ID: PMRREP33527| 181 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

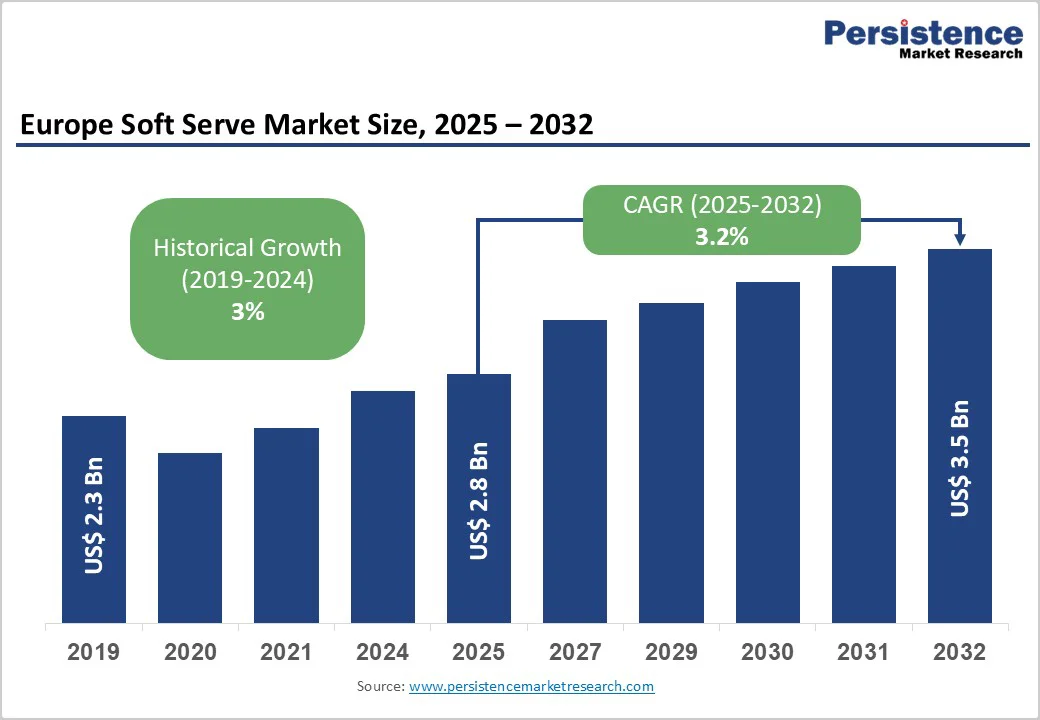

The Europe soft serve market size is likely to be valued at US$2.8 Billion in 2025, and is estimated to reach US$3.5 Billion by 2032, growing at a CAGR of 3.2% during the forecast period from 2025 to 2032, driven by shifting consumer preferences toward health-conscious and plant-based options, the rapid expansion of quick-service restaurant (QSR) chains across both mature and emerging Europe markets, and rising demand for premium, experiential soft serve experiences driven by social media influence.

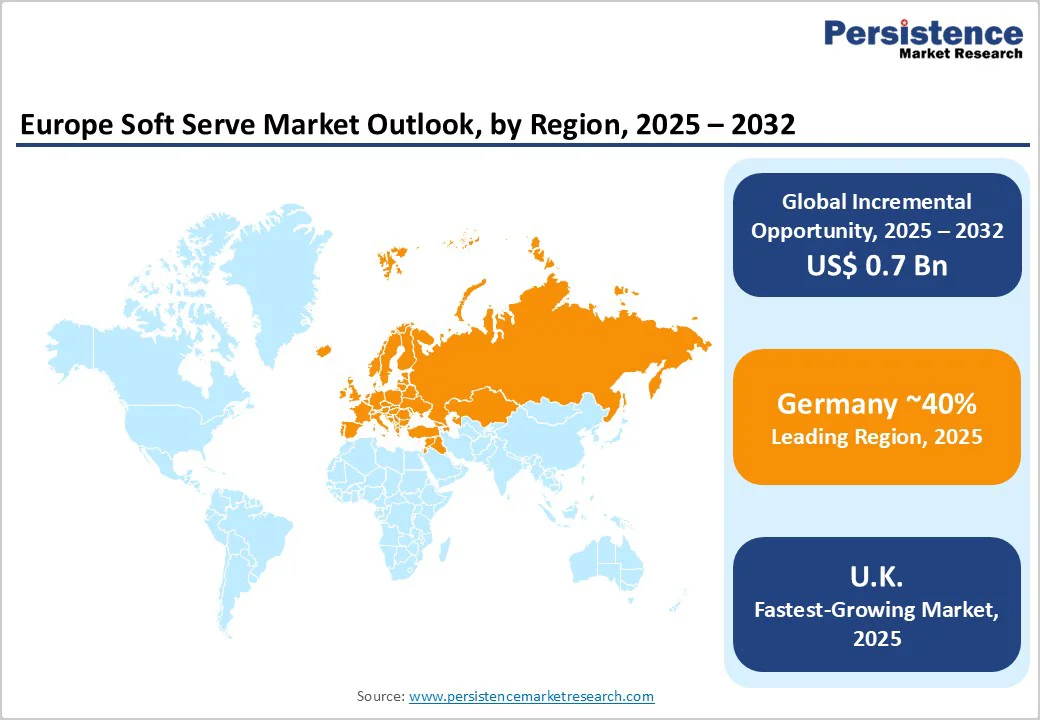

Germany leads the market, the U.K. is the fastest-growing, while Poland and Russia show faster growth. Innovations in functional ingredients and digital distribution boost opportunities, with the market driven by a mix of traditional frozen desserts and new products targeting younger, health-conscious consumers.

| Key Insights | Details |

|---|---|

| Europe Soft Serve Market Size (2025E) | US$2.8 Bn |

| Market Value Forecast (2032F) | US$3.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 3.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 3% |

The Europe soft serve market growth is fueled by the increased adoption of functional and plant-based products, reflecting a broader shift toward wellness-oriented dietary consumption in the region. According to the European Food Safety Authority (EFSA) and various health surveys, a growing number of consumers actively seek plant-based alternatives, driven by lactose intolerance, ethical consumption, and environmental sustainability considerations.

Functional ingredient integration, including probiotics, plant proteins, and adaptogens, commands premium pricing, inflating margins by over 40%, and has led to exponential year-over-year sales growth in select Western European markets. These trends are opening lucrative niches for innovators leveraging microencapsulation technology for nutrient stability and health benefit delivery.

Despite its tremendous growth potential, the market contends with significant seasonal demand fluctuations, with a large portion of consumption occurring during warmer months (May-September). This consumption concentration imposes operational challenges, including uneven equipment utilization, inventory management inefficiencies, and compressed revenue windows, reducing profitability for smaller operators and increasing capital risk.

Rising costs in dairy, sustainable packaging materials mandated by the European Union (EU)’s regulatory frameworks, and logistical complexities in sourcing specialty ingredients have created additional cost barriers compressing margins industry-wide. Weather unpredictability further hampers demand stability, complicating forecasting and exacerbating supply chain risks.

The rise of online food delivery platforms such as Uber Eats, Deliveroo, and Just Eat is opening hitherto non-existent growth avenues within the soft serve market by providing access to broader consumer bases beyond physical retail locations.

Operators integrating digital ordering, personalized recommendations through AI, and real-time tracking are experiencing sizable increases in order volumes, with premium soft serve offerings demonstrating high demand elasticity in these channels.

This channel fosters urban market penetration, impulse purchase behavior, and operational efficiencies, unlocking incremental revenue of several million dollars for companies. The convergence of digital consumer habits with experiential soft serve product innovation presents a lucrative growth vector for agile market participants.

Vanilla continues to lead flavor-wise with an estimated 39% of the Europe soft serve market revenue share in 2025. This dominant position is due to vanilla’s widespread consumer recognition, versatility in pairing with other flavors and toppings, and operational simplicity for foodservice providers who benefit from streamlined inventory and logistics.

Vanilla constitutes nearly 40% of Germany’s soft serve consumption, illustrating its entrenched popularity in the largest Europe market. This segment also benefits from strategic premiumization via the use of high-quality vanilla beans, organic certifications, and experiential consumption positioning in artisanal retail environments.

The “Others” segment, including innovative, botanical, limited-edition, and exotic soft serves, is driven by millennial and Gen Z demand for novel, Instagrammable taste experiences and experiential food culture. It features nostalgic Americana flavors such as cereal milk and peanut butter & jelly, botanical options such as lavender and elderflower, and global profiles such as ube and tahini.

Brands such as Ben & Jerry’s leverage these trends with oat-based vegan and premium core-filled products, commanding higher price points. Agile R&D and social listening enable rapid innovation, shortening time-to-market and sustaining consumer engagement in this dynamic segment.

Dairy-based soft serve retains overwhelming dominance with a 70% revenue share in 2025, supported by an established dairy production infrastructure and consumer familiarity with creamy, traditional frozen desserts across Europe. This segment combines full-fat, low-fat, and high-protein variations, accommodating consumers across health and indulgence spectrums.

German leadership in dairy reflects both consumer preferences and large-scale dairy industries capable of supplying high volumes consistently. The segment’s evolution is marked by incremental premiumization through organic certifications and artisanal cold chain logistics, maintaining its primary position in mainstream and mass-market channels.

Plant-based alternatives represent the most rapid growth segment, boasting a high CAGR from 2025 to 2032, fueled by demographic shifts toward veganism, lactose intolerance awareness, and ecological concerns. Various bases, such as oat, almond, coconut, soy, and hemp milk, are now more easily available for manufacturers to diversify product portfolios and cater to different taste preferences and nutritional needs.

Technological advances have enhanced texture and mouthfeel alignment with traditional dairy formulations, increasing consumer acceptance. The segment commands price premiums, reflected in higher margins and profitability for brands prioritizing sustainability credentials. Market penetration is still nascent relative to overall soft serve consumption, suggesting significant expansion potential.

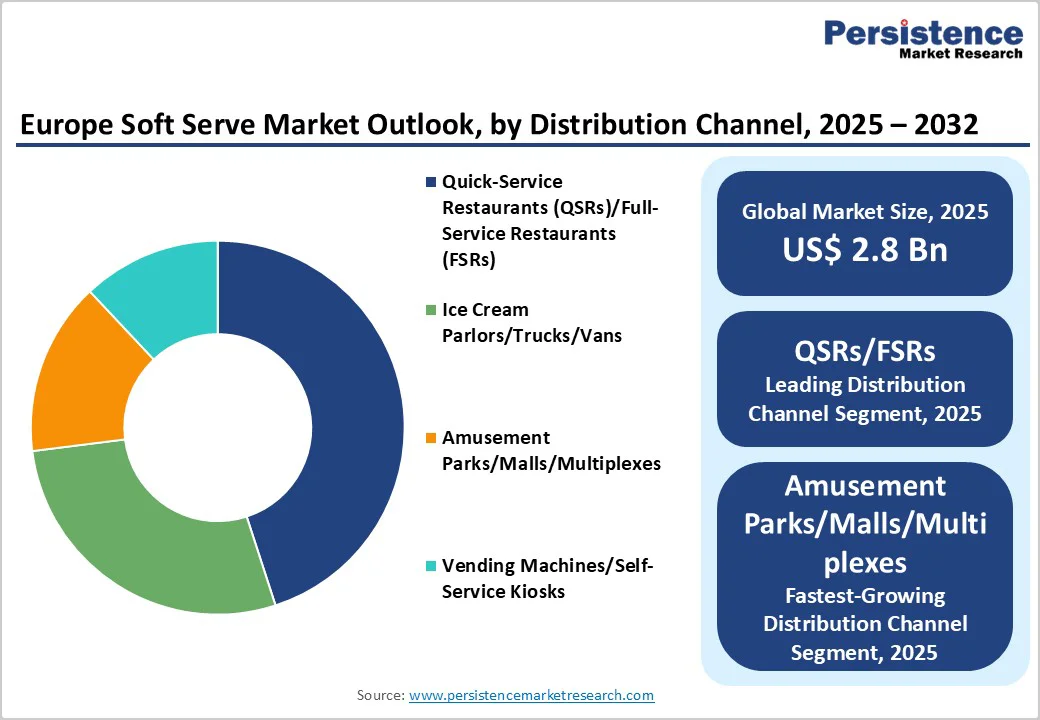

QSR and FSR operators collectively command the largest channel share at 45% in 2025, driven by expanding store footprints, evolving consumer convenience preferences, and embedded menu integration of soft serve offerings. Multinational brands such as McDonald’s, Burger King, and KFC leverage scalable supply chains and standardized equipment, enabling rapid delivery of consistent soft serve products to mass consumer bases.

This channel also benefits from impulse purchases and value meal bundling, contributing significantly to the overall market size. The feature-rich investment in self-service kiosks and catering technology by QSRs/FSRs supports operational flexibility and consumer engagement. Strategic geographic expansion into high-growth Eastern Europe markets further amplifies the prospects of this channel.

Emerging alternative channels, including amusement parks, kiosks, food trucks, and third-party delivery platforms, have gained meaningful traction, representing fast-evolving but smaller revenue contributors. Digital delivery platforms such as Uber Eats have accelerated accessible soft serve procurement beyond physical stores, particularly in urban demographics responding favorably to convenience and impulse consumption.

Food trucks and kiosks offer experiential consumer engagement with dynamic flavor and topping customization. Amusement and event venues leverage high foot traffic and multisensory consumption experiences to command premium pricing. These channels collectively support market innovation diffusion and consumer inclusivity, expanding soft serve reach across demographic and geographic spectra.

Germany commands the leading position with roughly 40% of the Europe soft serve market share in 2025. Its mature foodservice infrastructure and extensive quick-service restaurant/dessert parlors network underpin stable demand growth through 2032. German consumers exhibit high health awareness and premiumization preferences, driving demand for specialty dairy formulations and emerging plant-based soft serve variants.

Regulatory emphasis on sustainability and innovative packaging solutions influences product development costs and supply chain dynamics. Competitive landscape includes dominant multinational players and influential regional brands, enabling varied market entry points. Investment trends focus on digital integration and premium product development to sustain long-term growth in a mature market.

The U.K. is the second-largest and fastest-growing market for soft serve products in Europe. The U.K.’s fragmented yet prolific franchise dessert market, exemplified by Creams Franchising’s 100+ locations, boosts soft serve consumption in urban and suburban settings. The U.K. market exhibits a strong digital food ordering infrastructure and extensive delivery platform integration, increasing channel diversity and reach.

Key growth drivers include consumer preference for experiential consumption and plant-based products, supported by ongoing regulatory emphasis on food labeling and safety. Competitive positioning features a mix of established multinational brands and dynamic specialty operators, fostering innovation and consumer engagement.

In France, the soft serve market expansion is fueled by the alignment of consumer behavior with artisanal and café culture, favoring premium offerings rooted in culinary tradition. The dominant presence of multi-brand QSR groups within the French foodservice ecosystem enables distribution scale and menu diversity.

Regulatory frameworks strongly support sustainability and food safety agendas, impacting ingredient sourcing and packaging innovations. The competitive environment balances large multinational foodservice providers with regional artisanal producers gaining traction. Investment opportunities focus on integrating soft serve into full-service dining and premium street food environments.

The Europe soft serve market landscape is moderately fragmented, with Unilever, Nestlé (via Froneri JV), and Froneri International controlling more than half of the revenue share. These companies are leveraging broad brand portfolios, deep foodservice and retail distribution networks, and significant R&D investment, enabling continuous product innovation and market coverage.

The market also comprises regional and specialty operators focusing on niche segments such as plant-based and artisanal products. This structure reflects high entry barriers related to capital intensity, regulatory compliance, and brand equity development. Competitive positioning is driven by innovation speed, product portfolio breadth, and geographic penetration.

The Europe soft serve market is projected to reach US$2.8 Billion in 2025.

Evolving consumer preferences emphasizing health-conscious and plant-based formulations, rapid expansion of quick-service restaurant chains across Europe, and a heightening demand for experiential and premium soft serve offerings are driving the market.

The Europe soft serve market is poised to witness a CAGR of 3.2% from 2025 to 2032.

Advancing functional ingredient formulations, integrating with digital-first distribution platforms, and tapping into the dynamic interplay of traditional frozen dessert consumption and innovative product segments for capturing younger, health-conscious demographics are key market opportunities.

Unilever PLC, Nestlé S.A., and Froneri International Limited are a few of the key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Flavor

By Formulation

By Distribution Channel

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author