ID: PMRREP3082| 200 Pages | 2 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

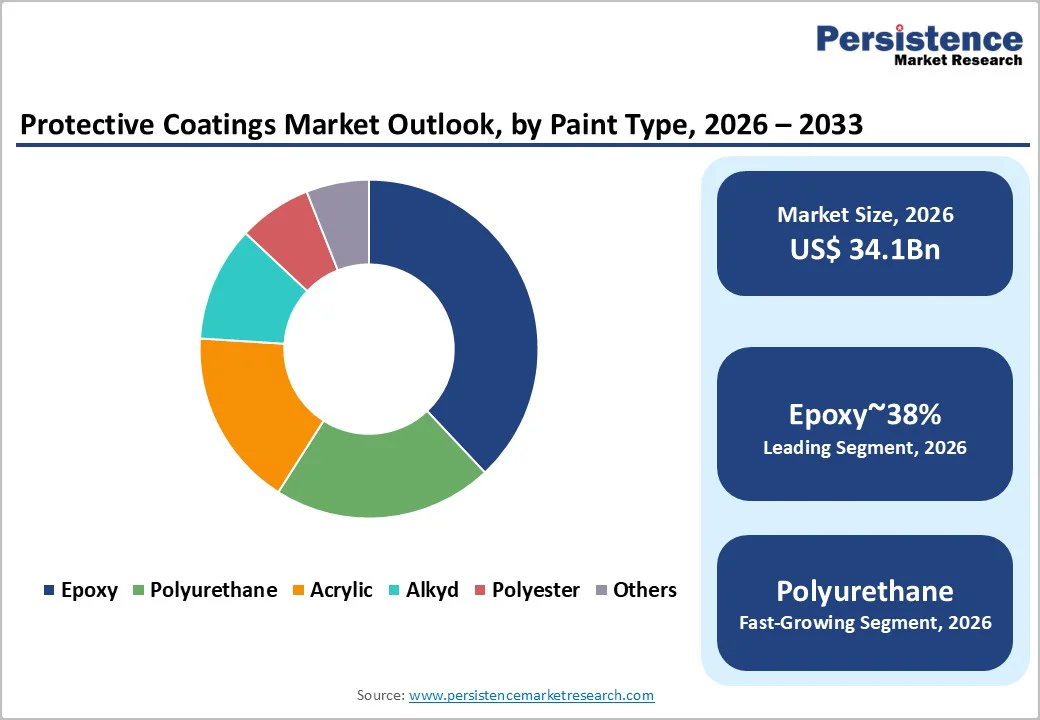

The global protective coatings market size is likely to be valued at US$ 34.1 Billion in 2026 and is expected to reach US$ 54.4 Billion by 2033, growing at a CAGR of 6.9% during the forecast period from 2026 and 2033.

The market is experiencing robust growth driven by escalating infrastructure development activities worldwide and stringent corrosion protection regulations across industrial sectors. The oil and gas industry's expansion, particularly in offshore exploration and LNG facilities, coupled with the renewable energy sector's rapid scaling especially in wind turbines and solar installations, is creating substantial demand for high-performance protective coating systems.

| Key Insights | Details |

|---|---|

| Protective Coatings Market Size (2026E) | US$ 34.1 Billion |

| Market Value Forecast (2033F) | US$ 54.4 Billion |

| Projected Growth CAGR (2026 - 2033) | 6.9% |

| Historical Market Growth (2020 - 2025) | 6.2% |

Expanding Global Infrastructure and Industrial Output Driving Coatings Demand

Global infrastructure modernization programs are significantly increasing the need for protective coatings across construction, transportation, and industrial sectors. According to the Asian Development Bank, developing Asia requires nearly US$ 1.7 trillion each year in infrastructure investments through 2030 to maintain economic growth and meet climate goals. In India, the manufacturing sector now contributes around 17% to GDP, supported by initiatives such as the Production Linked Incentive (PLI) schemes that continue to accelerate industrial output.

In the United States, the construction sector contributes approximately 4.5% to national GDP and includes more than 745,000 general contractor firms employing over 7.6 million workers. This vast infrastructure network requires ongoing use of protective coatings for corrosion prevention, weatherproofing, and extending asset life. Aging bridges, highways, and public utilities demand frequent maintenance using advanced high-performance coating systems, ensuring durability and long-term structural safety. As countries modernize and expand their infrastructure, the demand for reliable protective coating solutions continues to accelerate globally.

Rising Renewable Energy Investments and Offshore Oil & Gas Expansion Boosting Consumption

The global shift toward renewable energy and continued development of offshore energy assets are major contributors to protective coatings demand. Offshore wind turbines require advanced coating systems on towers, blades, and nacelles to withstand saltwater corrosion, UV exposure, and harsh atmospheric conditions, ensuring long-term operational efficiency. Solar installations also rely on protective coatings to maintain performance by preventing surface degradation caused by environmental factors.

At the same time, the oil and gas industry remains a critical market segment, using coatings to protect pipelines, offshore platforms, and storage vessels in highly corrosive environments. In 2024, this sector accounted for around 21.7% of global protective coatings consumption, supported by LNG terminal expansion and petrochemical growth in the Middle East and U.S. Gulf Coast. Emerging technologies such as self-healing coatings and nanotechnology-based formulations are further enhancing durability, reducing maintenance needs, and lowering lifecycle costs, making them highly valuable for long-term energy infrastructure protection.

High Initial Costs and Application Complexity Limiting Market Adoption

High-performance protective coatings-especially epoxy, polyurethane, and specialized advanced formulations-often come with higher upfront costs, which limit their adoption in price-sensitive regions and segments. These coatings typically require rigorous surface preparation, such as achieving Sa2.5 cleanliness levels, along with controlled application conditions to ensure strong adhesion and long-term performance.

Multiple coating layers, strict dry film thickness (DFT) requirements, and the need for trained professionals and specialized tools further increase project complexity and cost. In emerging markets across Africa and parts of Asia Pacific, limited local manufacturing capacity and reliance on imports add additional cost pressures. Longer curing times for certain systems can also delay project schedules, making them less attractive for fast-paced construction or industrial projects where speed is a priority. These challenges make it difficult for some users to justify the initial investment despite the long-term benefits of reduced maintenance and extended asset life.

Environmental Regulations Increasing Compliance Burden for Manufacturers

Increasingly strict regulations on volatile organic compound (VOC) emissions are creating significant challenges for manufacturers of traditional solvent-based protective coatings. In the United States, the Environmental Protection Agency (EPA), under 40 CFR 59, enforces specific VOC limits across various coating categories, pushing manufacturers to redesign formulations. The European Union imposes even stricter emission guidelines, accelerating the shift toward water-based and powder coating technologies.

Although these sustainable alternatives support global environmental goals, they may present performance limitations in extreme industrial conditions, requiring careful balancing of regulatory compliance and application needs. Compliance also requires extensive product testing, certification processes, and detailed documentation, increasing development time and operational costs. Manufacturers and applicators must continually upgrade technologies, equipment, and processes to meet these evolving standards. These regulatory pressures create barriers for smaller companies and slow down overall market expansion despite growing interest in eco-friendly protective coating solutions.

Growing Demand for Sustainable, High-Performance, and Advanced Coating Technologies

The growing global focus on sustainability is creating strong opportunities for companies developing eco-friendly and advanced protective coating solutions. Major players are increasingly investing in technologies such as powder coatings, bio-based resins, and VOC-free systems to meet tightening environmental regulations. PPG Industries aims to achieve 50% of total sales from sustainably advantaged products by 2030, with increased investment in powder coatings. In March 2024, Sherwin-Williams launched Repacor SW-1000, a 100% solids, VOC-free coating designed for offshore wind turbines and heavy industrial steel structures, offering full corrosion protection in a single thick coat.

Arkema strengthened its sustainable portfolio with new product launches at the American Coatings Show 2024 and received Mass Balance ISCC+ certification at its Spain facility. AkzoNobel is developing advanced powder coatings tailored for electric vehicle batteries. Additionally, innovations in nanotechnology and self-healing coatings provide superior durability, reduced maintenance, and improved lifecycle performance, creating strong competitive advantages for early adopters.

Strong Growth Potential across Emerging Asia Pacific Infrastructure Markets

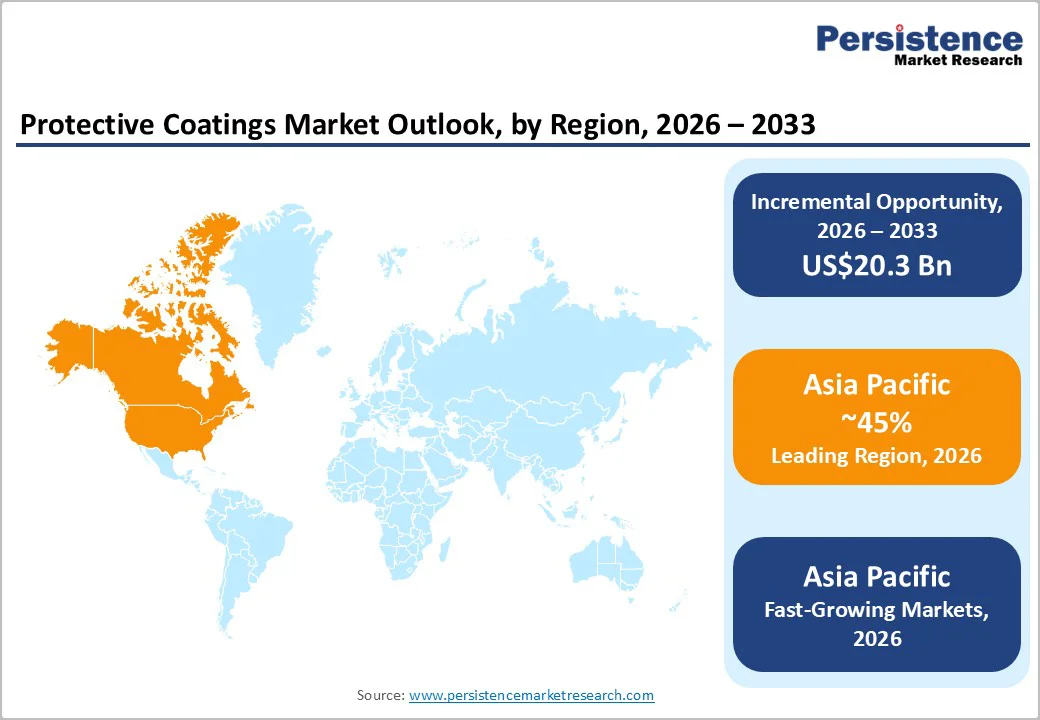

Asia Pacific remains the most lucrative region for protective coatings, expected to achieve the highest growth rate due to ongoing industrial development, rapid urbanization, and major infrastructure investments. The region is projected to hold nearly 45% of global market share, with China, India, Japan, and South Korea driving substantial demand. India’s Make in India initiative, along with major advancements in automotive, construction, and power sectors, continues to boost protective coatings consumption.

China’s extensive manufacturing base and push for sustainable, green infrastructure further increase the adoption of advanced coating technologies. Japan and South Korea lead in high-performance coatings for automotive and electronics manufacturing, where water-based technologies are steadily replacing solvent-based systems. ASEAN countries such as Vietnam, Indonesia, and Thailand are benefiting from industrial relocation trends and expanding logistics and port infrastructure. Rapid growth in regional renewable energy installations including offshore wind and large-scale solar projects provides additional opportunities for specialized high-durability coating systems.

Epoxy coatings hold the dominant position in the global protective coatings market, accounting for approximately 38% market share due to their superior adhesion, chemical resistance, and durability. These coatings are widely used in industries such as oil and gas, marine, and infrastructure where assets face aggressive corrosion and environmental challenges. Their ability to protect steel and concrete structures under severe operating conditions makes them indispensable for long-term asset protection. Technological advancements, such as the introduction of 100% solids epoxy formulations and epoxy-based intumescent fire protection coatings, continue to strengthen this segment. The combination of performance reliability and lifecycle cost benefits ensures epoxy coatings remain the preferred choice for heavy-duty applications worldwide.

Solvent-based coatings lead the protective coatings market with around 41% share, supported by their proven performance, application flexibility, and strong presence across industrial segments. These coatings offer excellent flow characteristics, faster drying times, and strong adhesion on a wide range of substrates, making them ideal for use in strict environments such as petrochemical facilities, marine structures, and oil and gas operations. However, the segment is facing increased scrutiny due to VOC emission regulations. Manufacturers are now developing hybrid formulations that merge the strengths of solvent-based and water-based technologies to meet regulatory and performance demands.

The infrastructure and construction segment holds the largest share of the protective coatings market at around 32%, supported by global infrastructure upgrades, urbanization, and the need for corrosion protection for public structures. Applications span bridges, highways, tunnels, commercial buildings, and utility networks that require long-term resistance against weathering, moisture, and chemical exposure. The oil and gas sector is the fastest-growing segment due to increasing investments in LNG terminals, offshore platforms, and pipeline expansions across the Middle East and U.S. Gulf Coast. Marine, renewable energy, and power generation industries also show strong growth, driven by large-scale offshore wind farms and solar power installations. Additional applications in refineries, water treatment plants, and cargo containers further stabilize market demand across cycles.

North America accounts for about 23% of global protective coatings demand, supported by strict regulatory standards, aging infrastructure, and strong industrial activity. The United States remains the dominant contributor, with the construction sector representing 4.5% of GDP and supporting millions of workers. This creates steady demand for high-performance coatings used to protect bridges, commercial buildings, public utilities, and industrial assets.

The region also benefits from a mature automotive industry and expanding electric vehicle production, which increasingly require advanced coating solutions. EPA regulations under 40 CFR 59 are pushing the industry toward low-VOC and water-based technologies. New federal building codes introduced in 2025 have increased the use of fire protection coatings in public infrastructure. Companies such as PPG and Sherwin-Williams are expanding their fire-resistant and offshore wind-specific coatings portfolios. Growing investments in offshore wind projects along the Atlantic Coast and Gulf of Mexico further support demand for specialized marine and corrosion-resistant coatings.

Europe is a mature and technologically advanced coatings market shaped by strict environmental regulations and a strong commitment to sustainability. EU VOC emission directives have driven manufacturers to transition toward water-based and powder coatings, making the region a leader in eco-friendly technologies. Germany drives significant demand due to its automotive manufacturing strength, while the UK continues to adopt protective coatings across expanding residential and commercial construction projects.

France and Spain are accelerating market growth through infrastructure renewal and industrial expansion. The region’s focus on renewable energy, especially offshore wind developments in the North Sea and Baltic Sea, is generating high demand for specialized marine-grade coatings. Arkema’s achievement of Mass Balance ISCC+ certification in Spain highlights industry efforts toward sustainable production. The 2025 merger between AkzoNobel and Axalta, creating a US$ 17 billion global coatings leader, is expected to enhance research capabilities and expand distribution networks internationally, further strengthening Europe’s influence in the global market.

Asia Pacific is the largest and fastest-growing region in the protective coatings market, accounting for about 45% of global demand. Growth is fueled by rapid industrialization, large-scale infrastructure investments, and expanding manufacturing bases across China, India, Japan, and South Korea. China leads the region with extensive construction projects and a strong industrial sector, while India’s growth is supported by the Make in India initiative and robust expansion in automotive, electronics, and engineering sectors.

According to the Asian Development Bank, developing Asia must invest nearly US$ 1.7 trillion annually in infrastructure through 2030, creating substantial demand for protective coatings. Japan and South Korea continue to advance high-performance coatings for automotive and electronics manufacturing, where water-based technologies are gaining traction. ASEAN countries including Vietnam, Indonesia, and Thailand are benefiting from industrial relocation, expanding port development, and manufacturing growth. Increasing investment in offshore wind farms and solar energy projects across the region further accelerates the adoption of advanced protective coating systems.

The global protective coatings market is moderately fragmented, with multinational leaders and strong regional players competing across diverse applications. Major companies such as Sherwin-Williams, PPG Industries, and the merged AkzoNobel-Axalta entity hold significant market share and continue to expand through acquisitions and technology investments. Market leaders are prioritizing sustainable, high-performance coating solutions, including low-VOC, VOC-free, and advanced formulations like nanotechnology-based and self-healing coatings. Regional players strengthen their presence through localized product portfolios, tailored distribution networks, and competitive pricing. Overall, innovation, sustainability, and strategic expansion remain the primary competitive drivers shaping the global protective coatings landscape.

The global Protective Coatings Market is expected to reach US$ 54.4 Billion by 2033, growing from US$ 34.1 Billion in 2026 at a compound annual growth rate (CAGR) of 6.9% during the forecast period from 2026 to 2033.

The market is primarily driven by accelerating infrastructure investments worldwide, with developing Asia requiring approximately US$ 1.7 trillion annually through 2030, and rising demand from renewable energy sectors, particularly offshore wind turbines and solar installations. Additionally, the oil and gas industry's expansion in offshore exploration and LNG facilities creates substantial demand for high-performance protective coatings.

Epoxy coatings dominate the resin type segment with approximately 38% market share, owing to their exceptional chemical resistance, superior adhesiveness, and outstanding durability. These properties make epoxy-based formulations indispensable across oil and gas, marine, and infrastructure industries where assets require protection against severe corrosive environments.

Asia Pacific dominates the global protective coatings market with approximately 45% market share, driven by rapid industrialization, massive infrastructure development, and strong manufacturing growth across key economies including China, India, Japan, and South Korea. The region also represents the fastest-growing market globally, supported by government-led initiatives and increasing adoption of advanced coating technologies.

Significant opportunities exist in developing sustainable coating technologies, particularly water-based and powder coating systems that meet stringent VOC regulations. The renewable energy infrastructure segment, especially offshore wind turbines and solar installations, presents substantial growth potential as these assets require specialized protective coatings. Additionally, expansion in Asia Pacific emerging markets driven by infrastructure development programs offers lucrative market entry and growth opportunities.

Key market players include The Sherwin-Williams Company, Akzo Nobel N.V., PPG Industries Inc., BASF Coatings, Axalta Coating Systems Ltd., Jotun A/S, Hempel A/S, Kansai Paints Co. Ltd., and The Valspar Corporation, among others. The November 2025 merger between AkzoNobel and Axalta created a global coatings leader with approximately US$ 17 billion in combined revenue, positioning it alongside Sherwin-Williams and PPG as a top-tier industry player.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Resin Type

By Technology

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author