ID: PMRREP35266| 135 Pages | 5 May 2025 | Format: PDF, Excel, PPT* | Food and Beverages

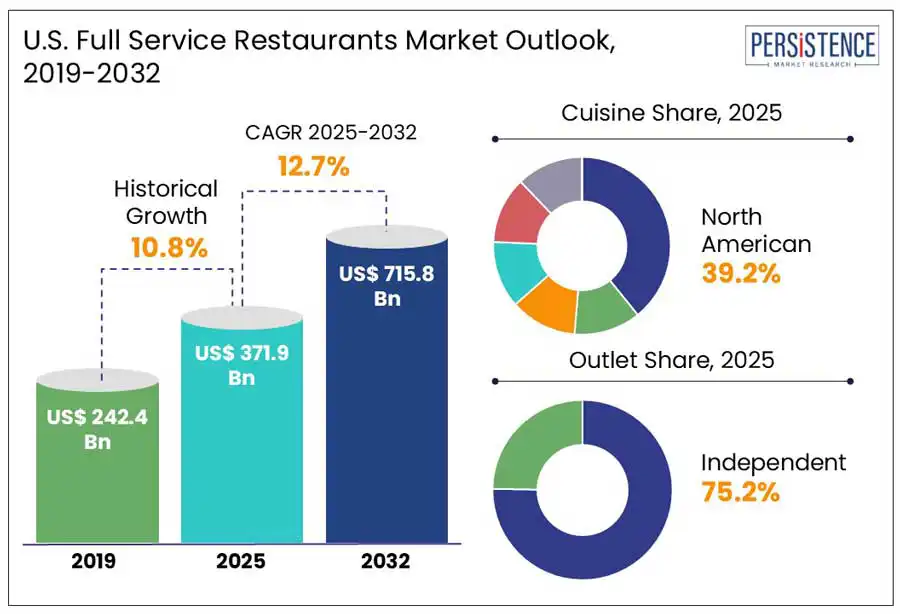

The U.S. full service restaurants market size is predicted to value at US$ 371.9 Bn in 2025 and reach US$ 715.8 Bn at a CAGR of 12.7% by 2032. Rapid evolution of consumer dining habits is a key factor expected to spur the U.S. market, says Persistence Market Research. According to a new study, around 80% of individuals in the country opt for ethnic cuisines in fine dining establishments at least once a month. It highlights the rising inclination of consumers toward diverse culinary experiences.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

U.S. Full Service Restaurants Market Size (2025E) |

US$ 371.9 Bn |

|

Market Value Forecast (2032F) |

US$ 715.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.8% |

Several millennial and Gen Z consumers in the U.S. are increasingly demanding in-person dining experiences that provide quality service, personalization, and a sense of occasion. The National Restaurant Association stated that in 2025, sales across full service restaurants are predicted to rise by 5.5%, reaching approximately US$ 400 Bn. This rapid shift from convenience and fast food is specifically high in suburban and urban areas. In these areas, consumers are showing a keen interest in dining and social gatherings due to entertainment and leisure.

A notable factor pushing this growth is the shift in demographics with high incomes. The younger demographics are mainly spending on experiences over material goods. OpenTable, for example, found in its 2024 survey that nearly 61% of diners aged 25 to 40 years prefer sit-down meals at restaurants that provide quality interaction, curated menus, and ambiance over fast-casual chains. The trend for experience economy is also rising owing to an increasing consumer interest in sustainable dining, chef-led concepts, and regional cuisines. It further encourages restaurant operators to experiment with novel dining options instead of choosing common quick-service options.

High inflationary pressures are expected to be a significant factor hindering the U.S. full service restaurant market growth to a certain extent. In 2024, food costs in the country surged by around 4.8%, found the U.S. Department of Agriculture (USDA). It has compelled several restaurant operators to either lower portion sizes or increase menu prices, which can affect cost-sensitive consumers. These restaurants are typically more sensitive to ingredient price fluctuations, mainly for premium and fresh items, unlike quick-service restaurants that rely on low-cost models.

Full service restaurants also have narrower margins compared to quick-service restaurants. Saltgrass Steak House, a Texas-based chain, declared in its Q4 2024 earnings that despite strong footfall, high beef prices had negatively affected profit margins. Consumer behavior also plays a significant role in hampering growth. Even if dine-in experiences show steady demand, a few consumers are becoming cautious about their spending due to the ongoing economic uncertainty.

Increasing adoption of loyalty programs and digital tools by full service restaurants is anticipated to create lucrative opportunities in the U.S. Several restaurants are incorporating technologies, including tableside payment options, online reservation systems, AI-backed loyalty programs, and mobile ordering to enhance their operational efficiency. They are also planning to refine their dining experience to attract a more digitally savvy and broader clientele. As per a new report, in 2024, nearly 57% of consumers in the U.S. reported that the availability of online payment and digital ordering options positively influenced their decision to visit a restaurant.

Digital loyalty programs are further helping full service restaurants to create strong consumer advocacy and brand communities. They are shifting toward experiential rewards such as private dining discounts, early access to new menu items, or exclusive chef’s table events, away from conventional point-based systems. Yard House, based in California, introduced a loyalty program in 2024. It provides members with early reservations for high-demand events such as beer festivals, resulting in 12% surge in loyalty sign-ups in just six months.

Based on cuisine, the market is divided into Asian, European, Latin American, Middle Eastern, and North American. Among these, the North American segment is predicted to command a dominant share of nearly 39.2% in 2025. This is attributed to high popularity of traditional North American dishes such as chicken wings, sandwiches, and burgers, which remain the most ordered food items in the U.S. Also, rising consumer preference for sustainable food options and locally sourced products will likely encourage restaurants to provide more organic and plant-based options. At the same time, they are estimated to maintain their original menu offerings that have historically attracted diners in the U.S. Surging number of steakhouses in the country is another key factor poised to propel the segment.

Middle Eastern cuisine, on the other hand, is speculated to showcase considerable growth through 2032. Increasing consumer demand for exotic and diverse flavors from the Middle East is projected to contribute to growth. The popularity of various traditional items such as hummus, tahini, and dips has recently surged in the U.S. due to their innovative flavor profile, vegetarian options, and use of fresh ingredients. This type of cuisine is gaining momentum among health-conscious consumers and those looking for new culinary experiences.

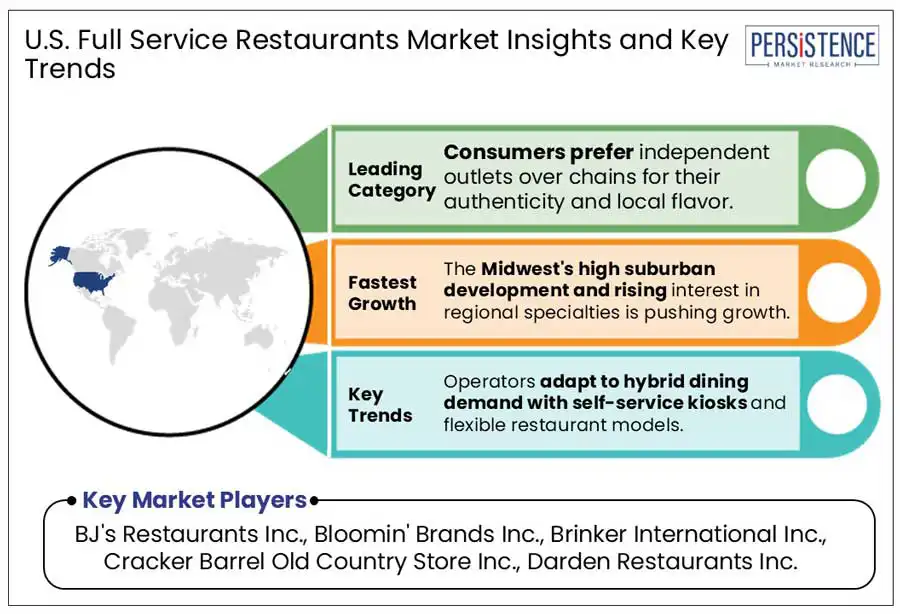

Based on outlet, the market is bifurcated into chained and independent. Out of these, independent outlets are assessed to account for about 75.2% of the U.S. full service restaurants market share in 2025. The growth is attributed to the ability of these restaurants to experiment with new items, introduce community outreach programs, and initiate promotional activities. They aim to generate long-term consumer loyalty with local communities. Independent restaurants, especially those with one or two locations have recently witnessed enhanced adaptability and resilience in catering to consumer expectations associated with ambiance and dining experiences.

Chained outlets are projected to reveal a decent CAGR from 2025 to 2032. These outlets are constantly adopting innovative technologies such as self-service kiosks that can help improve cost-effectiveness and service speed. Large-scale operators are also gaining access to new markets due to the chained model. It has successfully blended the potential for globalization with the rising demand for online meal ordering. In addition, various operators are inclined toward franchising over company-operated outlets due to lower operational risks and reduced capital requirements.

In West U.S., states such as Oregon, Washington, and California are well-known for their robust dining cultures. These are speculated to be the leading hubs for fast service restaurant operators. A few markets, however, are likely to face certain challenges for regulatory compliance, real estate prices, and labor costs. In April 2024, for example, the minimum wage for retail and fast-food workers in California increased to US$ 20 per hour. It compelled various full service restaurants to raise wages to gain a competitive advantage.

The California Restaurant Association stated that this wage hike is estimated to lead to a 7 to 10% surge in operating costs for restaurants in the state, pushing small-scale establishments to shut down or scale back their operations. Despite these challenges, restaurants in Los Angeles, Seattle, and San Francisco are adopting QR-based ordering, AI-based recommendation engines, and automation to optimize operations while offering top-notch service. Upscale chains, including Canlis and Lazy Bear have already embraced dynamic pricing models for reservations replicating the airline industry. These models have helped them enhance revenue generation during peak hours.

States such as Tennessee, Florida, North Carolina, and Georgia in the Southeast are witnessing considerable growth due to the booming tourism industry. With a rising influx of international and domestic travelers, cities, including Savannah, Charleston, Orlando, and Miami, are showing significantly high year-round foot traffic. Sophisticated restaurant groups such as Tavistock Restaurant Collection and José Andrés Group have extended their operations in Florida after realizing the state’s skyrocketing demand for hospitality.

According to a new report, in 2023, the number of full service restaurant openings rose by around 9% in Orlando alone. It was mainly supported by increasing travel activities around the Orange County Convention Center and Walt Disney World. The Southeast further benefits from a favorable economic and regulatory environment, unlike the West. Restaurant operators can flexibly manage labor costs as minimum wage levels are lower in various states in the Southeast U.S., ranging from US$ 7.25 to US$ 10 per hour. It has encouraged national chain and independent restaurant operators to extend their presence across this zone.

The Midwest is expected to hold a share of around 29.6% in 2025. Growth is attributed to high demand for value-oriented experiences and community-centric dining preferences. Kansas City, Indianapolis, Minneapolis, and Chicago are considered the key markets for restaurant operators. The relatively lower cost of real estate has attracted several operators to the Midwest to extend their footprint and generate a high share. Ohio's Cooper’s Hawk Winery & Restaurants and Michigan-based Andiamo have experienced success in extending their presence into Tier-II cities due to easy access to loyal consumer bases and favorable leasing rates.

The U.S. full service restaurants market is competitive with the presence of various large-scale as well as emerging players. Their success in the market is highly reliant on an operator’s ability to adapt to evolving consumer preferences and ongoing technological innovations. Small-scale players focus on improving consumer experience, integrating digital tools, and updating their menus. A few operators are also enhancing operational efficiency, investing in staff training, and developing robust loyalty programs.

The U.S. full service restaurants market is projected to reach US$ 371.9 Bn in 2025.

Increasing consumer preferences for dining out and the desire for exotic cuisines are the key market drivers.

The market is poised to witness a CAGR of 12.7% from 2025 to 2032.

The emergence of consumer loyalty programs and rising focus on digital tool integration are the key market opportunities.

BJ's Restaurants Inc., Bloomin' Brands Inc., and Brinker International Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Cuisine

By Outlet

By Location

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author