ID: PMRREP33146| 189 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

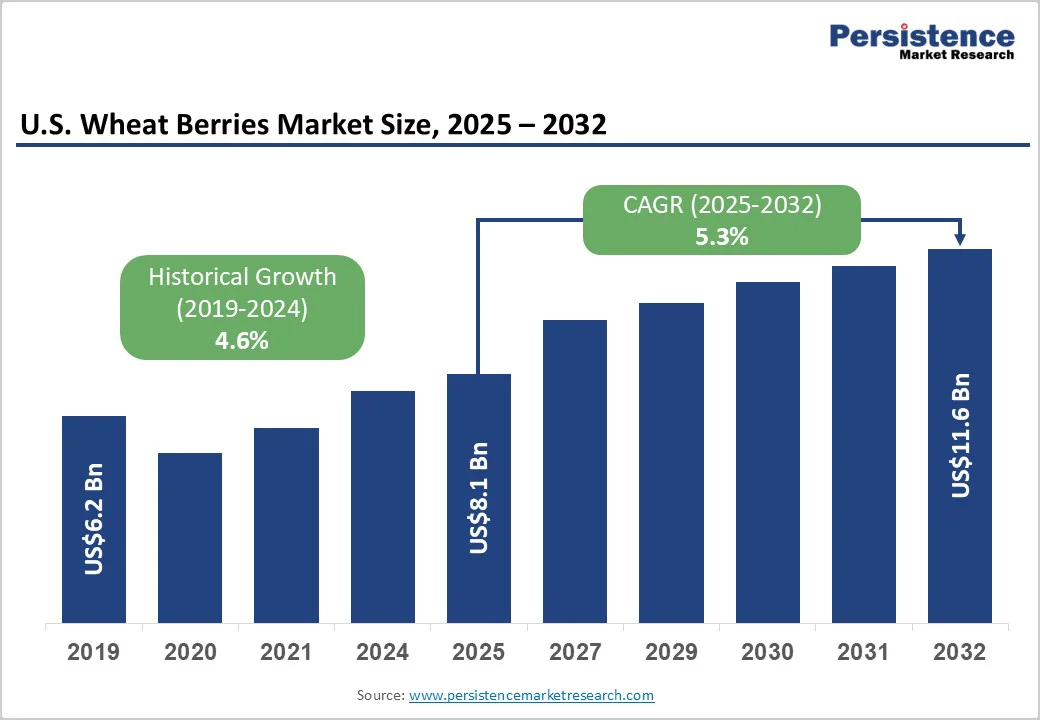

The U.S. wheat berries market size is likely to be valued at US$8.1 billion in 2025. It is expected to reach US$11.6 billion by 2032, growing at a CAGR of 5.3% during the forecast period from 2025 to 2032, driven by consumer demand for food products that are made from wheat or wheat flour, which is fairly static and largely unaffected by the variation in wheat prices or disposable income.

Wheat is central to the American diet, appearing in pasta, bread, pastries, baked goods, crackers, and cereals. The rising demand for bakery products, higher disposable incomes, and shifting post-pandemic lifestyles will also drive market growth. Busy working consumers increasingly choose convenient, versatile, and shelf-stable wheat-based foods such as bread, pizza crusts, and pasta, boosting overall market growth.

| Key Insights | Details |

|---|---|

| Wheat Berries Market Size (2025E | US$8.1 Bn |

| Market Value Forecast (2032F) | US$11.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.6% |

Health consciousness among consumers has grown considerably over the past few decades, with people prioritizing nutrition and immunity enhancement through their dietary choices.

Wheat-based foods are increasingly recognized for their numerous health benefits, including improved metabolism, better cholesterol management, blood sugar regulation, and effective weight control. Products made from enriched wheat flour, such as pasta, bread, and breakfast cereals, are fortified with folate, essential vitamins, and minerals, providing consumers with affordable yet nutritionally rich meal options.

Baked food manufacturers are capitalizing on this health-driven trend by reformulating their offerings to improve nutritional content. Strategies such as reducing sugar intake and incorporating nutrient-dense ingredients, such as seeds, fruits, and nuts, are increasingly being adopted to align with evolving consumer preferences. These initiatives are expected to drive further market growth for wheat berries, which are considered one of the most wholesome and natural sources of nutrition.

In parallel, the rising demand for plant-based foods is further supporting the wheat berries market. Plant-based diets, known for being rich in fiber and essential nutrients while low in fat and calories, are gaining widespread acceptance among health-conscious consumers. Concerns about obesity, chronic diseases, and lifestyle-related health issues have made people more inclined toward natural, minimally processed alternatives such as wheat berries.

The expanding vegan population in the U.S. and the growing movement against animal cruelty and processed meat consumption are amplifying the shift toward plant-based eating patterns. As consumers continue to adopt healthier and more sustainable lifestyles, the demand for nutrient-dense, plant-based ingredients such as wheat berries is expected to increase steadily, fueling long-term market expansion in the U.S. and beyond.

Consumption of gluten-free products is expanding quickly, and consumers are removing gluten from their diets. Many people are eliminating gluten because they believe it is a healthy practice. Gluten is bad for people with celiac disease and those who have non-celiac gluten sensitivity, as it damages their small intestine and causes allergic reactions.

The gluten-free diet is also endorsed by many celebrities, which will further increase the number of people opting for it. Significant health benefits associated with gluten-free products, such as reduced chronic inflammation and a reduced risk of cardiovascular disease, and the growing preference among gluten-intolerant consumers will hinder the growth of the wheat berries market in the U.S. to some extent.

In recent years, the food supply has been experiencing negative growth due to an unbalanced climate and uncertain conditions, which is creating a supply-demand imbalance and posing challenges for food safety measures. Several incidents have occurred that are unlike regular occurrences, affecting the supply of wheat berries.

Growing consumer awareness about the adverse effects of pesticides and chemical additives has significantly increased the demand for organic and natural food products. This shift in consumer preference is prompting manufacturers to expand their product lines with organic wheat berries produced through sustainable and chemical-free farming practices.

The perceived health benefits of organic foods, including lower exposure to harmful residues and higher nutrient value, are major factors driving this demand. Consumers are also becoming more cautious about food safety and the long-term effects of processed products, resulting in stronger market momentum for fresh, traceable, and organically grown wheat across the U.S. Many producers now offer both conventional and organic varieties to cater to diverse consumer needs.

Parallel to this trend, the use of wheat berries in animal feed is rapidly expanding due to their high protein and amino acid content. With an energy value ranging from 3.0 to 3.5 Mcal ME (Metabolizable Energy), wheat berries serve as an efficient and nutritious feed ingredient. Their moisture content, typically below 14%, helps prevent microbial contamination and improves digestibility.

Wheat bran, a by-product rich in fiber and protein, is widely used in ruminant and pig feed formulations to enhance nutrient absorption and performance. However, in ruminant diets, inclusion levels must be carefully managed to avoid ruminal acidosis caused by high fermentability.

Overall, the combination of increasing consumer preference for organic foods and growing reliance on wheat berries as a sustainable, protein-rich feed ingredient presents a dual growth opportunity for manufacturers in both the food and animal nutrition sectors.

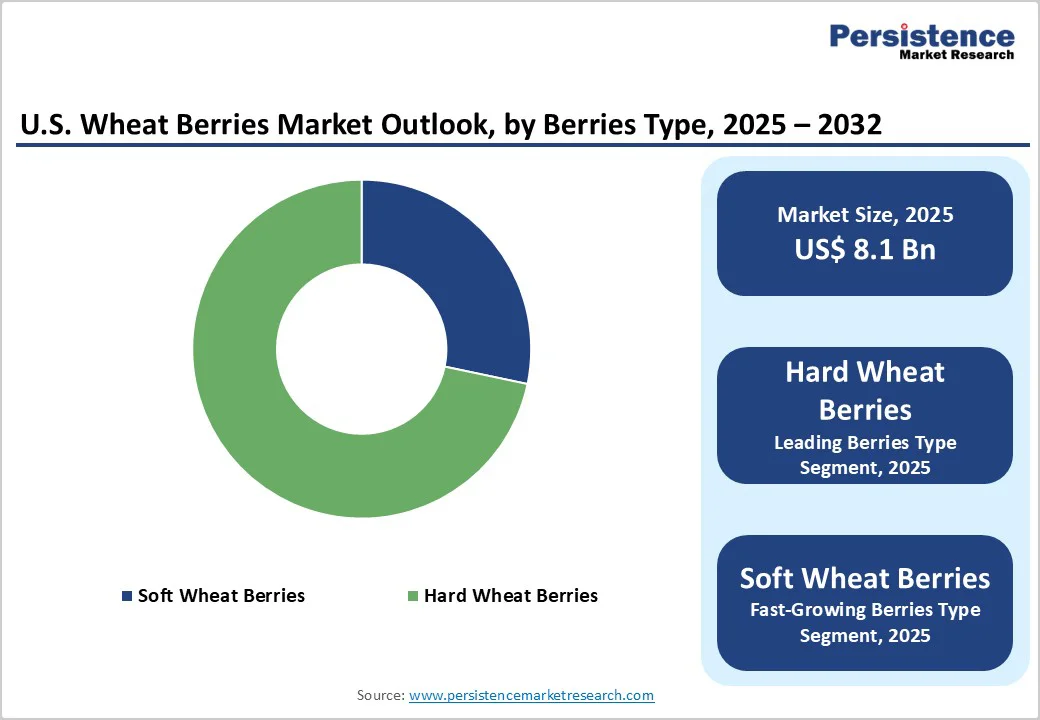

The hard wheat berries segment dominates the market by type, driven by their high protein content, superior baking characteristics, and widespread applications across bread, pasta, and specialty baked goods. Hard wheat berries, particularly hard red spring and hard red winter varieties, contain 12-15% protein content, making them ideal for yeast bread production.

Hard wheat berries are widely used in premium bakeries and food manufacturing. U.S. wheat production includes significant hard red winter, hard red spring, and hard white wheat classes.

Commercial bakeries, artisan bread makers, and pasta manufacturers prefer hard wheat berries for their consistent performance, nutritional density, and consumer appeal. Companies, including Bob's Red Mill Natural Foods, Fairhaven Mill, and Sunnyland Mills, offer hard wheat berry products that emphasize high-protein benefits.

The processed food and beverage industry dominates the U.S. wheat berries market, accounting for approximately 59% of the total value share in 2024. Wheat berries are widely used in bakery products, meat products, pasta, nutritional and snack bars, crackers, cookies, and confectionery items to enhance taste, texture, and nutritional value.

Their versatility and affordability make them a key ingredient across staple foods. Demand remains particularly strong in bread, buns, and rolls, where whole wheat, multigrain, and seed-based variants are increasingly popular.

Multigrain and whole wheat bread have witnessed about 19% growth in consumption, indicating consumers’ preference for fiber-rich, healthier grain products. Food manufacturers continue to rely on wheat berries for their functional properties and contribution to wholesome, flavorful formulations.

Evolving lifestyles, rising demand for convenient, shelf-stable foods, and the sustained popularity of bakery items are expected to drive steady growth in the U.S. wheat and wheat flour market.

The U.S. wheat berries market exhibits a moderately fragmented competitive structure, featuring established milling companies, specialty whole-grain processors, and emerging organic grain brands. Major players, including Bob's Red Mill Natural Foods, La Milanaise, The Scoular Company, and Whole Grain Milling Co., leverage extensive processing capabilities, established distribution networks, and strong brand recognition.

Regional mills, including Palouse Brand, Fairhaven Mill, Natural Way Mills, and Daybreak Mill, differentiate through local sourcing, identity preservation, and direct farmer relationships. Companies are investing in organic certification, non-GMO verification, and sustainable farming partnerships to capture premium market segments.

Product innovation focuses on specialty wheat varieties, including Kamut, spelt, and ancient wheat berries, appealing to gourmet and health-focused consumers. Strategic positioning emphasizes nutritional benefits, minimal processing, and transparent supply chains.

The U.S. wheat berries market is projected to be valued at US$8.1 Billion in 2025.

The U.S. wheat berries market is driven by rising health consciousness, whole grain consumption trends, expanding bakery sector demand, and growing awareness of nutritional benefits.

The U.S. wheat berries market is poised to witness a CAGR of 5.3% between 2025 and 2032.

Expanding e-commerce distribution, developing premium organic wheat berries, creating direct-to-consumer subscription models, and targeting health-focused consumers seeking whole grain products represent high-potential growth avenues.

The prominent players in the wheat berries market include Bob's Red Mill Natural Foods, La Milanaise, The Scoular Company, Palouse Brand, Whole Grain Milling Co., and Fairhaven Mill.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| U.S. Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Nature

By Berries Type

By Application

By Distribution Channel

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author