ID: PMRREP35463| 143 Pages | 4 Jul 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

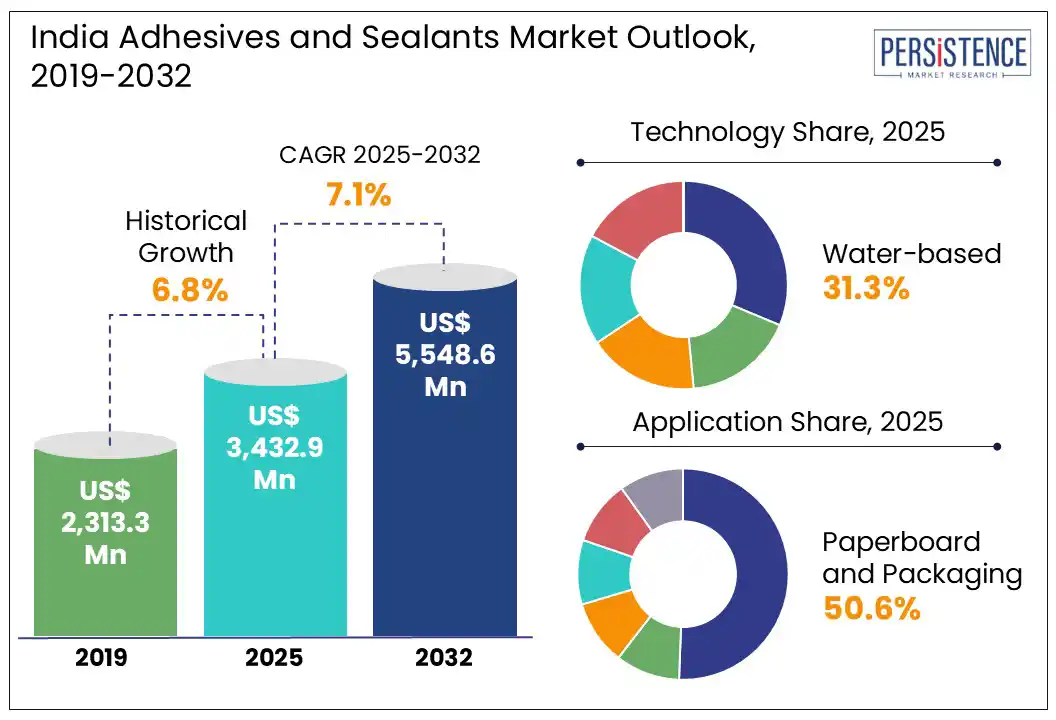

The India adhesives and sealants market size is likely to be valued at US$ 3,432.9 Mn in 2025 and is estimated to reach US$ 5,548.6 Mn in 2032, growing at a CAGR of 7.1% during the forecast period 2025-2032.

The India adhesives and sealants market is undergoing a remarkable transformation owing to shifting industrial dynamics, regulatory reforms, and the push for sustainable manufacturing. The market is evolving into a complex ecosystem propelled by high-performance chemistries developed for flexible packaging, EVs, smart infrastructure, and aerospace. Water-based adhesives are being extensively used in FMCG and food-safe packaging, whereas structural sealants are seeing adoption in high-rise façades across Tier-1 cities.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

India Adhesives and Sealants Market Size (2025E) |

US$ 3,432.9 Mn |

|

Market Value Forecast (2032F) |

US$ 5,548.6 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

7.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.8% |

The booming aerospace industry is significantly pushing the India adhesives and sealants market growth as the country shifts from assembly-based operations to indigenous manufacturing. The surging number of aircraft manufacturing and maintenance contracts is prompting OEMs and Tier I suppliers to adopt lightweight bonding solutions to reduce aircraft weight and improve structural integrity. Structural adhesives are increasingly replacing conventional fastening methods in composite bonding. It is specifically evident in the manufacturing of UAVs and military aircraft such as the HAL Tejas Mk1A.

India’s increasing Maintenance, Repair, and Overhaul (MRO) capacity is another significant driver, finds Persistence Market Research. The government is striving to turn the country into a global MRO hub and reduce dependency on Singapore and Dubai. Hence, aerospace-grade sealants for fuel tanks, cabins, and windshields are in high demand. Bengaluru-based MRO companies, for instance, have reported an uptick in usage of two-component sealants and flame-retardant adhesives. It was evident during structural repairs and cabin retrofits of both commercial and defense aircraft.

Potential health hazards associated with solvent-based adhesives and prolonged curing times of certain formulations are creating hindrances in adoption across specific industries in India. Various solvent-based adhesives release high levels of Volatile Organic Compounds (VOCs), contributing to indoor air pollution and posing risks such as respiratory irritation. As per a 2023 study, factory workers exposed to high-VOC adhesives in unventilated spaces reported up to 38% higher incidence of respiratory issues compared to those using water-based alternatives. These health-related concerns are prompting resistance among labor unions and regulatory bodies.

India’s tight environmental and workplace safety enforcement in industrial zones has further led to high compliance costs for units using conventional high-VOC adhesives. Several plywood units in Haryana and Gujarat, for example, have had to shift to low-VOC or zero-VOC adhesives to meet state-level pollution board standards. This raised concerns over production speed and costs, particularly when switching to alternatives with slow cure times.

The emergence of bio-based adhesives and electronic sealants in India is unlocking new growth avenues. Local manufacturers are increasingly responding to both export-driven standards and domestic policy shifts encouraging the reduction of VOC emissions and petrochemical reliance. The Bureau of Indian Standards (BIS), for example, is in the process of revising norms to line up adhesive formulations with global sustainability benchmarks, which is incentivizing research in bio-based variants. This is relevant for sectors such as packaging, automotive interiors, and construction, where environmental certifications are becoming essential for B2B procurement.

The government is also emphasizing circular economy practices under the India Plastics Pact. Sustainable Packaging guidelines by the Central Pollution Control Board (CPCB) are propelling packaging companies to explore ready-to-use adhesives derived from renewable feedstocks such as lignin, soy protein, and starch. Various start-ups are experimenting with Cashew Nutshell Liquid (CNSL)-based formulations that can replace phenol-formaldehyde resins in wood panels and laminates. These adhesives are not only formaldehyde-free but also biodegradable, gaining traction among plywood manufacturers catering to export markets in Europe.

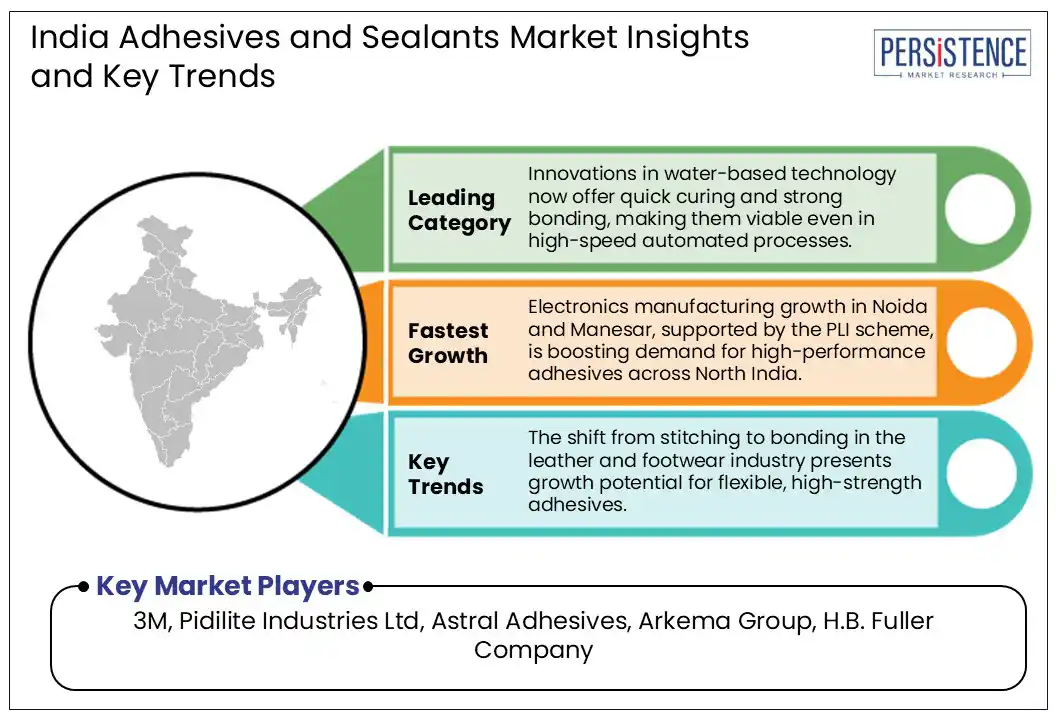

In terms of technology, the market is divided into water-based, solvent-based, hot melt, and reactive. Among these, the water-based segment is predicted to hold around 31.3% of the India adhesives and sealants market share in 2025, backed by rising environmental regulations, high demand for eco-compliant materials, and health concerns around solvent-based products. Industries such as packaging, footwear, and textiles are rapidly shifting to water-based solutions to meet both local safety requirements and international quality standards. The rise of contract manufacturing in India, particularly for global apparel and shoe brands, has also propelled adoption.

Solvent-based solutions are expected to see average growth through 2032 due to surging environmental restrictions, rising raw material costs, and a gradual shift toward green alternatives. Despite its historical dominance in automotive trims and furniture, its growth is being moderated by increasing scrutiny over VOC emissions. Several state regulatory bodies have begun implementing strict air quality norms, mainly in high-pollution zones. It has further compelled small-scale manufacturers to adopt water-based alternatives.

Based on application, the market is segregated into paperboard and packaging, building and construction, transportation, leather and footwear, and furniture. Out of these, paperboard and packaging will likely account for approximately 50.6% of share in 2025 due to the exponential growth of e-commerce, food delivery services, and Fast-Moving Consumer Goods (FMCG). All of these rely heavily on corrugated boxes, folding cartons, and flexible packaging. Another key factor is the shift from plastic to paper-based alternatives in compliance with India’s single-use plastic ban. It has compelled food packaging manufacturers to adopt water-based and food-grade adhesives suitable for bonding laminated paper wrappers, trays, and paper cups.

Leather and footwear, on the other hand, is poised to witness a significant CAGR from 2025 to 2032 amid the presence of several small and medium enterprises in the sector that rely on adhesive-intensive manufacturing processes. India is the second-largest producer of footwear globally, with production exceeding 2.6 Bn pairs annually, revealed the Council for Leather Exports. Most of this output requires adhesive tape films for sole attachment, upper bonding, and insole lamination, making them important for both cost efficiency and speed.

North India showcases a diverse and evolving market boosted by industrial clusters, infrastructure development, and changing consumer preferences. The National Capital Region (NCR), including Delhi, Gurugram, and Noida, is a significant consumption center. This is mainly for high-performance adhesives used in electronics assembly, interior décor, modular furniture, and smart appliances. Noida’s electronics manufacturing clusters are increasingly using hot-melt and pressure-sensitive adhesives for display panels and circuit boards due to the Production Linked Incentive (PLI) scheme.

In Haryana, primarily Manesar and Faridabad, the strong base of auto component manufacturers fuels demand for structural adhesives and thread-locking sealants. Manufacturers in the state are gradually moving away from welding and mechanical fastening for light-weighting purposes. Punjab, with its dominance in sports goods, bicycle components, and low-cost footwear manufacturing continues to rely on solvent-based rubber adhesives. The rise of luxury and green building projects in Chandigarh and parts of Delhi has further increased the uptake of hybrid sealants with high UV and chemical resistance for façades.

South India has emerged as a technologically developed and export-oriented hub for adhesives and flexible firestop sealants. It is augmented by thriving electronics, automotive, aerospace, and real estate sectors. Tamil Nadu has witnessed a notable surge in demand for specialty adhesives used in electronics manufacturing and e-mobility components. The Sriperumbudur-Oragadam belt near Chennai has shown increased procurement of thermally conductive adhesives and conformal coatings.

In Karnataka, Bengaluru continues to lead in aerospace-grade adhesives and sealants owing to its ecosystem of defense Public Sector Undertakings (PSUs), DRDO labs, and private aerospace start-ups. Bengaluru’s satellite and space-tech players are creating new niches for cryogenic sealants and vacuum-compatible adhesives in small satellite propulsion systems. Hyderabad’s Genome Valley and pharma corridor have further driven demand for medical-grade and packaging adhesives.

West India is a significant hub for the adhesives and insulating foam sealants industry due to its strong industrial base, port connectivity, and presence of leading sectors, including electronics and automotive. Gujarat plays a key role as a raw material supplier. It houses a major portion of India’s petrochemical and chemical production, especially in Vadodara, Ankleshwar, and Dahej. In these areas, feedstocks such as ethylene, propylene, and toluene required for synthetic adhesives are produced.

Companies such as GACL and Reliance Industries indirectly support the adhesives ecosystem by ensuring consistent raw material availability, helping downstream players scale production and low costs. Maharashtra is considered one of the most prominent consumers of industrial adhesives in West India owing to the presence of leading automotive clusters in Pune and Chakan. Demand for structural adhesives and high-temperature sealants has surged with the expansion of EV assembly lines by Tata Motors and Mahindra Electric.

The India adhesives and sealants market is characterized by the presence of several global multinationals and domestic players. They are vying for share through innovation, localized offerings, and pricing strategies. Leading international brands have established a significant presence, leveraging their research and development capabilities as well as wide industrial product portfolios. They often target high-performance applications in automotive, electronics, aerospace, and industrial manufacturing, where quality and compliance are important. Domestic players have also carved out dominant positions, especially in consumer and construction segments.

The market is projected to reach US$ 3,432.9 Mn in 2025.

Increasing green building projects and boom in e-commerce are the key market drivers.

The market is poised to witness a CAGR of 7.1% from 2025 to 2032.

Innovations in water-based technology and indigenous manufacturing of aerospace-grade adhesives are the key market opportunities.

3M, Pidilite Industries Ltd, and Astral Adhesives are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Adhesive Type

By Sealant Type

By Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author