ID: PMRREP33519| 199 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

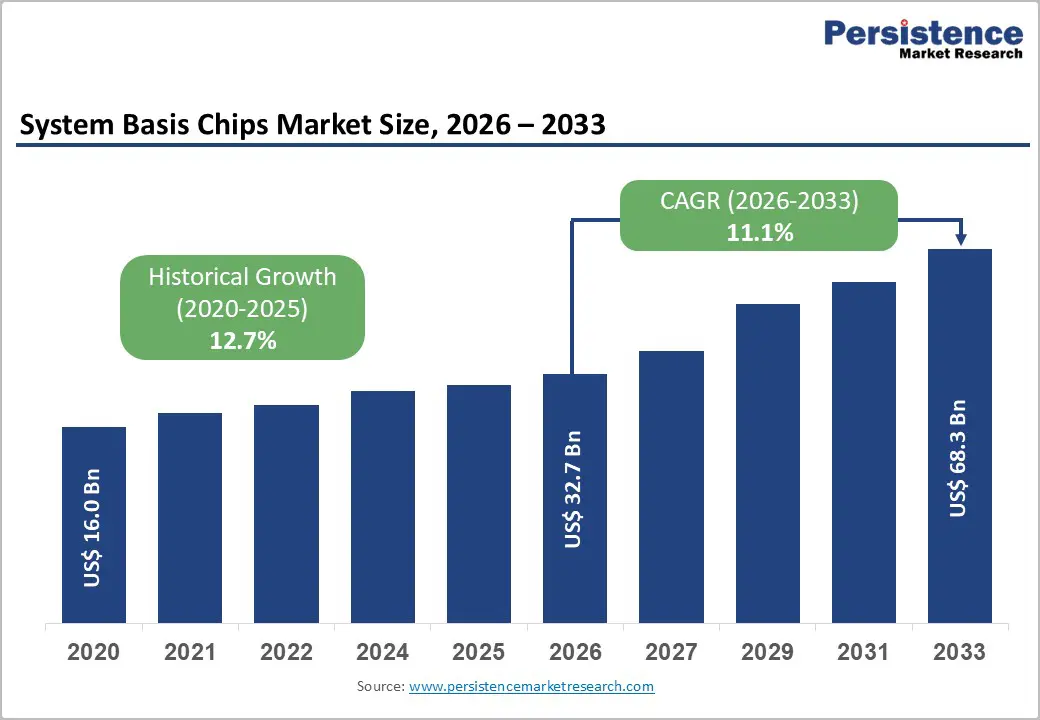

The global system basis chips (SBC) market size is expected to be valued at US$ 32.7 billion in 2026 and projected to reach US$ 68.3 billion by 2033, growing at a CAGR of 11.1% between 2026 and 2033.

Market growth is driven by accelerating global EV adoption, the deployment of 800-volt architectures, and the expansion of connected vehicle features that demand advanced power, control, and communication chipsets. Strengthening regulatory mandates for safety and emissions reduction are also driving widespread ADAS integration, firmly positioning system-based chips as foundational components supporting modern powertrains, safety electronics, body control systems, and evolving infotainment platforms.

| Key Insights | Details |

|---|---|

| System Basis Chips Market Size (2026E) | US$ 32.7 billion |

| Market Value Forecast (2033F) | US$ 68.3 billion |

| Projected Growth CAGR (2026 - 2033) | 11.1% |

| Historical Market Growth (2020 - 2025) | 12.7% |

The automotive industry is undergoing rapid electrification, with global EV sales expected to grow at nearly 20% CAGR through 2030, sharply increasing demand for advanced System Basis Chips used in battery management, motor control, and power distribution. BEVs are projected to account for about 75% of new EV production by 2030, reflecting a major shift that will intensify semiconductor requirements. The rise of 800-volt architectures further boosts the need for high-efficiency, thermally robust power management semiconductors, supported by fast-growing adoption of SiC MOSFETs, whose demand is forecast to increase tenfold between 2023 and 2035.

As SiC inverters already account for more than a quarter of BEV powertrains, integrated System Basis Chips are becoming essential for coordinated power, safety, and thermal management. Complementing global trends, India’s 22.5% surge in EV production in 2024 underscores expanding electrification momentum across both mature and emerging markets.

The automotive industry is systematically deploying Advanced Driver Assistance Systems (ADAS) across vehicle segments, with the ADAS semiconductor market estimated at US$ 11.3 billion in 2024 and projected to grow at a 15.2% CAGR through 2034, driving exponential demand for sophisticated processing semiconductors. Adaptive cruise control, lane-keep assistance, automatic emergency braking, and traffic sign recognition require a specialized System-on-Chip (SoC) that coordinates data from cameras, radar sensors, and lidar systems with centralized processing controllers.

The emergence of autonomous vehicle technologies requires integrating AI-accelerators, edge computing capabilities, and sensor fusion architectures into unified System Basis Chip platforms, enabling real-time decision-making without reliance on cloud processing. Qualcomm’s partnership with BMW (announced May 2025), integrating the Snapdragon Ride Flex platform to deliver combined infotainment and ADAS capabilities, demonstrates a systematic evolution toward integrated semiconductor solutions. Government regulatory mandates, including Euro NCAP safety requirements and emerging autonomous vehicle regulations, are compelling the systematic deployment of ADAS across vehicle portfolios, establishing synchronized market demand drivers.

Despite robust growth drivers, the System Basis Chip market faces formidable supply chain challenges, with the automotive semiconductor industry projecting a potential shortage of mature chips (28nm and above) in 2025, which could threaten production continuity for established vehicle platforms. The extreme capital intensity of semiconductor fabrication (with new advanced facilities requiring US$ 15-20 billion investment) has created concentrated manufacturing capacity controlled by limited producers, including TSMC and Samsung, with capacity fully allocated through 2027 according to Yole Group analysis.

The bifurcation of semiconductor demand into distinct mature and advanced-node requirements complicates supply planning, with manufacturers requiring simultaneous access to mature 28nm+ nodes for established functionality and to sub-16nm advanced nodes for emerging AI and autonomous capabilities. Small and medium-sized automotive manufacturers are reluctant to adopt advanced System Basis Chip solutions due to cost concerns and complexity, as implementations require specialized engineering expertise unavailable to regional suppliers, constraining addressable market penetration.

The escalating geopolitical tension between the United States, the European Union, and China is fundamentally reshaping semiconductor supply chains, with China’s 25% domestic content mandate by 2025 compelling automotive OEMs to source semiconductors from domestic suppliers, disrupting established supplier relationships. Chinese semiconductor companies, including BYD Semiconductor, StarPower, and Horizon Robotics, are rapidly expanding their capabilities in system-based chip development and production, leveraging government policy support and indigenous design expertise to challenge established Western suppliers.

The uncertainty surrounding U.S. export restrictions on advanced semiconductor technologies and evolving trade protection policies creates planning complexity for multinational semiconductor suppliers attempting to serve global automotive markets. Regulatory fragmentation across different jurisdictions creates requirements for regionally specific System Basis Chip variants, increasing development costs and complicating manufacturing efficiency.

Telematics and infotainment systems have emerged as the fastest-growing application for automotive semiconductors, with market growth rates exceeding 18% CAGR driven by consumer demand for connectivity, real-time navigation, personalized entertainment, and cloud service integration. The integration of 5G connectivity into automotive platforms (with 5G chipset adoption expected to surpass 4G in 2025 and revenues nearing US$ 900 million) creates a synchronous demand for System Basis Chips capable of managing high-bandwidth communication, cybersecurity, and low-latency data processing.

Vehicle-to-Everything (V2X) communication capabilities require sophisticated System Basis Chip architectures integrating cellular modems, wireless processors, and encryption accelerators, enabling real-time vehicle-to-infrastructure communication for traffic management optimization and enhanced safety. Over-the-Air (OTA) update capabilities necessitate System Basis Chip architectures with secure boot mechanisms, cryptographic acceleration, and robust firmware management supporting remote software deployment without service center intervention.

The emergence of autonomous vehicle technologies represents a compelling high-growth opportunity for System Basis Chip providers capable of integrating multiple sensor streams, edge AI processing, and real-time decision-making within unified semiconductor architectures. Tesla’s Full Self-Driving (FSD) system, leveraging custom AI semiconductors and Waymo’s Level 4 autonomous vehicles utilizing NVIDIA DRIVE SoCs, demonstrates the commercial viability of advanced semiconductor integration, enabling autonomous capability development.

The integration of AI accelerators within System Basis Chips enables local processing of camera feeds, radar data, lidar point clouds, and ultrasonic sensor signals, eliminating cloud dependency and addressing latency and privacy concerns critical for autonomous vehicle deployment. The proliferation of advanced sensor suites, including solid-state lidar, high-resolution cameras, and millimeter-wave radar, creates demand for System Basis Chips with multiple high-bandwidth sensor interfaces and advanced signal processing capabilities. The convergence of edge AI computing advances, sensor technology maturity, and regulatory framework development is expected to drive sustained high-growth demand for specialized autonomous vehicle-oriented system-on-chip (SoC) chips.

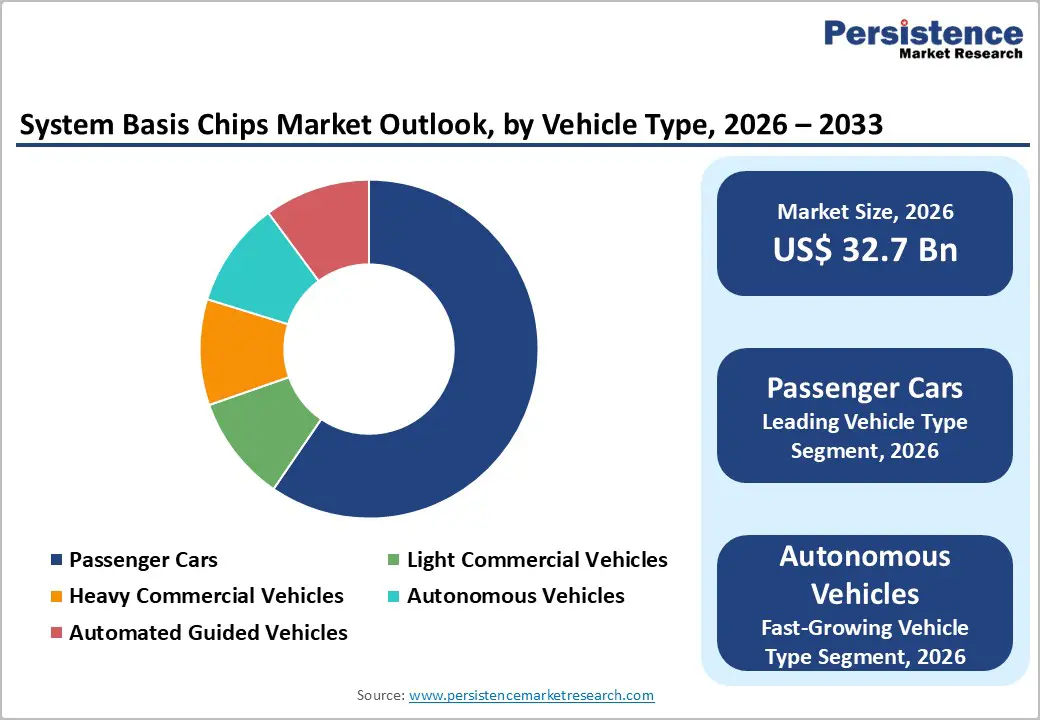

Passenger Cars hold the dominant share of the vehicle type category, contributing nearly 68% of total demand in 2025, driven by their high global production volumes and rapid shift toward electrified powertrains. This segment relies heavily on advanced system-based chips to manage functions across powertrain control, safety systems, body electronics, and infotainment integration.

The increasing adoption of EVs within mainstream passenger car segments has accelerated the need for unified semiconductor platforms that support high efficiency, compact design, and regulatory compliance. Strong supply chain maturity, faster model-refresh cycles, and broader consumer acceptance of electrification further strengthen the segment’s leading position over commercial vehicles, which typically adopt new semiconductor technologies more slowly.

Powertrain applications lead the market with about 32% share in 2025, reflecting their critical role in enabling efficient motor control, battery management, and high-voltage distribution in hybrid and electric vehicles. As EV adoption expands, powertrain semiconductor designs are transitioning toward highly integrated System Basis Chips that combine real-time processing, thermal management coordination, converter control, and voltage regulation within a single platform. This shift reduces system complexity and cost while improving energy efficiency and reliability across electric drivetrains. The growing use of silicon carbide-based power modules and high-voltage architectures further increases the need for advanced System Basis Chips capable of supporting next-generation powertrain requirements.

North America accounts for a strong 26% share of the global system basis chips market in 2025, supported by a well-established automotive ecosystem, advanced semiconductor design capabilities, and stringent safety and emissions regulations that accelerate the adoption of high-performance semiconductor platforms. The United States leads regional growth with OEMs such as Tesla, General Motors, and Ford increasingly investing in in-house semiconductor development, domain controllers, and autonomous-driving compute platforms. Federal policy initiatives-including the CHIPS and Science Act and Infrastructure Investment and Jobs Act-are strengthening domestic manufacturing capacity and reducing import dependency, thereby improving supply chain resilience.

North America also leads in autonomous vehicle innovation, with Waymo, Cruise, and Tesla driving demand for sensor-fusion-optimized and AI-enabled System Basis Chips. The region’s early transition to 800-volt EV architectures, coupled with strong leadership in silicon carbide (SiC) technology, is further propelling demand for advanced powertrain-oriented System Basis Chips that enable superior efficiency, thermal performance, and rapid-charging compatibility.

Europe accounts for approximately 23% of global market share in 2025, driven by concentrated automotive manufacturing in Germany, the United Kingdom, France, and Spain, stringent regulatory frameworks, and established semiconductor design capabilities. Germany dominates European semiconductor consumption, with companies including Bosch, Continental, ZF, and BMW systematically integrating advanced System Basis Chips into vehicle platforms meeting stringent Euro NCAP safety requirements and emerging EU autonomous vehicle regulations.

The European market demonstrates particular emphasis on safety system integration, with Advanced Driver Assistance Systems (ADAS) sensors achieving higher penetration than North American markets, driven by regulatory mandates and consumer preference for safety-oriented technologies. European automotive suppliers, including Infineon Technologies, STMicroelectronics, and NXP, are leveraging regional proximity to automotive customers for close system integration and customization, supporting next-generation vehicle architectures. The consolidation of automotive supply chains toward major tier-1 suppliers creates opportunities for System Basis Chip providers to establish partnerships with dominant regional suppliers.

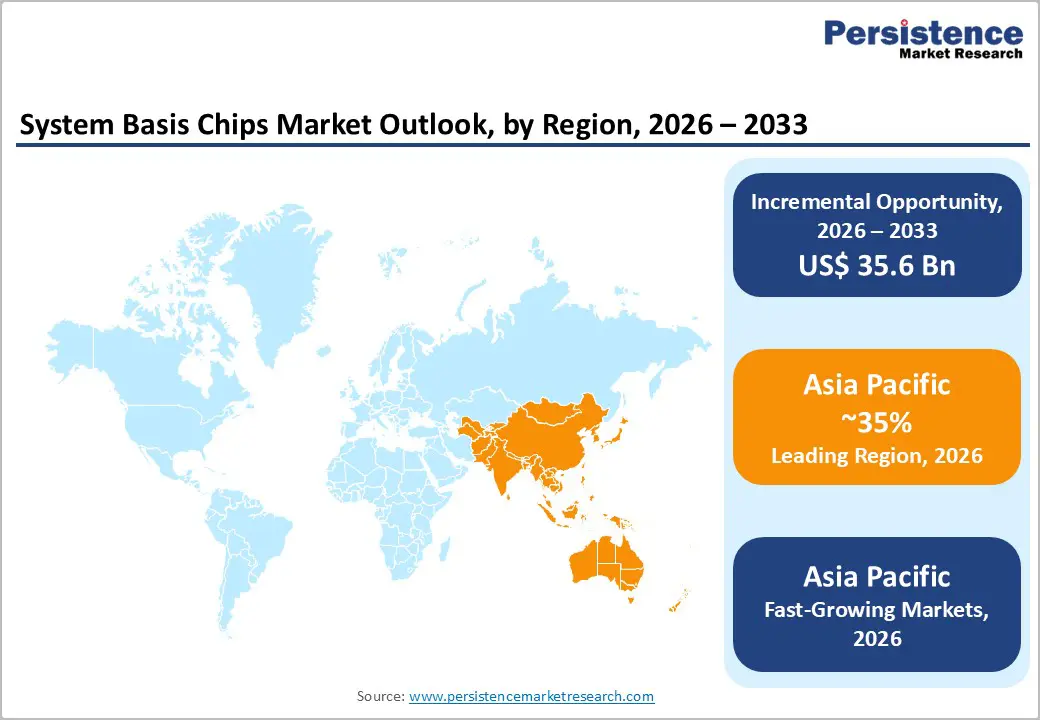

Asia Pacific emerges as the fastest-growing region, projected at 13.8% CAGR through 2032, driven by massive EV production expansion, emerging autonomous vehicle development, and established semiconductor manufacturing infrastructure across China, Japan, India, and Southeast Asia. China dominates regional semiconductor consumption, with automotive production exceeding 30 million units annually and EV production surpassing North American and European production combined, creating extraordinary demand for System Basis Chips across powertrain, safety, and infotainment applications.

Chinese automotive OEMs, including BYD, Nio, Li Auto, and XPeng are systematically integrating advanced System Basis Chips into vehicle platforms, with BYD’s vertical integration into semiconductor design establishing domestic System Basis Chip production capabilities, reducing foreign semiconductor dependency. India’s EV market expansion, with passenger EV production surging 22.5% year-over-year in 2024, combined with government incentive programs including the FAME II scheme and PLI programs, is expected to drive accelerated system-based chip adoption as Indian OEMs and global manufacturers establish production capacity. The regional concentration of semiconductor manufacturing capacity, including TSMC, Samsung, and emerging Chinese foundries, positions the Asia Pacific as critical for global System Basis Chip supply, with capacity fully allocated through 2027 according to Yole Group analysis.

The global system basis chips market demonstrates a moderately consolidated structure, with a mix of established semiconductor leaders, emerging specialized suppliers, and increasing vertical integration by automotive OEMs. Large multinational semiconductor firms collectively hold a significant share of the market by leveraging deep expertise in power management, vehicle networking, embedded processing, and functional safety. At the same time, the industry is experiencing structural shifts as major EV manufacturers expand in-house semiconductor design to secure supply chains, reduce dependency on external vendors, and optimize chips for proprietary vehicle platforms.

In parallel, rapidly advancing suppliers in Asia supported by strong government incentives and expanding design capabilities are strengthening their presence, particularly in power electronics and high-voltage architectures. Competitive differentiation increasingly revolves around advancements in silicon carbide technology, integrated safety and security features, domain and zonal architecture compatibility, and chip-level optimization for autonomous driving and software-defined vehicle platforms, shaping long-term market positioning and technological leadership.

The market is expected to reach US$ 32.7 billion in 2026.

Growth is driven by the rise in EV adoption, 800-volt architectures, expanding ADAS use, autonomous vehicle development, 5G connectivity, and software-defined vehicle platforms.

Asia Pacific leads with about 35% share in 2024 and is also the fastest-growing region.

Major opportunities lie in telematics and infotainment growth and advanced sensor fusion and edge AI for autonomous vehicles.

The leading market players include Infineon Technologies, NXP Semiconductors, STMicroelectronics, Texas Instruments, and Renesas Electronics, among others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Vehicle Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author