ID: PMRREP4319| 297 Pages | 10 Jul 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

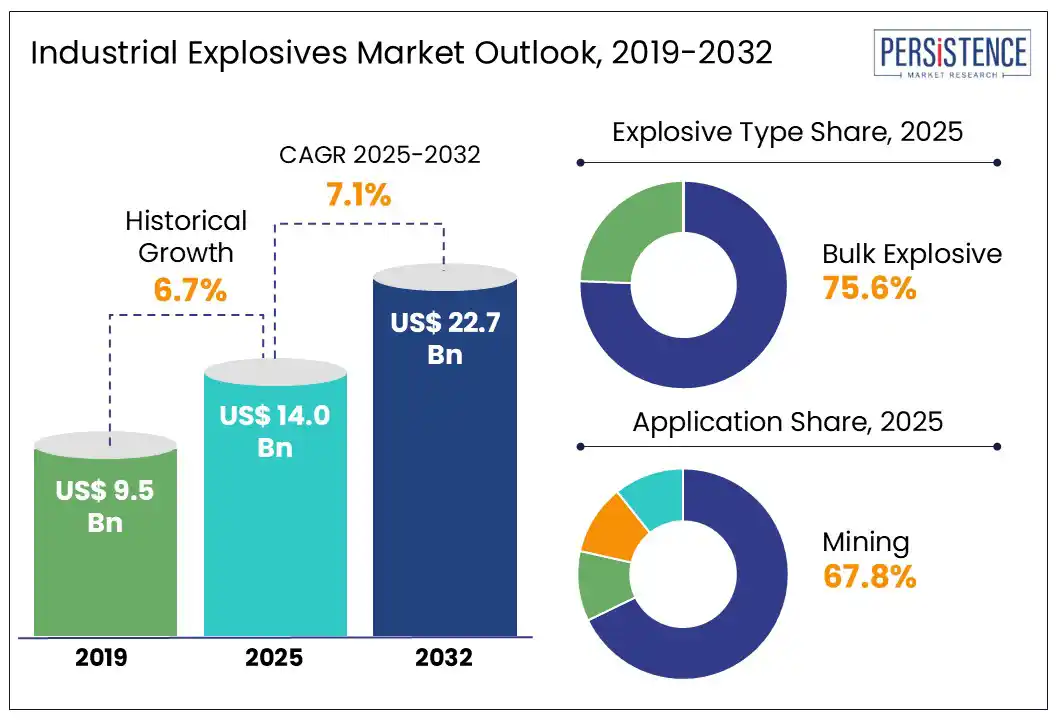

According to the Persistence Market Research report, the global industrial explosives market size is likely to be valued at US$ 14.0 Bn in 2025 and is expected to reach US$ 22.7 Bn by 2032, growing at a CAGR of 7.1% during the forecast period from 2025 to 2032.

Mining momentum continues across South America, with Brazil’s sector hitting USD 10.12 billion in Q3 2024 and Chile driving copper and lithium output to meet clean energy targets. In India, mineral production rose 5.9% YoY, and the U.S. construction sector reached US$2.2 trillion in 2024, signalling the rise in consumption of energy materials in both infrastructure and resource extraction.

Europe and Oceania have witnessed a strategic reshuffle. EURENCO’s €500 million investment, MANUCO acquisition, and 3D-printed modular charge rollout mark a high-tech leap in energetic component manufacturing. Orica’s low-carbon TAN blast and Dyno Nobel’s EMEA-LATAM expansion demonstrate the market's shift toward green and regionalized solutions.

Key Industry Highlights:

|

Global Market Attribute |

Details |

|

Market Size (2024A) |

US$ 13.1 Bn |

|

Estimated Market Size (2025E) |

US$ 14.0 Bn |

|

Projected Market Value (2032F) |

US$ 22.7 Bn |

|

Value CAGR (2025 to 2032) |

7.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.7% |

Advances in explosive compositions and detonation systems are reshaping the energy materials industry. The U.S. Army Research Laboratory is developing safer yet more powerful materials, such as BODN, that outperform TNT while eliminating toxic hazards.

Orica’s milestone of producing its 100 millionth electronic detonator at its Brownsburg facility in Canada underlines global demand for precision blasting tools such as the WebGen™ system, which enables wireless, delay-free detonation through rock, air, or water. This evolution reflects how digital initiation and engineered energetics now drive both safety and scale across defense, mining, and civil operations.

Dyno Nobel’s launch of the world’s first electric bulk explosive MPU at Fortescue’s Solomon site in Western Australia shows how decarbonization and safety converge. Powered by a 390-kWh lithium-polymer battery and backed by a 650-kWh renewable fast charger, the innovation ties directly to a broader emissions-cutting roadmap. Its Missouri plant’s tertiary abatement project alone is set to slash 520,000 tonnes of CO2e annually, cutting 30% of operational emissions.

BME, backed by South Africa's Omnia Group, is also driving post-pandemic innovation, showcasing digital explosives platforms and new emulsions tailored for precision blasting in global markets.

Strict environmental controls and safety regulations continue to restrict how far the blasting materials industry can grow. Frequent policy revisions, delays in obtaining licenses, and region-specific restrictions increase operational hurdles for mining and construction firms.

Many countries are tightening the rules around storage, transport, and on-site handling, making compliance costlier and more complex, especially for smaller players and emerging economies.

At the same time, heightened public scrutiny and concerns around ground vibrations, air blasts, and toxic fume emissions are fueling opposition to blasting operations near populated or ecologically sensitive zones. Transporting sensitive compounds like emulsions, ANFO blends, or nitrate-based mixtures across long distances adds to the liability. These challenges are forcing firms to balance performance with safety, slowing deployment in newer markets.

Surging mining and infrastructure activity across high-growth territories continues to unlock fresh ground for explosives and rock fragmentation companies.

Leading players like Enaex, BME, and Dyno Nobel are capturing this momentum through expanded footprints, strategic deals, and local investments. For instance, Enaex’s $45 million acquisition of an Australian fragmentation company added five emulsion plants and over 40 mobile units to its portfolio, while BME’s U.S. debut introduced advanced electronic initiation systems and high-energy emulsions to large-scale blasting contractors.

Joint ventures are emerging as a powerful tool to integrate local strength with global blasting technology. BME’s alliance with a key Indonesian manufacturer enabled the commissioning of its first mobile manufacturing units and emulsion plant outside its home base, expanding access to Southeast Asia’s fast-evolving mining markets.

Global data confirms the upside Asia now commands over 60% of global mining production, and emerging economies across multiple continents are scaling quarrying, mineral extraction, and energy transition efforts at pace. All of this unlocks enormous room for innovation-led detonation solutions across diverse geographies.

A sharp surge in global mining and construction efforts is intensifying the need for high-energy materials, with U.S. nonfuel mineral production alone reaching $106 billion in 2024, per the USGS Summary Report 2025. Crushed stone led the pack with an estimated US$25.7 billion in value, accounting for 24% of total production. The rise in output of industrial minerals such as gypsum, feldspar, and clay reflects steady activity in aggregate-based industries.

Large infrastructure upgrades under the Bipartisan Infrastructure Law, including the Gordie Howe International Bridge and JFK Airport redevelopment continue to push extraction operations, strengthening demand for blasting components across major construction zones.

India and China are accelerating resource extraction across Asia Pacific, adding strong momentum to the region’s mining-driven consumption of energetic materials. India reported mineral production of INR 192,734 crore in FY 2023–24, supported by flagship infrastructure schemes like Bharatmala Pariyojana and the Gati Shakti Master Plan. Mining clusters in Odisha, Chhattisgarh, and Gujarat are expanding to meet infrastructure-led raw material needs. China, with its Belt and Road Initiative and large-scale inland connectivity projects, is fueling activity across key mineral basins.

This continuous growth across Asia Pacific is keeping the demand steady for blasting agents used in quarrying, open-pit, and tunnel excavation, especially for strategic minerals critical to EVs and clean energy.

Bulk explosives lead the charge with a 75.6% share in the blasting materials segment, driven by rising demand for safer, greener, and high-performance solutions.

Dyno Nobel, on April 1, 2025, launched trials of the world’s first electric bulk explosive mobile processing unit (MPU) at Fortescue’s Solomon site in Australia. With a 390 kWh lithium polymer battery and 650 kWh fast-charging station, the MPU slashes workplace risks and emissions. This follows Dyno Nobel’s US$8 million N2O abatement project in Missouri, which cuts 520,000 tonnes of CO2e annually, pushing its net-zero by 2050 goal.

The environmental edge of bulk-grade detonation technology gained further ground on June 27, 2024, when Orica partnered with De Beers Canada at the Gahcho Kué diamond mine. Their deployment of Fortis™ Protect bulk explosives, paired with i-kon™ III electronic detonators and an upgraded MMU™ delivery system, led to a 78.85% drop in nitrate levels a benchmark in eco-compliant blasting. This outcome, part of De Beers’ “Building Forever” vision, reflects how bulk charge systems now combine impact with responsibility in harsh terrain and regulated zones.

Mining holds the estimated market share of around 67.8% in 2025, driven by the sector’s massive consumption of high-energy detonation materials for extraction and fragmentation. According to the World Mining Data 2024, global mining output reached18.7 billion metric tons in 2022, up from 11.3 billion in 2000, showing persistent expansion in mineral-rich economies. Asia accounted for 61.7% of global mining activity, with production surging across non-ferrous meta,ls, industrial minerals, and mineral fuels key segments heavily reliant on commercial blasting technologies.

Most of this growth stems from developing and upper-middle-income nations, where mineral resources fuel GDP and infrastructure growth. The same data reveals these regions lead global extraction volumes, reinforcing their role as core end-users of advanced blasting agents.

The Rare Earth Elements (REE) market is a stark example of this trend, with China, the U.S., Australia, and Myanmar responsible for nearly 97% of total REE production, driving sustained use of bulk and packaged explosives in remote and high-volume mining zones.

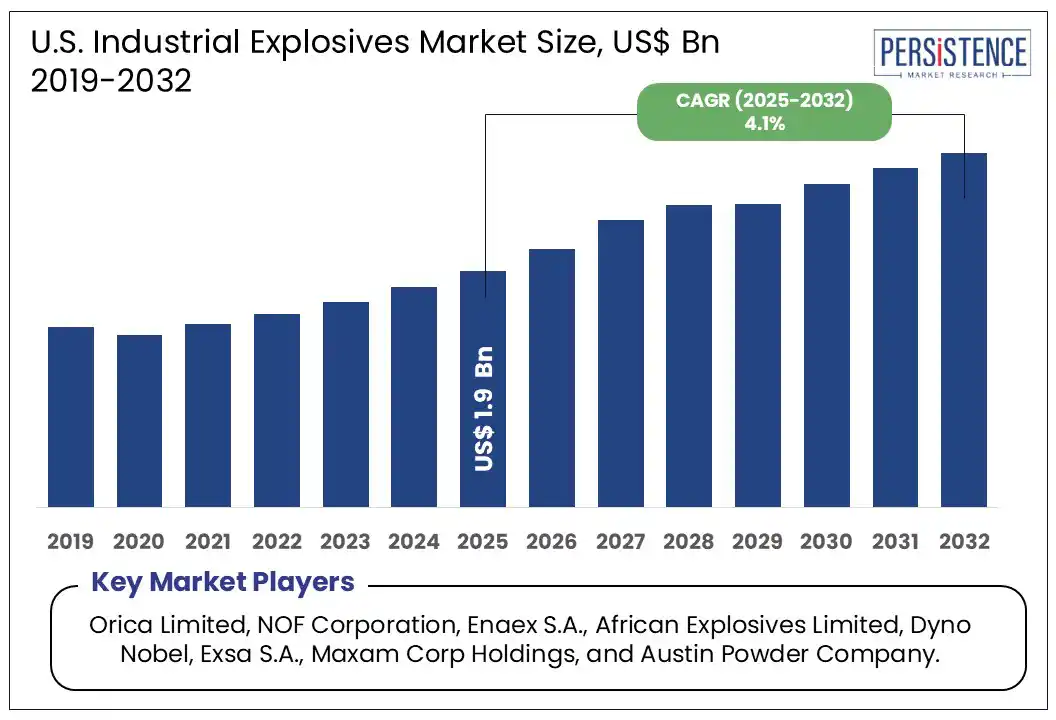

The U.S. and Canada are modernizing their blasting operations with advanced digital detonators, emission-free mobile processing units, and AI-driven safety tools.

Dyno Nobel’s launch of shock-resistant DigiShot® XR detonators and trials of electric MPUs at Fortescue show a clear shift toward precision and sustainable energy materials handling. Enaex and Normet’s pilot project for teleoperated underground charging reflects the growing move to automation and remote handling to reduce site-level hazards.

Canada’s mining sector, valued at US$161 billion in 2022, is driving stronger demand for advanced blasting systems across over 200 active mines. Producers are scaling up operations in potash, critical metals, and diamonds, prompting companies like Orica to deploy nitrate-reduction frameworks in sub-Arctic sites. Austin Powder’s fresh backing from AIP is reinforcing its innovation pipeline and tightening its grip on clean-tech explosives, signaling a shift in how North America powers its resource extraction.

Europe commands an 11.3% market share, fueled by rapid defense modernization and precision charge systems. EURENCO’s Modular Charge for NATO 155mm artillery, built with robotized 3D printing in France and Sweden, signals a shift toward smarter, scalable munitions. With mining support activities still accounting for the smallest revenue share, efficiency-focused systems are gaining traction across core sectors like metal ore and coal extraction.

The region’s extractive sector, generating $185.3 billion in 2022, is leaning on high-tech blasting tools to drive productivity across lignite, petroleum, and quarry operations. With nearly three-quarters of the sector’s workforce tied to mining and quarrying, demand for advanced detonation systems is rising. Europe’s manufacturers are anchoring supply chains with integrated facilities and automation to match surging mining output.

The industrial explosives market remains consolidated, with Orica, Enaex, Dyno Nobel, Maxam, and Austin Powder setting the pace through targeted acquisitions, green technology launches, and expansion into new territories.

Orica’s acquisition of Exsa expanded its reach in Latin America, while its hydrogen-based TAN and electronic detonator milestones underline its commitment to sustainable mining. Enaex is rapidly building market presence across North America and Africa through joint ventures and strategic buyouts, positioning itself to compete head-on with other major players. Dyno Nobel is advancing battery-powered MPUs and next-gen detonators to meet rising demand for safer, low-emission blasting.

Maxam is strengthening its foothold in Latin America with advanced cartridge manufacturing, supporting environmentally aligned mining operations. Austin Powder is scaling up global operations following a strategic investment from AIP, while BME, NOF Corporation, and

African Explosives are leveraging joint ventures and digital tools to solidify regional positions. EURENCO, through automation and defense-grade expansion, is reinforcing its role in high-performance energetic materials. These leaders are not only dominating supply, they’re actively reshaping the blasting landscape through sustainability, precision, and strategic integration.

The global industrial explosives market is projected to be valued at US$ 14.0 Bn in 2025.

Bulk Explosives dominate the market with a 75.6% share in 2025, driven by rising demand for high-performance, low-emission blasting solutions across mining and infrastructure sectors.

The market is poised to witness a CAGR of 7.1% from 2025 to 2032.

Smart blasting technologies, digital detonators, and low-emission explosive systems are reshaping energy material applications across mining, defense, and infrastructure.

Strategic global expansion, joint ventures, and acquisitions in high-growth regions are unlocking new demand for advanced blasting solutions.

Key market players include Orica Limited, NOF Corporation, Enaex S.A., African Explosives Limited, Dyno Nobel, Exsa S.A., Maxam Corp Holdings, and Austin Powder Company.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available on Report |

By Explosive Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author