ID: PMRREP32388| 158 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

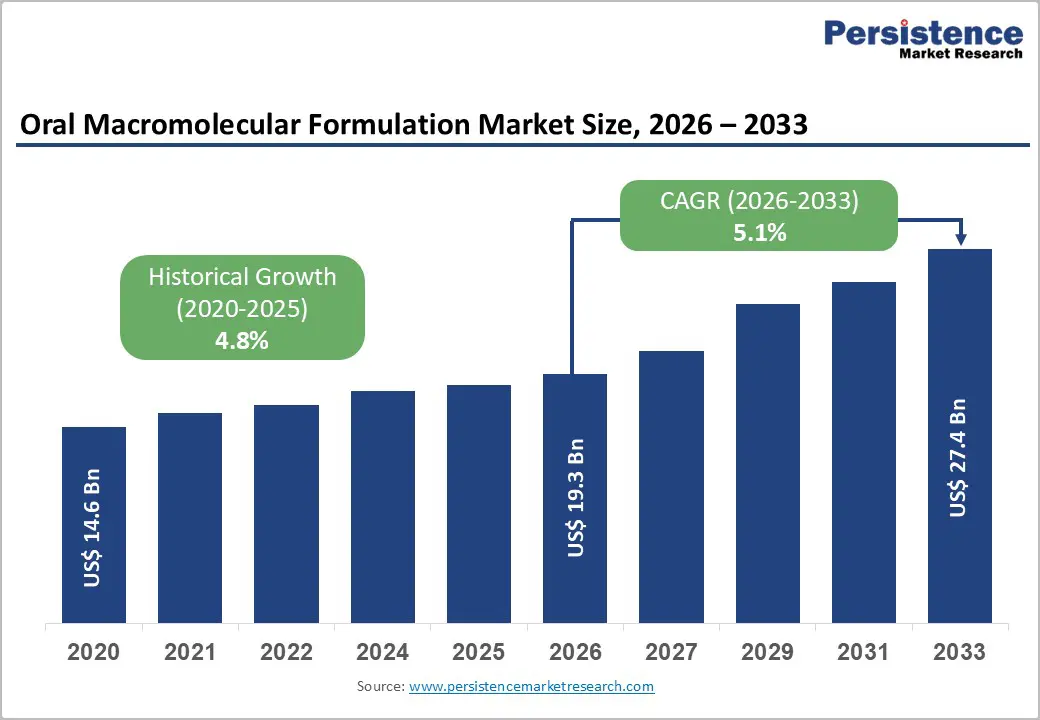

The global oral macromolecular formulation market size is expected to be valued at US$ 19.3 billion in 2026 and projected to reach US$ 27.4 billion by 2033, growing at a CAGR of 5.1% between 2026 and 2033.

The market is primarily driven by escalating demand for non-invasive biologic delivery systems coupled with technological advances in absorption enhancement technologies, permeation enhancers, and protective formulation strategies. Patient preference for oral administration over injectable therapeutics, driven by improved compliance, reduced infection risk, and enhanced convenience, creates compelling incentives for pharmaceutical companies to invest in oral formulation development. Furthermore, the rising prevalence of chronic metabolic diseases such as type 2 diabetes and inflammatory bowel disease, where oral biologics demonstrate superior therapeutic efficacy, propels substantial market expansion. Strategic investments in R&D by pharmaceutical giants alongside favorable regulatory pathways for novel excipients and delivery systems continue to accelerate clinical translation of oral macromolecular candidates.

| Global Market Attributes | Key Insights |

|---|---|

| Oral Macromolecular Formulation Market Size (2026E) | US$ 19.3 billion |

| Market Value Forecast (2033F) | US$ 27.4 billion |

| Projected Growth CAGR (2026-2033) | 5.1% |

| Historical Market Growth (2020-2025) | 4.8% |

Market Growth Drivers

Non-Invasive Administration and Enhanced Patient Compliance

The shift from injectable to oral delivery routes represents a fundamental transformation in patient-centric drug administration. Parenteral delivery remains associated with needle-related anxiety, infection risk, and reduced long-term compliance, particularly in chronic disease management requiring lifelong therapy. The global diabetes population is projected to reach 535 million individuals by 2030, with substantial patient segments expressing a strong preference for oral alternatives to injectable insulin and GLP-1 therapies. Novo Nordisk's FDA approval of oral semaglutide (Wegovy) in January 2026, demonstrating average weight loss of 16.6% at 64 weeks compared to traditional injections, exemplifies market-validated demand for oral macromolecule formulations. This landmark achievement validates technological feasibility of transcellular peptide absorption through permeation enhancer technologies and stimulates accelerated investment across the pharmaceutical industry. Patient studies indicate oral formulations increase medication adherence by 40-60% relative to injectable counterparts, translating to improved therapeutic outcomes and reduced healthcare burden from disease complications.

Technological Advancements in Bioavailability Enhancement

Proteolytic degradation and poor intestinal permeability have historically limited oral macromolecule delivery to bioavailability rates of 0.5-1.0%. Contemporary innovations in permeation enhancers, protective coatings, and nanoparticle carrier systems have fundamentally transformed feasibility landscapes. Salcaprozate sodium (SNAC), an FDA-approved permeation enhancer integrated into Rybelsus® (oral semaglutide), operates through multi-mechanism strategies: local pH elevation inactivates pepsin, protects semaglutide from gastric proteolysis, and facilitates transcellular membrane permeation through formation of permeation-enhancer-filled membrane defects. Recent molecular dynamics simulations published in peer-reviewed literature demonstrate SNAC enables semaglutide incorporation into epithelial membranes at bioavailability rates exceeding clinical efficacy thresholds. Advanced carriers including solid lipid nanoparticles (SLNs), nanostructured lipid carriers (NLCs), self-microemulsifying drug delivery systems (SMEDDS), and lipid-polymeric hybrid systems (LPHs) address challenges of solubility, stability, and controlled release kinetics. Industries investing in these technologies have reported 2.3-fold to 2.34-fold bioavailability improvements relative to conventional suspensions, enabling rational progression toward clinical viability. Research initiatives at pharmaceutical innovation hubs across North America, Europe, and Asia Pacific continue expanding technological frontiers, with estimated 350+ peptide therapeutics in clinical development stages, of which only 2-5 have achieved oral approval, indicating substantial market expansion potential as formulation barriers dissolve.

Market Restraints

Regulatory Complexity and Excipient Approval Timelines

Oral macromolecule formulations require novel excipients and permeation enhancers with undefined toxicological profiles, creating substantial regulatory approval uncertainties. The FDA's current framework demands comprehensive toxicology packages, preclinical safety assessments, and clinical pharmacology studies for new permeation enhancers, with timelines extending 5-7 years beyond conventional drug development pathways. Only 2-3 permeation enhancers have achieved regulatory approval globally, limiting formulation optimization flexibility and creating bottlenecks in innovation pipelines. The FDA's pilot PRIME initiative addressing independent excipient pathways remains nascent, with regulatory precedents insufficient to guide sponsors confidently. Additionally, safety concerns regarding tight junction modulation, potential co-absorption of pathogens, and long-term epithelial integrity remain incompletely characterized, requiring extensive clinical surveillance programs. Developers must demonstrate bioequivalence between oral and injectable formulations through rigorous pharmacokinetic studies—a requirement increasing development costs by $50-100 million per candidate. Regulatory harmonization disparities between FDA, EMA, and emerging market authorities create additional complexity, forcing multinational developers to maintain parallel regulatory strategies. These structural challenges disproportionately burden smaller biotechnology enterprises lacking capital resources for protracted regulatory navigation.

Market Opportunities

Accelerated Adoption of GLP-1 and Diabetes Therapeutics in Emerging Markets

The global type 2 diabetes population is projected to expand to 645 million individuals by 2045, with 85% of new cases emerging in low-to-middle-income regions. India, China, Southeast Asia, and Latin America face escalating diabetes burden with limited healthcare infrastructure supporting injectable therapy administration. Oral macromolecule formulations enable decentralized diabetes management through community health workers and retail pharmacies, dramatically expanding treatment accessibility. India's Production Linked Incentive scheme has specifically targeted GLP-1 drug manufacturing, with government announcements indicating intent to support generic oral GLP-1 production post-patent expiration. Eli Lilly announced $1 billion+ investment in India during 2025 to expand diabetes and obesity drug manufacturing capacity. Sanofi announced €1 billion investment for new insulin production facilities in Beijing to capture Chinese domestic demand. Rising middle-class populations in Asia Pacific generating disposable income for chronic disease management creates addressable market expansion of $8-12 billion annually by 2033. Regulatory pathways in emerging markets remain more flexible than FDA/EMA standards, enabling faster clinical translation. Successful oral formulations targeting Indian, Chinese, and Southeast Asian populations would generate 30-50% incremental market revenues within forecast periods.

Lyophilized Peptides, mRNA Therapeutics, and Next-Generation Macromolecule Platforms

Contemporary innovation extends beyond conventional peptide/protein macromolecules toward nucleic acid therapeutics, antibody-drug conjugates (ADCs), and engineered biologics requiring oral bioavailability. mRNA therapeutics demonstrate clinical efficacy for infectious disease prevention and cancer immunotherapy, with multiple candidates advancing to clinical trials. Oral mRNA delivery addresses cold-chain logistics constraints limiting parenteral vaccine distribution in resource-limited settings. Chinese pharmaceutical companies are achieving significant milestone breakthroughs in oral ADC platforms following government emphasis through "Made in China 2025" initiatives. Nanoparticle-based vaccine platforms leveraging lipid nanoparticles and polymeric carriers enable oral mucosal immunity induction, addressing pandemic preparedness and endemic infectious disease burdens. Wuxi Biologics announced expanded biologics manufacturing capacity targeting advanced therapeutic modalities. Market participants developing platform technologies applicable across diverse therapeutic modalities achieve competitive barriers protecting revenue streams through 2033-2035. Projected market expansion into next-generation macromolecules creates $6-9 billion incremental opportunity unaddressed by current therapeutic portfolios.

Molecule Type Analysis

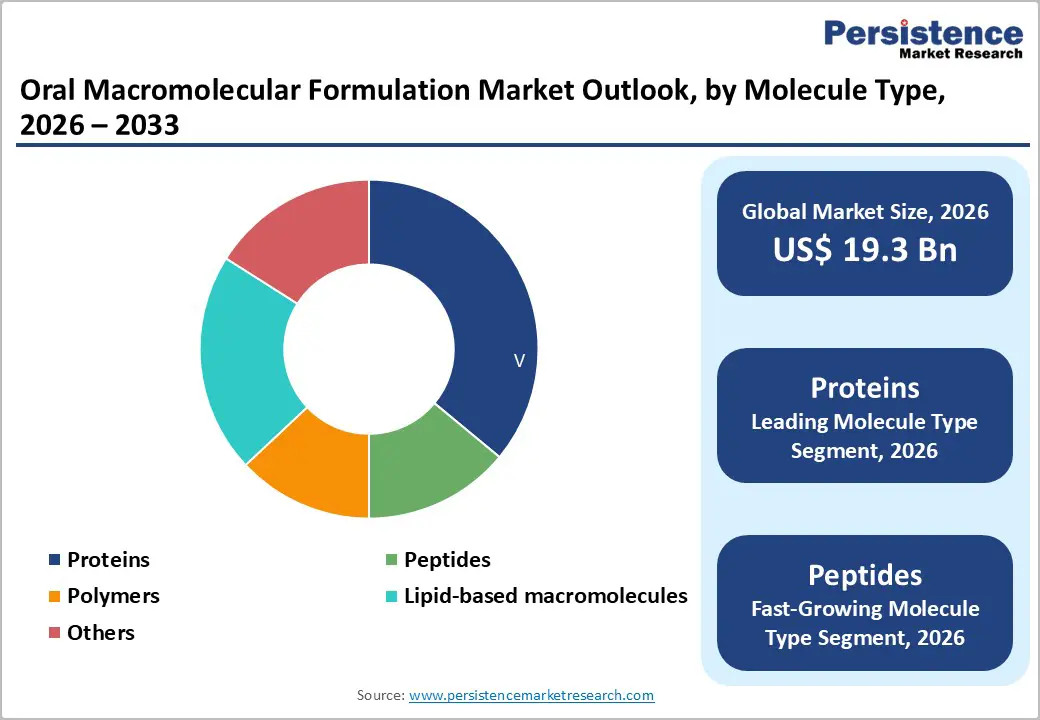

Proteins represent the dominant molecule type segment, commanding approximately 36% market share in 2025, driven by established clinical safety profiles, extensive manufacturing experience, and regulatory precedent supporting oral delivery. Insulin, monoclonal antibodies, and growth hormone therapeutics demonstrate substantial clinical proof-of-concept for oral administration, enabling market confidence in protein-based investments. Enzymes and therapeutic antibodies targeting gastrointestinal pathologies achieve favorable oral bioavailability through local absorption mechanisms requiring minimal systemic circulation. Novo Nordisk, Merck, and AstraZeneca maintain substantial R&D pipelines targeting oral protein formulations, leveraging market position to capture emerging opportunities. Protein manufacturing infrastructure benefits from decades of optimization experience across biopharmaceutical industry, enabling cost-effective scaling. Regulatory frameworks supporting protein therapeutic development remain more established than alternative macromolecule categories, reducing approval timeline uncertainties. However, peptide therapeutics emerge as the fastest-growing segment with CAGR exceeding 6.2% annually through 2032. GLP-1 peptide therapeutics demonstrate unmatched clinical efficacy for diabetes and obesity management, with global diabetes incidence driving sustained demand expansion. Pfizer, Eli Lilly, Sanofi, and AstraZeneca compete aggressively in oral peptide development, allocating $500 million+ annually to portfolio advancement. Peptide bioavailability challenges have been substantially overcome through permeation enhancer innovations and formulation technologies, reducing development risk premiums. Polymers and lipid-based macromolecules capture 12-15% combined market share, with emergence in advanced drug delivery applications and novel therapeutic platforms.

End User Analysis

Pharmaceutical and biopharmaceutical companies represent the leading end-user segment, commanding 60-65% market share in 2025, driven by substantial R&D investments, regulatory expertise, and commercialization infrastructure. Institutes across North America, Europe, and Asia Pacific operate GLP-certified preclinical/early-stage clinical facilities supporting pharmaceutical sponsor development objectives. Government-funded research initiatives in China, India, and Southeast Asia expand institutional participation through national innovation programs emphasizing biologics development self-sufficiency. Hospitals and clinics represent 15-20% end-user segment share, reflecting emerging roles in clinical trial execution, patient recruitment, and post-market pharmacovigilance. Academic medical centers in leading pharmaceutical markets maintain specialized gastroenterology and endocrinology practices supporting oral macromolecule trials and clinical validation studies. Fastest-growing end-user segments emerge within emerging market research institutes and specialized manufacturing facilities, reflecting India's and China's strategic emphasis on biologics innovation and manufacturing capacity development.

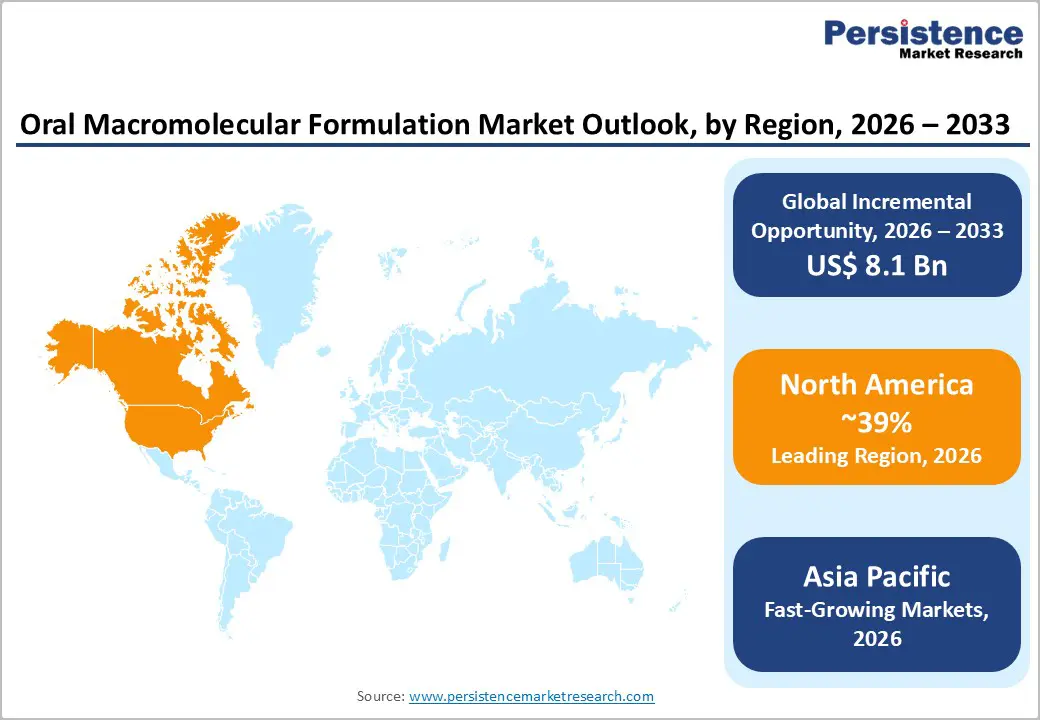

North America Oral Macromolecular Formulation Market Trends

North America continues to dominate the oral macromolecular formulation landscape, driven by its advanced pharmaceutical infrastructure, substantial R&D investments, and strong regulatory support for novel delivery technologies. The region, particularly the United States, leads the adoption of oral biologics and peptides as healthcare systems prioritize patient friendly, non invasive therapies for chronic conditions like diabetes and gastrointestinal diseases. Major biotech clusters and collaborations between academic institutions and pharmaceutical companies accelerate innovation in formulation platforms that enhance stability and absorption of large molecules. High healthcare spending and proactive regulatory pathways expedite clinical development and approval of cutting edge oral macromolecular drugs. Additionally, rising patient preference for oral treatment over injectable alternatives fuels market momentum. While established players expand portfolios, emerging technologies such as advanced permeation enhancers and targeted delivery systems are shaping the next wave of growth, reinforcing North America’s leadership position.

Asia Pacific Oral Macromolecular Formulation Market Trends

Asia Pacific is rapidly emerging as a key growth engine in the oral macromolecular formulation market, outpacing developed regions due to rising healthcare investments, expanding pharmaceutical manufacturing capacity, and a growing burden of chronic diseases such as diabetes and cardiovascular conditions. Countries like China, India, Japan, and South Korea are witnessing heightened demand for patient friendly oral biologics and peptide therapies, driven by large patient populations and increasing awareness of non invasive treatment options. Local companies are accelerating R&D and partnering with global biopharma firms to develop and commercialize advanced oral formulations tailored to regional needs. Government initiatives and regulatory reforms are improving market access and supporting innovation in delivery technologies that enhance the bioavailability and stability of macromolecules. In addition, expanding healthcare infrastructure and rising middle class spending on advanced medicines further fuel adoption. These combined trends position Asia Pacific as the fastest growing and most dynamic regional market in the global oral macromolecular formulation landscape.

Market Structure Analysis

The Oral Macromolecular Formulation Market is highly competitive, characterized by intense innovation in drug delivery technologies and formulation approaches. Companies are investing heavily in research to develop oral biologics and peptides with enhanced stability, bioavailability, and patient compliance. Strategic collaborations, licensing agreements, and mergers are common to accelerate product development and market penetration. Market players focus on differentiating through proprietary delivery platforms, advanced permeation enhancers, and nano formulation technologies.

Key Market Developments

The global oral macromolecular formulation market is expected to be valued at US$ 19.3 billion in 2026 and projected to reach US$ 27.4 billion by 2033.

The market is primarily driven by escalating patient preference for non-invasive oral administration over injectable therapeutics, technological advancements in permeation enhancers and absorption enhancement systems, rising prevalence of type 2 diabetes and obesity affecting 535+ million individuals globally, and regulatory breakthroughs, including the FDA's approval of oral semaglutide, demonstrating clinical feasibility.

North America maintains dominant regional leadership with 39% global market share in 2025, reflecting mature pharmaceutical markets, world-class research infrastructure, FDA's supportive regulatory framework enabling rapid clinical translation, and concentration of biotechnology innovation across United States.

The most significant emerging opportunity involves generic competition post-patent expiration for GLP-1 peptide therapeutics, anticipated 2028-2032, enabling affordable oral drug access for 50+ million eligible diabetic and obese patients across emerging markets, including India, China, Southeast Asia, and Latin America.

Novo Nordisk A/S, Pfizer Inc., Merck & Co., Inc., Sanofi S.A., etc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Molecule Type

Therapeutic Area

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author