ID: PMRREP25030| 199 Pages | 18 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

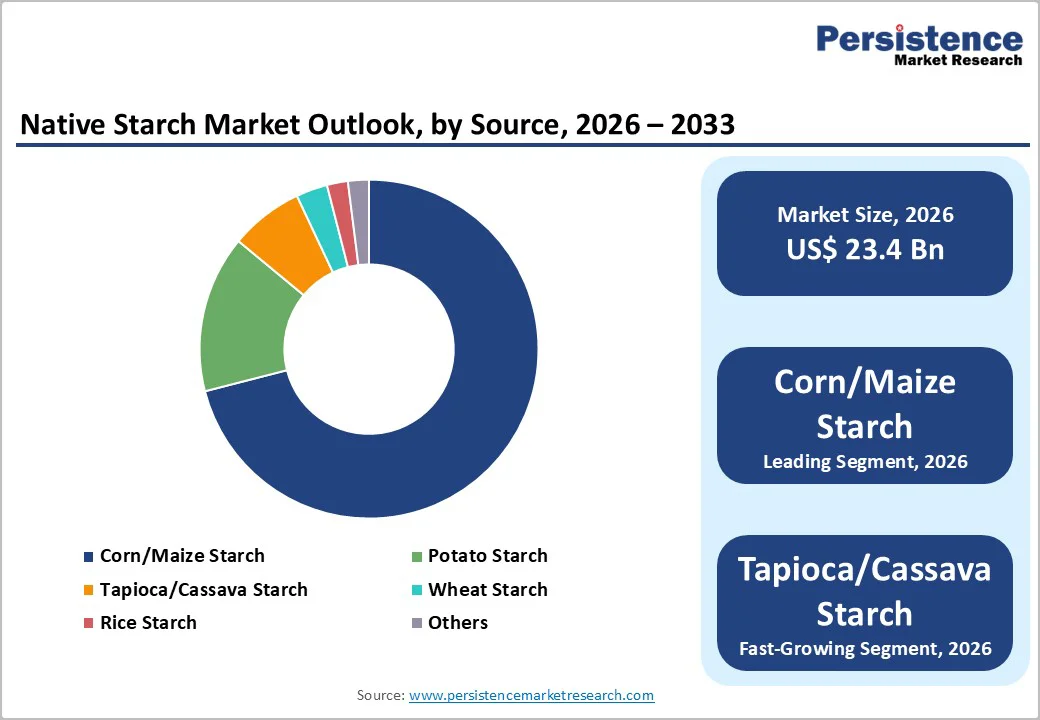

The global native starch market size is estimated to grow from US$ 23.4 billion in 2026 to US$ 31.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period from 2026 to 2033.

The global market is experiencing dynamic growth, driven by rising demand for clean-label, plant-based, and sustainable food solutions. Companies are leveraging technological innovation, organic sourcing, and versatile applications to capture evolving consumer preferences while expanding their regional footprints.

| Key Insights | Details |

|---|---|

| Global Native Starch Market Size (2026E) | US$ 23.4 Bn |

| Market Value Forecast (2033F) | US$ 31.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.6% |

Growing reliance on clean, simple ingredient systems is pushing native starch into the spotlight as a preferred natural thickener across multiple food categories. Companies are reformulating sauces, soups, bakery fillings, and dairy alternatives to eliminate chemically modified additives, and native starch delivers viscosity, texture stability, and mouthfeel without triggering regulatory or labeling concerns.

Its compatibility with heat, shear, and pH variations has improved significantly through better crop selection and advanced processing, making it a dependable option for manufacturers aiming to simplify formulations. As consumer scrutiny intensifies around ingredient transparency and “kitchen-cupboard” familiarity, native starch becomes a strategic tool for brands seeking to balance functionality with label purity.

This shift is accelerating demand among both multinational and regional food producers.

A volatile climate profile is steadily reshaping the reliability of starch-producing crops, creating a disruptive undercurrent across the native starch supply chain. Sudden temperature shifts, unpredictable monsoon patterns, and prolonged drought cycles are impacting cassava, maize, potato, and wheat yields, causing significant inconsistencies in starch density, granule size, and moisture levels.

These quality fluctuations push processors to invest heavily in screening, purification, and recalibration to maintain product uniformity for food, pharmaceutical, and industrial applications. Costs rise further when manufacturers must secure alternative raw material sources to offset seasonal shortfalls.

Such instability complicates forward-planning, contract pricing, and production scaling, restraining market growth for companies that depend on stable agronomic conditions to sustain premium-grade native starch output worldwide.

A wave of consumer trust in organic labels is reshaping how native starch producers plan their next decade, creating an opening that rewards strategic scale-up. As organic food portfolios diversify into snacks, ready meals, infant nutrition, and clean-label beverages, manufacturers with certified organic starch capacity gain preferential access to high-value supply contracts.

This momentum encourages companies and startups to invest in traceable farming networks, residue-free processing lines, and region-specific organic crop clusters that secure year-round availability. Brands seeking to avoid synthetic additives rely heavily on organic tapioca, corn, and potato starches for texture, stability, and viscosity.

The opportunity widens further as regulatory bodies tighten organic standards, elevating the competitive advantage of suppliers capable of consistent certification, transparency, and scalable output.

Corn/Maize Starch holds approx. 74% market share as of 2025, establishing itself as the cornerstone of the global native starch market due to its widespread availability, versatile functionality, and cost efficiency. Its applications span across food, pharmaceuticals, and industrial sectors, offering excellent thickening, gelling, and stabilizing properties.

Potato starch, prized for its high viscosity and clarity, finds strong demand in frozen foods, snacks, and gluten-free products. Tapioca/Cassava starch is favored in regions seeking easy digestibility and clean-label formulations, particularly in beverages and confectionery.

Wheat starch supports bakery and processed foods with its binding and texture-enhancing properties, while rice starch, gentle and hypoallergenic, is increasingly used in baby foods and specialized dietary applications.

Paper & Corrugated Board is projected to grow at a CAGR of 5.7% during the forecast period, driven by the rapid expansion of e-commerce, rising demand for sustainable packaging, and increasing consumption of consumer goods worldwide. The packaging industry is shifting toward eco-friendly materials, and corrugated board offers lightweight, recyclable, and cost-effective solutions that protect products during transportation.

Its adaptability allows for customized designs, making it ideal for branding and marketing purposes. Additionally, growth in the food and beverage sector and the rising preference for delivery services are accelerating demand. The material’s strength, durability, and ability to accommodate diverse shapes and sizes further enhance its appeal, positioning paper and corrugated board as a high-growth segment in the global native starch market.

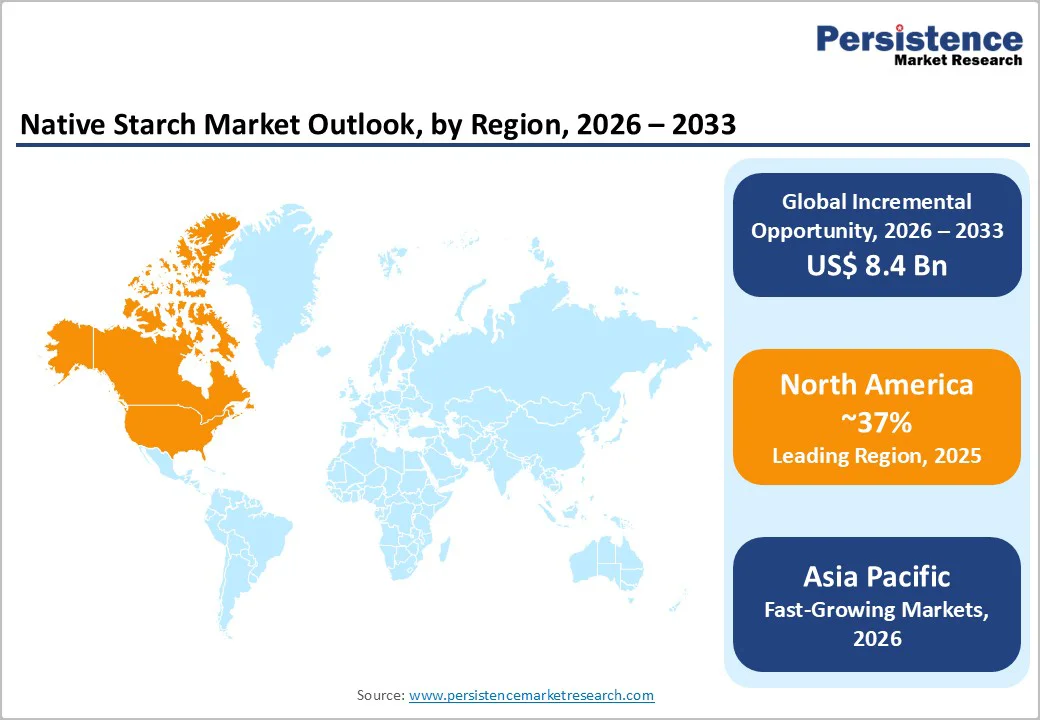

North America holds approximately 37% market share in the global Native Starch Market, reflecting strong industrial adoption and evolving consumer preferences in the US and Canada. In recent years, clean-label and plant-based product trends have significantly shaped starch demand, with food manufacturers seeking natural thickening, gelling, and stabilizing solutions.

Innovative applications in gluten-free, dairy alternative, and ready-to-eat products are driving experimentation with corn, potato, and tapioca starches. Sustainability and eco-friendly sourcing are becoming key priorities, influencing procurement decisions across the region.

Leading brands such as Cargill, Ingredion, Tate & Lyle, and Roquette are expanding their North American presence, introducing specialty starches that enhance texture, shelf life, and functionality while catering to evolving health-conscious and environmentally aware consumer segments.

Asia Pacific Native Starch Market is expected to grow at a CAGR of 5.7%, fueled by rapid industrialization, urbanization, and rising demand for processed and convenience foods across the region. In China and India, increasing adoption of ready-to-eat meals, bakery products, and beverages is driving demand for versatile starches.

Japan and South Korea are witnessing a surge in clean-label, gluten-free, and functional food products, prompting the use of potato, tapioca, and rice starch for texture and stability. Indonesia and Southeast Asian nations are expanding their snack, confectionery, and dairy markets, creating opportunities for locally sourced starches.

Additionally, growing awareness of eco-friendly and sustainable ingredients is influencing food formulation practices. Starch is increasingly leveraged for its thickening, binding, and stabilizing properties across diverse food and industrial applications in the region.

The global native starch market is moderately consolidated, with a mix of established players and agile startups shaping competitive dynamics. Leading companies are investing in advanced processing technologies to enhance functional properties, improve yield, and expand application versatility across food, beverage, and industrial sectors.

Startups are exploring organic starch production and leveraging vertical integration to ensure consistent raw material quality and traceability. There is a growing focus on obtaining certifications for organic, non-GMO, and clean-label products to meet evolving consumer expectations.

Innovations in sustainable farming, energy-efficient processing, and value-added product development are gaining traction. Collaborative initiatives with food manufacturers, co-packers, and ingredient suppliers are enabling companies to differentiate offerings while scaling production efficiently, reinforcing competitiveness in a rapidly evolving market landscape.

The global native starch market is projected to be valued at US$ 23.4 Bn in 2026.

Increasing use of native starch as a natural thickener is driving the global Native Starch market.

The global native starch market is poised to witness a CAGR of 4.5% between 2026 and 2033.

Organic food’s rapid expansion is opening the door for producers to ramp up certified organic native starch manufacturing, creating a prime growth opportunity for companies able to meet tightening purity and sustainability standards.

Major players in the global Native Starch market include Cargill, Incorporated, Ingredion, ADM, Tate & Lyle, Roquette Frères, Tereos S.A., AGRANA Beteiligungs-AG, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author