ID: PMRREP33560| 220 Pages | 24 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

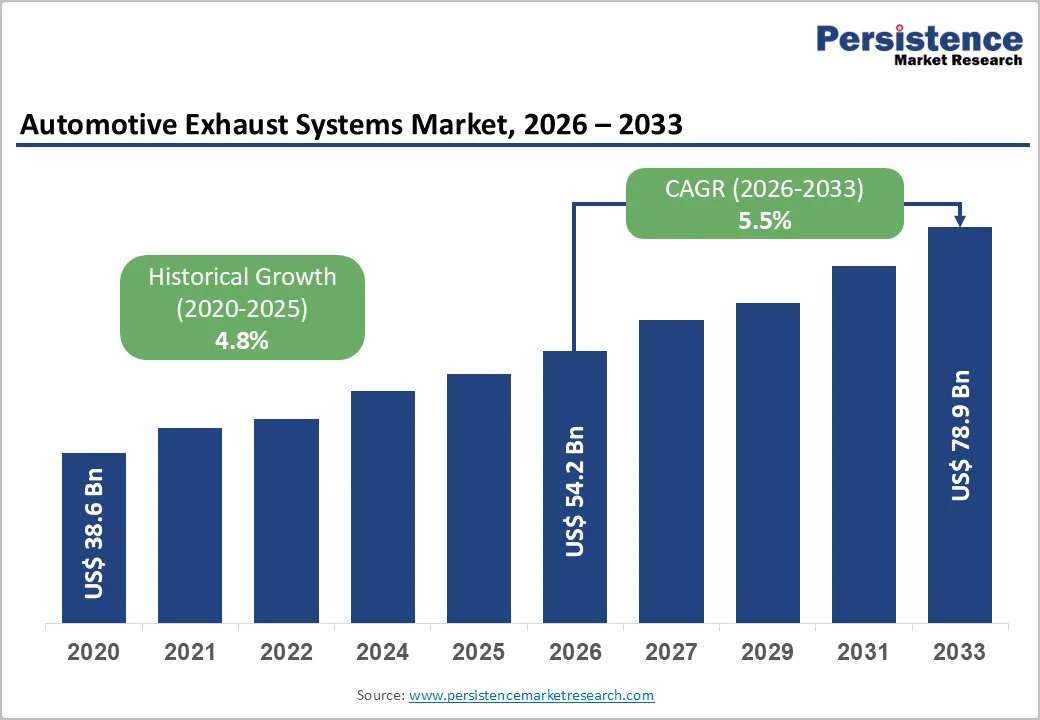

The global automotive exhaust systems market size is likely to value at US$ 54.2 billion in 2026 and is projected to reach US$ 78.9 billion by 2033, growing at a CAGR of 5.5% between 2026 and 2033.

Growth is underpinned by stringent tailpipe emission regulations, continued production of gasoline and diesel vehicles in emerging markets, and ongoing demand for cost-effective aftertreatment in light commercial and heavy vehicles. Within the component mix, exhaust manifolds account for about 38.8% of revenues, while mufflers are the fastest-growing subsegment, reflecting both regulatory and NVH (noise, vibration, harshness) requirements.

| Key Insights | Details |

|---|---|

|

Automotive Exhaust Systems Market Size (2026E) |

US$ 54.2 Bn |

|

Market Value Forecast (2033F) |

US$ 78.9 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.5% |

|

Historical Market Growth (CAGR 2020 to 2024) |

4.8% |

Regulators are tightening limits on NOx, particulate matter (PM), hydrocarbons, and CO, directly increasing the complexity and value of exhaust and aftertreatment systems. The European Union’s Euro 7 standard, agreed in 2024, cuts NOx limits for heavy-duty engines by around 50–56% versus Euro VI and reduces PM limits by approximately 20%, while also introducing durability and on-board monitoring requirements. In June 2024 the U.S. EPA announced new light-duty standards that target a 50% reduction in NOx and 40% reduction in PM emissions from 2025. China’s move from China VI to planned China VII and India’s prospective BS VII will further tighten requirements. These policies force OEMs to adopt more advanced exhaust manifolds, catalysts, particulate filters, and sensors, sustaining demand for integrated exhaust systems despite long-term electrification trends.

The push to meet stricter limits at lower back-pressure and cost is driving innovation across catalysts, filters, manifolds, and thermal management. Industry analyses highlight selective catalytic reduction (SCR), gasoline particulate filters (GPF), lean NOx traps (LNT), and advanced exhaust gas recirculation (EGR) as key growth technologies. In January 2024, Tenneco announced an integrated thermal management system designed to maintain optimal exhaust temperatures in hybrid and conventional vehicles, improving catalyst light-off and emission control under low-load conditions. In February 2024, Faurecia (FORVIA) unveiled a lightweight exhaust manifold using high-strength aluminum alloy to reduce system mass while preserving durability. These innovations support OEM targets for fuel economy and CO2 reduction and enable compliance with durability and real-driving emissions (RDE) provisions in Euro 7 and comparable standards.

Growing BEV and plug-in hybrid penetration, especially in Europe, China, and parts of North America, structurally reduces the addressable market for conventional exhaust systems in light-duty passenger cars. Several long-range forecasts project BEVs to account for a substantial share of new car sales by 2030–2035, which will gradually erode exhaust volumes in those segments. While commercial and emerging markets mitigate this impact in the medium term, suppliers must manage overcapacity risk and rationalize ICE-focused production footprints.

Exhaust aftertreatment systems rely on precious metals such as platinum, palladium, and rhodium, whose prices are volatile and sensitive to geopolitical and mining supply dynamics. Elevated or unstable prices increase system cost and pressure margins for both OEMs and tier-1 suppliers. At the same time, the broader automotive supply chain faces semiconductor constraints and fluctuating steel and alloy prices, which can disrupt production and raise working capital needs. These structural cost and supply risks constrain the ability of some OEMs and suppliers to invest aggressively in next-generation exhaust technologies, particularly in lower-margin vehicle segments and price-sensitive emerging markets.

Despite electrification, the global vehicle parc will retain hundreds of millions of ICE vehicles for decades, particularly in developing regions and in heavy-duty fleets. This creates a durable opportunity in replacement exhaust components, catalysts, mufflers, and pipes for maintenance, emissions compliance, and performance upgrades. Market studies suggest that the overall exhaust system sector could reach US$ 60–80 Bn by 2030, with a significant share linked to aftermarket and service parts. Suppliers with strong distribution networks, flexible manufacturing, and region-specific portfolios can capture recurring revenue, especially as emissions testing and inspection regimes tighten and aging fleets require more frequent exhaust system replacement.

Hybrid powertrains and next-generation diesel engines require more sophisticated thermal management and aftertreatment architectures to remain compliant under RDE and on-board monitoring (OBM) requirements. Tenneco’s 2024 integrated thermal management solution is an example of emerging systems designed to maintain catalyst activity during low-load hybrid operation. There is also continued demand for SCR-DPF combinations, advanced DOCs, and low-temperature NOx control in long-haul trucks and off-highway applications, where diesel remains hard to replace. This niche potentially representing billions of dollars annually in high-value exhaust content offers margin-accretive growth for suppliers that can provide integrated, modular systems optimized for lifecycle CO2 and pollutant emissions.

Gasoline engines dominate the exhaust systems market with roughly 83.2% share, reflecting their prevalence in global passenger car production. Gasoline exhaust systems rely heavily on three-way catalysts and increasingly on gasoline particulate filters (GPFs) to meet strict Euro 6/7 and China VI/VII particulate and cold-start emission limits. Although gasoline engines naturally produce lower NOx, tightening regulations have increased system complexity and value.

Diesel holds a smaller share but remains a higher-value, technology-intensive segment, especially in commercial and heavy-duty vehicles. Growth is supported by diesel’s efficiency and torque advantages in long-haul applications. Diesel exhaust systems incorporating DOC, DPF, SCR, and ammonia slip catalysts carry significantly higher content, making the segment resilient even as light-duty diesel volumes stabilize or decline.

The exhaust manifold is the largest component category, accounting for about 38.8% of market revenues in 2026. Manifolds channel exhaust gases from engine cylinders, manage high thermal loads, and support rapid catalyst light-off. With OEMs adopting engine downsizing, turbocharging, and close-coupled catalysts, manifold design has grown more complex, driving greater use of stainless steel and high-temperature alloys. This keeps manifold value closely tied to ICE production while allowing material upgrades to boost unit pricing.

Mufflers are the fastest-growing segment, expected to record about 8.6% CAGR. Increasing noise regulations, rising SUV and pickup demand, and consumer expectations for quieter cabins are driving more advanced muffler designs, including active valves and tuned resonators, supporting sustained growth.

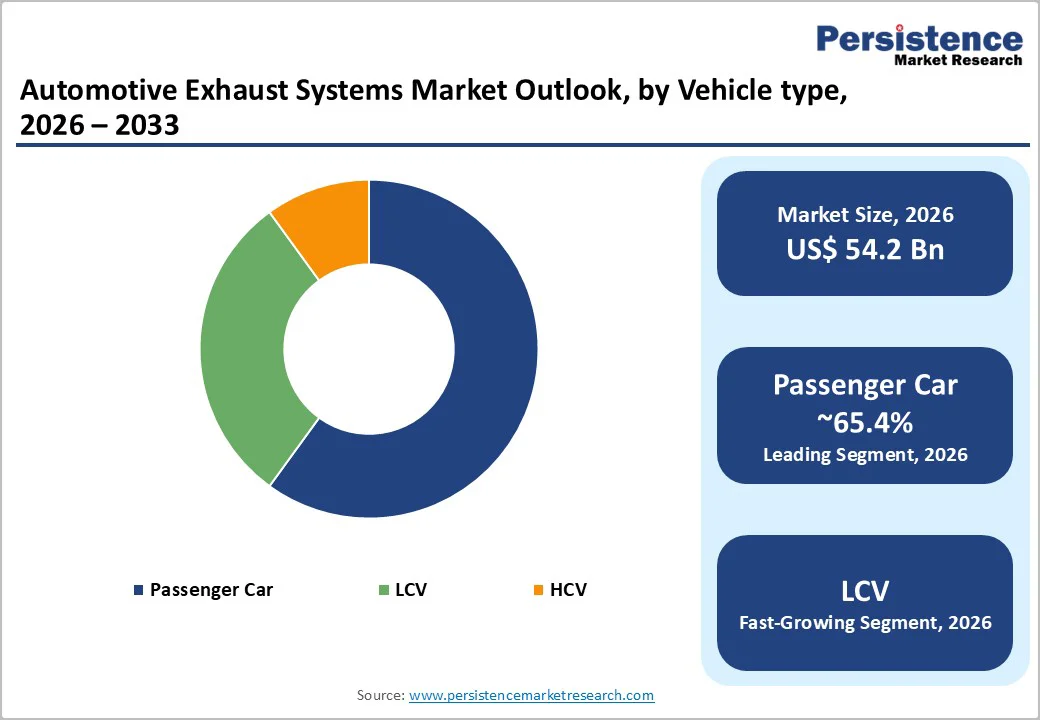

Passenger cars hold the largest share of the exhaust systems market at around 65.4%, driven by high global production volumes and stringent emission standards in regions such as Europe, China, and North America. Their exhaust systems including manifolds, pipes, mufflers, and catalytic converters constitute a significant portion of overall market revenue. Despite growing BEV adoption, the large global ICE passenger car fleet continues to sustain strong demand.

Light commercial vehicles (LCVs) represent the fastest-growing segment, supported by expanding e-commerce, last-mile delivery, and urban logistics. Most LCVs still rely on gasoline and diesel engines, often requiring advanced aftertreatment systems like SCR and DPF. This increases exhaust system value per vehicle, enabling LCVs to outpace passenger cars in value growth.

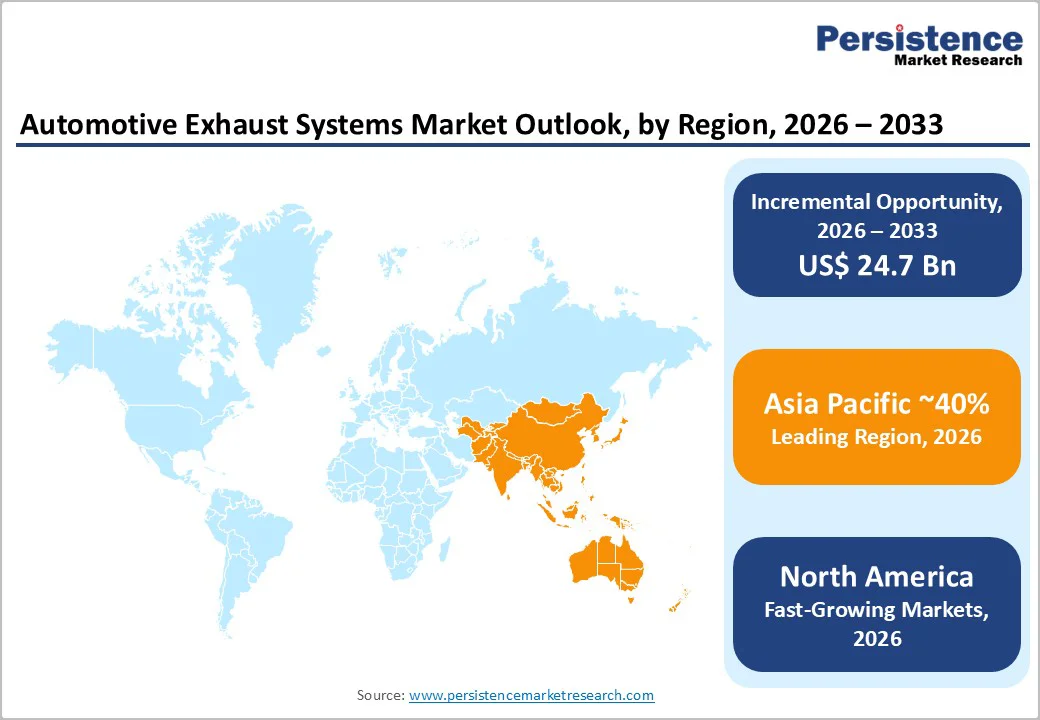

North America represents a significant share of global exhaust system revenues, with U.S. sales of about US$ 5.63 Bn in 2026 and a projected US$ 8.51 Bn by 2033, equating to ~11.6% of global market value. The region’s market is driven by high per-capita vehicle ownership, strong pickup and SUV demand, and robust LCV and HCV fleets. New EPA emission standards for light-duty vehicles from 2025 will cut NOx by 50% and PM by 40%, requiring more advanced catalysts, GPF/DPF, and tighter thermal and sensor control.

The U.S. regulatory framework combines federal EPA rules with California Air Resources Board (CARB) and other state programs, creating a demanding environment for exhaust and aftertreatment design. Heavy-duty rulemakings and greenhouse gas (GHG) standards for trucks further reinforce the need for high-performance diesel exhaust solutions.

Europe is both a major production hub and a regulatory bellwether for automotive exhaust systems. European emission standards (Euro 6 and now Euro 7) set stringent type-approval, durability, and RDE requirements that strongly influence global exhaust designs. Euro 7 introduces lower NOx and PM limits, extends durability requirements, and mandates more robust on-board monitoring, with heavy-duty NOx limits reduced by over 50% versus Euro VI and CO limits by around 62% on the WHTC test cycle.

Germany, the U.K., France, and Spain are key markets. Germany hosts major OEMs (Volkswagen Group, BMW, Mercedes-Benz, Stellantis operations) and several leading exhaust suppliers (Eberspächer, Friedrich Boysen, Continental, Benteler), creating a dense innovation ecosystem. The U.K. is implementing its own post-Brexit regulations and preparing for Euro 7-aligned rules, influencing local exhaust system requirements.

Asia-Pacific is the largest and one of the fastest-growing regional markets, accounting for about 40% of global automotive exhaust system revenues in 2022. High vehicle production in China, Japan, India, South Korea, and ASEAN underpins this dominance. Emission regulations such as China VI (and planned China VII) and India’s BS-VI (moving toward BS VII) are closely aligned with Euro 6/7, requiring complex aftertreatment systems including GPF, DPF, SCR, and advanced EGR.

China is central, with large passenger and commercial vehicle volumes and an ongoing transition from older China III/IV vehicles to China VI/VII-compliant fleets, creating both OEM and retrofit opportunities. Japan and South Korea maintain high technical standards and focus on efficiency and durability, favoring advanced exhaust designs for gasoline and diesel powertrains.

The automotive exhaust systems market is moderately concentrated. Valuate data indicates the top five players hold around 35% of global revenues, while Tenneco and Friedrich Boysen together account for roughly 14% share. Major OEM-focused suppliers span Europe, North America, and Asia, with Faurecia/Forvia, Tenneco, Eberspächer, Boysen, Benteler, Futaba, Sejong, Bosal, Sango, Yutaka Giken, Katcon, Dinex, Wanxiang, and others identified as key players. Competition centers on technology, global manufacturing footprint, cost efficiency, and program wins with major automakers, rather than on price alone.

The Automotive Exhaust Systems market is estimated to be valued at US$ 54.2 Bn in 2026.

The key demand driver for the Automotive Exhaust Systems market is the tightening of global emission and noise regulations.

In 2026, the Asia Pacific region will dominate the market with an exceeding 40% revenue share in the global Automotive Exhaust Systems market.

Among the Vehicle type, Passenger Car holds the highest preference, capturing beyond 65.3% of the market revenue share in 2026, surpassing other Vehicle type.

The key players in Automotive Exhaust Systems are Faurecia, Tenneco Inc., Eberspächer Group and Friedrich Boysen GmbH & Co. KG.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Fuel Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author