ID: PMRREP3543| 188 Pages | 13 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

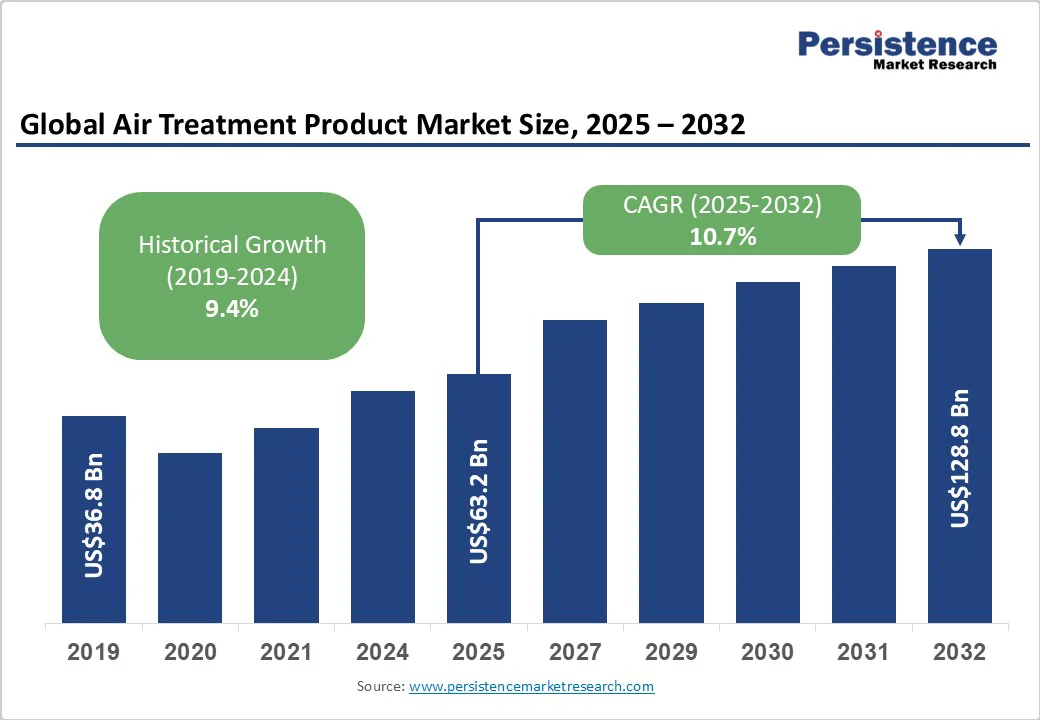

The global air treatment product market size is likely to be valued at US$63.2 Billion in 2025 and is estimated to reach US$128.8 Billion in 2032, growing at a CAGR of 10.7% during the forecast period 2025 - 2032, driven by increasing concerns over air quality in residential and industrial settings. Rising levels of industrial emissions are pushing businesses to invest in effective air purification systems.

| Key Insights | Details |

|---|---|

| Air Treatment Product Market Size (2025E) | US$63.2 Billion |

| Market Value Forecast (2032F) | US$128.8 Billion |

| Projected Growth (CAGR 2025 to 2032) | 10.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 9.4% |

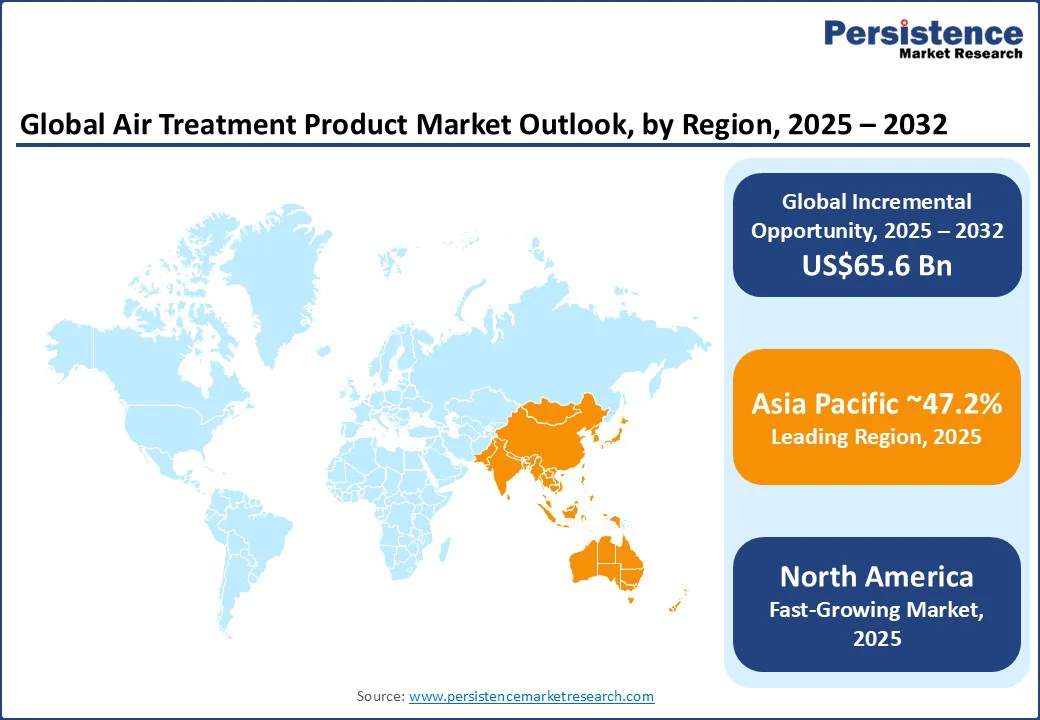

Rapid urbanization and industrial expansion in Asia Pacific and North America have drastically raised levels of airborne pollutants, including particulate matter, volatile organic compounds, and chemical fumes. This surge in environmental contaminants has propelled both commercial and residential sectors to invest in air treatment solutions.

Industrial facilities, especially in manufacturing, construction, and chemical processing, are now integrating dust collectors, exhaust air systems, and unique filtration units to safeguard worker health and ensure regulatory compliance. In urban residential spaces, worsening smog levels and vehicular emissions have prompted households to adopt smart air purifiers with HEPA and activated carbon filters.

The increasing incidence of respiratory conditions, including allergies, asthma, and other airway sensitivities, has become a key factor boosting demand for air treatment products. Populations in urban and industrialized regions are exposed to allergens, dust, pollen, and airborne pathogens, prompting proactive measures to improve indoor air quality. Approximately 454.6 million people globally were estimated to suffer from chronic respiratory diseases in 2019, with asthma being the most prevalent among them.

This trend has augmented development in consumer-focused solutions such as smart home air purifiers equipped with real-time air quality monitoring, HEPA filtration, and ionization technology. Honeywell and Daikin, for example, are supplying commercial HVAC systems with improved filtration to hospitals and offices in North America.

The widespread availability of unbranded or grey market air treatment products is limiting growth by undermining consumer trust and creating price sensitivity. These products often lack proper certification, unique filtration technologies, and after-sales support, which can compromise indoor air quality and operational safety in industrial settings.

For instance, in India and parts of Southeast Asia, low-cost air purifiers and dust collectors are often sold through online marketplaces without rigorous quality checks, affecting sales of certified brands such as Honeywell and Daikin. This trend compels established players to increase investments in brand differentiation, marketing, and consumer education, diverting resources from research and product innovation.

The rising adoption of EVs is hampering the market, specifically for engine exhaust and industrial air filtration applications. As EVs produce little to no exhaust emissions, the traditional demand for vehicle-related exhaust air systems and certain industrial filtration solutions may decline, impacting manufacturers focused on these applications.

For example, companies that supply diesel particulate filters or selective catalytic reduction systems may face reduced growth opportunities in Europe and North America, where EV adoption is accelerating. This shift necessitates innovation in alternative air treatment solutions and diversification into residential, commercial, and industrial air purification segments.

Emerging countries in Asia Pacific, Latin America, and Africa are witnessing rapid industrialization, which is pushing demand for novel air treatment solutions. Expanding manufacturing hubs, especially in electronics, automotive, and chemical sectors, generate high volumes of dust, fumes, and airborne pollutants, prompting the adoption of industrial dust collectors, air purifiers, and exhaust systems.

For instance, India’s Make in India initiative and China’s continued investment in industrial parks are increasing demand for reliable air filtration systems that comply with workplace safety standards. Companies such as Camfil are expanding their footprint in these markets by introducing modular air treatment solutions suitable for diverse industrial setups.

Strict Government Regulations on Industrial Emissions

Stringent government policies aimed at controlling industrial air pollution are creating substantial growth opportunities for the market. Regulatory mandates in Europe, North America, and Asia Pacific require factories and processing units to limit particulate emissions, VOCs, and hazardous fumes.

These are encouraging the installation of unique filtration and exhaust systems. For example, the European Union’s Industrial Emissions Directive and the U.S. Clean Air Act enforce strict limits on airborne pollutants. These have prompted companies to provide specialized filtration solutions for heavy industries.

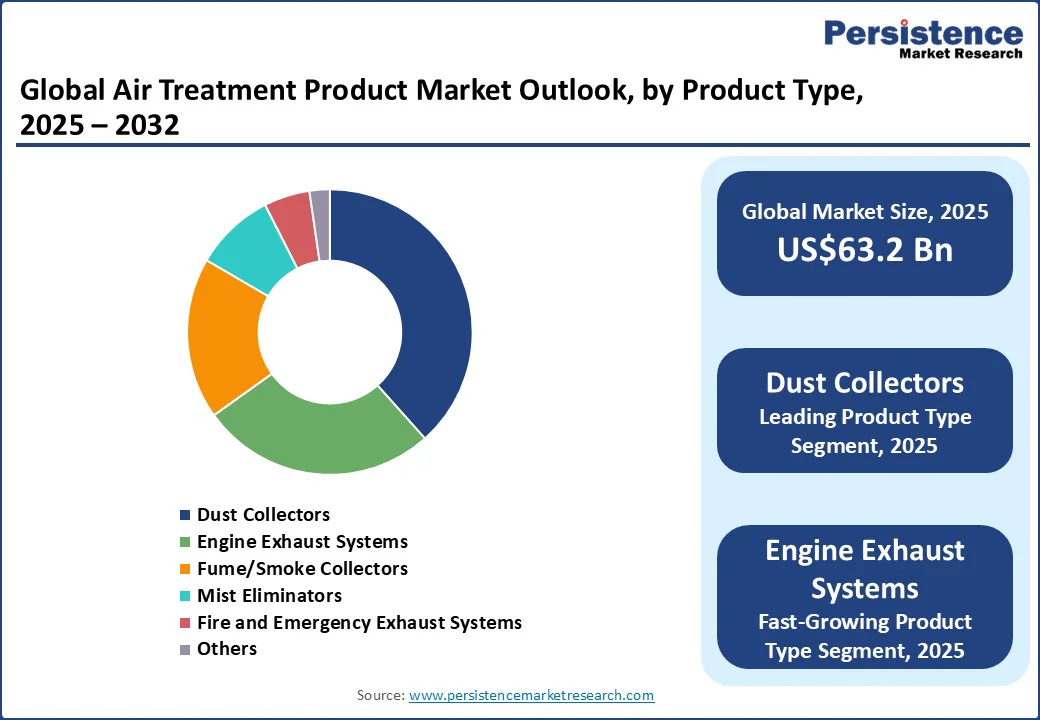

Dust collectors are estimated to account for nearly 38.4% of the market share in 2025, as they efficiently capture and remove fine particulate matter generated in industrial and manufacturing processes. They help with protecting both workers and equipment.

Their high adaptability to diverse industrial applications further makes them a standard choice. For instance, Donaldson and Camfil are introducing novel baghouse and cartridge dust collectors that deliver high filtration efficiency and reduced maintenance downtime.

Engine exhaust systems are gaining impetus due to rising environmental regulations and surging adoption of diesel and gas-powered machinery in the construction and logistics sectors. These systems help in reducing harmful emissions, including NOx and particulate matter, and improve compliance with air quality standards. For example, Fleetguard (Cummins) is developing modular exhaust after-treatment systems that integrate Diesel Particulate Filters (DPFs) and Selective Catalytic Reduction (SCR) units.

Exhaust air will likely record a share of around 65.6% in 2025, as it efficiently removes contaminated air, fumes, and particulates from industrial, commercial, and residential environments, ensuring clean indoor spaces. Industries such as metal fabrication, chemical processing, and healthcare rely heavily on exhaust air systems to maintain regulatory compliance and worker safety.

Compressed air is a key application as it is essential for operating pneumatic tools, automation equipment, and industrial processes while minimizing contamination. Air treatment products for compressed air, including dryers and filters, ensure the removal of moisture, oil, and particulates, which protects machinery and improves product quality.

The commercial sector is poised to dominate with a share of approximately 48.3% in 2025 as businesses and public facilities prioritize maintaining high indoor air quality to protect employee health, ensure regulatory compliance, and improve productivity.

Offices, hospitals, schools, and shopping malls invest in large-scale air treatment systems, including HVAC-integrated purifiers and industrial dust collectors. For example, Honeywell’s Healthy Buildings Air Quality solutions are being widely adopted in commercial spaces across Europe and North America to monitor and refine indoor air quality in real time.

The residential sector is anticipated to see steady growth through 2032, fueled by rising health awareness and growing concern about indoor pollutants, allergens, and airborne pathogens. Consumers now adopt compact, smart air purifiers and HEPA-based systems for bedrooms, living areas, and kitchens. For instance, Dyson’s air purifiers with HEPA filtration and app-controlled monitoring have seen superior uptake in urban markets across Asia Pacific and Europe, reflecting a shift toward healthy indoor living.

In 2025, Asia Pacific is predicted to account for approximately 47.2% of the market share, owing to rising air pollution levels and increasing health awareness. China, India, and Japan are at the forefront of this growth.

India’s surging middle class is increasingly prioritizing indoor air solutions, especially as outdoor air quality often exceeds safe levels. Japan is pioneering the development of UV-LED purifiers such as those by Daikin, which achieve 99% virus suppression, boosting both domestic and export sales.

The regional market is characterized by a diverse product landscape, including HEPA filters, activated carbon filters, ionic air purifiers, and ozone generators. HEPA filters currently dominate the market due to their effectiveness in removing particulate matter and allergens from the air. The commercial sector holds the largest market share, fueled by increasing awareness of indoor air quality and its impact on occupants' health and well-being.

In North America, the market is evolving with a focus on innovation, sustainability, and domestic manufacturing. Companies are integrating smart technologies and energy-efficient solutions into their products to meet the rising demand for clean indoor air. Manufacturers are emphasizing the importance of clean and dry compressed air for industrial processes, leading to surging adoption of novel filtration systems.

Technological developments such as variable speed drives and heat recovery systems are being introduced to reduce operational costs and comply with environmental sustainability goals. These are mainly relevant in sectors such as construction and mining, where portable solutions are in demand.

The market is also witnessing a shift toward energy-efficient and portable air treatment solutions, catering to residential and commercial applications. Companies are investing in research activities to launch products that not only improve indoor air quality but also contribute to energy savings.

The market is experiencing considerable growth in Europe, spurred by increasing awareness of indoor air quality and its impact on health. Germany dominates the market with a substantial share attributed to its stringent environmental regulations and high levels of industrialization. The increasing air pollution in urban areas and large cities creates a challenge for city authorities. It makes the need to protect individuals from fine particulate matter (PM2.5) a priority.

Technological developments are a key driver in this market. Manufacturers are integrating smart features such as IoT connectivity and novel filtration technologies into their products. For instance, companies such as Dyson and Philips are leading the development of smart air purifiers equipped with HEPA and activated carbon filters, catering to both residential and commercial applications.

The global air treatment product market is dominated by leading players such as Samsung, LG, Honeywell, and Panasonic. They focus on smart and energy-efficient solutions. For instance, Honeywell recently expanded its Healthy Buildings Air Quality portfolio by introducing Electronic Air Cleaners with UV systems and a new line of IAQ sensors to improve and measure indoor air quality in business buildings. Asia Pacific, specifically Japan, India, and China, leads in terms of air treatment product demand. Companies such as Havells India have reported rising demand for air treatment products, contributing to their higher-than-expected earnings in recent quarters.

The air treatment product market is projected to reach US$63.2 Billion in 2025.

Rising urban and industrial pollution and increasing respiratory health concerns are the key market drivers.

The air treatment product market is poised to witness a CAGR of 10.7% from 2025 to 2032.

Integration of smart sensors and adoption of novel HEPA filtration technologies are the key market opportunities.

Honeywell International, Samsung Electronics Co., Ltd., and Winix Inc. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Vertical

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author