ID: PMRREP35480| 199 Pages | 23 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

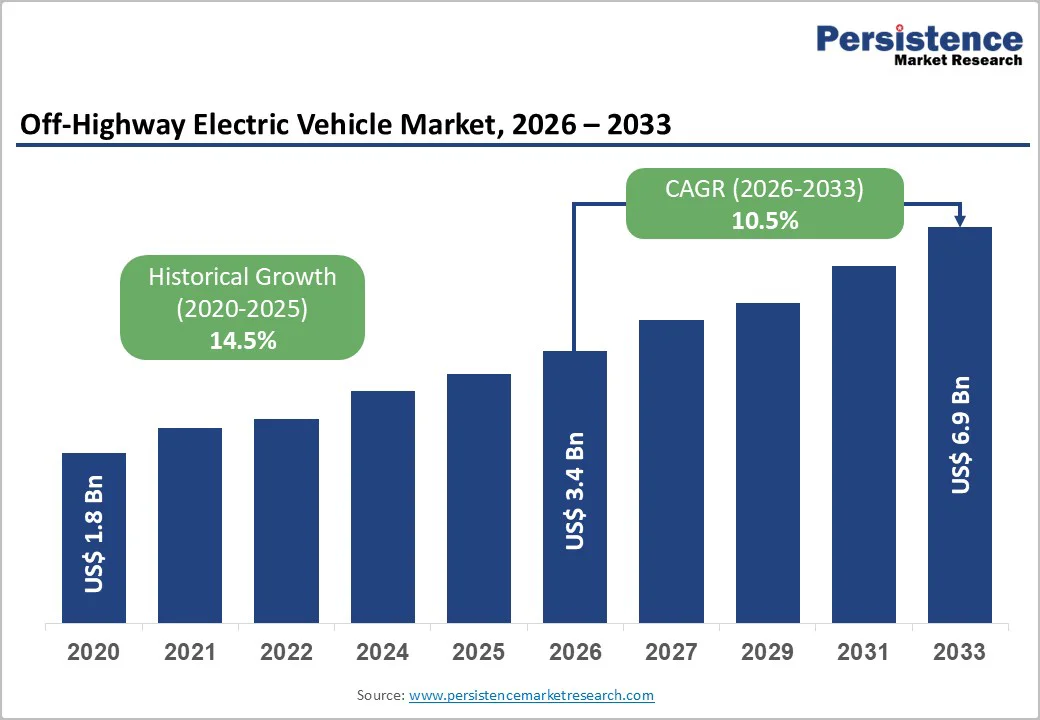

The global off-highway electric vehicle market size is likely to be valued at US$ 3.4 billion in 2026 to US$ 6.9 billion by 2033 growing at a CAGR of 10.5% from 2026 to 2033.

Stringent environmental regulations and emissions reduction targets are key drivers of growth in the off-highway electric vehicle market. Governments worldwide are enforcing tighter emission standards, particularly in sectors such as construction, mining, and agriculture, which rely heavily on diesel-powered machinery. These regulations are pushing companies to adopt electric alternatives to comply with both local and international environmental standards.

| Key Insights | Details |

|---|---|

|

Off-Highway Electric Vehicle Market Size (2026E) |

US$ 3.4 Bn |

|

Market Value Forecast (2033F) |

US$ 6.9 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

10.5% |

|

Historical Market Growth (CAGR 2020 to 2025) |

14.5% |

Advancements in Battery and Electric Powertrain Technologies

Rapid technological innovation in battery chemistry, power management systems, and electric drivetrains is making off-highway electric vehicles more efficient, reliable, and commercially viable. Lithium-ion batteries now offer greater energy density, faster charging, and longer lifecycles, enabling electric machines to handle demanding tasks with extended uptime. For instance, Komatsu’s electric mini excavators and Bobcat’s E10e are equipped with next-gen batteries that offer up to 4–6 hours of continuous operation and fast recharging.

Danfoss Power Solutions and Bosch Rexroth are supplying highly efficient electric drive systems tailored for harsh off-road environments. These advancements reduce the total cost of ownership by lowering fuel and maintenance costs. Additionally, modular battery packs and scalable powertrains allow manufacturers to electrify a broader range of equipment without compromising performance, making electric solutions increasingly attractive across off-highway applications.

Limited Charging Infrastructure in Remote Areas

One of the major restraints in the OHEV market is the lack of charging infrastructure, particularly in remote construction, mining, and agricultural sites where these vehicles are primarily used. Unlike urban EVs, off-highway machines often operate in undeveloped regions with unreliable grid access, making regular charging a logistical challenge. For example, Komatsu and Hitachi Construction Machinery have acknowledged this limitation by introducing hybrid alternatives or machines with portable charging solutions.

However, the adoption of fully electric vehicles is still hindered by the need for high-capacity, fast-charging systems that are both mobile and rugged enough for off-grid use. Companies like JCB have started offering on-site charging trailers, but these solutions are not yet scalable or cost-effective for mass deployment. Without adequate infrastructure support, downtime due to charging delays or battery depletion remains a critical operational risk.

Supply Chain Concentration and Trade Policy Risk

The OHEV value chain is heavily exposed to critical minerals, batteries, and power electronics, which are concentrated in a few countries. Trade tensions and tariffs on imported battery packs, power electronics, and drive systems, particularly between the U.S. and China, are expected to modestly reduce previously forecast growth, as highlighted by global off-highway EV market updates that trimmed CAGR expectations by around 0.7 percentage points. These policies can delay electrification of construction and agricultural fleets by raising equipment costs and complicating sourcing strategies. At the same time, OEMs face supply risk around Li-ion cells, semiconductor components, and high-power connectors, which can extend lead times and hinder fleet deployment schedules.

Urbanization and infrastructure expansion are key growth drivers for the off-highway electric vehicle (OHEV) market.

Urbanization and infrastructure expansion are major growth drivers of the off-highway electric vehicle (OHEV) market, driven by rising demand for sustainable construction and industrial machinery in expanding urban areas. As cities grow, infrastructure projects such as roads, bridges, and commercial buildings increase, driving the need for efficient, low-emission construction equipment. OHEVs provide a cleaner, quieter alternative to traditional diesel-powered machines, helping industries comply with stringent environmental regulations and reduce carbon footprints.

For example, the global off-highway electric vehicle market was valued at USD 3.4 billion in 2026 and is expected to grow at a CAGR of 10.1% through 2033, driven by urbanization and infrastructure development. Leading manufacturers like Hyundai Construction Equipment are investing heavily in electric off-highway vehicles, expanding production capacity and integrating advanced battery technologies to meet growing market demand.

Transition from Lead-Acid to Lithium-Ion in Off-Highway Equipment

Today, lead-acid batteries still dominate off-highway applications, accounting for around three-quarters of installed capacity in some segments due to low upfront cost and a mature supply base. However, Li-ion shipments are growing at over 23% annually across automotive and industrial markets, with the broader automotive Li-ion segment forecast to expand at a CAGR of about 33.7% through 2028.

As battery prices fall and operators experience the benefits of opportunity charging, higher usable energy, and longer cycle life, the installed base will progressively migrate from lead-acid to Li-ion and next-generation chemistries. This presents a high-growth opportunity for Li-ion suppliers, integrators, and OHEV OEMs to upsell premium battery options, smart BMS, and service contracts.

Electrified Construction, Agriculture, and Mining Solutions

Dedicated reports on electric vehicles for construction, agriculture, and mining show market revenues rising from about US$ 4.5 billion in 2024 to US$ 12.0 billion by 2034 (10.3% CAGR) for these applications alone. Electric construction equipment markets are projected to reach US$ 18 billion by the early-2030s, with CAGRs of around 13%, as excavators, loaders, dozers, and cranes shift to battery-electric or hybrid architectures. In agriculture, electric tractors and implements are structurally aligned with sustainable farming and precision agriculture trends, while mining operators are piloting electric haul trucks and loaders to cut ventilation and fuel costs. Collectively, these verticals represent tens of billions of dollars in incremental OHEV demand by the early 2030s.

The Battery Electric Vehicle (BEV) segment leads the off-highway electric vehicle market, holding a 63% share and projected to grow at a CAGR of over 10.2% from 2026 to 2033. Advancements in lithium-ion battery technology have enhanced energy density, charging speed, and lifespan, making BEVs more suitable for demanding applications such as construction and mining. BEVs produce zero emissions during operation, aligning with global environmental regulations and sustainability targets, particularly in urban areas focused on reducing air pollution.

BEVs offer lower operational and maintenance costs due to fewer moving parts and reduced servicing needs. A notable development includes Daimler Truck North America’s (DTNA) launch of a BEV Dealer Certification Program in March 2024. The initiative equips Freightliner dealers to support the growing shift toward electric trucks, ensuring a high-quality customer experience and safe, efficient service infrastructure to meet the increasing demand for battery-electric commercial and off-highway vehicles.

The lead-acid battery segment dominated the off-highway electric vehicle market in 2026, driven by its affordability, proven reliability, and suitability for applications where cost efficiency outweighs performance limitations. Despite lower energy density and shorter lifecycle compared to modern alternatives, lead-acid batteries remain relevant in specific off-highway use cases that prioritize durability and low initial investment.

The lithium-ion battery segment is expected to grow rapidly from 2026 to 2033, supported by its high energy density, lightweight construction, and long cycle life. Li-ion batteries deliver superior range, power output, and efficiency, making them ideal for a wide variety of off-highway EV applications. Their increasing adoption reflects industry demand for high-performance, long-lasting, and energy-efficient battery technologies.

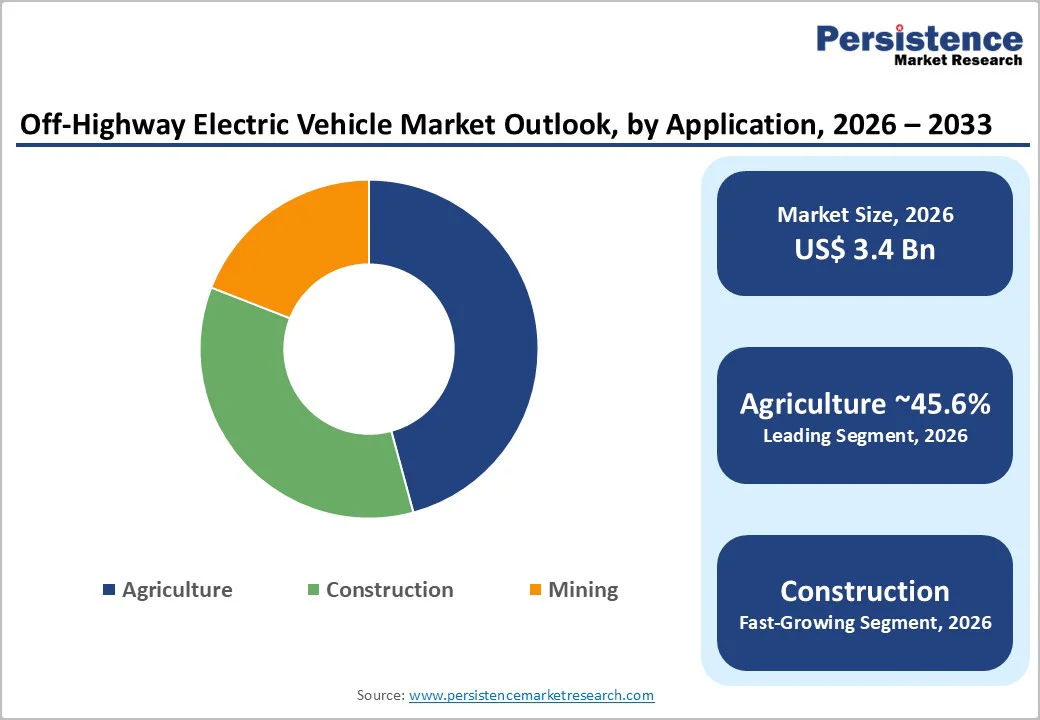

In 2025, the agriculture segment led the off-highway electric vehicle market, driven by rising adoption of modern farm machinery in North America and Europe. Farmers are increasingly turning to electric tractors and harvesters to boost productivity, enable automation, and address labor shortages. Electrification offers key advantages over traditional internal combustion engines (ICE), including lower emissions, reduced maintenance, and improved efficiency, contributing to more sustainable and profitable operations.

Looking ahead, the construction segment is expected to experience substantial growth from 2026 to 2033. The shift toward electric construction equipment is gaining momentum as fuel prices rise and diesel operating costs remain high. Electric machines offer lower long-term expenses, reduced environmental impact, and compliance with tightening emission regulations. Advancements in battery technology and increasing demand for clean, quiet, and efficient equipment are making electrification a compelling option for construction firms, driving significant growth across this segment.

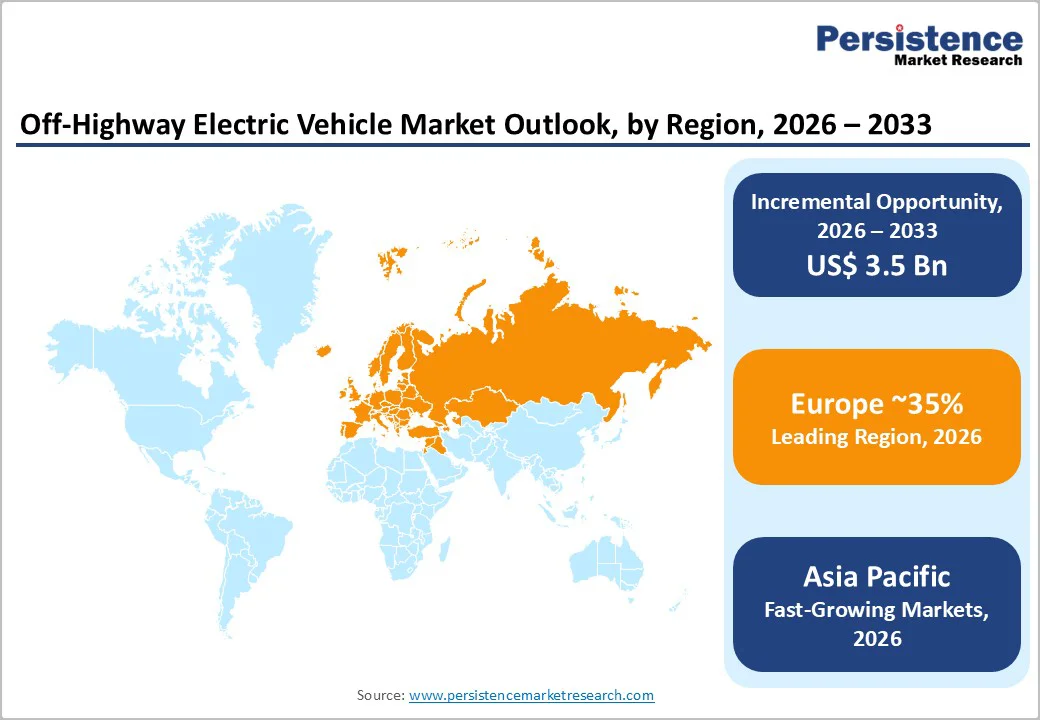

The Asia Pacific region is projected to grow at the highest CAGR from 2026 to 2033 in the off-highway electric vehicle (OHEV) market. Countries like China, India, and Japan are leading this growth, driven by infrastructure development, increased demand in construction and agriculture, and government efforts to curb emissions and reduce fossil fuel dependency.

China is expected to witness steady growth due to its strong construction and agricultural sectors, extensive charging infrastructure, and the presence of multiple domestic OHEV manufacturers. In India, the agricultural sector’s significant contribution to the economy is pivotal for notable market growth. Government initiatives promoting e-tractor adoption are playing a key role in this transition.

Japan is expected to register a positive CAGR, backed by its commitment to environmental sustainability and technological innovation. These factors position the Asia Pacific region as a major growth hub for off-highway electric vehicles in the coming years, contributing significantly to the global shift toward clean mobility.

The U.S. off-highway electric vehicle (OHEV) market is experiencing steady growth, fueled by strong federal and state regulatory support aimed at reducing emissions and modernizing infrastructure. Incentives such as tax credits and green procurement policies are accelerating the adoption of electric construction, mining, and agricultural equipment. Rising fuel costs and the push toward sustainability are prompting fleet operators to shift from diesel to electric alternatives.

Technological advancements and increased investments in charging infrastructure and pilot deployments are enhancing market readiness. A notable example is Amsted Automotive’s April 2025 expansion of its U.S. manufacturing operations, introducing new components tailored for the off-highway EV market. With 13 domestic facilities, the company aims to serve its customers more efficiently while reducing costs and tariff exposure. This strategic investment reflects a broader trend of domestic manufacturing growth and innovation in the U.S. off-highway EV space, supporting long-term industry development.

In 2025, Europe dominated the off-highway electric vehicles (EV) industry, driven by government initiatives promoting clean energy and offering incentives for EV adoption. Heightened environmental concerns and strict emission regulations have accelerated the shift from internal combustion engine (ICE) vehicles to electric alternatives.

The UK is projected to achieve a significant CAGR from 2026 to 2033, supported by the government’s commitment to zero emissions for all new vehicles by 2032. This regulatory clarity is opening new opportunities for off-highway EV manufacturers and encouraging sustainable practices across industries.

Germany is also poised for notable market growth during the same period. As a major force in Europe’s automotive sector and a global leader in vehicle exports, Germany has focused on e-mobility and developed strategic policy frameworks, creating a supportive ecosystem for off-highway EV development. Both countries play a critical role in reinforcing Europe’s leadership in the electric mobility transition.

The current market strategy in the off-highway electric vehicle (EV) industry is centered on advancing product innovation through the integration of electric powertrains and improving vehicle performance and durability. Companies are actively forming strategic partnerships with battery and component suppliers while increasing investments in research and development. These efforts aim to expand electric offerings across various applications and capitalize on government incentives to accelerate market adoption.

A strong focus is being placed on developing modular vehicle platforms and flexible charging solutions to accommodate diverse operational needs. Another strategic priority is the creation of region-specific models that address local regulatory standards and environmental conditions, particularly in emerging markets.

In addition, manufacturers are incorporating digital technologies such as telematics and remote diagnostics to enhance vehicle performance, monitor usage, and support efficient fleet management. To facilitate the shift from diesel to electric, companies are also building comprehensive after-sales support systems and launching training programs, helping customers adapt to electric platforms with greater confidence and ensuring long-term success in the transition.

The Off-Highway Electric Vehicle market is estimated to be valued at US$ 3.4 Bn in 2025.

Sustainability & Corporate ESG Goals and Stringent Emission Regulations are the major growth drivers.

The industry is estimated to rise at a CAGR of 10.5% through 2033.

Electrification of agriculture, construction & mining equipment, and retrofitting diesel equipment constitute growth opportunities.

The global off-highway electric vehicle market is dominated by major players such as Caterpillar Inc., CNH Industrial N.V., Hitachi Construction Machinery Co., Ltd., J C Bamford Excavators Ltd. and Komatsu Ltd.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Battery Type

By Propulsion

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author