ID: PMRREP14941| 182 Pages | 19 Feb 2025 | Format: PDF, Excel, PPT* | Healthcare

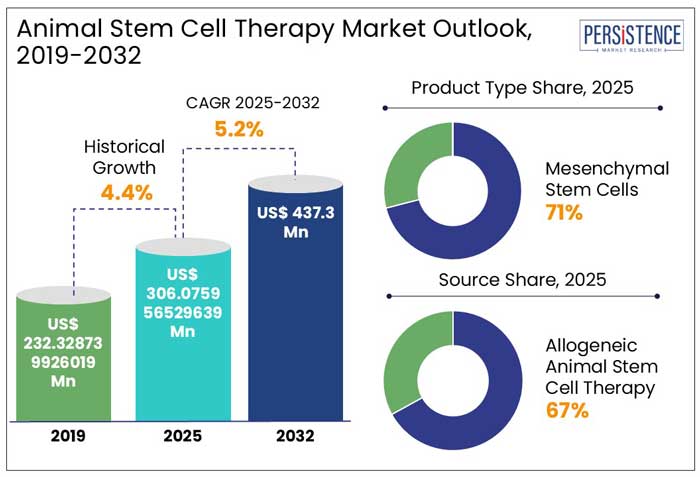

The global animal stem cell therapy market size is anticipated to reach a value of US$ 306.1 Mn in 2025 and is set to witness a CAGR of 5.2% from 2025 to 2032. The market will likely attain a value of US$ 437.3 Mn in 2032.

Max, a 12-year-old tabby cat, used to once rule the house by curling up on windowsills, jumping onto bookcases, and chasing shadows. But as arthritis developed, his movements became stiff and slow. A different struggle was encountered by Thunder, a beloved racehorse in the countryside, who had a tendon injury that seemed to end his career. And then there is Donna, a senior Labrador, who has hip dysplasia and whose once-unstoppable tail is wagging less every day.

Pet owners and veterinarians had few choices for years: surgery, painkillers, or watching their beloved pets suffer. However, this narrative is being rewritten by stem cell therapy. Recent studies reveal-

Stem cell therapies are hence creating new opportunities in veterinary medicine- right from elite equine athletes to aging house cats.

Key Highlights of the Animal Stem Cell Therapy Industry

|

Global Market Attributes |

Key Insights |

|

Animal Stem Cell Therapy Market Size (2025E) |

US$ 306.1 Mn |

|

Market Value Forecast (2032F) |

US$ 437.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.4% |

Innovations in Precision Medicine and Immune Modulation Techniques Surged in Historical Period

In the historical period from 2019 to 2024, the global animal stem cell therapy industry witnessed a CAGR of 4.4%. Innovations in gene editing technologies, immune modulation strategies, and precision medicine coincided with the development of animal stem cell therapy during this period. These innovations opened the door to more effective and individualized regeneration treatments.

Mesenchymal stem cells (MSCs) were used to treat conditions like inflammatory bowel disease in dogs due to discoveries about their immune-modulating capabilities. In comparison to a control group, dogs undergoing MSC therapy exhibited a 70% improvement in clinical scores and a significant decrease in inflammation, according to a clinical trial carried out by veterinary researchers.

Shift toward Science-backed Approaches to Create New Opportunities through 2032

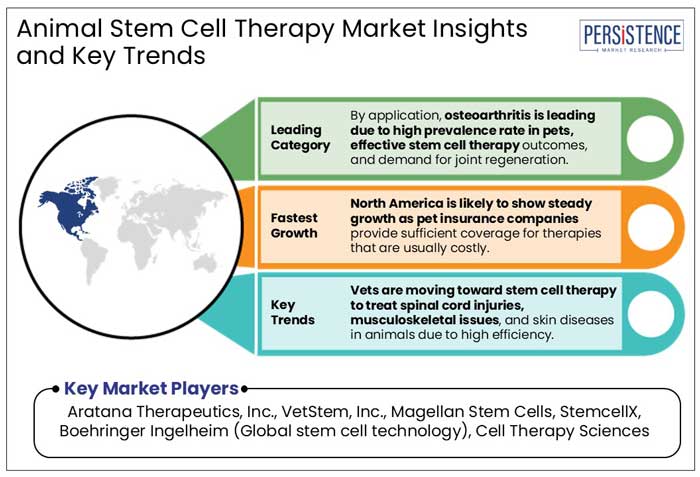

From 2025 to 2032, the animal stem cell therapy industry is likely to showcase a CAGR of 5.2%. Stem cell therapy is anticipated to become popular in veterinary medicine during the forecast period for the treatment of several diseases. Recent studies have shown that it is capable of managing conditions like soft tissue injuries in animals.

Certain tissues like cartilage recover slowly. Stem cell therapy is projected to help wounded tissues return to their original or nearly original state by promoting healing in areas that have not responded to more conventional methods.

Meniscal injury and bone spavin, a degenerative joint disease that produces discomfort and inflammation, are projected to be effectively treated with MSCs in horses. After a single injection, the stiffness usually improves for at least 90 days, and occasionally for up to 180 days. Hence, increasing shift toward more science-backed, novel methods like stem cell therapies from traditional veterinary practices is anticipated to forge new prospects in the next ten years.

Growth Drivers

Stem Cells are Providing Effective Solutions for Inflammatory Diseases in Animals

Stem cell therapy appeared like something out of a science fiction film not so long ago. However, stem cell technology and therapy have emerged as a new area of veterinary medicine. Species like feline, canine, and equine are benefiting greatly from the use of stem cells in regenerative therapy.

Stem cells are currently being used in regenerative medicine to treat inflammatory diseases of the aforementioned species, including chronic, non-responsive gingivostomatitis (oral mucosal inflammatory disease), ligament problems, such as cranial cruciate ligament (CCL) tears, and bone injuries. For example,

Stem cells will likely be used to treat and perhaps cure a wide range of additional disorders that were previously believed to be incurable as research progresses.

Injection Site Issues and Infections May Present Challenges for Stem Cell Procedures

The beneficial aspect of stem cell therapy is that it eliminates the need for artificial replacements or synthetic cells. Instead, to support natural healing, they are replacing damaged or injured tissue in animals with their own tissue. Rejection or negative reactions are less likely when their own tissue is used. Additionally, compared to other conventional treatment options, there might be less adverse effects of stem cell therapy.

There are, however, risks associated with any surgery. Like any surgical or medical procedure, the harvesting of stem cells through surgery carries some hazards. During treatment, there is a chance of infection and irritation at the injection site. But, compared to other pharmaceutical injections or vaccines, stem cell therapy does not carry a higher risk of infection or inflammation at the site.

Collaborations between Companies and Research Institutes to Propel Treatment Development

Companies in the animal stem cell therapy industry are set to gain new opportunities by collaborating with veterinary research institutes. These collaborations can help improve the legitimacy and efficacy of stem cell therapies in veterinary medicine by promoting cooperative research projects, clinical trials, and the development of novel treatment regimens.

Innovative labs, specialized equipment, and presence of skilled researchers and clinicians well-versed in the most recent developments in veterinary science are often found in research institutions. For instance,

Companies that collaborate with research institutes can gain access to clinical trial participants, exchange research findings, and gain insights into best practices. These can further help develop more potent treatments in the coming years.

Source Insights

High Costs and Invasive Procedures in Autologous Therapy Pushing Shift to Allogenic Solutions

By source, the allogenic segment is anticipated to hold an animal stem cell therapy market share of 67% in 2025. Even though both allogenic and autologous stem cell therapies have shown good results in the treatment of joint problems and tissue injuries in animals, allogenic treatments have lately become more popular worldwide.

Easy availability of allogenic stem cell therapy is anticipated to be a key growth driver. In autologous therapy, veterinarians need to extract the stem cells from the injured animal. After that, it takes around 2 to 3 weeks until the treatment is ready for application, which is time consuming.

Allogenic therapy, on the other hand, can be ordered and delivered in 2 to 3 days as the treatment containing the donor’s stem cells is already made and ready for use. It can also be stored for up to 12 months in proper condition.

It is easier to produce more treatment doses from donor-derived cells in allogenic stem cell therapy. However, in autologous therapy, the cells need to be extracted with an invasive procedure and then transported to the lab for preparation. This is an expensive process and hence vets prefer allogenic stem cell therapy.

Product Type Insights

Easy Isolation and Accessibility of Mesenchymal Stem Cells Boosting Adoption in Veterinary Treatments

In terms of product type, the mesenchymal stem cells segment will likely hold a share of 71% in 2025. Mesenchymal stem cells (MSCs) are mainly preferred as these can be easily isolated and obtained from adipose tissue and bone marrow.

They are set to be used therapeutically to treat issues of the musculoskeletal system like tendons, ligaments, and joints, especially in horses and dogs. MSCs are also being utilized to treat recurrent airway blockage in horses, and there are efforts to use them to treat chronic kidney disease and inflammatory bowel disease in cats.

On the other hand, hematopoietic stem cell (HSC) gene therapy has accelerated due to large animal models. Owing to their relative ease of manipulation and capacity to repopulate the whole hematopoietic system for the duration of an animal’s life, HSCs make good targets for gene therapy. Over the past ten years, developments in ex-vivo transduction techniques and the application of retroviral vectors have resulted in effective gene transfer in nonhuman primates and canines. Dogs with hematopoietic diseases are now being healed by HSC gene therapy.

North America Animal Stem Cell Therapy Market

Expanded Coverage Leading to High Recommendations from Veterinarians in North America

North America is anticipated to hold a share of 29% in the global market in 2025. Animal stem cell therapy is gaining impetus in the region as several pet insurance companies are providing coverage for therapy. In the U.S. animal stem cell therapy market, companies like Embrace Pet Insurance, ASPCA Pet Health Insurance, Petplan Pet Insurance, and Pets Best Insurance are offering coverage for specific conditions.

When veterinarians are aware that insurance will cover stem cell therapy, they are more inclined to recommend it. Pet owners are also anticipated to feel secure in adopting therapies that are covered by their insurance policies because of the increased referrals from veterinarians, creating a feedback loop.

Veterinarian stem cell treatment is an emerging field in Canada that is mainly used to treat bone injuries, ligament damage, and osteoarthritis. These treatments are provided by clinics such as Riverside Small Animal Hospital, emphasizing their capacity to lessen suffering and improve pets' quality of life.

Europe Animal Stem Cell Therapy Market

Breakthroughs in Canine Osteoarthritis Treatment to Boost Demand for Stem Cell Solutions in Europe

Europe is estimated to showcase considerable growth in the foreseeable future. This is due to ongoing research activities across various countries to find the efficacy rate of animal stem cell therapies for osteoarthritis. For example,

Canine osteoarthritis has also become a topic of interest in France. Dômes Pharma’s TVM brand, for example, launched a ready-to-use stem cell treatment for canine osteoarthritis of the elbow and hip in January 2023.

It is considered the first and only licensed stem cell therapy in Europe for canine osteoarthritis. The treatment option has proved to reduce stiffness and pain, as well as enhance quality of life and mobility.

Latin America Animal Stem Cell Therapy Market

Interdisciplinary Research Initiatives Foster Growth in Veterinary Stem Cell Technologies in Latin America

As in other parts of the world, stem cell research is gaining attention as a rapidly growing field in Latin America. Regenerative medicine has been designated as a priority for research and funding by various countries in the region. Along with opportunities, the industry presents operational, technical, and regulatory challenges.

Uruguay invests around 0.4% of its GDP on research and development, according to the World Bank. The Organization for Economic Cooperation and Development estimates that this rate will double over the next five years, reaching 1.5% by 2030. The public sector is responsible for most of Uruguay’s research spending.

The Ministry of Health is authorized to approve programs and legalize centers to work with stem cells with either nonclinical or clinical purposes. There is a research group in the country working on stem cell therapies, specifically in veterinary medicine. A few examples of research initiatives include studies on mesenchymal stromal cells and clinical studies on bone marrow derived stem cells transplantation.

In Mexico, the National Council of Science and Technology offers various grant programs. Supporting organ, tissue, and stem cell transplantation and preservation is the main goal of such programs.

In Chile, on the other hand, academic institutions are where most research is conducted. The number of young scientists working in this field has reached a critical mass. Several teams are now studying stem cells, tissue repair, and regeneration in various animals.

Key companies in the global animal stem cell therapy industry are focusing on gaining fast-track approvals from authorities like the U.S. Food and Drug Administration (FDA). They aim to conduct in-depth research and development activities in stem cells to find new treatment options for animals.

A few start-up firms are striving to bag funds from large-scale financers to scale their businesses, develop a sustainable revenue model, and acquire customers. Apart from that, large-scale companies are mainly collaborating with small-scale pharmaceutical firms to co-develop innovative therapies for animals to gain a competitive edge.

Key Industry Developments

The market is set to reach a value of US$ 306.1 Mn in 2025.

Magellan Stem Cells, StemcellX, and Boehringer Ingelheim are a few leading providers.

The industry is set to rise at a CAGR of 5.2% through 2032.

Collaborations between companies and research institutions are set to give rise to innovative therapies.

The industry is estimated to reach a value of US$ 437.3 Mn in 2032.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Source

By Application

By Species

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author