ID: PMRREP33515| 199 Pages | 17 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

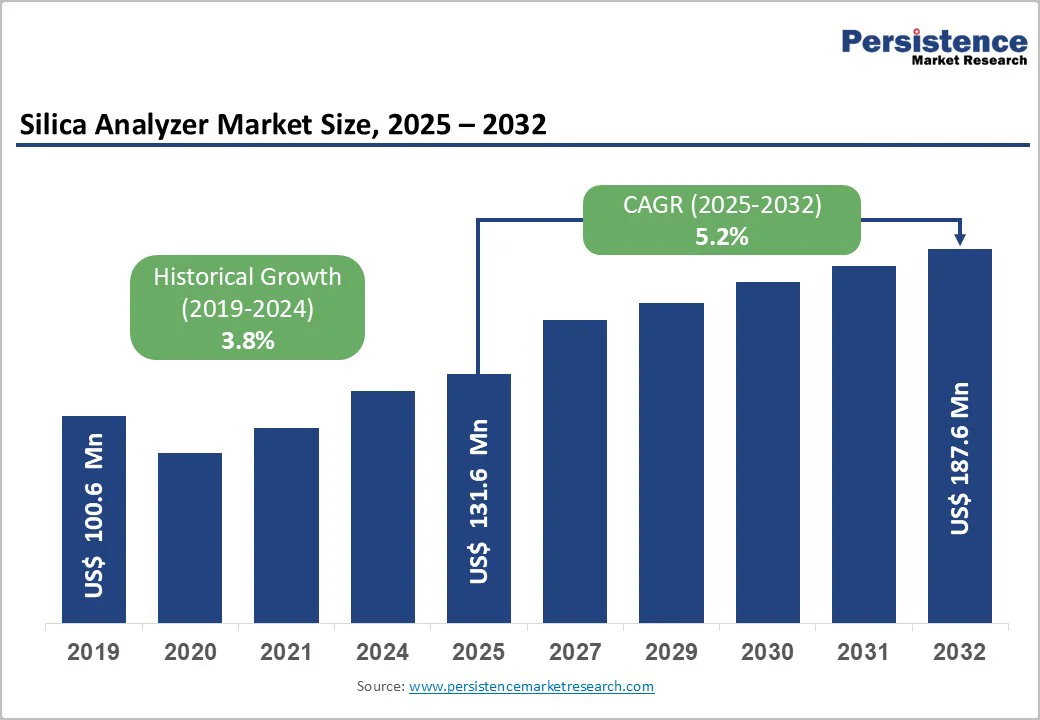

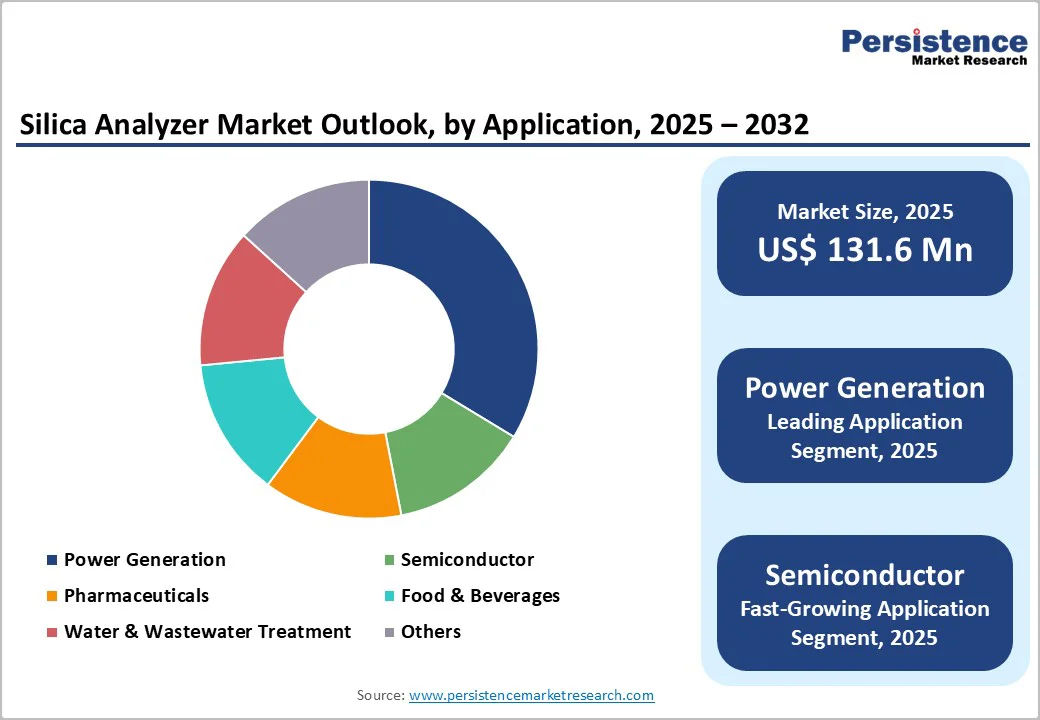

The global silica analyzer market size is valued at US$ 131.6 million in 2025 and is projected to reach US$ 187.6 million by 2032, growing at a CAGR of 5.2% between 2025 and 2032.

The global market is experiencing a transition from laboratory-based testing to continuous online monitoring systems, reflecting industry-wide priorities toward operational efficiency, equipment protection, and compliance automation.

Growth drivers are predominantly macroeconomic, including rising electricity demand, semiconductor manufacturing expansion, and stringent water quality regulations across multiple jurisdictions.

| Key Insights | Details |

|---|---|

| Silica Analyzer Market Size (2025E) | US$ 131.6 Mn |

| Market Value Forecast (2032F) | US$ 187.6 Mn |

| Projected Growth (CAGR 2025 to 2032) | 5.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.8% |

Drivers - Growing Demand for Electricity and Power Generation Industry Expansion

The global electricity demand is projected to increase by approximately 2.1% annually through 2032, with the International Energy Agency (IEA) reporting that fossil fuels and nuclear power plants continue to represent 60%+ of global generation capacity.

Silica deposits in boiler systems and turbine blades directly compromise operational efficiency, corrosion resistance, and maintenance costs. The power generation segment commands >40% revenue share of the silica analyzer market, as utilities require real-time silica monitoring to prevent catastrophic equipment failure and reduce operational downtime.

According to the U.S. Energy Information Administration (EIA), thermal power plants operate at optimal efficiency only when silica levels remain below 20 ppb (parts per billion). Silica analyzers enable this precision monitoring, allowing power operators to optimize ion-exchange polishing systems and extend equipment lifecycle.

With capital expenditure in global power generation infrastructure exceeding US$ 500 billion annually (World Bank data), investment in monitoring solutions including silica analyzers represents approximately 2-3% of total plant capital, driving consistent market demand.

Semiconductor and High-Purity Manufacturing Requirements

The semiconductor manufacturing sector demands ultrapure water with silica concentrations below 5 ppb, a requirement mandated by industry standards including SEMI F1-23 and ISO 14644 cleanroom classifications. The semiconductor market is projected to reach US$ 675 billion by 2032 (CAGR 7.8%), with wafer fabrication facilities (fabs) representing the most capital-intensive segment.

Each fab requires continuous silica monitoring across multiple process points from water purification systems to chemical mechanical polishing processes. Semiconductor manufacturers increasingly deploy multi-channel silica analyzers to monitor parallel production streams, reducing defect rates and improving yield.

The pharmaceutical industry similarly demands silica monitoring for Good Manufacturing Practice (GMP) compliance and water-for-injection (WFI) purity verification. This expansion in semiconductor capacity, particularly in Asia-Pacific regions, directly correlates with silica analyzer adoption rates.

High Costs and Advancing Alternatives Restrict Silica Analyzer Market Growth

High capital and operational costs, combined with growing competition from alternative monitoring technologies, significantly restrain silica analyzer market adoption. Entry-level systems cost US$ 15,000-30,000, with installation adding 40-50% more, while annual consumables require US$ 5,000-12,000 per instrument.

Smaller facilities, especially in emerging markets, struggle with these financial and training demands, as skilled operator requirements raise operational expenses by an additional 20-30%. At the same time, technologies such as LIBS and NAA, along with lower-cost offline laboratory testing, are reducing demand for continuous analyzers by an estimated 15-20%, further limiting market expansion.

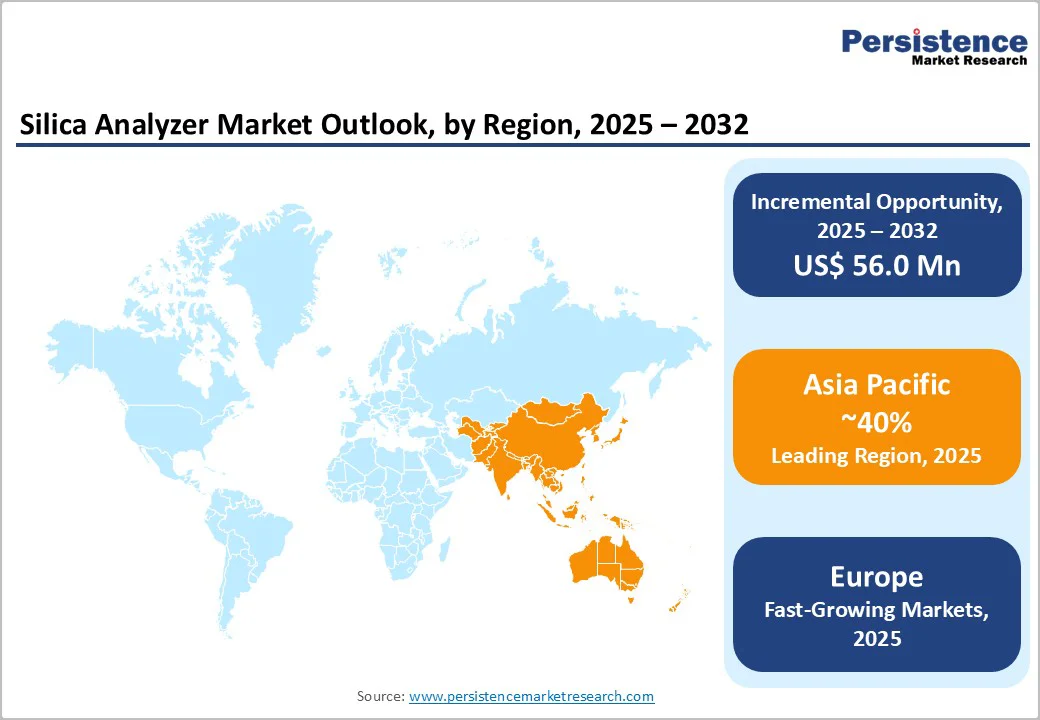

Asia-Pacific Industrial Growth and Smart Analytics Drive Strong Opportunities for Silica Analyzer Market Expansion

Asia-Pacific markets including China, India, and Vietnam are rapidly expanding power generation, semiconductor manufacturing, and industrial wastewater infrastructure, creating strong demand for silica analyzers. China’s 14th Five-Year Plan allocates US$1.4 trillion for industrial modernization, while wastewater treatment capacity in the region is growing at a 12% CAGR, with each facility requiring silica monitoring systems for regulatory compliance.

Despite this expansion, market penetration in Asia-Pacific remains 30-40% lower than North America, presenting a substantial greenfield opportunity valued at US$40-50 million between 2025 and 2028. Simultaneously, the shift toward IoT-enabled, cloud-connected silica analyzers with predictive maintenance is accelerating at an 8-10% CAGR.

These smart systems offer remote monitoring, automated reporting, and ERP integration, with industries willing to pay 25-35% price premiums for enhanced analytics, reduced downtime, and improved operational efficiency.

The silica analyzer market is primarily driven by two segments: equipment and consumables, each contributing differently to revenue growth and long-term profitability. Equipment remains the market leader with over 60% revenue share, comprising sensing modules, electronic processing units, and display interfaces.

This segment benefits from high unit margins of 40-50% and consistent demand from capital-intensive industries requiring permanent, 24/7 monitoring systems. Although equipment growth is moderate at 4-5% CAGR due to long replacement cycles of 7-10 years, advancements in digital connectivity and improved accuracy continue to support steady upgrade-driven purchases.

In contrast, consumables represent the fastest-growing category, expanding at 7-8% CAGR, driven by recurring demand for reagents, membranes, calibration solutions, and disposable analytical modules. Each installed analyzer generates US$ 5,000-12,000 in annual consumable revenue, making this segment a key profitability driver.

With the global installed base expected to grow 15-20% annually, consumables currently account for 35-40% of total market revenue and are projected to rise to 42-45% by 2032, further strengthening recurring income streams for manufacturers.

The silica analyzer market is driven primarily by two major industry segments: power generation and semiconductor manufacturing. Power generation remains the dominant segment, accounting for over 40% of total market revenue, supported by more than 1,800 GW of global thermal power capacity. Coal, natural gas, and nuclear plants rely heavily on silica monitoring for operational efficiency, equipment protection, and maintenance cost reduction.

In contrast, semiconductor manufacturing stands out as the fastest-growing segment, expanding at an 8-10% CAGR. Semiconductor fabs demand ultrapure water monitoring with silica levels below 5 ppb, as required by SEMI standards.

Accelerated global fab construction driven by the U.S. CHIPS Act and similar incentives in Europe and Asia will add 30+ new fabs by 2030, each requiring 8-12 silica analyzers, contributing US$ 3-5 million in demand per facility. This segment currently contributes 25-28% of market revenue and is expected to reach 32-35% by 2032.

Asia-Pacific remains the largest and fastest-growing regional market, holding over 40% of global revenue and projected to reach US$ 85-90 million by 2032. This dominance is driven by rapid industrialization, strong power generation expansion, and accelerating semiconductor manufacturing localization supported by supply chain diversification efforts.

China accounts for 45-50% of regional silica analyzer demand, supported by over 1,100 GW of coal-fired power capacity, 60% of global coal capacity and continuous modernization cycles. Its semiconductor industry is adding 15 advanced fabs by 2030, pushing the silica analyzer market to US$ 35-40 million annually with 6-7% CAGR. Japan maintains a mature market valued at US$8-10 million with stable 4-5% growth driven by high replacement rates.

India, an emerging high-growth market, is expanding power generation capacity by over 50% through 2032 and strengthening pharmaceutical manufacturing, with its silica analyzer market expected to grow from US$ 4-5 million to US$ 8-10 million (CAGR 8-10%).

Europe accounts for roughly 18-22% of the global market, with a projected regional value of US$ 25-30 million by 2032, growing at 4-5% CAGR. The region is defined by stringent environmental regulations, mature industrial infrastructure, and strong momentum toward circular economy and sustainability initiatives.

Germany leads with 30-35% of regional demand, driven by chemical manufacturing, power generation, and semiconductor industries, supported by strict water quality standards and a US$ 6-8 million market growing at 3-4%. The United Kingdom contributes 15-18%, driven by power generation modernization and pharmaceutical manufacturing, representing a US$ 3-4 million market.

France and Spain together hold 25-30% of demand, supported by EU environmental directives and steady replacement cycles, with a combined market of US$ 5-7 million growing at 3-5% CAGR. Growth across Europe is propelled by the EU Industrial Emissions Directive, the shift from coal to natural gas and renewables, Green Deal efficiency initiatives, pharmaceutical GMP compliance, and circular economy-driven water reuse requirements.

Regulatory frameworks including the revised EU Water Directive and the Industrial Emissions Directive mandate strict and real-time water quality monitoring, generating sustained demand for certified analyzers. The competitive landscape shows moderate fragmentation, with global manufacturers holding 65-70% share and strong participation from German and Swiss firms (25-30%), supported by rising investments in sustainability-focused technologies and compliance-driven product innovation.

The global silica analyzer market shows moderate consolidation, with the top five players HACH (Danaher Corporation), Yokogawa, Shimadzu, Swan Analytik, and Endress+Hauser collectively holding about 55-60% market share through strong distribution networks, broad product portfolios, and robust technical support.

Mid-tier manufacturers capture an additional 25-30%, leveraging regional expertise and niche application strengths, while over 50 fragmented competitors share the remaining 10-15%, primarily serving cost-sensitive emerging markets.

High entry barriers, including strict regulatory certifications such as ISO 9001, advanced technological expertise, and capital investment requirements of US$10-15 million reinforce this market structure. Herfindahl-Hirschman Index (HHI) values between 1,800 and 2,000 confirm a moderately concentrated market, where firms maintain competitiveness through technology leadership and superior service rather than pricing power.

The silica analyzer market is estimated to be valued at US$ 131.6 Mn in 2025.

A key demand driver for the global Silica Analyzer market is the expanding need to monitor and control silica levels in industrial water/steam cycles, primarily in power generation and semiconductor manufacturing.

In 2025, the Asia Pacific region will dominate the market with an exceeding 40% revenue share in the global Silica Analyzer market.

Among application, power generation has the highest preference, capturing beyond 40% of the market revenue share in 2025, surpassing other applications.

ABB Ltd., Thermo Fisher Scientific, Mettler Toledo, HORIBA, Ltd., SPX FLOW, Inc., Nikkiso Co., Ltd., Hach, and Swan Analytical Instruments AG are a few leading players in the Silica Analyzer market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author