ID: PMRREP22522| 148 Pages | 7 Jul 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

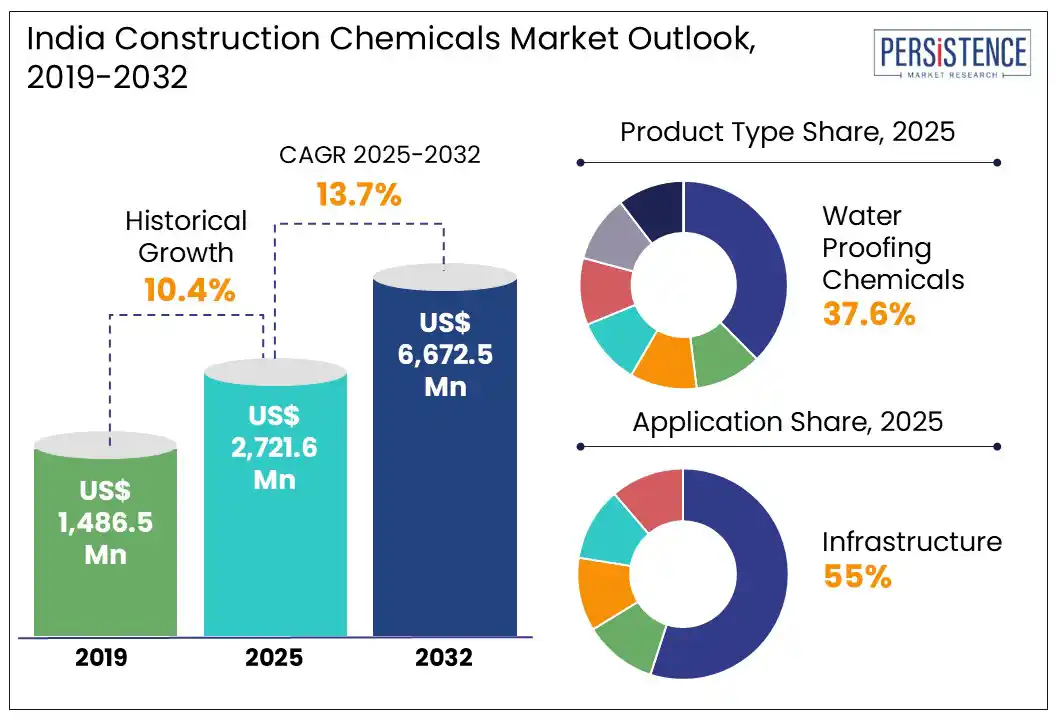

India Construction Chemicals market is likely to be valued at US$2,721.6 million in 2025 and is expected to reach US$6,672.5 million by 2032, growing at a CAGR of 13.7% from 2025 to 2032. Rise in spending on residential and commercial construction activities, along with increased investments in the infrastructure sector, are key factors driving market demand.

North India and South India are anticipated to remain key markets in the India Construction Chemical business owing to the growing consumption of construction chemicals in Mega Projects and Make in India Projects, which are forecast to expand at a CAGR of 13.4% and 15.4%, respectively, during the same period. The Indian construction chemicals market is expected to account for nearly 4% to 5% of the global market in 2025.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

Construction Chemicals Market Size (2025E) |

US$ 2,721.6 Mn |

|

Projected Market Value (2032F) |

US$ 6,672.5 Mn |

|

India Market Growth Rate (CAGR 2025 to 2032) |

13.7% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

10.4% |

India’s construction chemicals market is poised for robust growth, fueled significantly by rising expenditures in residential and commercial construction activities alongside massive investments in the infrastructure sector. The government’s National Infrastructure Pipeline (NIP) program, with planned investments of approximately US$1.4 trillion by 2025, is a cornerstone of this expansion, targeting critical sectors such as energy, roads, railways, and urban development. In the Union Budget 2025-26, the capital investment outlay for infrastructure has been increased to US$128.64 billion, representing 3.1% of GDP, underscoring the government's commitment to infrastructure-led growth.

The Union Housing and Urban Affairs Ministry’s budget was raised by 18% to US$11.07 billion for FY26, with major allocations directed toward urban development, affordable housing, and street vendor support. These allocations are expected to accelerate urbanization and construction activities, particularly in tier-2 and tier-3 cities, which are witnessing resilient demand for affordable housing despite inflationary pressures.

The housing market witnessed a landmark year with sales soaring to a new all-time high of approximately 0.303 million residential units. Launches also reached a record level, with developers unveiling around 0.302 million new units across the country’s seven largest cities, nearly matching the unprecedented sales volume. In the fourth quarter of 2024 alone, residential property sales totaled 0.073 million units across India’s top cities. The majority of these sales were concentrated in three major urban centers, such as Bengaluru, Mumbai, and Pune, which together accounted for about 64% of the total quarterly sales volume. This surge in housing demand is expected to drive increased need for specialized, sustainable, and high-performance construction chemicals tailored to India’s evolving construction sector.

The Indian construction chemicals market faces significant challenges due to intense competition from the unorganized sector. The unorganized sector, which includes numerous small-scale manufacturers and local suppliers, often provides construction chemicals at lower prices by compromising quality and adherence to standards. This price-driven competition makes it challenging for established and organized players to maintain market share and profitability, particularly in price-sensitive segments such as affordable housing and small-scale construction projects.

Product differentiation also poses a challenge in this market. Many construction chemicals, such as concrete admixtures, waterproofing agents, and adhesives, share similar basic functionalities, making it challenging for manufacturers to differentiate their offerings. Without significant innovation or value-added features, companies struggle to justify premium pricing or build strong brand loyalty. This intensifies competition and pressures margins.

To address these challenges, organized players must focus on continuous innovation, rigorous quality assurance, and educating customers about the long-term advantages of superior construction chemicals. Developing specialized, sustainable, and technologically advanced products can help establish distinct market positioning and lessen the impact of unorganized competitors. However, until these gaps are closed, intense competition and product differentiation remain significant constraints for the Indian construction chemicals market.

The rising focus on sustainability and eco-friendly building practices in India is creating significant opportunities for the construction chemicals market through the emergence of green and bio-based products. As environmental concerns intensify and regulations tighten, builders and developers are increasingly adopting construction chemicals derived from renewable biological resources that reduce carbon footprint and environmental impact.

Bio-based construction chemicals, including bio-concretes, natural fiber composites, bio-plastics, and low-VOC coatings, offer environmentally friendly alternatives to traditional chemical products. These materials not only enhance the durability and performance of structures but also align with India’s ambitious goals for net-zero carbon buildings and green urban development under initiatives such as the Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY).

India’s bio-based construction materials market, though still nascent, is gaining traction due to the abundant availability of raw materials such as bamboo, agricultural residues, and coconut coir, especially in regions such as North-East India, Kerala, and Maharashtra. The global bio-based construction materials market is projected to grow at a CAGR of around 17.4%, and India is expected to follow this upward trajectory given its expanding construction sector and government support for sustainable development.

The adoption of these green chemicals is further encouraged by the demand for energy-efficient insulation, water-repellent adhesives, and non-toxic surface treatments that improve indoor air quality and reduce lifecycle costs. Additionally, prefabricated construction using bio-based materials is emerging as a cost-effective and sustainable building method, opening new avenues for innovative chemical formulations.

Waterproofing chemicals hold a leading position in the India construction chemicals market, accounting for approximately 38% of the market share in 2025. Waterproofing chemicals are extensively used in roofing, basements, walls, water tanks, bridges, and tunnels to protect structures from water damage, enhance durability, and reduce maintenance costs. The rising urbanization and infrastructure development in major cities such as Bengaluru, Mumbai, and Pune also contribute to the growing demand for these chemicals.

Concrete admixtures are expected to witness significant market growth during the forecast period from 2025 to 2032. Concrete admixtures improve the properties of concrete, such as workability, strength, durability, and curing time, making them essential for modern construction practices. The increasing focus on infrastructure projects, urban housing, and commercial buildings is driving the demand for advanced admixtures that enable faster construction and enhanced structural performance.

Bases on application, the residential is projected to witness the highest growth rate of nearly 14.9% CAGR during 2025 to 2032, driven by rapid urbanization, rising housing demand, and government initiatives promoting affordable and sustainable housing. The residential construction market in India is expanding robustly, fueled by urban migration and increasing middle-class incomes. Government programs such as Pradhan Mantri Awas Yojana, target over 20 million affordable homes.

Moreover, government initiatives such as affordable housing schemes, tax incentives, and green building mandates are further stimulating growth in the residential construction and renovation sectors. These factors combined are making the residential application segment a focal point of expansion across the Indian construction and housing markets.

About one-third of the Indian market will continue to be dominated by North India. The rapid infrastructural development and the rising population, necessitates additional residences and offices, are the main causes of growth in the area.

Leading states driving the need for construction chemicals in the northern section of India include Punjab, Delhi, Haryana, and Uttar Pradesh. In the north, in Nalagarh, Master Builder Solutions established its facility. Other construction chemical factories in the area owned by Master Builder Solutions are enhanced by this facility.

Mapei is the global leader in adhesives and construction chemicals and inaugurated their third factory at Kosi, Mathura to cater to the growing demand for construction chemicals in Northern India. The setup is planned to speed up the market time for products, as the site is strategically located and well-connected with Northern India via rail and roadways.

Demand for construction chemicals in South India is expected to remain prominent in the country. In the southern region, notably in cities such as Bengaluru, Chennai, Hyderabad, commercial building development is one of the key drivers of growth as well as ongoing mega projects including Market of India, SPR City, DLF Downtown (IT corridor), Chennai Metro – Phase 2, FinTech City, Defence Corridor, Aerospace and Defence Park Sriperambudur which is encouraging the need for construction chemicals in the forthcoming years.

India Construction Chemicals market is moderately fragmented, comprising Tier I, Tier II, and Tier III players operating both domestically and globally. Several of the major players are focusing on the expansion of the construction chemicals business and have installed various manufacturing facilities around India to capture a major market share and maintain a leading position.

Companies are also leveraging partnerships with infrastructure developers, government-backed housing missions, and contractors to secure large-scale, long-term supply deals across India’s rapidly growing construction sector.

The India construction chemicals market is projected to be valued at US$ 2,721.6 Bn in 2025.

Key growth drivers include the rising spending on residential and commercial construction activities, along with increased investments in the infrastructure sector, are key factors driving market demand.

The construction chemicals market is poised to witness a CAGR of 13.7% from 2025 to 2032.

Emerging green and bio-based construction chemicals are driving sustainable growth in India.

Major players in the construction chemicals market include Sika AG, Saint-Gobain, Mapei, Pidilite Industries Ltd., and others.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

Kilo Tons for Volume US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author