ID: PMRREP33197| 218 Pages | 24 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

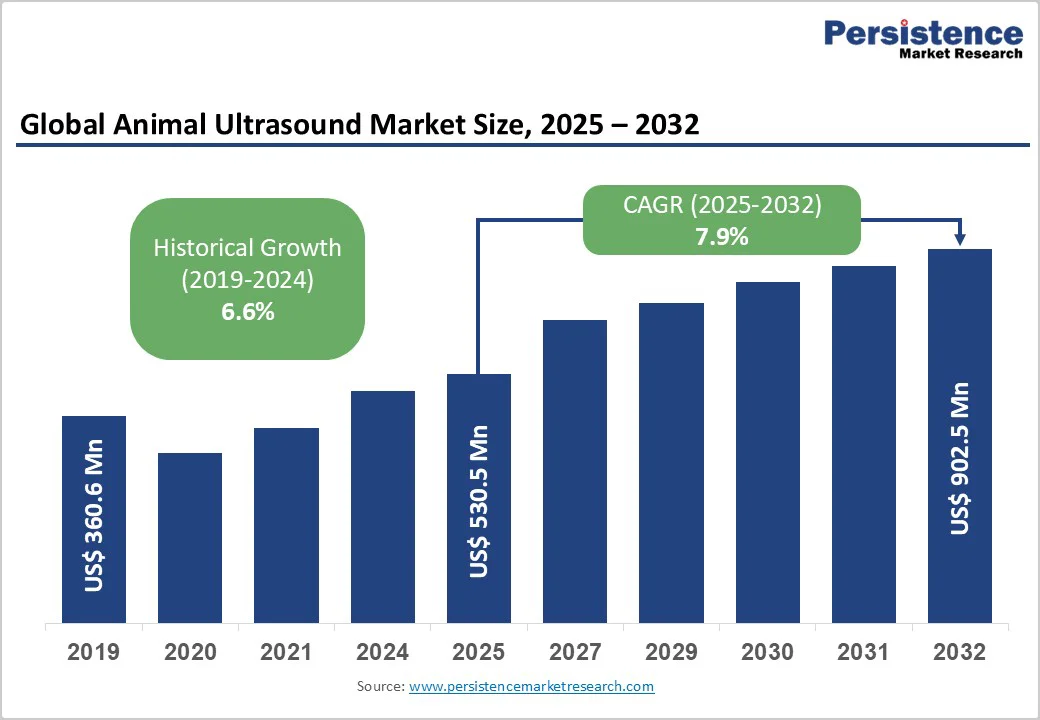

The global animal ultrasound market size is likely to be valued at US$530.5 Million in 2025, and is estimated to reach US$902.5 Million by 2032, growing at a CAGR of 7.9% during the forecast period 2025 - 2032, driven by the Accelerating pet ownership rates, heightened awareness of preventive veterinary care, and technological innovations in portable diagnostic imaging systems.

Market growth is driven by pet humanization, rising disposable incomes in emerging markets, and the adoption of AI-enabled and telemedicine-integrated ultrasound systems. Small companion animals, especially dogs and cats, account for the largest share, while portable ultrasound devices continue gaining traction for their on-site diagnostic convenience and cost-effectiveness, particularly in rural veterinary settings.

| Key Insights | Details |

|---|---|

| Animal Ultrasound Market Size (2025E) | US$530.5 Mn |

| Market Value Forecast (2032F) | US$902.5 Mn |

| Projected Growth (CAGR 2025 to 2032) | 7.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.6% |

Veterinary diagnostics are experiencing significant tailwinds from the unprecedented rise in shelter animal adoptions and the deepening humanization of pets across developed and emerging markets. According to the American Society for the Prevention of Cruelty to Animals (ASPCA), approximately 2 million dogs were adopted from shelters in 2024, reflecting a sustained increase in pet acquisition despite economic uncertainties.

The American Pet Product Association (APPA)'s 2025 Industry Report reveals that approximately 94 million U.S. households now own pets, establishing a robust foundation for veterinary diagnostics expansion. Modern consumers are increasingly viewing companion animals as family members rather than property, showing greater willingness to invest in advanced diagnostic modalities for early disease detection and preventive care protocols.

The humanization phenomenon is manifesting in elevated expenditure patterns across veterinary diagnostics, with pet owners demonstrating a greater propensity to authorize comprehensive imaging procedures that were historically reserved for critical cases.

This behavioral transformation is particularly pronounced among millennials and Generation Z demographics, who constitute a growing proportion of pet ownership and exhibit higher engagement with veterinary preventive medicine.

The animal ultrasound market growth is confronting substantial resistance stemming from prohibitive equipment costs and acute shortages of trained veterinary sonographers, particularly affecting small independent practices and veterinary clinics in developing regions.

Advanced ultrasound systems featuring 3D/4D imaging capabilities, AI-enhanced interpretation algorithms, and portable form factors command price points ranging from US$15,000 to US$50,000 or higher. This is a formidable capital burden for small-scale veterinary operations operating on constrained budgets.

Beyond initial acquisition costs, ongoing expenses, including maintenance contracts, software licensing fees, probe replacements, and system upgrades, compound the total cost of ownership, creating a formidable financial barrier.

The capital intensity challenge is particularly acute in rural and remote veterinary practices where patient volumes may not justify the investment in advanced ultrasound equipment, leading practitioners to rely on conventional diagnostic methods or refer complex cases to larger facilities, thereby constraining organic market expansion.

This economic barrier is further exacerbated by limited access to favorable financing mechanisms in several burgeoning markets, where veterinary equipment leasing and credit facilities remain underdeveloped.

The convergence of AI capabilities with telemedicine-enabled veterinary ultrasound systems represents a transformative opportunity poised to expand market accessibility and clinical utility across underserved geographic markets and specialty applications.

AI-powered diagnostic algorithms are demonstrating remarkable proficiency in automated image analysis, anatomical structure identification, and abnormality detection, effectively reducing the technical expertise barriers that have historically constrained ultrasound adoption in general veterinary practices.

Modern veterinary ultrasound platforms incorporating AI-assisted interpretation features such as automated measurement tools and real-time guidance systems are enabling practitioners with limited training to perform diagnostic examinations with enhanced confidence and accuracy, thereby democratizing access to advanced imaging capabilities.

Telemedicine integration is also generating unprecedented opportunities for remote consultation models where veterinarians in rural or resource-constrained settings can perform ultrasound examinations using portable devices while transmitting real-time imaging feeds to veterinary specialists located anywhere globally for immediate interpretation and diagnostic guidance.

This teleconsultation paradigm is particularly valuable for large animal veterinary medicine, where transporting livestock or equine patients to centralized diagnostic facilities presents significant logistical challenges and animal welfare concerns.

Small companion animals, primarily dogs and cats, are set to command a dominant 53.2% of the animal ultrasound market revenue share in 2025, driven by the exponential growth in companion animal populations across developed and emerging economies.

The intensifying humanization trend is elevating pets to family member status and stoking increased willingness among owners to invest in advanced diagnostic procedures. Urban demographic shifts, declining birth rates, and increasing single-person households are amplifying companion animal ownership, particularly in metropolitan areas where veterinary infrastructure is most developed and ultrasound technology adoption rates are highest.

The large animal segment is likely to demonstrate robust growth through 2032 due to the increasing adoption of portable ultrasound technology for on-site field diagnostics in livestock management and equine veterinary medicine.

Agricultural modernization initiatives and precision livestock farming practices are fueling the demand for reproductive ultrasound services, pregnancy detection, and musculoskeletal imaging in horses and cattle. Portable ultrasound systems are proving transformative for large animal applications, eliminating the logistical challenges and animal welfare concerns.

Portable ultrasound scanners are establishing market leadership, holding around 56% revenue share in 2025, on account of their compact form factors, enhanced mobility, and cost-effectiveness relative to traditional cart-based systems.

The portability advantage is proving particularly compelling across diverse veterinary practice settings, from mobile veterinary services and farm-based large animal practices to emergency veterinary clinics and shelter medicine applications where space constraints and on-site diagnostic requirements favor compact, lightweight systems.

Technological advancements in miniaturization, battery technology, and wireless connectivity are enabling portable systems to deliver vastly enhanced images while also offering superior flexibility for point-of-care applications and field diagnostics.

Cart-based ultrasound scanners continue to dominate high-end clinical applications where superior image resolution, advanced processing capabilities, and comprehensive feature sets justify their premium positioning.

These systems are expected to advance at a steady CAGR during 2025 - 2032, supported by the ongoing demand from specialty veterinary hospitals, academic veterinary medical centers, and large multi-doctor practices that prioritize imaging performance and diagnostic versatility over portability considerations.

Manufacturers are also introducing hybrid configurations featuring detachable displays, modular transducer ecosystems, and convertible designs that accommodate both stationary and mobile usage scenarios.

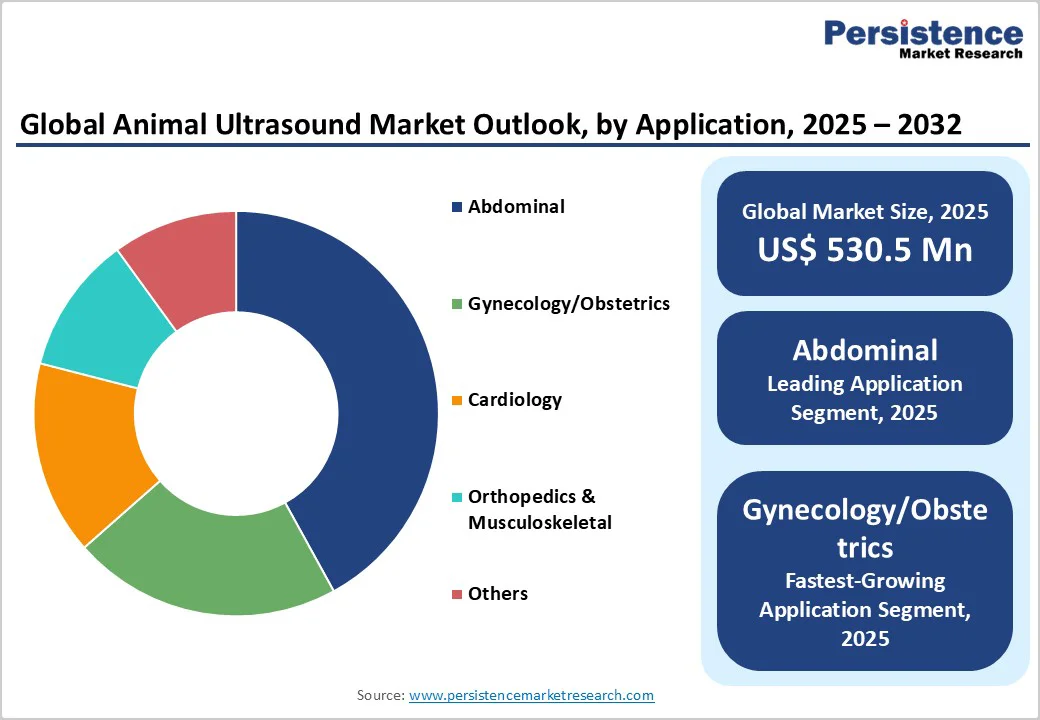

Abdominal ultrasound is set to lead the animal ultrasound market, capturing around 42% share in 2025, due to its broad utility in evaluating internal organs in both small and large animals. The segment’s dominance is driven by the high prevalence of gastrointestinal, urinary, and hepatobiliary disorders, alongside ultrasound’s superior soft tissue contrast, real-time imaging, and non-invasive nature.

These advantages allow detailed assessment of organ structure, vascular perfusion, and fluid accumulation, as well as serial monitoring of chronic conditions, post-operative follow-ups, and guided interventional procedures without ionizing radiation exposure.

The gynecology/obstetrics segment is forecasted to grow fastest between 2025 and 2032, driven by rising demand for reproductive ultrasound in companion animal breeding and livestock management. Ultrasound is essential for pregnancy detection, fetal viability assessment, parturition timing, and reproductive pathology diagnosis.

Growth is pronounced in equine reproduction and commercial breeding of purebred dogs and cats, with increasing owner awareness fueling adoption for ovulation monitoring, pregnancy confirmation, and fetal counting. This underscores ultrasound’s expanding role in preventive and reproductive veterinary care across clinical and agricultural settings.

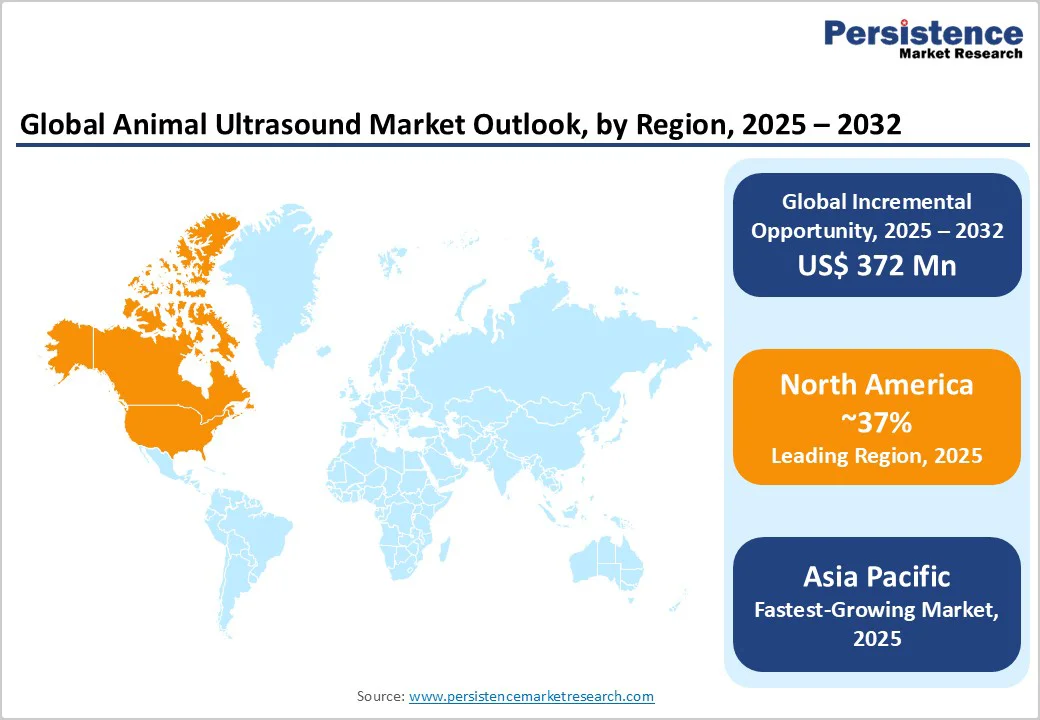

North America is projected to hold approximately 37.3% of the animal ultrasound market in 2025, driven by advanced veterinary infrastructure, high per-capita spending on pet care, and strong innovation ecosystems. The U.S. leads the region, with around 94 million pet-owning households and well-established specialty networks and academic veterinary centers.

Ongoing veterinary education, including board certification in radiology and ultrasonography through the American College of Veterinary Radiology, is increasing the number of skilled practitioners. This expertise, combined with early adoption of advanced imaging technologies, supports sustained market growth and adoption of cutting-edge ultrasound solutions across companion and large animal care.

The leadership position of North America is reinforced by the presence of major ultrasound equipment manufacturers, including GE HealthCare, FUJIFILM SonoSite, and Heska Corporation, alongside leading veterinary diagnostic service providers that collectively create a dynamic competitive landscape, fostering rapid innovation cycles and product commercialization velocity.

The regulatory framework administered by the U.S. Food and Drug Administration (FDA) provides clear pathways for veterinary medical device approval while maintaining rigorous safety and efficacy standards, creating market predictability that encourages research and development investments.

Europe holds a strong position in the animal ultrasound market, led by Germany, the U.K., France, and Spain, each shaped by regulatory frameworks, veterinary practice structures, and cultural attitudes toward animal healthcare. Germany leads the region, supported by robust R&D, veterinary universities, and research institutions advancing diagnostic ultrasound applications.

Prominent manufacturers such as SonoScape and Draminski produce high-quality, innovative veterinary ultrasound systems. In the U.K., market growth is driven by rising pet ownership, increasing demand for advanced diagnostics, and the adoption of portable and AI-integrated ultrasound devices, reflecting technological advancement and evolving veterinary care standards across the region.

The European regulatory environment, harmonized through the European Medicines Agency (EMA) and CE Mark certification processes, provides streamlined market access across member states while maintaining rigorous safety standards, reducing commercialization barriers for manufacturers seeking pan-European distribution.

The region is witnessing increasing investment in veterinary specialty centers and referral hospitals equipped with advanced imaging capabilities, creating demand for premium cart-based ultrasound systems, while simultaneously experiencing growth in mobile veterinary services and farm animal practices adopting portable ultrasound technology for on-site diagnostics.

Asia Pacific is emerging as the fastest-growing regional market, driven by rapid economic development, urbanization, and increasing awareness of animal health, as cultural attitudes toward pets shift and companion animal ownership rises. China, Japan, and Australia are leading the regional expansion.

In China, the surge in urban pet populations, fueled by rising affluence, single-child family structures, and growing demand for pet companionship, is creating substantial opportunities for veterinary diagnostic equipment manufacturers. The country’s large livestock sector is also adopting precision farming technologies, including ultrasound, for reproductive management and disease monitoring, further driving demand across companion and production animal segments.

Japan represents a mature veterinary market, characterized by high per-capita spending on pet care, advanced veterinary services, and sophisticated consumer expectations for animal healthcare quality. Australia combines high companion animal ownership with a robust livestock industry, reflecting characteristics of both developed and agricultural veterinary markets.

The region benefits from strong domestic manufacturing capabilities, particularly in China and South Korea, where companies such as Mindray and SonoScape supply competitively priced ultrasound equipment for both domestic and export markets. Investment from multinational veterinary healthcare firms is rising, focusing on establishing distribution networks, after-sales service, and training infrastructure to capture growth in this high-potential Asia Pacific market.

The global animal ultrasound market is moderately consolidated, with the top five players capturing nearly 50% of revenue. Esaote SpA leads with a 12-14% share, offering a comprehensive portfolio of portable and cart-based veterinary systems. GE HealthCare adapts its human imaging expertise for veterinary solutions, including the LOGIQ series and Vscan Air handheld devices.

Market dynamics feature ongoing consolidation as larger medical device firms acquire specialized veterinary imaging companies to expand portfolios. Multinationals focus on technological innovation, brand strength, and service networks, while regional manufacturers compete through pricing, localized support, and niche application expertise.

The global animal ultrasound market is projected to reach US$530.5 Million in 2025.

Accelerating pet ownership rates, heightened awareness of preventive veterinary care, and technological innovations in portable diagnostic imaging systems are driving the market.

The animal ultrasound market is poised to witness a CAGR of 7.9% from 2025 to 2032.

The humanization of pets, rising disposable incomes in emerging economies, and the integration of AI and telemedicine capabilities into ultrasound platforms are key market opportunities.

Esaote S.p.A., GE HealthCare, and FUJIFILM Holdings Corporation are some of the key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Animal Type

By Product

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author