ID: PMRREP35426| 148 Pages | 17 Jun 2025 | Format: PDF, Excel, PPT* | Healthcare

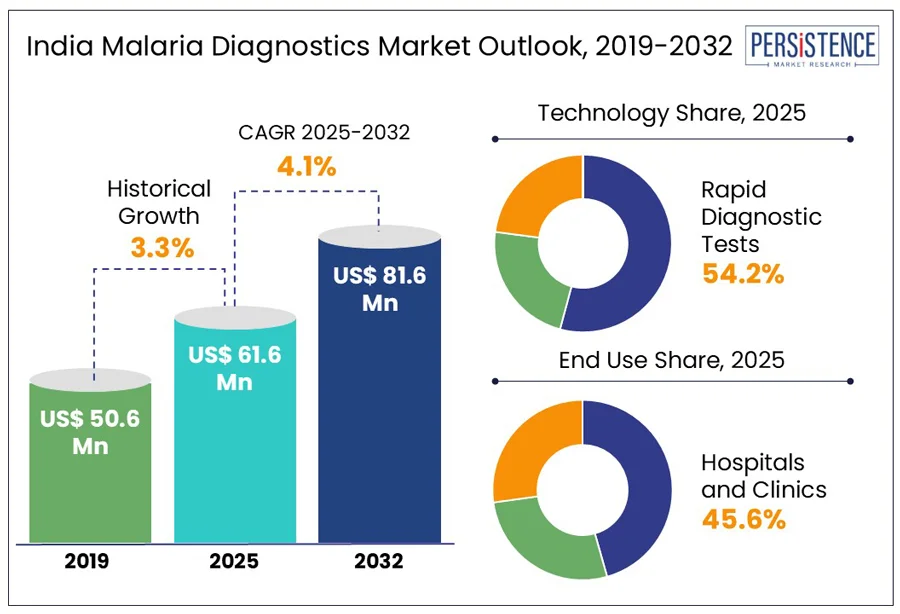

India malaria diagnostics market size is predicted to reach US$ 81.6 Mn in 2032 from US$ 61.6 Mn in 2025. It will likely witness a CAGR of around 4.1% in the forecast period between 2025 and 2032.

India malaria diagnostics market is benefiting from strategic partnerships between the government, international organizations, and private healthcare providers. Government programs, including the National Strategic Plan for Malaria Elimination are significantly increasing access to diagnostic tools in the country. Collaborations with private diagnostic firms are also ensuring a steady supply of superior yet cost-effective malaria test kits. International organizations, including the Global Fund and the World Health Organization (WHO), are further offering technical and financial support to improve malaria detection efforts.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

India Malaria Diagnostics Market Size (2025E) |

US$ 61.6 Mn |

|

Market Value Forecast (2032F) |

US$ 81.6 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.3% |

Inadequate healthcare infrastructure in India's rural and tribal regions has significantly propelled demand for accessible malaria diagnostics. Around 95% of the country's population resides in malaria-endemic areas, with 80% of cases concentrated among 20% of the population living in hilly and tribal areas, finds the National Center for Vector Borne Diseases Control (NCVBDC). These areas often lack sufficient healthcare facilities, resulting in delayed diagnoses and treatment. In Uttar Pradesh’s Sonbhadra district, for instance, limited field staff and poor internet connectivity have hampered timely case reporting and outbreak responses.

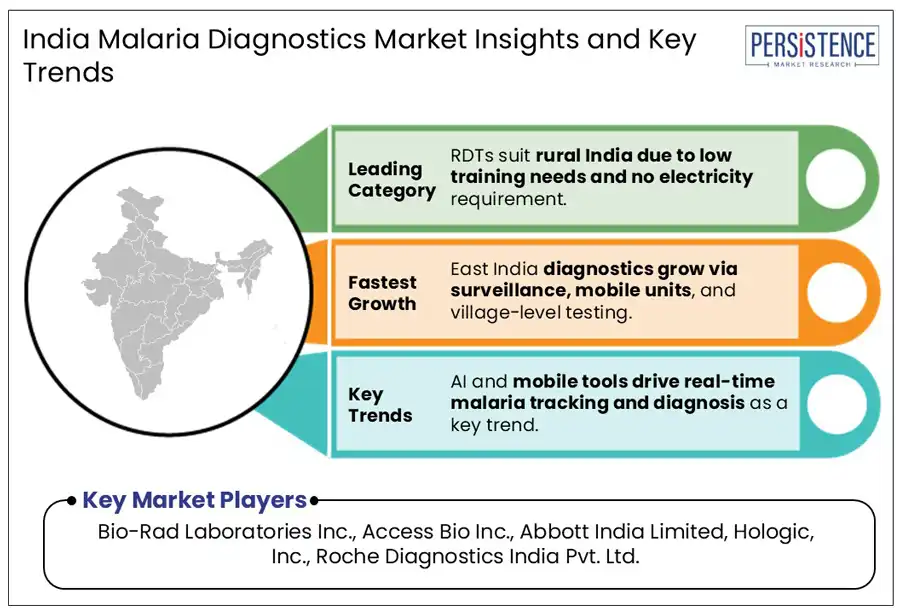

To address these challenges, there has been a surge in the adoption of Rapid Diagnostic Tests (RDTs), which provide quick results and are ideal for deployment in resource-limited settings. The Government in Odisha, for example, distributed over 40.49 lakh Long-Lasting Insecticidal Nets (LLINs) and intensified surveillance in malaria-prone districts. It helped in ensuring the availability of testing devices and active disease monitoring. In addition, novel solutions, such as a cost-effective, portable microscope with built-in AI for automated malaria diagnosis including the MAIScope is developed to facilitate accurate testing in remote areas.

Microscopy, while traditionally considered the gold standard in malaria detection technologies in India, exhibits significant limitations in detecting low parasite densities. This is particularly evident in asymptomatic individuals and mixed-species infections. Studies have revealed that microscopy can miss more than 25% of malaria cases, with sensitivity dropping to nearly 42.7% in low-endemic areas, including Meghalaya and Assam, when compared to PCR diagnostics.

The detection threshold for microscopy typically ranges from 50 to 100 parasites per microliter, whereas PCR methods can identify as few as 0.01 parasites per microliter. This disparity means that submicroscopic infections, which are prevalent in India's rural areas, often go undetected, undermining malaria elimination efforts. Additionally, the sensitivity of microscopy for mixed infections, including concurrent P. vivax and P. falciparum, is notably low, with detection rates around 45%, thereby complicating accurate diagnosis and treatment.

Next-Generation Sequencing (NGS) is significantly improving malaria diagnostics in India by enabling high-resolution genomic surveillance of the plasmodium species. A study published in the National Library of Medicine, for instance, utilized amplicon sequencing to analyze five antimalarial resistance genes, namely, Pfmdr1, Pfk13, Pfdhps, Pfdhfr, and Pfcrt, in 158 P. falciparum isolates from Rourkela, Nadiad, and Chennai.

The study found distinct regional patterns of drug resistance, with mutant Pfcrt and Pfdhfr haplotypes prevalent in Chennai and Nadiad. Rourkela, on the other hand, exhibited a higher proportion of wild-type alleles. Such insights are important for developing region-specific treatment strategies and monitoring the emergence of drug-resistant strains. Collaborative initiatives, including the India International Centers of Excellence for Malaria Research (ICEMR), are also leveraging NGS to study antimalarial drug resistance and parasite genetic diversity, boosting the India malaria diagnostics market growth.

By technology, the segmentation comprises microscopy, RDTs, and molecular diagnostic tests. Among these, RDTs are projected to account for a share of approximately 54.2% in 2025 owing to their adaptability to India’s diverse and often challenging healthcare sector. Their ability to deliver quick results without the requirement for innovative laboratory infrastructure makes them particularly valuable in remote areas. RDTs are expected to be increasingly used in public health centers, and outreach programs in Assam, Jharkhand, and Odisha bearing a significant portion of malaria.

Molecular diagnostic tests, especially PCRs, are predicted to witness a considerable CAGR from 2025 to 2032 amid their superior sensitivity and specificity, primarily in detecting low-density and asymptomatic infections that traditional methods often miss. Their adoption is further augmented by their ability to detect submicroscopic infections, which are prevalent in low-endemic regions and among asymptomatic carriers. These hidden reservoirs of infection contribute to ongoing transmission and pose significant challenges to national malaria elimination programs in India. PCR's ability to detect parasitemia as low as 1 parasite/µL makes it an ideal tool in identifying and treating these cases.

Based on end-use, the market is trifurcated into hospitals and clinics, diagnostic centers, and academic and research institutions. Out of these, hospitals and clinics are predicted to account for nearly 45.6% of the India malaria diagnostics market share in 2025, backed by their ability to manage severe and complicated malaria cases, which require comprehensive and immediate medical intervention. The widespread adoption of RDTs in these settings facilitates cost-effective and quick diagnosis, essential for reducing complications and enhancing malaria treatment.

Diagnostic centers, on the other hand, are gaining momentum in the field of infectious disease diagnostics in India due to their specialized infrastructure, expansive reach, and novel testing capabilities. These centers are equipped with innovative laboratories, enabling them to provide a wide range of diagnostic services, including RDTs and microscopy. Their ability to offer accurate and timely results also makes them ideal for the early detection and management of malaria, mainly in areas with high prevalence rates.

In East India, Odisha Assam, Jharkhand, and Meghalaya are at the forefront in terms of prevalence rate due to climatic conditions favoring mosquito and parasite proliferation. For example, the National Center for Vector Borne Diseases Control (NCVBDC) found that in 2023, Odisha alone had approximately 42,000 malaria occurrences. It further confirmed that the state contributed nearly 18.7% of India’s malaria tally. It was followed by Chhattisgarh (31,713), Jharkhand (31,140), West Bengal (26,493), and Tripura (22,412).

Odisha’s Durgama Anchalare Malaria Nirakaran (DAMaN) program has been significant in targeting malaria hotspots, focusing on the requirement for rapid diagnosis. In the Northeast, a mass survey revealed that out of 3,322 individuals screened in Meghalaya and Assam, around 19.5% were detected with malaria parasites. Among asymptomatic individuals, 19.4% had plasmodium infections. The sensitivity and specificity of microscopy were 42.7% and 99.3%, respectively. While traditional diagnostics remain the mainstay in East India’s malaria detection efforts, their limitations necessitate the integration of more sensitive molecular tools.

In North India, Punjab and Haryana have reported a significant reduction in malaria cases, with Punjab detecting only 49 positive cases out of 1,114 samples using microscopy in a recent study. Nested PCR, however, detected 64 positive cases in the same cohort, revealing a 23.4% prevalence of submicroscopic infections that traditional methods missed. This highlights the limitations of conventional diagnostics in low-transmission settings and the requirement for more sensitive molecular tools.

Surveillance systems in North India face challenges owing to fragmented reporting and underrepresentation of private healthcare data. As per a study published in the National Library of Medicine, the current surveillance captures only about 8% of the actual malaria burden, mainly because of the non-inclusion of private sector data and dependence on paper-based reporting. This hinders the timely detection of outbreaks and undermines elimination efforts.

In West India, encompassing states such as Goa, Rajasthan, Maharashtra, and Gujarat, the malaria diagnostics is characterized by a combination of rural outreach programs and urban-centric healthcare infrastructure. For example, Gujarat’s public health system employs blood smear examinations free of cost at peripheral health centers. These are complemented by active surveillance through field workers conducting house-to-house visits for blood sample collection. Delays in microscopy results, however, tend to lead to presumptive treatment with chloroquine, contributing to drug resistance.

RDTs have been launched to address the limitations of microscopy, facilitating prompt treatment and delivering immediate results. For instance, in a study conducted in Ahmedabad, the validity of RDTs was evaluated against blood smear examinations. It emphasized the significance of sensitivity and specificity in adopting RDTs as alternative diagnostic tools. The integration of RDTs into the diagnostic protocol aims to reduce reliance on clinical suspicion alone, further enhancing treatment accuracy.

India malaria diagnostics market contains various multinational corporations, large-scale diagnostic chains, and local manufacturers. Multinational companies are striving to establish a robust presence by providing innovative diagnostic tools such as molecular diagnostics and Rapid Diagnostic Tests (RDTs). They are leveraging their global expertise to introduce new solutions catered to India, thereby improving the accuracy and speed of malaria detection. Domestic companies have capitalized on their deep understanding of local market requirements. They are focusing on manufacturing affordable and accessible diagnostic kits, ensuring wide reach, especially in resource-limited settings.

The market is projected to reach US$ 61.6 Mn in 2025.

The increasing public health burden of malaria and the lack of robust healthcare infrastructure in remote areas are the key market drivers.

The market is poised to witness a CAGR of 4.1% from 2025 to 2032.

Launch of innovative RDTs to get quick results and surging government initiatives are the key market opportunities.

Bio-Rad Laboratories Inc., Access Bio Inc., and Abbott India Limited are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Technology

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author