ID: PMRREP31098| 187 Pages | 5 Sep 2025 | Format: PDF, Excel, PPT* | Industrial Automation

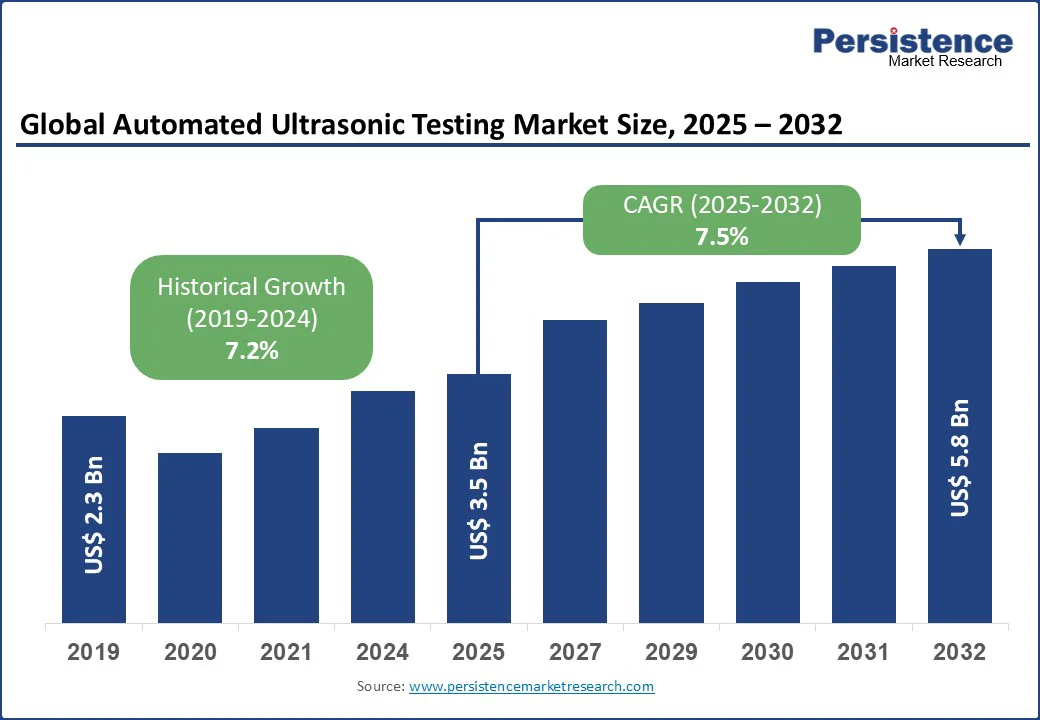

The global automated ultrasonic testing (AUT) market size is likely to reach US$3.5 Bn in 2025. It is expected to grow to US$5.8 Bn by 2032, registering a CAGR of 7.5% during the forecast period from 2025 to 2032.

The automated ultrasonic testing industry is experiencing robust growth, driven by increasing demand for non-destructive testing (NDT) solutions across critical sectors such as aerospace, oil and gas, power generation, manufacturing, and construction. Advancements in automation, precision testing technologies, and the need for enhanced safety and quality assurance in industrial applications are key factors propelling market expansion.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Automated ultrasonic Testing market Size (2025E) |

US$3.5 Bn |

|

Market Value Forecast (2032F) |

US$5.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.2% |

The rise in adoption of automated testing systems, particularly in high-stakes industries such as aerospace and oil and gas, is fueled by their ability to provide accurate, repeatable, and efficient inspections. These systems ensure the structural integrity of critical components, reduce human error, and comply with stringent regulatory standards, further boosting market demand.

The rising demand for non-destructive testing (NDT) in the aerospace and energy sectors is a significant driver for the growth of advanced inspection technologies, including Phased Array Ultrasonic Testing (PAUT) and other ultrasonic testing methods. In the aerospace sector, stringent safety standards and the critical need for structural integrity in aircraft components make NDT indispensable.

For instance, Boeing and Airbus routinely use PAUT to inspect aircraft fuselage panels and turbine blades for internal cracks and corrosion without dismantling the components. Non-destructive testing ensures high reliability and reduces the risk of catastrophic failures, making it an essential part of aircraft manufacturing, maintenance, and repair operations.

The energy sector, including oil and gas, nuclear, and renewable energy industries, relies heavily on NDT to monitor pipelines, pressure vessels, turbines, and wind turbine blades. Companies such as Shell and Siemens Energy employ ultrasonic and phased array testing to detect flaws in critical infrastructure, preventing leaks, structural failures, and downtime while ensuring compliance with safety regulations.

As energy infrastructure ages and new projects emerge globally, the demand for precise, efficient, and cost-effective NDT solutions continues to grow. The integration of advanced technologies such as PAUT enhances detection accuracy, accelerates inspection processes, and reduces operational risks, further driving market adoption.

The growth of the non-destructive testing (NDT) market, particularly advanced technologies such as Phased Array Ultrasonic Testing (PAUT), is hindered by the high initial investment and ongoing maintenance costs. PAUT systems consist of sophisticated hardware components, including multi-element probes, high-precision scanners, and advanced imaging software, which require substantial capital expenditure.

For instance, companies such as Olympus and GE offer PAUT systems priced in the tens of thousands of dollars, which can be a significant barrier for small and medium-sized enterprises or organizations in emerging markets, even though these systems offer superior accuracy and efficiency compared to conventional ultrasonic testing. Beyond the initial purchase, maintenance and operational costs further add to the financial burden.

Regular calibration, software updates, and replacement of worn-out probes are necessary to maintain optimal performance, while technical servicing requires specialized knowledge and skilled operators. Training personnel to correctly operate these systems and interpret complex data outputs adds another layer of expense.

These costs can limit the adoption of advanced NDT solutions, especially in sectors with budget constraints or lower inspection volumes. While the long-term benefits, such as improved safety, reduced downtime, and precise defect detection, are significant, the high total cost of ownership remains a key restraint for widespread market growth.

Advancements in artificial intelligence (AI) and robotics integration present a significant growth opportunity for the automated ultrasonic testing market. AI-powered AUT systems can analyze inspection data in real time, detect defects with greater accuracy, and predict maintenance needs, reducing human intervention and improving efficiency.

For instance, AI algorithms can enhance PAUT systems by identifying micro-cracks in aerospace components with up to 95% accuracy, compared to 85% for traditional methods. The integration of robotics allows for automated inspections in hazardous or hard-to-reach environments, such as offshore oil platforms or nuclear power plants, enhancing safety and scalability.

The adoption of Industry 4.0 technologies, including IoT and machine learning, further amplifies the potential of AUT systems. For instance, companies such as MISTRAS Services are developing AI-integrated AUT solutions that enable predictive maintenance, reducing downtime by up to 30% in oil and gas facilities.

As industries increasingly prioritize automation and smart manufacturing, the development of AI- and robotics-enhanced AUT systems is expected to drive innovation, lower long-term costs, and open new avenues for market growth.

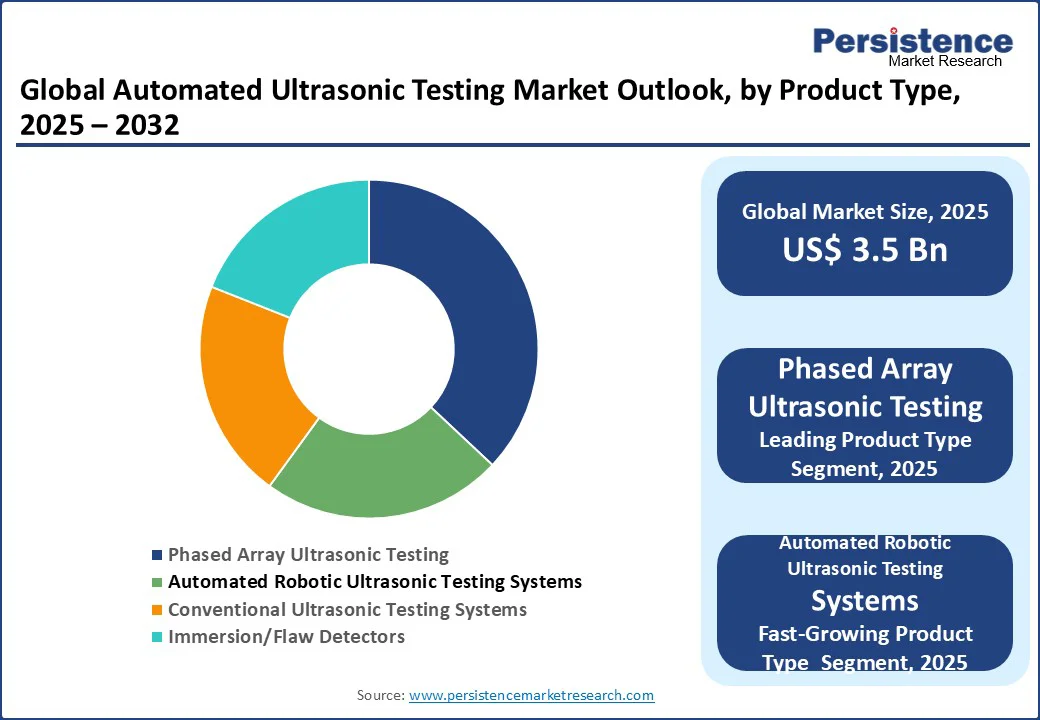

Phased Array Ultrasonic Testing (PAUT) Systems dominate the sector, expected to account for approximately 37% of the share in 2025. Their dominance stems from their versatility, high-resolution imaging, and ability to inspect complex geometries in industries such as aerospace and oil and gas.

PAUT systems, offered by companies such as MISTRAS Services and IRISNDT, enable rapid, accurate flaw detection, making them ideal for critical applications such as aircraft engine inspections and pipeline integrity assessments. Their ability to provide real-time data and integrate with automated systems further drives their adoption.

The automated robotic ultrasonic testing systems segment is the fastest-growing, driven by the increasing demand for automation in hazardous and high-precision environments. These systems, utilized by firms such as JANX and Talon Test Labs, offer enhanced efficiency and safety in applications such as power generation and manufacturing. The rise of Industry 4.0 and the need for scalable, automated inspection solutions are accelerating the adoption of robotic AUT systems, particularly in North America and the Asia Pacific.

Aerospace leads the automated ultrasonic testing market, holding a 40% share in 2025. The need for rigorous safety standards and quality control in aircraft manufacturing and maintenance drives the segment’s dominance. AUT systems are critical for inspecting complex components such as turbine blades and composite materials, ensuring compliance with FAA and EASA standards.

The oil and gas segment is the fastest-growing, propelled by the increasing need for pipeline and infrastructure inspections to ensure safety and compliance. The rise in global energy demand and investments in pipeline maintenance, particularly in North America and the Asia Pacific, is driving rapid adoption. AUT systems enable real-time monitoring and defect detection, reducing operational risks and downtime in this critical sector.

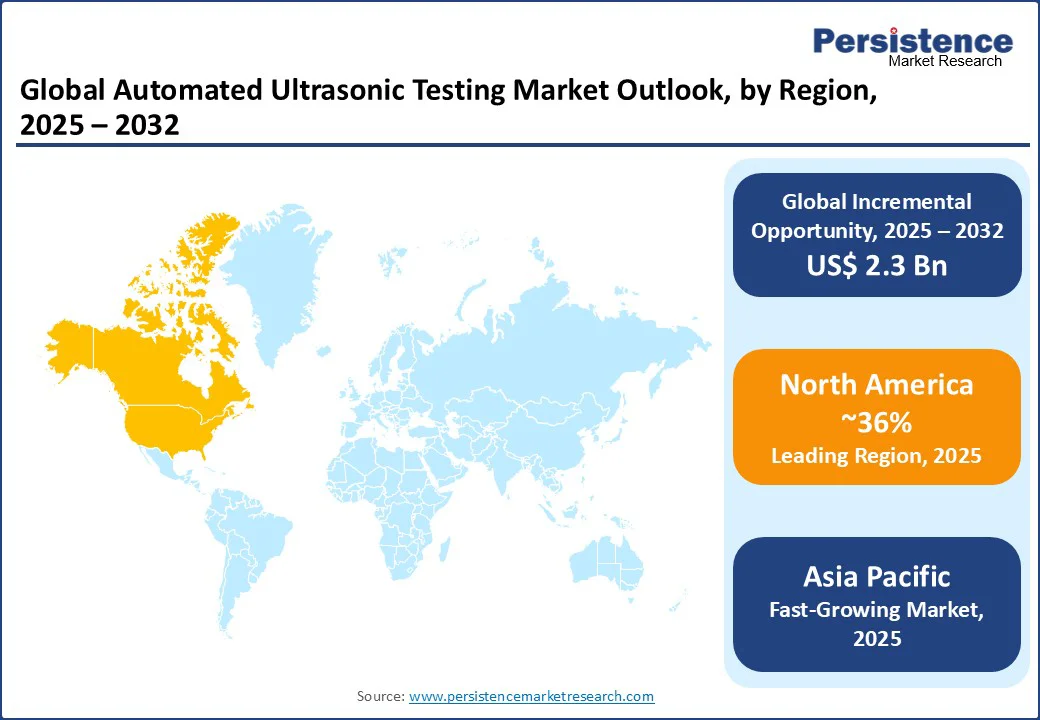

North America is expected to command a substantial share of the global automated ultrasonic testing (AUT) market, accounting for approximately 36% in 2025. This dominance is primarily driven by the presence of major industrial hubs in the United States, including aerospace manufacturing clusters, oil and gas facilities, and power generation plants, which require regular and highly reliable inspection solutions.

The region has witnessed significant adoption of advanced non-destructive testing (NDT) technologies, including phased array ultrasonic testing (PAUT) and automated inspection systems, owing to stringent safety regulations, quality standards, and continuous investments in industrial infrastructure.

The aerospace and energy sectors are key contributors to market growth in North America. Aerospace companies, such as Boeing and Lockheed Martin, increasingly rely on AUT systems for inspecting aircraft components, ensuring structural integrity, and reducing downtime. Similarly, the oil and gas industry deploys these systems for pipelines, pressure vessels, and offshore platforms to enhance safety and operational efficiency.

Additionally, the growing trend of smart manufacturing and predictive maintenance in North America has further accelerated the adoption of AI- and robotics-integrated AUT solutions, enabling precise defect detection and real-time monitoring. Overall, North America’s strong industrial base, technological advancement, and regulatory environment position it as a leading market for AUT systems, with continued growth anticipated over the forecast period.

Europe is a significant player in the automated ultrasonic testing market, supported by strong industrial frameworks and collaborative R&D initiatives. Leading countries such as Germany, France, and the United Kingdom drive market growth through their advanced manufacturing and aerospace sectors.

Germany, home to companies such as TÜV, leads in AUT adoption for manufacturing and power generation, driven by stringent quality standards and Industry 4.0 adoption. France’s aerospace industry, led by Airbus, fuels demand for PAUT systems to inspect composite materials and engine components. The UK, with its focus on renewable energy and offshore oil and gas, drives demand for robotic AUT systems for infrastructure inspections.

The European Union’s emphasis on sustainability and safety regulations, enforced by agencies such as EASA and the European Committee for Standardization (CEN), supports the adoption of advanced AUT technologies. Collaborative R&D projects, such as those funded by Horizon Europe, are fostering innovations in AI-integrated AUT systems, ensuring Europe’s competitive edge in the global market.

The Asia Pacific region is emerging as a high-growth market for automated ultrasonic testing (AUT), driven by rapid industrialization, significant infrastructure investments, and increasing adoption of advanced non-destructive testing (NDT) technologies in key countries such as China and India. Expanding industrial sectors, including aerospace, automotive, oil and gas, and energy, are creating strong demand for efficient and reliable inspection solutions to ensure safety, compliance, and operational efficiency.

In countries such as China, the expansion of aerospace manufacturing and energy infrastructure projects has led to increased implementation of automated ultrasonic testing systems for pipeline inspection, turbine evaluation, and aircraft component monitoring.

Similarly, India is witnessing the growing deployment of AUT systems in power plants, oil refineries, and heavy manufacturing facilities to improve inspection accuracy and reduce downtime. The integration of AI and robotics in AUT systems is also gaining traction across the region, enabling predictive maintenance, real-time defect detection, and automated inspections in hazardous or hard-to-reach environments.

Supportive government initiatives and rising investments in smart manufacturing and Industry 4.0 technologies are further propelling market adoption. Overall, Asia Pacific’s combination of rapid industrial growth, increasing infrastructure projects, and technological advancement positions it as a key driver of global AUT market expansion over the forecast period.

The global automated ultrasonic testing (AUT) market is characterized by intense competition, featuring a blend of major global players and numerous regional and niche vendors. In mature markets such as North America and Europe, companies such as MISTRAS Services, TÜV, and IRISNDT dominate, leveraging economies of scale, advanced R&D capabilities, and strong partnerships with industrial giants in aerospace, energy, and manufacturing sectors. These firms focus on developing advanced PAUT and robotic AUT systems, enabling high-precision inspections and predictive maintenance solutions.

Asia Pacific is witnessing rapid growth, propelled by industrial expansion, infrastructure investments, and increasing adoption of automated testing solutions. This trend is attracting both international players, such as STANLEY Inspection and JANX, and regional, cost-focused vendors that cater to local industries. The industry exhibits a dual structure - it is consolidated at the top with major global firms, yet remains fragmented across mid-sized and regional players.

To sustain a competitive edge, companies are increasingly prioritizing AI and IoT integration, smart and scalable system development, product innovation, and digital-first strategies. Strategic collaborations, targeted acquisitions, and technology-driven solutions are further shaping competition and accelerating AUT adoption across industries worldwide.

The global automated ultrasonic testing market is projected to reach US$ 3.5 Bn in 2025.

The increasing demand for non-destructive testing in the aerospace and energy sectors is a key driver.

The automated ultrasonic testing market is poised to witness a CAGR of 7.5% from 2025 to 2032.

Advancements in AI and robotics integration are a key opportunity.

MISTRAS Services, TÜV, IRISNDT, STANLEY Inspection, and JANX are among the key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author