ID: PMRREP34576| 180 Pages | 17 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

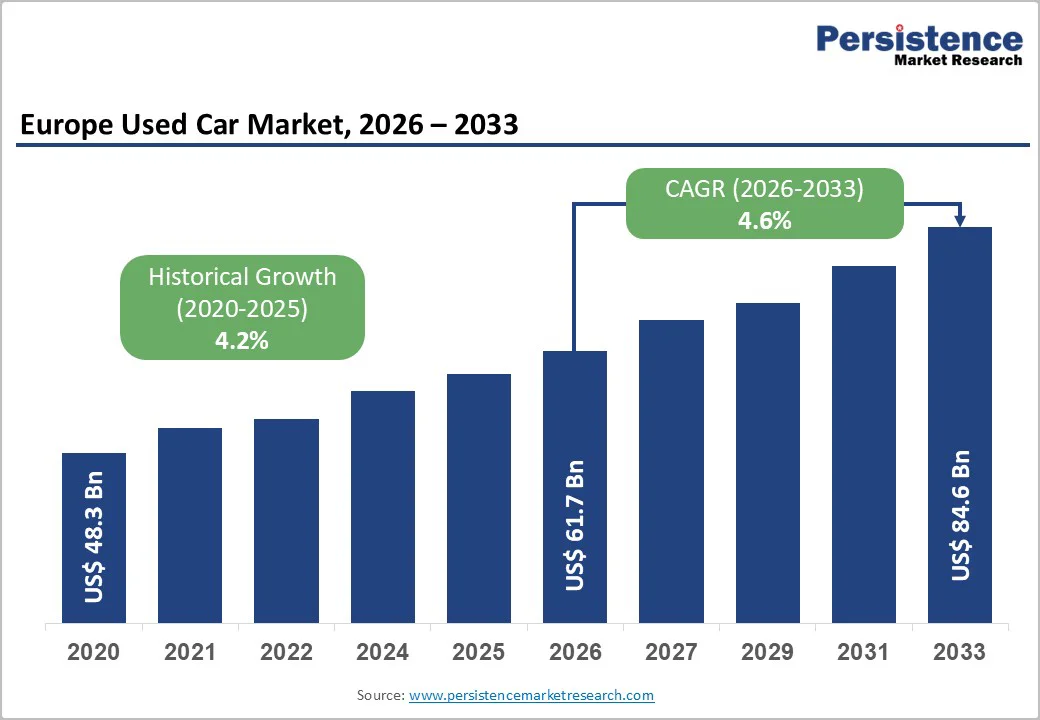

The Europe used car market size is likely to be valued at US$61.7 billion in 2026, and is expected to reach US$84.6 billion by 2033, growing at a CAGR of 4.6% during the forecast period from 2026 to 2033, driven by the increasing prevalence of affordability preferences, rising demand for eco-friendly second-hand vehicles in urban mobility, and advancements in online sales platforms.

Rising demand for low-emission vehicles, including hatchbacks and hybrids, is driving growth in the European used car market. Certified pre-owned programs and digital inspections enhance transparency and reliability, while the market’s role in promoting sustainable, cost-conscious transport further fuels adoption.

| Key Insights | Details |

|---|---|

|

Europe Used Car Market Size (2026E) |

US$61.7 Bn |

|

Market Value Forecast (2033F) |

US$84.6 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

4.6% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.2% |

Rising consumer preference for affordability is creating significant opportunities for used-car dealers, driven by demand for cost-effective, convenient, and low-maintenance mobility. High new-car prices often strain budgets, particularly for young buyers and families, leading to delayed purchases and dissatisfaction. Certified inspections, digital listings, hybrid conversions, EV-compatible vehicles, and extended warranties provide a budget-friendly alternative, simplifying transactions and reducing financing needs.

The European used car market also mitigates risks such as depreciation, unexpected maintenance costs, and environmental impact. It improves fuel efficiency and makes upgrades easier, particularly for SUVs and sedans, making it attractive to cost- and eco-conscious buyers. As global mobility providers broaden access and enhance digital solutions, demand is steadily rising for hatchbacks through online platforms and established dealerships.

High development and inspection costs pose a significant barrier for companies advancing next-generation used-car platforms and novel sales systems. Developing innovative services such as AI valuations, certified EV checks, or hybrid diagnostics requires extensive research, specialized scanners, and advanced digital tools that are far more expensive than basic listings. Reliability presents an even greater challenge, as many refurbished vehicles, battery-tested hybrids, and mileage-verified diesels are vulnerable to wear, history gaps, and fraud. These issues require rigorous optimization to ensure that the vehicles remain trustworthy throughout resale and ownership. Achieving long-term value often involves costly diagnostic trials, sophisticated VIN tracing, and the use of high-grade warranties, which significantly increase operational expenditures.

Meeting stringent regulatory requirements for emission data, safety compliance, and transaction transparency requires multiple audits under varying conditions and in various inventory batches. This adds both time and financial burden to development timelines. Scaling up operations requires controlled lots, specialized logistics, and quality-assurance systems, further driving up overall costs. For smaller dealers, these challenges can limit inventory expansion or delay digital integration.

Advancements in digital and certified pre-owned platforms are transforming the Europe used car market landscape by addressing two major challenges, trust gaps and inventory variability. Digital platforms are engineered to enable real-time listings, reducing reliance on physical visits and enabling seamless cross-border sales. Innovations, such as VR inspections, blockchain histories, AI pricing, and hybrid matching, significantly improve transparency and reduce fraud, lowering logistical costs for buyers and sellers.

Progress in certified pre-owned platforms, including warranty-backed hybrids, online auctions, peer-to-peer hybrids, and vendor-verified sedans, supports more reliable transactions by stimulating market confidence, the buyer’s first line of defense against lemons and depreciation. These formats eliminate uncertainties, enhance satisfaction, and allow self-service without agents, making them highly suitable for mass mobility programs. New technologies such as AR test drives, VLP-based valuations, and eco-scoring further enhance decision-making and value response.

Hatchback is anticipated to dominate the market, accounting for approximately 35% of the market share in 2026. Its dominance is driven by urban practicality, cost-effectiveness, and fuel efficiency, making it preferred for city commuting. Hatchbacks provide compact storage, ensure maneuverability, and contribute to low emissions, making them suitable for large-scale urban campaigns. For example, in Europe, compact hatchbacks such as the Peugeot 208 have led overall car sales, with the 208 topping the European sales charts in 2022 by delivering more than 206,000 units and displacing the iconic Volkswagen Golf, a testament to hatchbacks’ strong appeal in urban markets driven by practicality, affordability, and efficiency.

SUV/MUV is likely to be the fastest-growing segment, due to its versatility and expanding use in family transport. Its spacious profile makes it ideal for a range of needs, reducing compromises. Continuous innovations in hybrid SUVs are further strengthening their appeal, driving rapid adoption across the U.K. and Germany, where demand for multi-purpose, high-ground-clearance vehicles is accelerating. For example, the Volkswagen T-Roc, a compact C-SUV, exemplifies the popularity of compact and mid-size SUVs for family transport in Europe, accounting for a significant share of SUV registrations in this segment (42%).

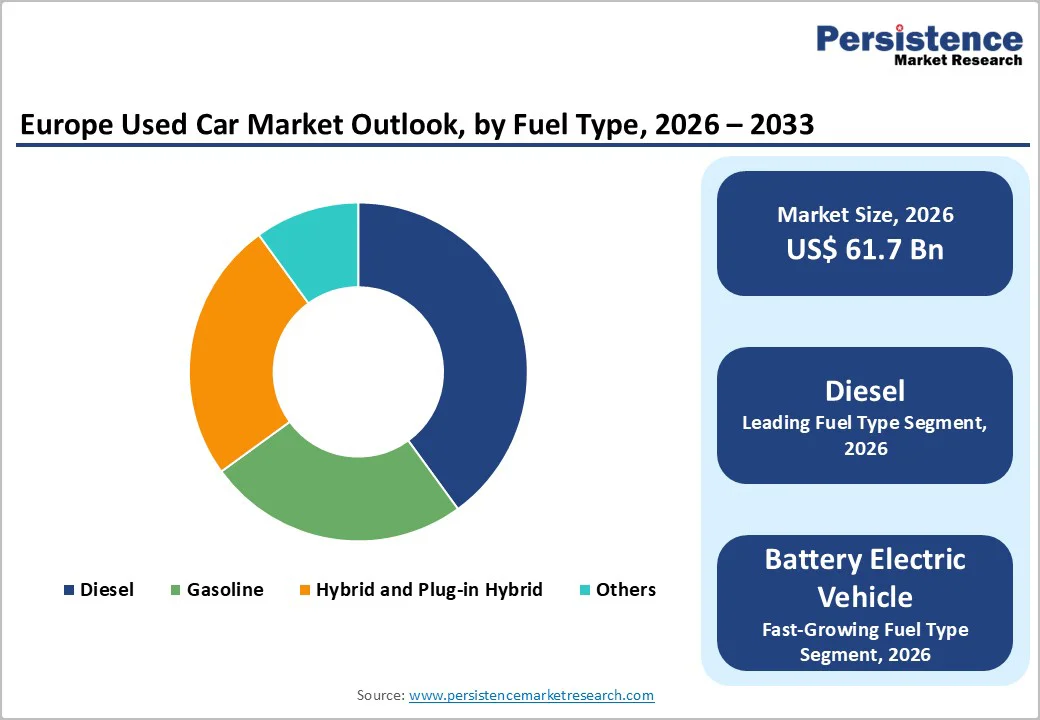

The diesel segment is anticipated to lead the market, holding approximately 40% of the share in 2026, driven by long-range efficiency, large fleet programs, and strong demand for economical options. The dominance continues as operators expand use for highways and vans. The increasing adoption of plug-in hybrids and the expansion of EV initiatives emphasize the growing emphasis on balanced performance. For instance, in 2024, diesel made up 84.5% of all new van registrations in the European Union, remaining the dominant fuel choice for vans.

The battery electric vehicle segment is the fastest-growing, driven by strong momentum in green mobility and the expanding inclusion of affordable second-hand EVs in urban fleets. The growing shift toward online platforms, along with improved battery warranties, is accelerating adoption. Advancements in charging infrastructure and continued progress of hybrid conversions entering resale trials drive market growth. For instance, in Europe, battery electric vehicles (BEVs) have seen rapid growth, surpassing other powertrain types. In the first half of 2025, new BEV registrations in the region rose by approximately 34% compared to the previous year, highlighting the strong shift toward fully electric mobility as both consumers and fleets increasingly adopt greener alternatives.

The unorganized segment is expected to dominate the market, contributing nearly 55% of revenue in 2026, as it remains the primary source of flexible pricing, local knowledge, and management of diverse buyer preferences that require quick deals. Their strong networks, informal ties, and ability to handle a range of vehicles drive higher volume. Unorganized vendors are leading hatchback and diesel rollouts and are featuring emerging hybrid trials. For example, local markets such as Gumtree routinely offer unverified sedans and SUVs while also facilitating peer-to-peer sales for affordable options, ensuring buyers receive tailored, low-cost access with high flexibility.

The organized segment is the fastest-growing, driven by its strong certification presence and expanding role in certified pre-owned sales. They offer convenient, quick, and accessible inspections, attracting buyers who prefer vetted, low-risk settings. Increased outreach programs, warranty focus, and wider availability of routine and premium vehicles further accelerate trust, boosting rapid adoption across both urban and semi-urban areas. For example, dealer chains such as Sytner Group Ltd provide walk-in certified EVs and hybrids, making mobility more reliable to local populations while reducing pressure on informal networks.

Offline is likely to dominate the market, with approximately 70% share in 2026, due to the high volume of physical inspections and strong global emphasis on hands-on evaluation. Regular test-drive schedules, negotiation requirements, and widespread access to dealer lots drive consistent demand. Rising focus on hybrids, SUVs, and online hybrids further strengthens offline market leadership. For example, in Europe, car buyers continue to rely heavily on offline channels. Survey data shows that 60% of consumers in Sweden, 58% in Britain, and 57% in France prefer purchasing vehicles through physical dealerships rather than online. This demonstrates that hands-on inspection, test drives, and in-person negotiation remain crucial factors, driving the dominance of offline automotive sales.

Online is projected to be the fastest-growing field, driven by the rising need for digital convenience, vulnerability to time constraints, and expanding adoption of virtual platforms. Improved transparency profiles, tailored listings, and stronger user interfaces for remote buyers support rapid uptake. The growing use of AR views, blockchain histories, and app-based auctions among digital natives further accelerates market growth. For example, in Europe, online automotive marketplaces such as AutoScout24 and Carwow exemplify the rapid growth of digital car-buying channels. AutoScout24 has become one of the continent’s most visited online car platforms, with millions of unique users searching through extensive vehicle listings each month, and it continues to expand features, such as dealer financing tools and digital price comparisons, to support online purchases.

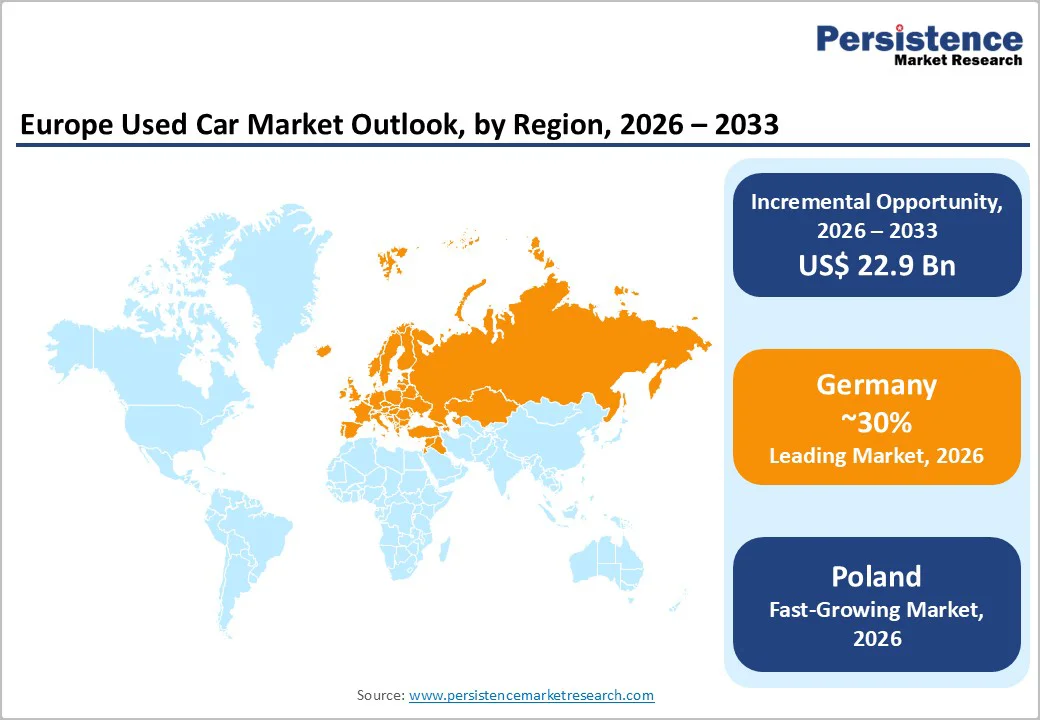

The U.K. is projected to account for nearly 20% of the Europe used car market in 2026, driven by the region’s advanced digital infrastructure, strong research and development capabilities, and high public awareness of mobility benefits. Retail systems in the U.K. provide extensive support for sales programs, ensuring broad access to used cars across hatchbacks, hybrids, and sedans. Increasing demand for online, convenient, and easy-to-access vehicles is further accelerating adoption, as these formats improve buyer compliance and reduce barriers associated with travel.

Innovation in used-car technology, including stable listings, improved valuation delivery, and targeted certification, is attracting significant investment from both the public and private sectors. Government initiatives and green campaigns continue to drive sales amid urban congestion, rising fuel costs, and emerging EV threats, creating sustained market demand. The growing focus on SUVs and plug-in hybrids, particularly for family and fleet use, is expanding the target population for the European used-car market. The U.K. trends show a 15% rise in online sales post-2025, with platforms such as Cazoo emphasizing EV inspections and hybrid warranties, influencing cross-border trust via shared EU standards.

Germany is expected to dominate the European used car market with a projected market share of 30% in 2026, driven by increased awareness of the quality benefits of pre-owned vehicles, robust retail systems, and government-supported export programs. As a key player in the European automotive landscape, Germany’s strong automotive heritage supports a steady flow of used car resales and fosters the adoption of innovative sales channels. These factors make Germany especially attractive for sedan buyers, budget-conscious consumers, and fleet operators, contributing to higher turnover and broader market reach.

Technological innovations in used car development, such as improved vehicle histories, channel-specific delivery systems, and enhanced hybrid options, are further driving market potential. The German government is actively backing research initiatives and vehicle auctions, catering to both everyday and premium vehicle needs, which strengthens consumer confidence. A growing emphasis on self-service options aligns with Germany’s focus on preventive mobility and reducing the need for in-person dealership visits. Additionally, public awareness campaigns and sales promotions are helping expand the market’s reach in both urban and rural areas.

With a high vehicle density (500 vehicles per 1,000 people) and a €50 billion (approx. USD 55 billion) annual trade value, Germany remains a significant player in the European used car market. Sedans, particularly models such as the BMW 3 Series, dominate the market, accounting for approximately 25% of used car sales in the region.

The Poland used car market is shaped by supply constraints, rising demand, and active cross-border trade. Like many European countries, Poland has faced semiconductor shortages, affecting new car production. This has led to increased demand for pre-owned vehicles, especially smaller petrol and diesel models, which are affordable and practical for urban driving. Consumers are increasingly seeking cost-efficient, immediately available options, fueling growth in the used-car market.

Cross-border trade is a key driver of Poland’s used car market, with many vehicles being imported from Western European countries, particularly Germany and the Netherlands. These countries have high vehicle turnover and stricter emissions regulations, pushing older cars into the resale market. Poland is a significant destination for these vehicles, offering a diverse range of models. Popular models such as the Volkswagen Golf and the Opel Astra are commonly sourced for their durability, affordability, and availability of parts.

The growing demand for fuel-efficient vehicles, including electric and hybrid models, is further diversifying the market. Polish consumers are becoming more discerning, placing greater emphasis on vehicle history, condition, and certification. Certified pre-owned programs and digital inspection platforms are gaining popularity. The influx of used vehicles from Western Europe contributes to competitive pricing, benefiting consumers but also posing challenges for local dealers in terms of pricing strategies and inventory management.

The European used car market features competition between established dealer leaders and emerging digital firms. In the U.K. and Germany, Auto1 Group SE and Emil Frey AG lead through strong R&D, distribution networks, and retail ties, bolstered by innovative listings and sales programs. In France, Aramis Group SA advances with localized solutions, enhancing accessibility.

Digital-enhanced delivery boosts trust, cuts fraud risks, and enables mass transactions across regions. Strategic partnerships, collaborations, and acquisitions merge expertise, expand inventories, and speed digitalization. Certified platforms solve quality issues, aiding penetration in trust-focused areas.

The Europe used car market is projected to reach US$61.7 billion in 2026.

The rising prevalence of affordability preferences and demand for eco-friendly second-hand vehicles are key drivers.

The Europe used car market is poised to witness a CAGR of 4.6% from 2026 to 2033.

Advancements in digital and certified pre-owned platforms are key opportunities.

Auto1 Group SE, Emil Frey AG, Cazoo Group Ltd, Pendragon PLC, and Aramis Group SA are the key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Vehicle Type

By Fuel Type

By Vendor Type

By Sales Channels

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author