ID: PMRREP33535| 179 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

The African pharmaceuticals market size is likely to be valued at US$29.3 billion in 2025. It is estimated to reach US$44.1 Billion by 2032, growing at a CAGR of 6.1% during the forecast period 2025−2032, driven by rapid urbanization, which is contributing to a rise in non-communicable diseases (NCDs) such as diabetes and cancer, alongside regulatory harmonization efforts under the African Medicines Regulatory Harmonisation (AMRH) program and the African Continental Free Trade Area (AfCFTA) framework.

Rising urban middle-class purchasing power is driving growth, with generics still capturing nearly half of the market. High-growth opportunities in biologics, GLP-1 agonists, and orphan drugs are also attracting strategic investors aiming for long-term consolidation in key hubs and emerging therapeutic areas.

| Key Insights | Details |

|---|---|

|

Africa Pharmaceuticals Market Size (2025E) |

US$29.3 Bn |

|

Market Value Forecast (2032F) |

US$44.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.8% |

The AMRH program is a critical catalyst reshaping pharmaceutical market dynamics across Africa. Regulatory harmonization efforts through AMRH have streamlined the product approval process by facilitating mutual recognition agreements among national regulatory authorities, compressing timelines from extended multi-country submissions to a consolidated, expedited regulatory pathway. This systematic simplification lowers market entry barriers and reduces the cost burden of regulatory compliance for manufacturers, encouraging greater investment in local pharmaceutical production. The operationalization of the Continental Regulatory Reliance Framework fosters unified quality standards and reliance protocols, enabling faster access to multiple countries with a single registration.

This regulatory progress not only accelerates time-to-market for innovative therapies but also strengthens the continent’s attractiveness to global and regional pharmaceutical manufacturers. The resulting efficiency gains are seen through reduced regulatory overhead, enhanced competition, and improved supply security through local manufacturing expansion. Companies such as Aspen Pharmacare are already leveraging these frameworks to localize high-growth therapeutic production, thereby capitalizing on the cost and time advantages these policy reforms impart.

The African pharmaceuticals market growth is constrained by substantial cold chain infrastructure inadequacies that undermine vaccine and biologic drug distribution. The limited capacity and reliability of temperature-controlled logistics networks restrict equitable access, especially in rural and peri-urban regions, resulting in significant product wastage and coverage gaps. This logistical bottleneck creates a two-tier system in which advanced therapies and vaccines remain concentrated in urban centers with adequate infrastructure, thereby curbing investor returns in higher-margin biologic segments. The capital-intensive nature of cold chain development competes with manufacturing facility investments, elongating project timelines and complicating financing strategies.

While several initiatives are underway to enhance cold chain capacity, progress is uneven and hampered by limited energy access and technical expertise in many regions. This persistent structural challenge poses significant risks to growth projections for vaccines and biologics, necessitating systemic investments in infrastructure and operational resilience. The burden falls not only on manufacturers but also on governments and development agencies to coordinate large-scale, sustainable cold chain enhancement plans.

The emergence of GLP-1 agonists as a therapeutic class targeting diabetes and obesity represents a compelling market opportunity uniquely positioned at the intersection of local manufacturing capabilities, unmet clinical needs, and favorable regulatory conditions. With urban populations experiencing a rising prevalence of metabolic disorders driven by lifestyle changes, the demand for cost-effective obesity and diabetes management is intensifying. Local production initiatives led by regional manufacturers such as Aspen Pharmacare are employing technological advances in fill-finish to significantly lower production costs and, in turn, retail prices, enabling broader patient access in previously underserved markets.

This emerging cost arbitrage is set to disrupt the premium pricing models of imported GLP-1 therapies and catalyze adoption beyond elite patient segments. Regulatory frameworks under AMRH have shortened approval timelines, giving first movers a speed-to-market advantage in capturing market share ahead of new entrants and biosimilars. The widening middle-class consumer base, coupled with increasing healthcare infrastructure investments and digital pharmacy platforms, creates a favorable environment for scalable uptake of these therapies. Strategic investors and manufacturers focused on localized supply chains and affordability-driven volumes are positioned to capitalize on an expanding addressable market.

At about 24%, infectious diseases and vaccines dominate the Africa pharmaceuticals market revenue share in 2025, reflecting the continent’s enduring health challenges. With a high prevalence of HIV, tuberculosis, and malaria, infectious disease therapies remain foundational to medical treatment and pharmaceutical demand. Antiretroviral treatments dominate this space, supported by extensive donor-funded programs that ensure subsidized access and widespread coverage. Tuberculosis treatments are also expanding, particularly in regions burdened with resistant strains. Vaccine programs are also gaining momentum through routine immunization efforts and newer offerings such as HPV and malaria vaccines.

Oncology is emerging as the fastest-growing therapeutic area, driven by increasing cancer incidence linked to urban lifestyle changes and aging populations. Improved diagnostic technologies in urban centers allow earlier detection, fueling demand for advanced treatments, including monoclonal antibodies and immunotherapies, which are becoming more accessible through biosimilar developments, reducing costs. Breast and gastrointestinal cancers constitute significant oncology sub-segments, with growing patient willingness to pursue innovative therapies as private healthcare infrastructure expands.

Generic drugs dominate Africa’s pharmaceutical market, accounting for an estimated 45% of market share, driven largely by affordability needs. High out-of-pocket healthcare spending sustains widespread generic use, which forms the backbone of essential medicines such as malaria treatments, tuberculosis drugs, and HIV antiretroviral therapies. Donor-funded programs further expand access, meeting high-volume demand despite pricing pressures that constrain revenue growth. Within this segment, branded generics target middle-class consumers willing to pay modest premiums for brand reliability, while unbranded generics account for the majority of volume in lower-income and public-sector markets. Regional manufacturers are increasingly consolidating their positions by optimizing supply chains, winning government tenders, and expanding into digital sales channels.

Biosimilars are the fastest-growing segment through 2032, gaining traction as patents on key biologic therapies expire. Though starting from a small base, biosimilars are driving growth in areas like rheumatoid arthritis, psoriasis, and inflammatory bowel disease, offering lower-cost alternatives to reference biologics. Regulatory harmonization under AMRH and investments in cold chain infrastructure are enabling scalable production, positioning biosimilars as a high-margin, revenue-generating opportunity.

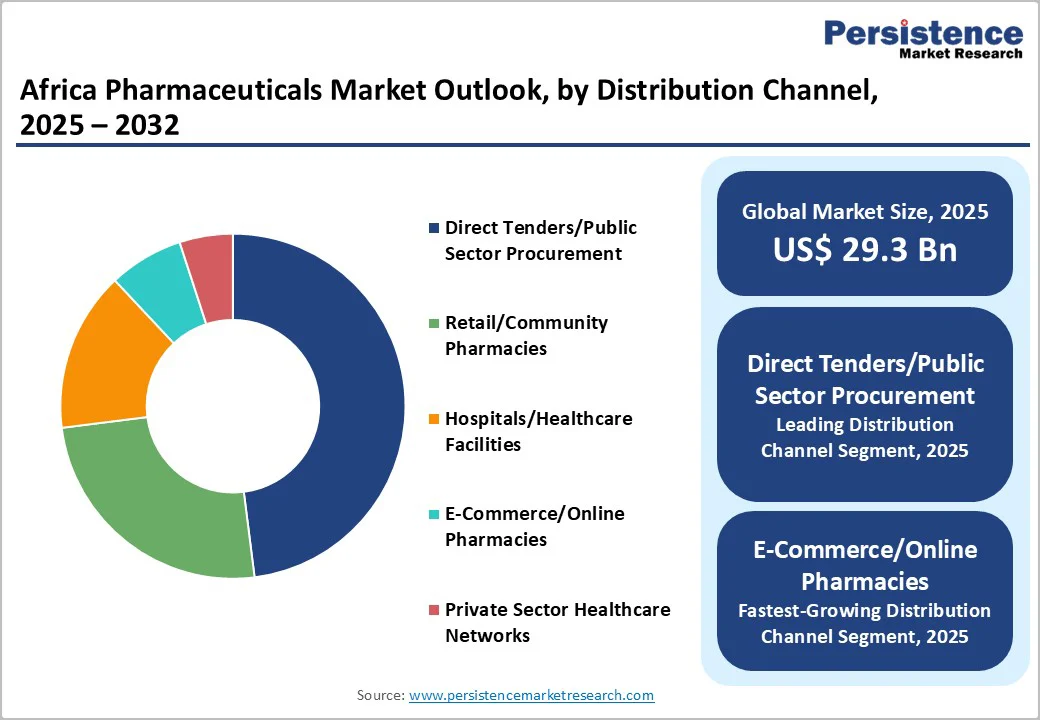

Direct tenders and public sector procurement remain the dominant pharmaceutical distribution channels in Africa, accounting for approximately 48% of revenue, driven by government health ministries and major donor-funded programs such as the Global Fund, GAVI, and PEPFAR. Countries including Egypt, Nigeria, South Africa, and Kenya conduct regular tender processes for essential medicines, vaccines, and critical therapies. Structural changes under the AMRH and AfCFTA frameworks are reducing tender fragmentation, enabling multinational manufacturers to streamline approvals and consolidate regional tenders.

E-commerce and online pharmacy channels are the fastest-growing distribution channels, concentrated in urban centers such as Cairo, Lagos, Johannesburg, and Nairobi. Rising digital literacy, smartphone penetration, and telemedicine-linked prescription delivery models, accelerated by the COVID-19 pandemic, have expanded consumer access, offering home delivery, price transparency, and integration with digital health systems. Growth is further supported by regulatory frameworks in Uganda, Kenya, and Nigeria, along with supply chain innovations enabling direct manufacturer-to-consumer delivery.

South Africa stands as sub-Saharan Africa's most sophisticated pharmaceutical market, characterized by advanced regulatory infrastructure, substantial manufacturing capacity, and a dual-track healthcare system serving both high-income, insured populations and broader public-sector markets. The market benefits from the leadership of the South African Health Products Regulatory Authority (SAHPRA) in continental regulatory harmonization, positioning the country as the primary entry gateway for multinational manufacturers pursuing African market access. This regulatory centrality creates a competitive advantage that attracts substantial foreign direct investment and enables rapid market penetration across the continent.

South Africa's manufacturing sector accounts for a significant share of Africa's pharmaceutical production, with integrated facilities spanning API production to finished goods manufacturing. Regional leaders, including Aspen Pharmacare, are strategically investing in high-growth therapeutic segments, particularly GLP-1 agonists and biosimilars, leveraging local cost advantages and established distribution networks. Private healthcare expansion among emerging middle-income populations is driving demand across therapeutic categories, while e-commerce distribution channels present exciting new opportunities.

Egypt dominates, capturing about 38% of the African pharmaceuticals market share in 2025, with its position indicative of both its substantial population base and regional export capabilities. The market benefits from significant government procurement concentration through the Ministry of Health and Population, supplemented by private healthcare and out-of-pocket consumer spending. Disease burden concentrates in cardiovascular conditions, infectious diseases driven by endemic burdens, and gastrointestinal disorders linked to environmental and dietary factors.

The country's pharmaceutical sector is anchored by major regional manufacturers operating integrated facilities that produce for both domestic and export markets, with production volumes among the highest in Africa. Manufacturing companies in Egypt benefit from favorable labor costs and established supply chain networks, positioning the country as the continental supplier to North Africa, the Middle East, and select sub-Saharan markets. API localization is increasingly prevalent, supporting downstream formulation economics and government objectives of reducing import dependency. Recent investments target emerging high-growth therapeutics, particularly GLP-1 agonists, signaling strategic positioning in premium therapeutic segments.

Nigeria emerges as the highest-growth pharmaceutical market in Africa, driven by its home to Africa's largest population, rapid urbanization that concentrates the disease burden in major metropolitan hubs, and expanding middle-class purchasing power. The country market exhibits extreme fragmentation with thousands of operators, reflecting low entry barriers and legacy distribution networks, yet strategic consolidation opportunities exist for investors targeting scale. Distribution remains highly concentrated in urban centers, particularly Lagos, creating a stark geographic divide between urban access to pharmaceuticals and rural scarcity.

Disease burden spans infectious diseases dominated by volume through malaria and parasitic infections, alongside emerging non-communicable disease prevalence in urbanizing populations. Regulatory modernization through the National Agency for Food and Drug Administration and Control (NAFDAC) has substantially accelerated product approval timelines and enhanced pharmacovigilance capabilities through continental partnerships. Manufacturing capacity is experiencing strategic expansion, particularly in biosimilar and emerging therapeutics segments, though constrained by power supply vulnerabilities and API import dependency. The competitive landscape reflects fragmentation with few dominant players and thousands of smaller manufacturers, creating consolidation opportunities.

The Africa pharmaceutical market landscape reflects a fragmented, generics-centered volume landscape alongside modestly consolidated specialty and branded drug segments. Market concentration is relatively low compared to global benchmarks, with the top ten companies controlling less than one-third of total market value, underscoring intense competition and diverse market participation. Regional leaders such as Aspen Pharmacare and EIPICO coexist with multinational giants active primarily in specialty medicines.

Competitive dynamics are accelerating as AMRH-driven regulatory efficiency reduces time-to-market barriers for generics and biosimilars, intensifying price competition and eroding margins in essential medicines. Emerging digital distribution platforms introduce novel competitive pressures by redefining pharmaceutical supply and consumer engagement. Market consolidation is ongoing primarily in high-margin therapeutic areas, supported by strategic M&A and manufacturing capacity expansions.

The Africa pharmaceuticals market is projected to reach US$29.3 Billion in 2025.

The increasing prevalence of non-communicable diseases, such as diabetes and cancer, due to rapid urbanization and growing purchasing power among middle-class urban populations, is driving the market.

The Africa pharmaceuticals market is poised to witness a CAGR of 6.1% from 2025 to 2032.

Regulatory harmonization through the AMRH and AfCFTA frameworks and expanding possibilities in biologics and biosimilars, GLP-1 agonists, and orphan drugs are key market opportunities.

Aspen Pharmacare Holdings Limited, EIPICO, and CIPLA South Africa are some of the key players in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Country Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Therapeutic Area

By Drug Classification

By Distribution Channel

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author