ID: PMRREP3226| 182 Pages | 10 Jul 2025 | Format: PDF, Excel, PPT* | Consumer Goods

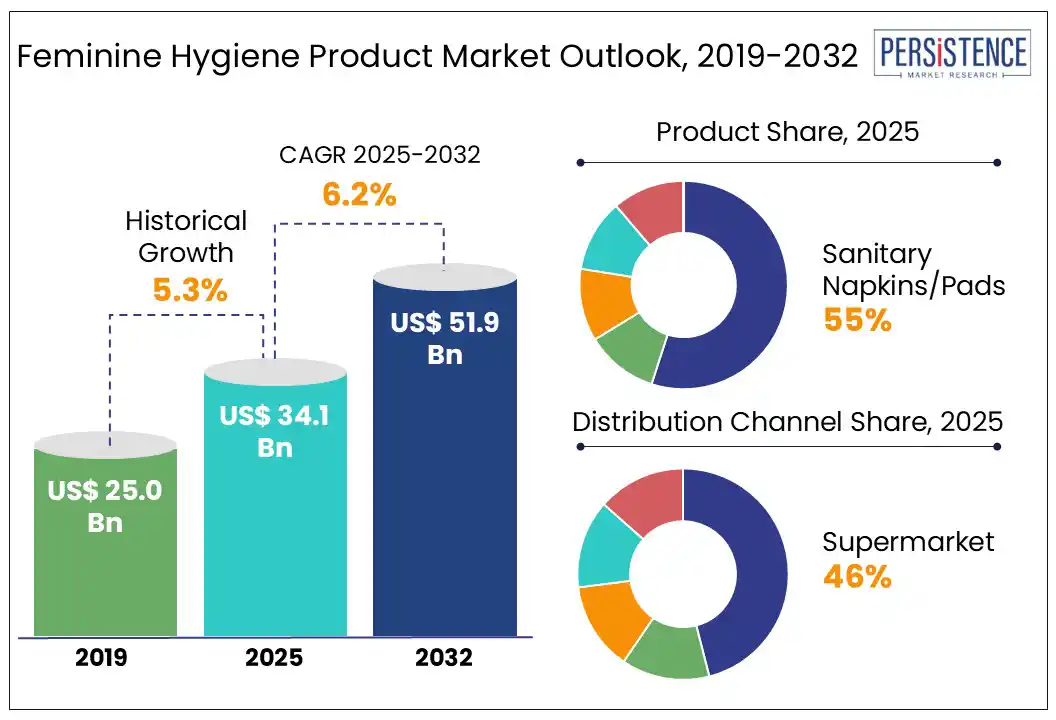

The global feminine hygiene product market size is likely to be valued at US$ 34.1 Bn in 2025 and is estimated to reach US$ 51.9 Bn in 2032, at a CAGR of 6.2% during the forecast period 2025 - 2032.

Rising awareness and education around menstrual hygiene, supportive government initiatives, and increasing disposable incomes, particularly in low- and middle-income countries drive adoption of hygiene products for feminine.

Feminine hygiene products encompass a wide range of items designed to support menstrual health, cleanliness, and comfort for women and girls. These products include sanitary napkins, tampons, menstrual cups, and specialized hygiene washes. They play a crucial role in promoting health, dignity, and participation in daily activities, especially during menstruation.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Feminine Hygiene Product Market Size (2025E) |

US$ 34.1 Bn |

|

Market Value Forecast (2032F) |

US$ 51.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.3% |

One of the primary drivers for the feminine hygiene product market growth is the rising awareness and education surrounding menstrual hygiene, propelled by global campaigns, government initiatives, and the efforts of local, national, and international NGOs. Private sector-led social programs, such as Procter & Gamble’s ‘Always Keeping Girls in School’ and educational outreach in schools, have helped normalize conversations about menstruation. These initiatives are proving vital in boosting product adoption and improving access to sanitary products, especially in underserved and rural communities. This surge in awareness has led to greater acceptance and usage of feminine hygiene products, thereby fueling the market in the process.

A significant restraint in the adoption of sanitary products is the rigid persistence of cultural taboos and social stigma surrounding menstruation, especially in Asian, African, and Latin American countries. In several communities, even today, menstruation is often misunderstood and seen as a taboo subject, leading to misinformation that prevents open discussions about menstrual health. Worsening this situation is the lack of education and social acceptance, which also restricts market penetration and can adversely impact women’s health outcomes globally.

A prominent opportunity in the feminine hygiene product market lies in the growing demand for sustainable and reusable alternatives, such as biodegradable pads. With increasing concerns about environmental damage, both consumers and manufacturers are markedly shifting toward eco-friendly solutions. Companies are innovating with organic materials and recyclable packaging, and the adoption of these products is expected to accelerate with the increasing awareness of their benefits. Regulatory support for sustainability will also strengthen market growth.

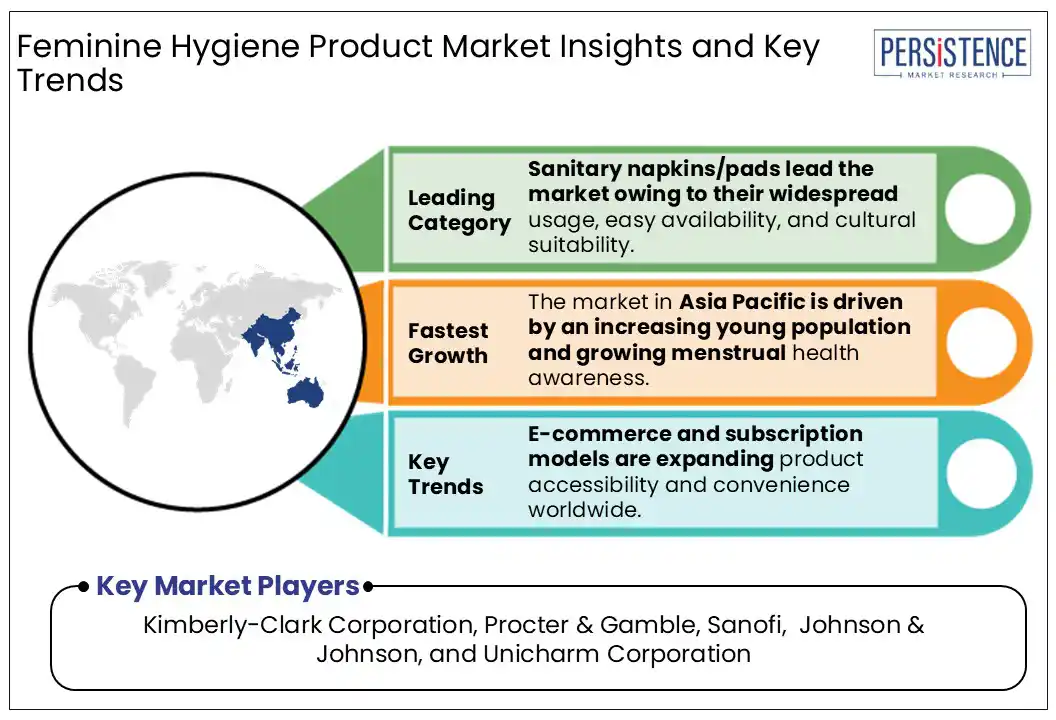

Based on product, this feminine hygiene product market has been segmented into sanitary napkins/pads, tampons, panty liners, menstrual cups, and feminine hygiene wash. Out of these, the sanitary napkins/pads segment is expected to dominate accounting for a market share of 55% in 2025, owing to their widespread usage, easy availability, and suitability for diverse cultural and economic contexts.

Sanitary pads are a staple feminine hygiene product globally, particularly in regions such as Asia Pacific, where they form the primary choice for menstrual hygiene due to their affordability and accessibility. They are available across urban and rural areas and cater to a wide range of income groups. Several governments and organizations distribute them at subsidized rates or for free in low-income regions, boosting their adoption.

Leading manufacturers are investing in product innovations, such as ultra-thin pads with high absorption, biodegradable options, and designs tailored for specific age groups or lifestyles. These developments have reinforced the popularity of sanitary pads.

Based on distribution channel, the market is divided into supermarket, convenience stores, department stores, retail pharmacies, and online purchases. Out of these, the supermarket segment is anticipated to dominate, accounting for 46% of the market share due to its convenience and accessibility.

Supermarkets offer a one-stop shopping experience, allowing consumers to purchase a wide range of feminine hygiene products alongside other household necessities. It provides an extensive selection of brands and product types, catering to diverse consumer preferences and budgets.

Supermarkets often feature discounts and promotional offers, making products more affordable and appealing to a broad customer base. The extensive network of supermarkets ensures product availability across various regions, including urban and suburban areas.

Supermarkets dominate the distribution of feminine hygiene products due to their convenience, variety, and accessibility. The rising prominence of online retail channels indicates a dynamic market poised for further evolution.

Asia Pacific is anticipated to lead the feminine hygiene product market share, accounting for approximately 34% of the market share over the forecast period. The growth is driven by a young population, rising disposable incomes, and growing menstrual health awareness. Government initiatives, such as India’s promotion programs targeting adolescent girls in rural areas, are playing a crucial role in reducing stigma and expanding access to hygiene products. Expanding availability of sanitary napkins and pads in both urban and rural regions, often supported by subsidies, is also promoting the growth of this market in the region.

The feminine hygiene product market in Europe is developing steadily, fueled by increased awareness about various sanitary products, high disposable incomes, and improved accessibility. Although sanitary pads remain a staple, innovations focus on ultra-thin and biodegradable options for environmentally conscious consumers. The market in Europe also benefits from widespread urbanization and supportive government initiatives. Another key driver is that the region is a global leader in sustainability and technological advancements. In Europe, regulations pertaining to product labeling, ingredient disclosure, and environmental impact are becoming more stringent.

The global feminine hygiene product market is highly competitive, marked by the presence of major players such as Procter & Gamble, Kimberly-Clark, and Johnson & Johnson. These players are strengthening their market presence by building extensive product portfolios, fostering brand recognition, and employing robust marketing strategies. These companies continually invest in product innovation to cater to evolving consumer preferences and address sustainability concerns. On the other hand, emerging brands such as Luna Daily and WUKA are gaining traction by introducing eco-friendly and reusable alternatives, including menstrual cups and period underwear. Meanwhile, regional players in Asia Pacific and Africa are addressing local needs through affordable products and strategic distribution partnerships.

The feminine hygiene product market is projected to reach US$ 34.1 Bn in 2025.

Rising awareness and education surrounding menstrual hygiene are the key market drivers.

The feminine hygiene product market is poised to witness a CAGR of 6.2% from 2025 to 2032.

The growing demand for sustainable and reusable alternatives, such as biodegradable pads, is a key market opportunity.

Major players in the Global Feminine Hygiene Product Market include Kimberly-Clark Corporation, Procter & Gamble, Sanofi and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author