ID: PMRREP4603| 169 Pages | 20 Aug 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

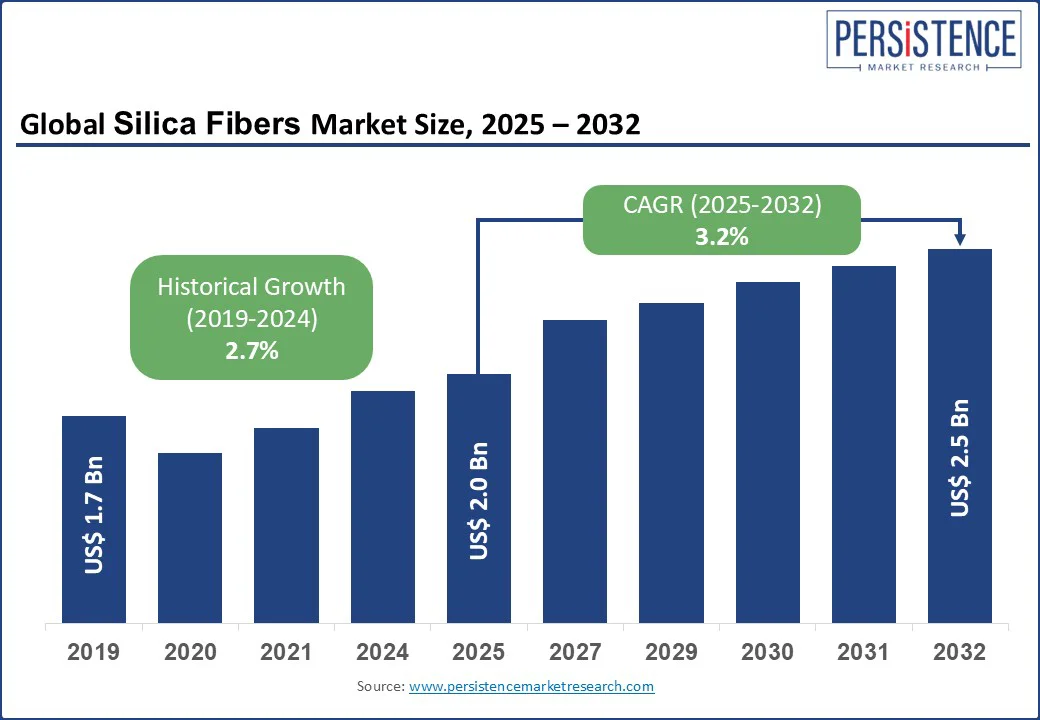

The global silica fibers market size is likely to be valued at US$2.0 Bn in 2025 and is estimated to reach US$2.5 Bn by 2032, growing at a CAGR of 3.2% during the forecast period 2025 - 2032.

Silica fiber, known for its exceptional strength and heat resistance, is a critical material in today’s high-tech industries. From enabling fast, reliable internet connections to enhancing durability in aerospace and automotive components, silica fiber plays a vital role in modern innovation. As global demand for advanced materials grows, the significance of silica fibers is becoming popular known for its unique properties and versatile applications.

Key Industry Highlights

|

Key Insights |

Details |

|

Silica Fibers Market Size (2025E) |

US$2.0 Bn |

|

Market Value Forecast (2032F) |

US$2.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.7% |

The silica fibers market is driven by several key factors, with a significant focus on the demand for silica fibers in construction and electronics and semiconductors. The global construction industry grew by 10% in 2025, with silica fiber composites used for fireproofing and insulation in high-rise buildings, boosting demand for high-temperature fibers and silica insulation.

A 2025 industry report indicated that 60% of new commercial buildings in developed markets use silica fiber composites for fire-resistant fibers, enhancing safety and compliance with regulations such as the EU’s Fire Safety Directive. In electronics & electrical, the global semiconductor market expanded by 15% in 2025, driving demand for fiber optics and nano silica fibers in silicon dioxide fibers for high-speed data transmission and chip manufacturing.

Companies such as Corning report 20% growth in fiber optics sales for 5G networks in 2025. The silica fiber manufacturing process and technologies, with US$150 Mn invested in R&D for quartz fibers and silica glass fibers, support applications in thermal protection systems and electrical insulation materials, further driving market growth.

High production costs pose a significant restraint to the silica fibers market, impacting the silica fiber manufacturing process and technologies. The production of continuous silica fibers and nano silica fibers requires energy-intensive processes and high-purity silica, increasing costs by 20-25% compared to traditional materials.

Silica fiber pricing trends show 10% cost increases in 2025 due to raw material scarcity and energy expenses. This limits adoption in cost-sensitive markets such as construction & building in developing regions, where 40% of projects opt for cheaper alternatives.

Fire-resistant fibers and industrial insulation solutions also face maintenance challenges, with 15% higher servicing costs for thermal protection systems. Supply chain disruptions for silica raw materials, particularly in the Asia Pacific, further constrain silica fiber innovations, impacting scalability.

The growth in aerospace and advancements in industrial insulation solutions present significant opportunities for the silica fibers market. The global aerospace industry is projected to grow at a CAGR of 8% through 2032, increasing demand for high-temperature fibers and silica insulation in thermal protection systems for aircraft engines and fuselages.

A 2025 report noted that 50% of new aircraft use silica glass fibers for lightweight insulation, reducing fuel consumption by 10%. Sustainable industrial insulation solutions, such as recyclable woven fabrics and non-woven fabrics, align with regulations such as the EU’s Circular Economy Action Plan, driving 15% growth in eco-friendly silica fiber composites in 2025.

Companies such as Prysmian are investing US$100 Mn in the silica fiber manufacturing process and technologies for fiber optics and nano silica fibers, targeting the electronics & electrical and aerospace sectors. Emerging markets, with one billion new construction projects projected by 2030, offer opportunities for silica fiber demand in construction and electrical insulation materials.

Continuous silica fibers hold approximately 50% of the market share in 2025 due to their use in fiber optics and thermal insulation, with 60% adoption in electronics & electrical, and aerospace. In electronics, continuous silica fibers enable advanced semiconductor manufacturing and optical communication, while in aerospace, they contribute to lightweight, heat-resistant materials essential for aircraft and spacecraft safety and performance.

Chopped Silica Fibers are driven by silica fiber composites in the construction industry and reinforcement material, with 35% growth in 2025. These short fibers enhance the mechanical strength, durability, and thermal resistance of composite materials, making them valuable for reinforcing concrete, polymers, and other building materials.

Thermal Insulation commands a 40% market share in 2025, driven by high-temperature fibers and silica insulation in construction & building and aerospace, with 50% adoption in industrial applications in 2025. The growing emphasis on sustainable building practices and stringent aerospace thermal standards is propelling demand, making thermal insulation a cornerstone of modern high-performance industries.

Composites are fueled by silica fiber composites in the construction industry and automotive, with 12% growth in 2025. Silica fiber composites offer superior strength-to-weight ratios, corrosion resistance, and thermal stability, making them ideal for reinforcing concrete structures, lightweight automotive parts, and safety components.

Woven Fabrics hold a 45% market share in 2025, driven by fire-resistant fibers in thermal protection systems and industrial insulation solutions, with 55% adoption in construction & building. Their ability to reinforce structural materials and provide thermal barriers helps improve building safety and performance, driving strong demand and market growth.

Yarns are fueled by silica glass fibers in electronics & electrical, and fiber optics, with 10% growth in 2025. The use of silica glass fiber yarns enhances performance and longevity in these high-tech applications, supporting the expansion of markets such as telecommunications, semiconductors, and consumer electronics.

Construction & Building holds a 30% market share in 2025, driven by silica fiber demand in construction and silica insulation, with 40% of new buildings using fire-resistant fibers in 2025. These fibers improve fire resistance and thermal insulation, reducing damage during fires and enhancing energy efficiency. By minimizing heat transfer, they reduce the need for excessive heating or cooling, leading to lower energy consumption and operational costs.

Electronics & Electrical is fueled by silica fibers for electronics and semiconductors, and fiber optics, with 15% growth in 2025. In semiconductors, silica fibers help in precise heat dissipation and insulation, enabling higher device performance and reliability. As semiconductor devices become smaller and more powerful, effective thermal management is essential to maintain performance and reliability.

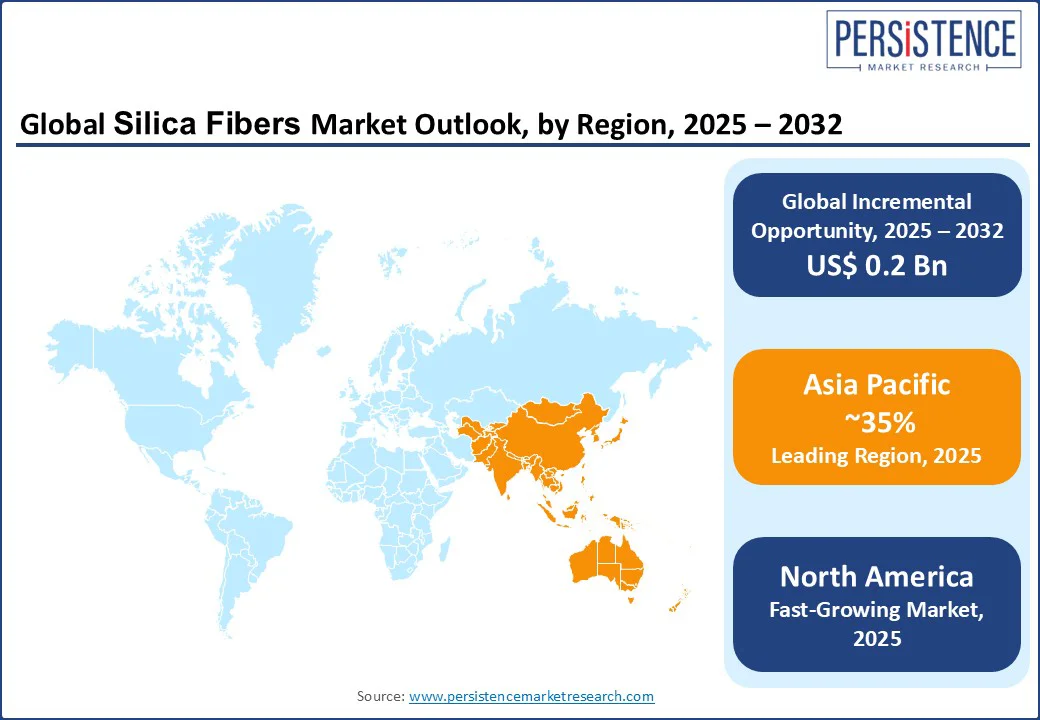

In North America, the silica fibers market holds a distinct position, commanding a 30% market share in 2025. North America is expected to achieve a CAGR of 3.5% by 2032. The U.S. dominates due to its advanced aerospace and electronics & electrical sectors. The U.S. market is driven by silica fibers for electronics and semiconductors, as well as thermal protection systems, with 50% of semiconductor facilities using fiber optics in 2025.

Silica fiber demand in construction grows by 10% annually, supported by silica insulation in commercial buildings. Corning and Nexans drive 25% of regional revenue, leveraging silica fiber manufacturing process and technologies for nano silica fibers and electrical insulation materials. These companies are investing in advanced manufacturing processes and innovations, including nano silica fibers and next-generation electrical insulation solutions.

In Europe, the silica fibers market accounts for a 25% market share, led by Germany, the UK, and France. Germany’s market is driven by aerospace and silica fiber composites in thermal protection systems, with 60% of aircraft using high-temperature fibers in 2025. The EU’s Fire Safety Directive boosts fire-resistant fibers, with 15% growth in industrial insulation solutions.

The UK’s electronics & electrical sector supports fiber optics by the BT Group. France’s construction & building drives 12% growth in silica insulation. €100 Mn in EU funding for green materials in 2025 enhances silica fiber innovations. This funding, combined with strict regulations and industrial modernization, positions Europe as a key hub for silica fiber innovation and application across multiple industries.

Asia Pacific is the most prominently growing region, holding the 35% market share, led by China, Japan, and India. China holds a 40% regional market share, driven by a 20% increase in construction & building projects in 2025, boosting silica fiber demand in construction and silica insulation. Japan’s market is fueled by silica fibers for electronics and driven by chemical processing and quartz fibers, with 90% of new chemical plants using silica fiber composites in 2025.

Silica fiber innovations and industrial insulation solutions, supported by US$25 Bn in industrial investments by 2030, drive growth. These investments aim to improve energy efficiency, sustainability, and fire safety across multiple industries, aligning with global environmental and safety standards.

The global silica fibers market is marked by fierce competition, with material manufacturers competing on innovation, quality, and sustainability. Corning and Prysmian dominate in fiber optics and silica glass fibers, while Nexans leads in electrical insulation materials. High-temperature fibers, nano silica fibers, and silica fiber composites in the construction industry add a competitive layer. Strategic partnerships and R&D investments in silica fiber manufacturing processes and technologies are key differentiators.

The silica fibers market is projected to reach US$ 2.0 Bn in 2025.

Rising demand in construction & building, electronics & electrical, and high-temperature fibers are key drivers.

The silica fibers market grows at a CAGR of 3.2% from 2025 to 2032, reaching US$ 2.5 Bn by 2032.

Opportunities include aerospace, industrial insulation solutions, and silica fiber innovations in fiber optics.

Key players include Corning, Prysmian, Nexans, Fujikura, Yangtze Optical Fiber, and Cable, Sterlite Technologies.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Form

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author