ID: PMRREP11683| 200 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

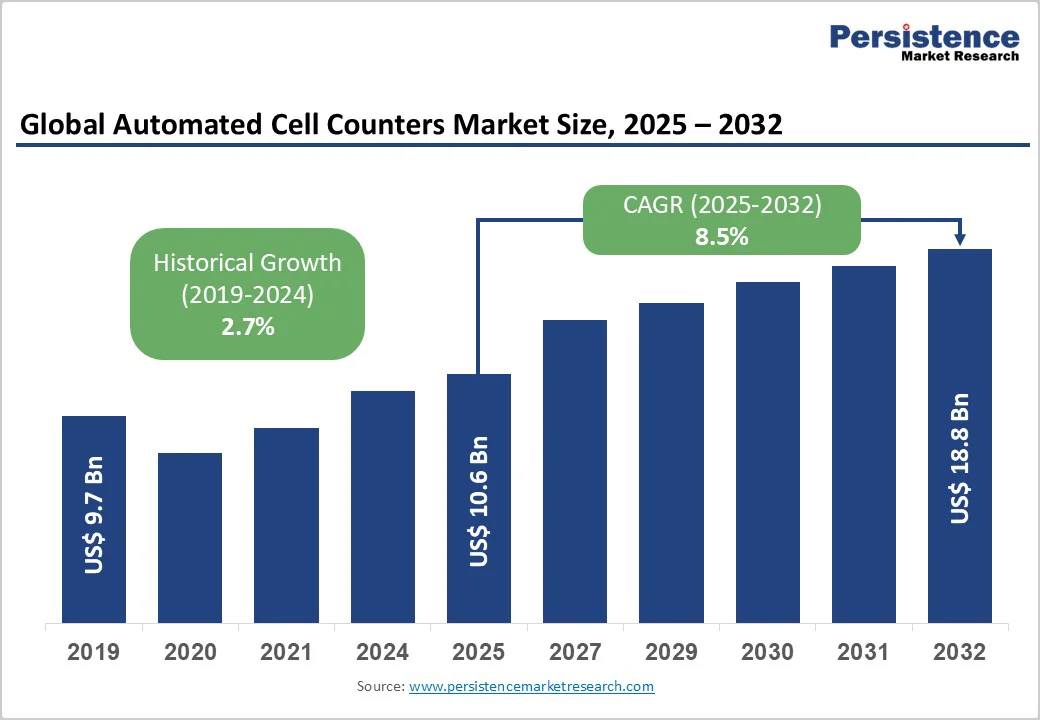

The global automated cell counters market size is likely to be valued at US$10.6 Billion in 2025, and is estimated to reach US$18.8 Billion by 2032, growing at a CAGR of 8.5% during the forecast period from 2025 to 2032, driven by expanding cell therapy manufacturing, accelerated biotech research funding, and increasing clinical adoption in personalized medicine and diagnostic workflows. Growth is fundamentally supported by macroeconomic factors such as increasing regulatory clearances for cell therapy products, the integration of AI/ML technologies across laboratory diagnostics, and the international push for automation in biopharmaceutical production.

| Key Insights | Details |

|---|---|

| Automated Cell Counters Market Size (2025E) | US$10.6 Bn |

| Market Value Forecast (2032F) | US$18.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.7% |

Rapid Progress in Cell Therapy Manufacturing and Regulatory Clearances

Cell therapy manufacturing is currently transforming the strategic scale and complexity of the market, creating a niche growth driver underpinned by robust regulatory support and investment inflows. As of 2025, multiple regulatory bodies, including the U.S. Food and Drug Administration (FDA), have cleared novel automated cell counting platforms tailored for CAR-T, stem cell, and tissue-engineered therapies, reflecting a sophisticated shift in clinical practice and commercialization.

For example, over 25 U.S. cell therapy manufacturing facilities now integrate AI-enabled cell counting and enumeration devices, enabling high-throughput quality assurance and real-time parameter monitoring. Regulatory harmonization and the inclusion of automated cell enumeration protocols in European Medicines Agency (EMA) and FDA guidelines have further catalyzed adoption across both clinical trial and commercial manufacturing phases.

High Upfront Capital Requirements and Cost Optimization Challenges

The automated cell counters market growth continues to face substantial barriers centered on capital investment requirements and constrained purchasing power among small-to-medium-sized laboratories and clinical facilities. Industry benchmarking indicates that benchtop and high-throughput automated cell counting instruments, especially those with integrated fluorescence and imaging capabilities, carry average initial purchase costs ranging from US$50,000 to US$80,000 per unit, with premium platforms exceeding US$350,000 depending on modular configuration.

This cost structure has resulted in delayed technology upgrades or outright exclusion from procurement cycles in mid-tier clinical labs and academic institutions. Furthermore, the total cost of ownership is elevated by mandatory software licensing, specialized reagents, and ongoing maintenance. These economic constraints are compounded by regulatory reimbursement uncertainty in certain regions, notably Asia Pacific and Latin America, where centralized budget allocations may not extend to advanced diagnostic instruments. As a result, competitive threats from low-cost, semi-automated, or manual counting solutions persist, stemming market share erosion outside premium biopharmaceutical and Tier 1 clinical markets.

Expansion in AI-enabled Point-of-Care and Distributed Laboratory Testing

A prime opportunity emerging within the automated cell counters market is the rapid expansion of AI-enabled point-of-care and distributed laboratory testing applications, especially in fast-growing healthcare economies and remote medical settings. Advanced analytics are allowing greater diagnostic accuracy, lower sample volumes, and real-time clinical decision-making across veterinary, environmental, and food safety sectors.

Technological convergence is intensifying, with microfluidic chip platforms and portable hand-held devices witnessing increasingly high shipment rates, reflecting the rise of distributed network testing in rural hospitals, ambulatory care centers, and global disease monitoring programs. Solution suppliers and investors are well-positioned to pursue lucrative opportunities in modular, scalable product lines tailored to variable infrastructure settings, combined with software-as-a-service and data analytics subscriptions.

Product Type Insights

The instruments segment is poised to dominate, projected to command approximately 41% of the automated cell counters market revenue share in 2025. This leadership position is reinforced by sustained demand for high-throughput flow cytometers and fluorescence-based automated cell counters, which are integral to clinical hematology, pharmaceutical research, and biologics manufacturing quality assurance. The adoption of advanced optics, multi-parametric analysis, and real-time data reporting features has elevated the value proposition of instruments for major end-users such as pharmaceutical companies and hospital laboratories. Market share consolidation of this segment is further driven by long-term capital equipment expenditure cycles combined with the recurring consumables revenue that high-spec instruments generate.

Application Insights

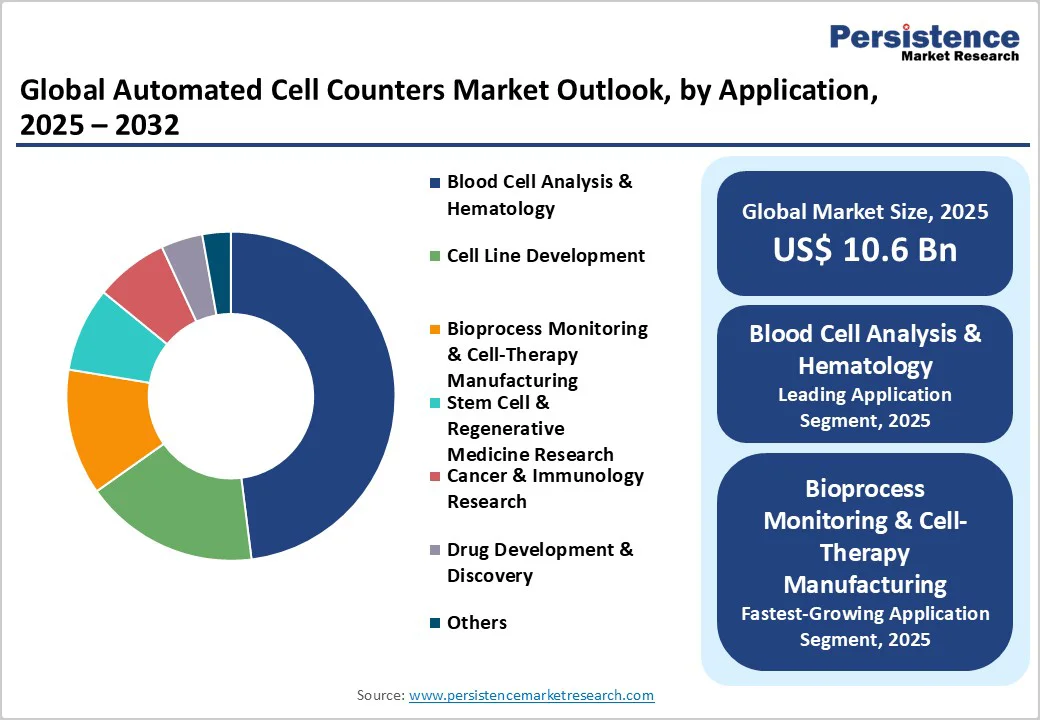

The blood cell analysis & hematology segment is likely to be the foremost application in 2025, representing nearly 48% of the automated cell counters market revenue. This segment’s preeminence is supported by entrenched adoption in hospitals, diagnostic centers, and clinical trial laboratories. Foremost growth determinants include a high demand for complete blood counts (CBC), white blood cell differentials, and platelet enumeration across oncology, infectious disease, and chronic disorder management. Regulatory reimbursement frameworks, such as those established by the Centers for Medicare & Medicaid Services (CMS) in the U.S. and analogous regulators globally, underpin widespread clinical acceptance.

The fastest-growing application area over 2025-2032 is bioprocess monitoring and cell therapy manufacturing. This growth is catalyzed by increasing cell therapy clinical approvals, contract manufacturing investments, and regulatory encouragements for automated quality control and release testing. Bioprocess monitoring applications require precise enumeration of various cell types within bioreactors and downstream processing systems, necessitating integrated platforms with AI-powered analytics, robust compliance tracking, and real-time monitoring capabilities. Companies focusing product development and service innovation in this segment are well positioned to capitalize on the rising global demand for regenerative medicine and personalized biologics.

End-user Insights

Pharmaceutical and biotechnology companies will continue to dominate the end-user landscape in 2025, accounting for around 56% of the market revenue. Their substantial market share is attributable to large-scale R&D portfolios, clinical trial operations, and advanced biologics manufacturing that require automated, high-precision cell counting technologies. Extensive regulatory oversight and the need for compliance with good manufacturing practices (GMP) reinforce this dominant position. These end-users are investing heavily in instrument modernization, AI integration, and cloud-enabled data management to optimize throughput, accuracy, and traceability across multiple production sites.

Hospitals and diagnostic laboratories are set to represent the fastest-growing end-user segment, with a forecast CAGR between 2025 and 2032. The shift toward automation in routine diagnostic workflows to improve efficiency, reduce human error, and support high patient volumes drives this expansion. Post-pandemic healthcare infrastructure investments, government subsidies for diagnostic modernization, and the growing need for decentralized testing in remote or underserved locations further catalyze growth. Providers targeting hospitals and diagnostics are focusing on flexible deployment models, ease-of-use features, and interoperability with electronic health records (EHR) systems.

North America Automated Cell Counters Market Trends

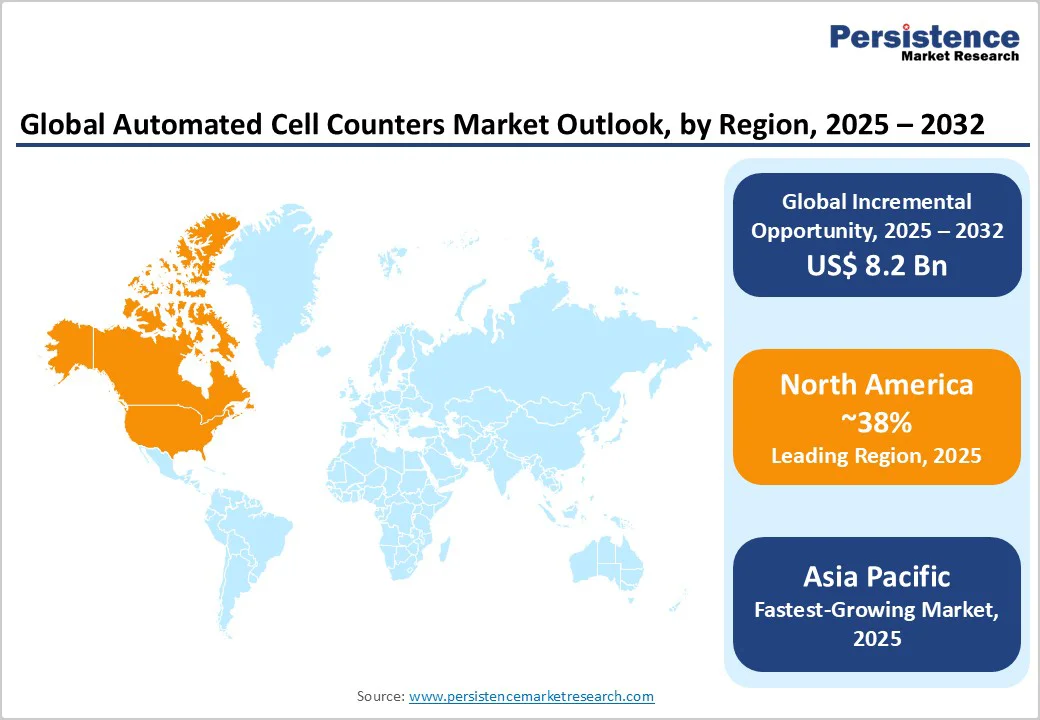

North America is anticipated to hold a commanding 38% of the automated cell counters market share in 2025. The promising growth prospects of the market here are founded on sustained investment in precision medicine, a robust regulatory framework led by the FDA, and integration of advanced AI and cloud technologies in clinical and manufacturing laboratories. The U.S. is the dominant contributor, leveraging a well-established innovation ecosystem comprising top-tier academic medical centers, biotech clusters, and venture-capital-backed start-ups. Regulatory momentum continues to favor innovation with streamlined pathways supporting automation and cell therapy manufacturing technologies, accelerating adoption.

Key regional drivers include large-scale biopharmaceutical production facilities, proactive regulatory harmonization initiatives, and extensive government-funded research programs such as the National Cancer Institute’s precision oncology efforts. Institutional adoption of AI-powered diagnostics is expanding rapidly, supported by healthcare system reforms emphasizing cost efficiency and quality outcomes. The competitive landscape is moderately consolidated, with leading players such as Thermo Fisher Scientific employing acquisition and R&D strategies to maintain technological leadership.

Europe Automated Cell Counters Market Trends

Europe is estimated to account for about 24% of the market in 2025, drawing strength from Germany’s industrial biotechnology prowess, the U.K.’s pioneering research infrastructure, and France’s expanding integration of digital diagnostic solutions. Harmonized regulatory standards under the EMA and concerted multi-country R&D funding initiatives, such as the Horizon Europe program allocating over €1.1 billion toward diagnostic innovations, have created a conducive ecosystem for the development and adoption of advanced healthcare technologies.

Germany leads in bioprocessing innovation and instrument adoption, followed by the UK’s focus on digital and cloud-based diagnostics. Regulatory frameworks prioritize quality assurance in advanced therapies, enabling rapid validation and market access for automated counter technologies. Competition is moderate to high, driven by incumbents such as Sartorius AG and Siemens Healthineers, alongside emergent specialized firms emphasizing AI integration. Investment flows reflect increased European venture capital commitments and government-backed technology consortia aimed at scaling interoperable diagnostics infrastructure.

Asia Pacific Automated Cell Counters Market Trends

Asia Pacific is predicted to be the fastest-growing regional market for automated cell counters through 2032. China, Japan, India, and ASEAN countries are spearheading dynamic growth driven by a combination of rising healthcare expenditure, government-led healthcare modernization, and expanding manufacturing capabilities. China’s dominant manufacturing output is providing cost-effective instrument and consumables solutions regionally and globally. In Japan, the focus of the healthcare industry is on advanced R&D and regulatory compliance that supports high-quality product innovation, while India’s universal healthcare expansion under national policy frameworks is driving procurement growth across urban and rural healthcare facilities.

Regulatory environments across Asia Pacific are evolving rapidly to align with international standards, facilitating technology transfer and market access. Local manufacturers and multinationals are engaging in strategic partnerships to leverage regional scale advantages. Competitive structures range from fragmented local ecosystems to multinational joint ventures. Investment trends indicate strong inflows in AI-enabled diagnostics and point-of-care platforms, particularly in emerging economies where decentralized testing infrastructure is prioritized to improve healthcare access.

The global automated cell counters market structure exhibits a moderate concentration. Capturing around half of the total market revenue, the top firms are dominating through extensive product portfolios, patented technologies, and broad geographic reach. The market's upper tier is characterized by intense competition based on speed, accuracy, integration capabilities, and service reliability. Market consolidation is driven by strategic acquisitions targeting niche technology innovation and cross-selling opportunities within life-sciences instrumentation.

Significant fragmentation persists in regional and portable product segments despite consolidation at the high end. Vendors are increasingly adopting SaaS and cloud connectivity models to supplement instrument sales, adding recurring revenue layers and strengthening competitive positioning. The competitive landscape analysis reveals a bifurcation between high-end instrument incumbents and agile regional or start-up innovators focusing on cost-effective, decentralized solutions.

Key Industry Developments

The global automated cell counters market is projected to reach US$10.6 Billion in 2025.

Expanding cell therapy manufacturing, accelerated biotech research funding, and increasing clinical adoption in personalized medicine and diagnostic workflows are driving the market.

The automated cell counters market is poised to witness a CAGR of 8.5% from 2025 to 2032.

Increasing regulatory clearances for cell therapy products, the integration of AI/ML technologies across laboratory diagnostics, and the international push for automation in biopharmaceutical production are key market opportunities.

Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), and Sysmex Corporation are a few of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author