ID: PMRREP31036| 188 Pages | 7 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

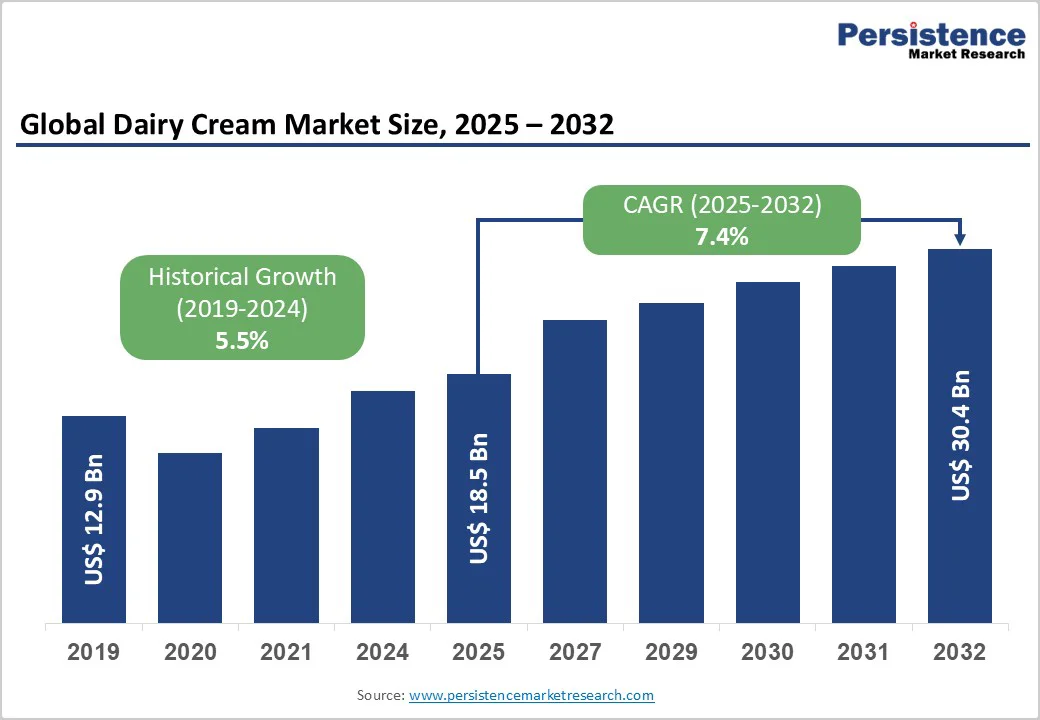

The global dairy cream market is expected to reach US$18.5 billion in 2025 and US$30.4 billion at a CAGR of 7.4% from 2025 to 2032. The global dairy cream market is witnessing steady growth, driven by rising demand for premium dairy products, expanding bakery and confectionery sectors, and increasing consumer preference for rich, natural ingredients.

Dairy cream, derived from milk fat, is widely used in cooking, desserts, beverages, and processed foods for its texture and flavor-enhancing properties. Packaging innovations, extended shelf-life variants, and the surge in ready-to-eat products are supplementing market growth.

| Key Insights | Details |

|---|---|

|

Dairy Cream Market Size (2025E) |

US$18.5 Bn |

|

Market Value Forecast (2032F) |

US$30.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.5% |

The rapid expansion of café culture and specialty coffee consumption worldwide is significantly driving demand for dairy cream. Consumers increasingly favor premium coffee experiences, where texture, richness, and mouthfeel play crucial roles in taste perception. Dairy cream enhances the sensory appeal of beverages like lattes, cappuccinos, and cold brews, offering a smooth, indulgent finish that plant-based alternatives often fail to replicate. The growing influence of global café chains, artisanal coffee houses, and at-home coffee machines further amplifies cream usage across both retail and foodservice channels.

Additionally, innovations such as frothing-friendly, low-sugar, and flavored cream variants cater to evolving consumer preferences, making dairy cream an essential component of modern coffee culture and beverage customization trends worldwide.

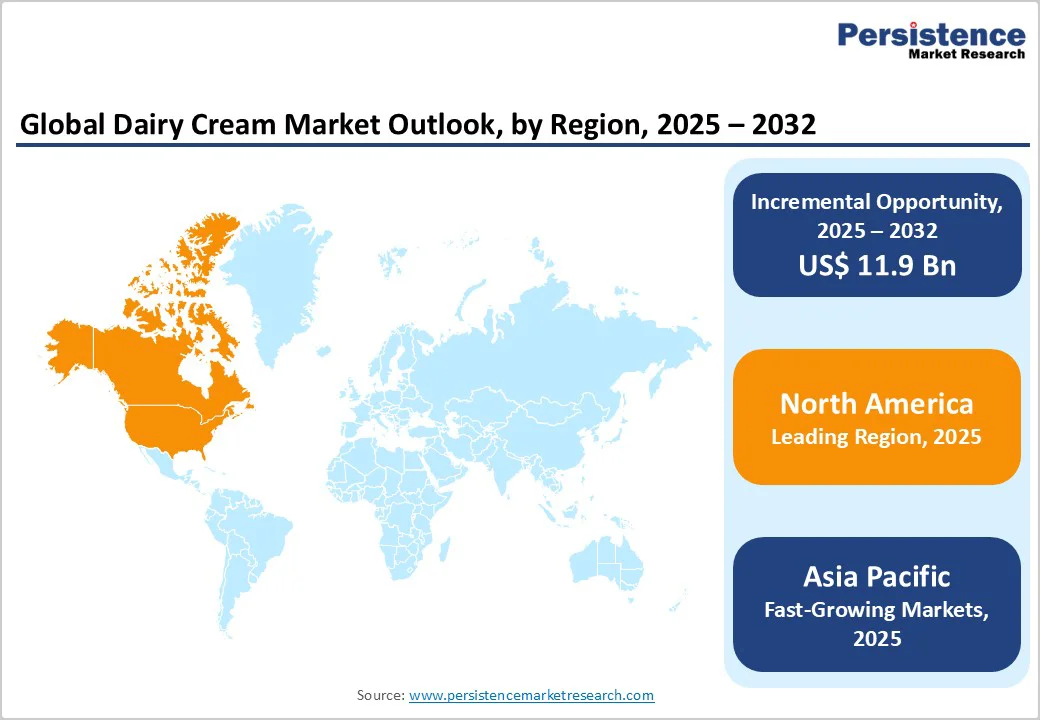

In developing regions, the dairy cream market faces a key restraint due to low consumer awareness and dietary preferences rooted in traditional staples. Populations in Asia, Africa, and parts of Latin America primarily rely on wheat, rice, and maize, which are inexpensive and culturally ingrained. Awareness of gluten-free, keto, or paleo diets remains limited to urban elites and expatriate communities, while the majority of consumers perceive dairy cream as an unfamiliar and unnecessary premium product. In addition, limited marketing efforts, weak distribution networks, and lack of product education restrict exposure to dairy cream’s health benefits. This knowledge gap slows adoption, preventing dairy cream from achieving the same acceptance and growth seen in North America and Europe.

The rising global focus on health and wellness is creating a strong opportunity for low-fat dairy cream in the market. As consumers become more calorie-conscious yet unwilling to compromise on taste and texture, low-fat creams offer the ideal balance between indulgence and nutrition. These products appeal to urban, fitness-oriented, and aging populations seeking heart-friendly and low-cholesterol options. Manufacturers are innovating with advanced processing techniques to retain the richness and whipping quality of traditional cream while reducing fat content. The trend aligns with the clean-label and diet-specific food movement, especially within weight management and functional food categories. Expanding product visibility through cafés, ready-to-cook meals, and premium dairy brands can further strengthen this fast-emerging, health-driven segment.

The organic dairy cream segment is emerging as the fastest-growing category, fueled by a global shift toward clean, ethical, and sustainable food consumption. Consumers increasingly associate organic dairy with purity, superior nutrition, and animal welfare, driving preference for cream made from hormone-free and grass-fed milk. Growing distrust of synthetic additives and pesticide residues has accelerated the adoption of certified organic products, especially in premium and health-conscious households. Additionally, regulatory support and the expansion of organic retail shelves across supermarkets and e-commerce platforms are boosting accessibility. Food manufacturers are leveraging organic cream in gourmet, baby food, and ready-to-eat formulations, positioning it as a healthier indulgence. This convergence of wellness, transparency, and sustainability makes organic dairy cream the market’s fastest-growing segment.

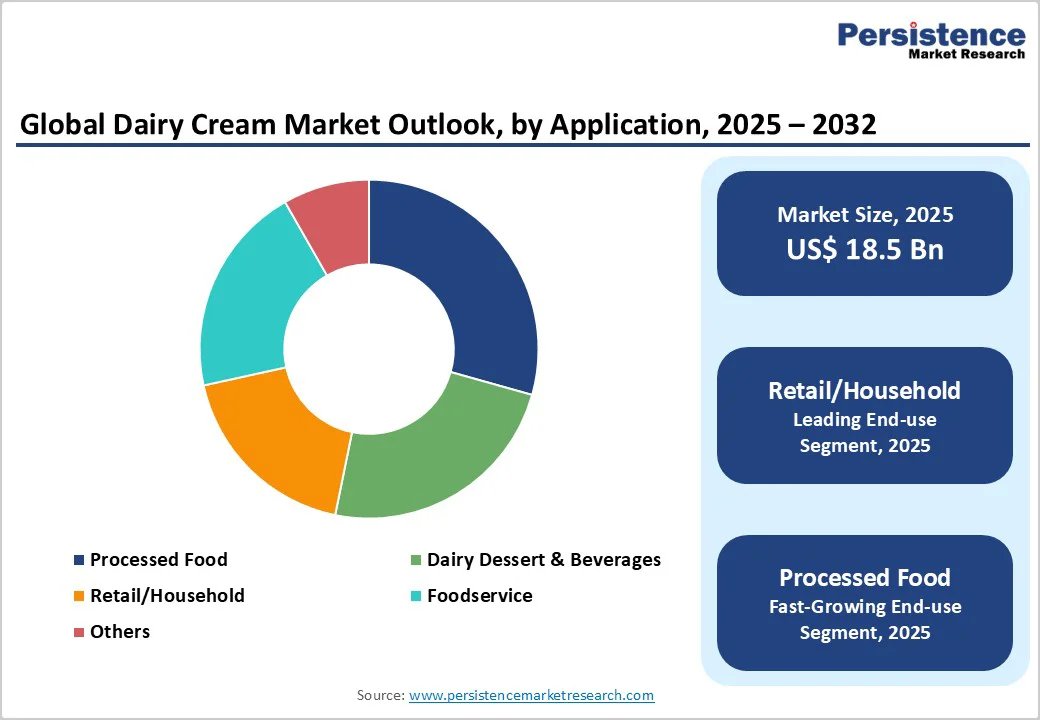

The processed food segment is the fastest-growing in the dairy cream market, driven by the global surge in convenience-oriented lifestyles. Consumers increasingly prefer ready-to-eat meals, frozen desserts, and instant sauces that incorporate dairy cream for enhanced creaminess, texture, and flavor stability. Food manufacturers leverage cream’s functional properties to improve product consistency and shelf life, particularly in baked goods, soups, and gourmet ready meals. Urbanization, rising dual-income households, and the expansion of quick-service restaurant chains amplify demand. Additionally, innovations in heat-stable and long-life cream formulations enable wider distribution and usage in processed foods, making this application the market’s fastest-expanding segment globally.

In North America, particularly the U.S., dairy cream consumption is driven by a blend of premiumization and convenience trends. Consumers increasingly seek high-quality, organic, and specialty creams for baking, coffee, and gourmet cooking. The growth of cafés, dessert chains, and home baking culture fuels demand for whipping and heavy creams. Additionally, there is rising interest in health-conscious variants, including low-fat and lactose-free options. Innovations in long-life UHT creams and ready-to-use packaging support wider distribution. The North American market also benefits from strong retail infrastructure, e-commerce growth, and a consumer preference for rich, indulgent, yet functional dairy products, maintaining its leading position globally.

The Asia-Pacific dairy cream market is the fastest-growing globally, driven by rapid urbanization, rising disposable incomes, and the westernization of diets. Increasing exposure to bakery, café, and dessert culture is boosting demand for whipping, cooking, and heavy creams. Growth is further supported by the expansion of foodservice chains, processed foods, and ready-to-eat meals, where cream enhances texture and flavor. Rising health awareness is also encouraging low-fat and fortified cream variants. E-commerce and modern retail channels are improving accessibility, while regional manufacturers innovate with locally flavored and culturally adapted creams, making Asia-Pacific a dynamic and high-potential market for dairy cream consumption.

The global dairy cream market is highly competitive, dominated by a mix of multinational dairy corporations and regional players. Key companies focus on product innovation, premiumization, organic offerings, and clean-label solutions to differentiate themselves. Strategic initiatives such as mergers, acquisitions, and partnerships with foodservice chains strengthen market presence. Companies are also investing in advanced processing technologies, sustainable sourcing, and eco-friendly packaging to meet evolving consumer preferences.

The global dairy cream market is projected to be valued at US$18.5 Bn in 2025.

Consumers increasingly prefer rich, high-quality creams for desserts, beverages, and gourmet cooking, boosting overall consumption.

The global market is poised to witness a CAGR of 7.4% between 2025 and 2032.

Dairy cream is increasingly used in sauces, soups, bakery mixes, and frozen desserts, driving new applications.

Glanbia Plc., Groupe Lactalis, Savencia Fromage & Dairy, Fonterra Co-operative Group, and others

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume if Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Nature

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author