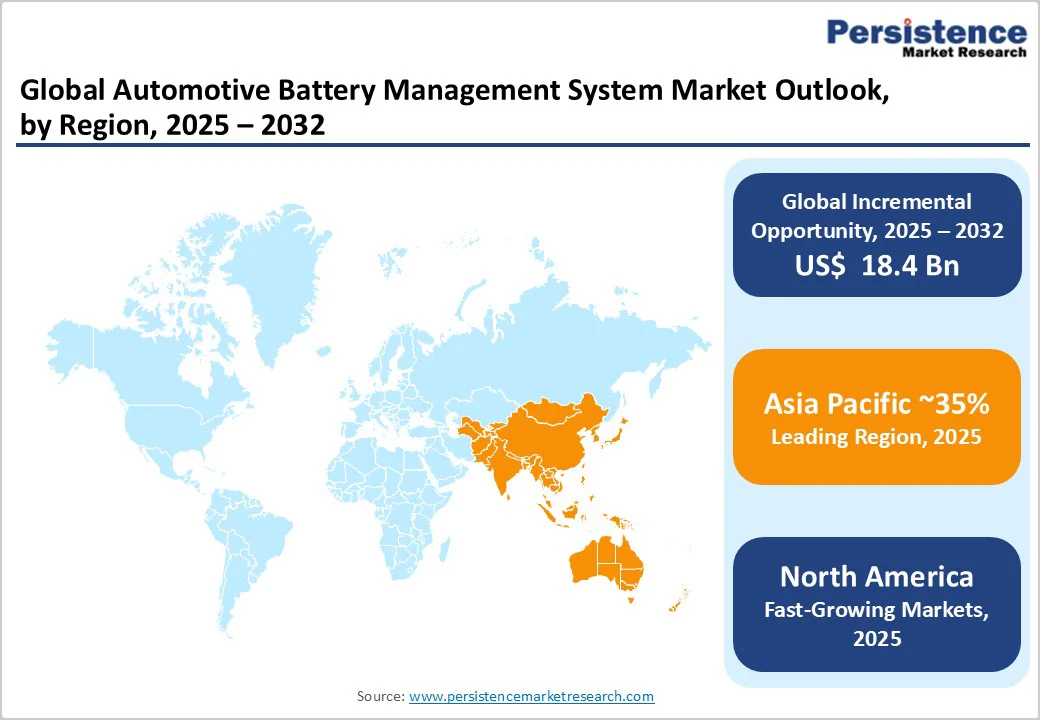

North America generates approximately US$2.8 billion market value in 2025 representing 28% global market share growing at 14.2% CAGR through 2032, driven by established EV manufacturer presence, aggressive electrification targets, and regulatory support.

The United States dominates regional market with 78-82% North American share through Tesla leadership, legacy OEM electrification including Ford F-150 Lightning and GM Ultium platform, and $7,500 federal EV tax credit supporting adoption.

Inflation Reduction Act battery manufacturing incentives supporting domestic cell production and BMS assembly create localized supply chain opportunities. The Canadian automotive sector is contributing 10-12% regional share through integrated North American EV production.

Europe represents a US$3.0-3.6 billion market in 2025, capturing a 30% share and growing at a 15.8% CAGR through 2032, characterized by the strictest emissions regulations, comprehensive battery regulations, and premium EV leadership. Germany leads the European market with 32-38% regional share through automotive manufacturing excellence, including BMW, Mercedes-Benz, Volkswagen, deploying advanced BMS across expanding EV portfolios.

EU Battery Regulation 2023/1542 mandating battery passports and circular economy compliance creates regulatory drivers for comprehensive BMS cloud connectivity and lifecycle documentation. The United Kingdom, France, and Scandinavian markets are demonstrating strong EV adoption, supporting BMS demand growth.

Asia Pacific represents the dominant region at approximately 38% global market share with an estimated market value of US$3.8 billion by 2025, growing at 18.5% CAGR through 2032, driven by Chinese EV market dominance, emerging market expansion, and battery manufacturing leadership.

China dominates Asia Pacific with 48-54% regional share through 9+ million annual EV production, domestic battery manufacturers CATL and BYD, and comprehensive government support, including subsidies and infrastructure investment.

India is emerging as a high-growth market, with a 16-20% CAGR, driven by expanding EV production, the government PLI scheme, and domestic battery manufacturing initiatives. Japan and South Korea together account for 16% of the regional share through technology leadership and export-oriented production.

The automotive BMS market exhibits moderate-to-high consolidation with leading players commanding approximately 45% combined market share, while emerging technology companies and regional specialists capture growing segments.

LG Energy Solution emerges as market leader with an estimated 14% market share through vertically integrated battery and BMS manufacturing, Korean automotive OEM relationships, and global production footprint. Samsung SDI maintains a competitive position with an 11% share through battery and BMS integration, technological innovation, and a focus on the premium vehicle segment.

The Automotive Battery Management System market is estimated to be valued at US$ 10.1 Bn in 2025.

The key demand driver for the Automotive Battery Management System (BMS) market is the rapid global expansion of electric vehicles (BEVs and PHEVs), which requires precise battery monitoring, safety management, and optimization for high-capacity lithium-ion packs.

In 2025, the North America region will dominate the market with an exceeding 35% revenue share in the global Automotive Battery Management System market.

Among the Battery Type, Lead-Acid Based holds the highest preference, capturing beyond 49% of the market revenue share in 2025, surpassing other Battery Type.

The key players in Automotive Battery Management System are Bosch, Affectiva, VitalConnect and Smart Eye AB.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Topology

By Battery Type

By Propulsion

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author