- Executive Summary

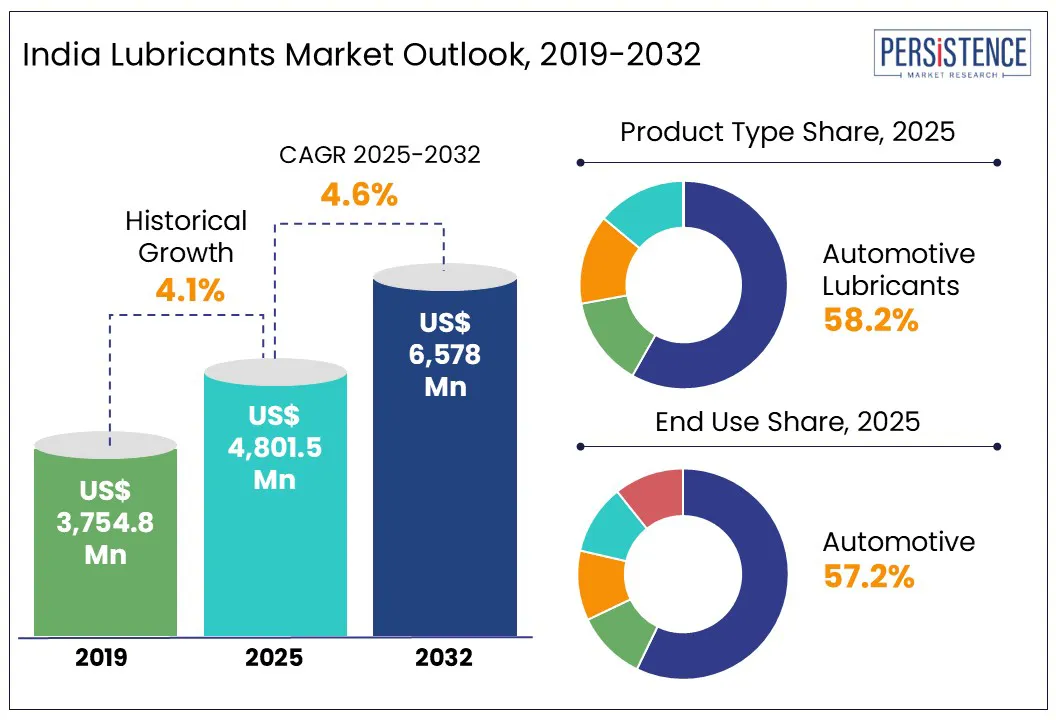

- India Lubricants Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Macro-economic Factors

- Automotive Industry Expansion and Vehicle Ownership Trends

- Environmental Regulations and Sustainability Goals

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Regulatory Landscape

- Value Chain Analysis

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Trend Analysis 2019 - 2032

- Key Highlights

- Key Factors Impacting Product Costs

- Pricing Analysis by End Use

- India Lubricants Market Outlook

- India Lubricants Market Outlook: Product Type

- Introduction / Key Findings

- Historical Market Product Type Provider (US$ Mn) and Analysis, By Product Type, 2019 - 2024

- Current Market Product Type Provider (US$ Mn) and Analysis and Forecast, By Product Type, 2025 - 2032

- Industrial Lubricants

- Process Oils

- General Industrial Oils

- Metalworking Fluids

- Industrial Engine Oils

- Greases

- Others

- Automotive Lubricants

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

- Marine Lubricants

- Engine Oil

- Hydraulic Oil

- Gear Oil

- Turbine Oil

- Greases

- Others

- Aerospace Lubricants

- Gas Turbine Oils

- Piston Engine Oils

- Hydraulic Oils

- Others

- Industrial Lubricants

- Market Attractiveness Analysis: Product Type

- India Lubricants Market Outlook: End Use

- Introduction / Key Findings

- Historical Market Product Type Provider (US$ Mn) Analysis, By End Use, 2019 - 2024

- Current Market Product Type Provider (US$ Mn) Analysis and Forecast, By End Use, 2025 - 2032

- Automotive

- Heavy Equipment

- Metallurgy and Metalworking

- Power Generation

- Others

- Market Attractiveness Analysis: End Use

- India Lubricants Market Outlook: Product Type

- India Lubricants Market Outlook: Region

- Key Highlights

- Historical Market Product Type Provider (US$ Mn) Analysis, By Region, 2019 - 2024

- Current Market Product Type Provider (US$ Mn) Analysis and Forecast, By Region, 2025 - 2032

- North India

- West India

- South India

- East India

- Market Attractiveness Analysis: By Region

- Competition Landscape

- Market Share Analysis, 2023

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Castrol Limited

- Overview

- Solution Portfolio

- Key Financials

- Market Developments

- Market Strategy

- Bharat Petroleum Corporation Limited

- Indian Oil Corporation Ltd.

- Hindustan Petroleum Corporation Limited

- Savita Oil Technologies Ltd

- TIDE WATER OIL CO. (INDIA) LTD

- Valvoline Inc.

- Royal Dutch Shell Plc

- Exxon Mobil Corporation

- TotalEnergies SE

- Gulf Oil International

- Others

- Castrol Limited

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment