ID: PMRREP33463| 177 Pages | 25 Jul 2025 | Format: PDF, Excel, PPT* | Food and Beverages

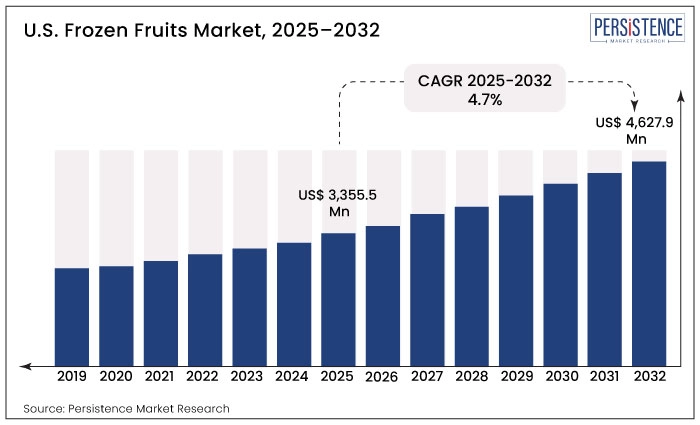

The U.S. frozen fruits market is estimated to increase from US$ 3,355.5 Mn in 2025 to US$ 4,627.9 Mn by 2032. The market is projected to record a CAGR of 4.7% during the forecast period from 2025 to 2032.

Increasing shift of millennials in the U.S. toward vegan diets is anticipated to augment frozen fruit sales in the near future. As per the Vegan Society, a third of shoppers are eliminating or cutting down on animal products with the high cost of living. The ease and accessibility of frozen fruit options are becoming increasingly alluring as more customers choose plant-based diets for ethical, environmental, or health-related reasons.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

U.S. Frozen Fruits Market Size (2025E) |

US$ 3,355.5 Mn |

|

Projected Market Value (2032F) |

US$ 4,627.9 Mn |

|

U.S. Market Growth Rate (CAGR 2025 to 2032) |

4.7% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

3.2% |

|

Zone |

Market Share in 2024 |

|

Southeast U.S. |

28.5% |

Southeast U.S. is poised to maintain a significant share in the U.S. frozen fruits market due to its favorable agricultural conditions, robust infrastructure, and strategic export capabilities. The zone benefits from a warm climate that supports the cultivation of key fruits such as strawberries, blueberries, peaches, and blackberries, which are staples in the industry.

States like Florida and Georgia are leading producers ensuring a steady supply to meet rising demand for frozen, nutrient-dense foods. Additionally, the presence of advanced cold storage facilities and proximity to key distribution hubs, including ports in Miami and Savannah, enhances the efficiency of both domestic and international shipments.

|

Category |

Market Share in 2024 |

|

Fruit Type - Berries and Grapes |

53.7% |

Berries and grapes are expected to lead the U.S. frozen fruits industry with a share of 53.7% in 2024. This is due to high consumer demand, versatility, and health benefits. Berries, such as strawberries, blueberries, and raspberries, are rich in antioxidants, vitamins, and fiber. These often align with the growing consumer focus on functional foods that promote immunity and wellness.

Grapes, particularly seedless varieties, are increasingly sought after for their convenience and use in smoothies, desserts, and snack packs. Additionally, the freezing process helps preserve their nutritional value, flavor, and texture, making them ideal for off-season consumption.

|

Category |

Market Share in 2024 |

|

End Use – Food and Beverage Industry |

41.2% |

The food and beverage industry is likely to dominate the frozen fruits business in the U.S. through 2031. It is due to the rising use of these fruits across multiple product categories, including smoothies, juices, yogurts, and baked goods.

Growing consumer preference for healthy, natural ingredients is also likely to propel demand for fruit-based offerings. It is projected to encourage food brands to incorporate frozen fruits into their product lines. Additionally, these fruits offer year-round availability, consistent quality, and reduced waste, which align with the operational efficiency sought by large-scale food and beverage companies.

The U.S. frozen fruits market is undergoing a significant transformation with the rising demand for exotic and specialty frozen fruits. It is creating lucrative opportunities for both manufacturers and retailers.

As consumers increasingly seek unique flavors and health benefits, demand for exotic fruits such as dragon fruit, passion fruit, and mangosteen is on the rise. This trend is fueled by a growing desire for products that offer distinctive taste experiences and nutritional advantages.

An exemplary player in this space is Frutifera USA, which specializes in a variety of frozen fruit pulps, including exotic offerings such as Lulo and passion fruit. These products cater to health-conscious consumers looking for flavorful and nutritious ingredients. However, these often appeal to chefs and food manufacturers seeking unique ingredients for beverages, desserts, and culinary creations.

By providing ready-to-use frozen pulps, Frutifera enables its customers to create innovative recipes while simplifying food preparation. The expansion of exotic and specialty frozen fruits segments allows brands to differentiate their product offerings. They are likely to appeal to niche markets while tapping into the broad health and wellness movement.

The U.S. frozen fruits industry witnessed steady growth at a CAGR of 3.2% from 2019 to 2024. It was driven by shifting consumer preferences toward convenience and health-focused foods. Historically, the market elevated as more consumers embraced frozen fruits for their nutritional value and extended shelf life compared to fresh alternatives.

From 2019 to 2024, the market benefited from trends like smoothie culture, plant-based diets, and increased demand for at-home cooking. Home cooking was particularly prevalent during the COVID-19 pandemic when frozen fruits saw a surge in retail sales due to stockpiling behavior.

The market is expected to maintain a positive trajectory, supported by rising awareness of clean-label foods and organic frozen fruit options. The forecast period points to continued innovation in product offerings, including exotic fruit varieties, mixed fruit packs, and value-added options like pre-cut or sweetened fruits.

Rising Preference for Natural and Organic Frozen Fruits to Boost Sales

Organic food sales have seen steady growth over the past decade with U.S. retail sales reaching over US$ 52 Bn in 2023, an average increase of 8% per year. Fresh fruits and vegetables, which accounted for 40% of these sales were the top category of organic food products.

Organic fresh fruits and vegetables generated around US$ 19.2 Bn in retail sales in 2023. This rising demand for green and organic products extends to frozen fruits as consumers increasingly seek convenient, healthy, and pesticide-free food options.

The U.S. Department of Agriculture (USDA) has reported a 79% increase in certified organic cropland acres between 2011 and 2021, reflecting the growing supply base for organic farming. Despite this rise, organic price premiums remain high due to the demand outpacing domestic supply, with imports playing a key role in meeting consumer needs.

The shift of health and environmentally conscious consumers toward organic frozen blueberries, strawberries, and cranberries continues to push the U.S. frozen fruits market. It will likely benefit from a combination of consumer preference for clean-label products and booming retail outlets, including conventional grocery stores and online platforms.

Bakery and Confectionery Sector Seeks Frozen Fruits to Maintain Food Quality

The bakery and confectionery sector is experiencing a significant surge in demand for frozen fruits, particularly berries like strawberries, blueberries, and raspberries. These fruits are prized for their ability to retain flavor, texture, and nutritional value even after freezing. Hence, these are ideal for use in a wide range of baked goods such as tarts, muffins, pies, and cheesecakes.

Unlike fresh fruits, frozen alternatives allow bakers to maintain consistent quality and availability throughout the year, minimizing seasonal fluctuations. Additionally, the controlled freezing process helps reduce wastage by extending the shelf life of fruits that would otherwise spoil quickly.

Added Sugar Content and Nutrient Loss May Hamper Sales

While frozen fruits offer several benefits, potential consumers should exercise caution when selecting these products, particularly regarding added sugars and nutritional content. Many frozen fruit varieties contain refined sugars, which can significantly increase calorie counts. For instance,

Consumers are advised to read packaging labels carefully for terms like ‘sweetened’ or ‘lightly sweetened’ to avoid unnecessary added sugars. Although frozen fruits retain most of their nutrients, there may be some loss of vitamin C during the freezing process. For example,

Manufacturers also face challenges during the processing stages, where they must act swiftly to maintain flavor, texture, and nutrition. This process involves washing the fruit, applying chemical compounds like ascorbic acid to halt ripening, and employing flash freezing to preserve quality. These factors can influence consumer perceptions and preferences, thereby restraining the U.S. frozen fruits market growth.

High Production Cost and Energy Expenses May Restrict Growth

According to the USDA’s Agricultural Marketing Service (AMS), the production costs for organic products are generally higher. It is due to labor-intensive farming practices, strict certification processes, and the use of organic inputs. These rising costs directly influence the pricing of organic frozen fruits, leading to a substantial premium in the marketplace.

In addition to raw material costs, energy expenses, particularly for storage and transportation, also play a critical role in the market for frozen fruits. Energy-intensive refrigeration systems are required to maintain the quality and safety of frozen products throughout the supply chain, right from farm to consumer.

Emergence of Isochoric Freezing Method to Create Fresh Growth Prospects

The introduction of isochoric freezing presents a significant opportunity for the U.S. frozen fruit snacks market by improving food quality, enhancing safety, and reducing energy consumption. Developed by researchers from the U.S. Department of Agriculture’s Agricultural Research Service and the University of California-Berkeley, this innovative method involves storing foods in sealed containers filled with liquid. It prevents ice crystallization, a common issue that compromises the texture and taste of frozen fruits.

Isochoric freezing requires no significant investment in new equipment, making it a feasible option for producers at every stage of the food supply chain- from growers to retailers. As this revolutionary freezing technique gains traction, it is set to redefine standards in the market. It will likely promote high quality products that meet the growing consumer demand for sustainable and safe food options.

Rising Demand for Smoothie Packs to Transform the Market

Rising demand for smoothie packs is transforming the market for frozen fruits in the U.S., as health-conscious consumers seek convenient and nutritious meal options. These pre-portioned packs are tailored for busy lifestyles. These allow consumers to blend their favorite fruits quickly without the hassle of measuring and preparing ingredients. Typically featuring a mix of berries, bananas, mangoes, and other fruits, these packs offer a diverse range of flavors and textures, catering to various dietary preferences and taste profiles.

The competitive landscape of the U.S. frozen fruits industry is characterized by a dynamic mix of established players and emerging brands, each vying for shares through innovation and strategic positioning. Companies, such as Dole Food Company, Ardo, and Wyman’s of Maine dominate the market. They have extensive distribution networks and a wide range of product offerings. These companies leverage their strong brand recognition to maintain customer loyalty. At the same time, they are continuously extending their product lines to include organic, non-GMO, and exotic frozen fruits that appeal to health-conscious consumers.

Recent Industry Developments

The market is expected to reach US$ 4,627.9 Mn by 2032.

The market is projected to grow at a CAGR of 4.7% during this period.

Berries and grapes lead with a projected 53.7% market share in 2024.

Innovations like isochoric freezing and smoothie packs are creating new growth avenues.

Top players include Dole Plc, Nature’s Touch, Wyman’s, and AGRANA (Dirafrost).

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

Value: US$ Bn, Volume: As applicable |

|

Key Zones Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

| Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Fruit Type

By Nature

By Form

By End Use

By Distribution Channel

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author